Fxview Review 2025

Pros

- No-dealing-desk broker with ECN pricing from 0 pips

- High leverage available to global clients

- Reliable CySEC-regulated broker

Cons

- Limited range of cryptocurrencies

- Does not accept traders from US and UK

- No ETFs available

Fxview Review

Fxview is a European broker specializing in CFDs in forex, stocks, cryptocurrencies (global clients only), commodities and indices markets. This 2025 broker review will explore the trading platforms offered by Fxview and the tools that they provide. Read on for a guide to the pros and cons of opening an account, including regulatory and security considerations and details on customer eligibility.

About Fxview

The online brokerage was established in 2017. Fxview Europe is owned and operated by Charlgate Ltd, which has its registered office in Limassol, Cyprus. Fxview Global (Charlgate SVG LLC) is registered in St. Vincent and the Grenadines.

The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Financial Services Commission (FSC) in Mauritius.

In June 2021, the Finvasia Group acquired Fxview.

Trading Platforms

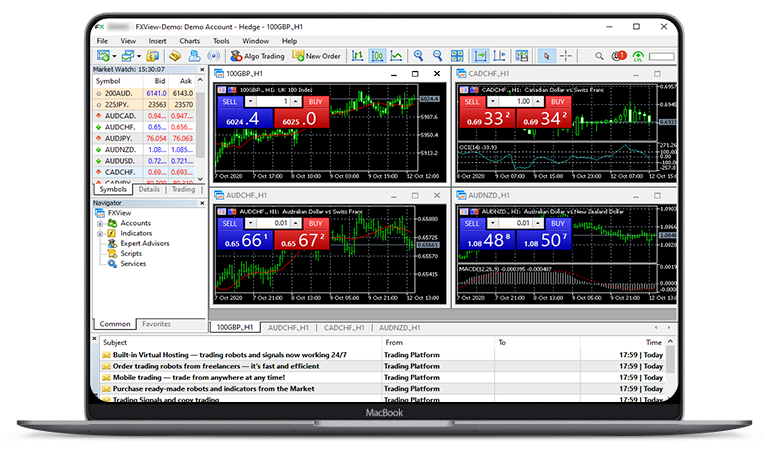

Like many online brokers, Fxview offers the renowned MetaTrader platforms: MT4 and MT5. The brokerage also offers ActTrader, as an alternative trading software. Web versions are available for each terminal for those that want to avoid a software download.

Key features of each trading platform includes:

MetaTrader 4

- Available on the web, desktop, Mac, Android and iPhone

- Automated trading via EAs

- 4 pending order types

- 30 default indicators

- One-click trading

- 9 time frames

- News section

MetaTrader 5

- Available on the web, desktop, Mac, Android and iPhone

- 6 pending order types

- 38 default indicators

- Economic calendar

- One-click trading

- 21 time frames

- News section

ActTrader

- Available on the web, desktop, Android and iPhone

- Risk management tools to conduct ‘what if’ analysis

- Visual strategy builder (for automated trading strategies)

- 4 pending order types

- 48 default indicators

- News section

- 11 time frames

Assets & Markets

Fxview specializes in CFD (Contract for Difference) trading. When purchasing a CFD, traders do not own the underlying asset. For example, when you purchase a CFD on gold, you don’t actually own the precious metal. The trader is simply speculating on the price movement. The profit (or loss) is the difference in value between when the contract is purchased and when it is sold.

The following markets are available:

- 70 forex pairs (majors, minors and exotics)

- 8 commodities (precious metals and energies)

- 11 indices (including the D30EUR and NASUSD)

- 400+ stocks and shares (US, UK & European markets)

- 5 cryptocurrencies (including BTC/USD, ETH/USD and more)

Spreads & Fees

Spreads start from 0.0 pips at Fxview. The best spreads are usually found in the most liquid markets, such as major forex pairs like the EUR/USD. Spreads in other markets such as commodities may be higher. For example, the XAU/USD market has a spread of 0.31. Low spreads mean that the market doesn’t have to move as far in the right direction before the trader begins to make a profit.

Raw spreads also mean that Fxview has to make its money through commission. The broker charges $1/$100k which is relatively low, but can affect high volume traders such as day traders and scalpers. Swap fees may also apply for those holding positions across more than one day.

Importantly, Fxview is an ECN (Electronic Communication Network) broker. This means it connects clients directly with other market participants without dealing desk intervention. This usually results in tighter spreads and faster trade executions.

Leverage

Leverage means traders can open positions with a greater value than their actual investment. For example, leverage of 1:10 would mean a trader could get exposure of $1,000 with an investment of $100.

Like most European brokers, the maximum leverage on forex majors such as EUR/USD, EUR/GBP and GBP/USD, is 1:30. However, the leverage offered to global clients is 1:500.

Mobile App

Fxview has its own mobile app available on the App Store (Fxview Phone) and Google Play (Fxview Droid) that syncs with its desktop and browser-based trading platforms.

The mobile terminal offers standard account management features, straightforward deposits and withdrawals, plus trade execution capabilities. Clients can also browse different assets and amend trade orders.

Note, Fxview clients can also download the MT4 and MT5 platforms to mobile devices.

Payment Methods

Deposits

The minimum deposit at Fxview is $200 for EU traders and $50 for Global traders. Note that there is a difference between minimum deposit and the minimum trade size of 0.1 lots.

Fxview does not charge fees for deposits. However, traders should be aware of any third party fees that may apply, for example, from their bank. The deposit processing time is instant for Visa/Mastercard, Skrill and Neteller.

The full list of deposit methods is as follows:

- Visa & Mastercard

- Bank Transfer

- Rapid Transfer

- Skrill

- Neteller

- Klarna

- Giropay

- Przelewy24

- Nordea Solo

- Cryptocurrencies (for global clients only)

Withdrawals

Withdrawal options are limited:

- Visa/Mastercard

- Bank transfer

- Neteller

- Skrill

- Cryptocurrencies (for global clients only)

Fxview does not charge withdrawal fees and the processing time is 1 business day. Third party fees may still apply.

Demo Account

Fxview offers a free demo account. This is particularly useful for beginners who want to get to grips with the trading platform, as well as more seasoned traders who want to test a new strategy that they have developed.

Clients can sign up for the paper trading account on the broker’s official website.

Deals & Promotions

A 100% deposit bonus is offered by the broker on every deposit above $200. Maximum leverage that can be availed for such is 300x. Note, this bonus is only available to non-EU clients.

Regulation & Licensing

Fxview is regulated by the Cyprus Securities and Exchange Commission (CySEC) and is a member of the Investor Compensation Fund (ICF). This means eligible clients can claim up to 20,000 EUR if the firm is unable to meet its obligations.

Fxview also holds a license with the Financial Sector Conduct Authority (FSCA) in South Africa (registration number 2018/303451/07, license number 50410).

In total, Fxview boasts more than 30+ registrations including BaFin 157125, CNMV (Spain) 4892, CONSOB (Italy) 5151, FCA (UK) 850138 and Finanstilsynet (Norway) FT00118545.

Additional Features

Fxview has a helpful Market News section that is updated regularly. This allows traders to stay informed of the latest market developments. This is particularly important for those using fundamental analysis as part of their trading strategy.

In addition, Fxview’s video tutorial section is one of the best available. It explains multiple trading strategies, financial terms and different indicators. Additionally, the broker has free online webinars, although the content is not particularly recent.

Fxview also facilitates API trading, allowing traders to connect platforms to the live data and liquidity that the online broker offers. This can improve execution speeds and gives lower latency.

Account Types

The RAW ECN account is Fxview’s main live trading account. It provides tight spreads with a reasonable commission.

Also available is the Fxview Zulu account that can connect with ZuluTrade, a firm with a good reputation for allowing retail traders to copy the trades of experienced investors. An Islamic account is available to global clients only.

Trading Hours

Trading hours vary depending on the market in question. Fxview’s server time is GMT+3 during US Daylight Saving Time (DST) and GMT+2 during US non-DST.

The forex market is open 00:05 Monday-24:00 Friday, with a daily break from 00:00-00:05. The hours of most of the commodities and indices markets are similar.

Customer Support

Fxview has a responsive customer support team, which will be a relief to many traders seeking reassurance that their broker will be on hand to deal with issues. Customer support at Fxview is available 24/5. We tested the live chat feature and received a response within seconds.

In addition to the live chat feature, the following customer support options are available:

- Online contact form

- Email (for EU clients info.eu@fxview.com or for global clients info@fxview.com)

- Phone (support numbers for EU clients are +357 2526-2288 or +357 2526-2040 and for global clients it’s +4420 3150 2475)

In terms of social media, Fxview also has a presence on Facebook, Twitter, Instagram, LinkedIn and Reddit. In addition, the company has its own YouTube channel.

Security

As is the case with most reputable brokers, Fxview uses segregated bank accounts to separate client money from company funds. In addition, user funds are spread across multiple financial institutions to reduce risk.

Two-factor authentication is an effective measure used by Fxview to strengthen security, as is 3D secure technology when processing card payments.

Fxview Verdict

Its low spreads will attract many investors, particularly day traders looking to keep costs low. The copy trading solution is another attractive feature that will appeal to beginners.

FAQs

Is Fxview Legit?

Yes, Fxview is a legitimate broker that is regulated by CySEC and registered in multiple jurisdictions around the world. It has been operating since 2017.

Is Fxview A Market Maker?

No. Fxview is an ECN broker which means they match orders directly with liquidity providers rather than going through a dealing desk. This usually means lower spreads and faster trade execution.

Can I Choose Which Trading Platform To Use On Fxview?

Yes, traders get a choice of three trading platforms: MetaTrader 4, MetaTrader 5 and ActTrader. MT4 and MT5 are more well-known but ActTrader still has a good range of features.

Where Can I Find Customer Reviews Of Fxview?

Trustpilot is a good place to look at customer reviews of various brokers including Fxview. Discussion forums such as Reddit can also provide useful insight into customer experience.

How Quick Is The Sign-Up Process On Fxview?

New customers will need to provide their personal details, trading experience, as well as verifying their account with proof of identity and address. This can be completed in around five minutes. Once they are registered, traders will be able to login and start trading.

Top 3 Alternatives to Fxview

Compare Fxview with the top 3 similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Fxview Comparison Table

| Fxview | Dukascopy | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3.3 | 3.6 | 4.3 | 4 |

| Markets | CFD, Forex, Stock, Indices, Commodities & Cryptocurrencies (global clients only) | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €200 (EU), $50 (Global) | $100 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, FSCA, FSC, CONSOB | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | 100% deposit bonus with deposit of min 200$ for global traders | 10% Equity Bonus | – | 100% Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | MT4, MT5, ActTrader | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global & EU Pro) | 1:200 | 1:50 | 1:1000 |

| Payment Methods | 10 | 11 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Fxview and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Fxview | Dukascopy | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

Fxview vs Other Brokers

Compare Fxview with any other broker by selecting the other broker below.

The most popular Fxview comparisons:

Customer Reviews

4.9 / 5This average customer rating is based on 10 Fxview customer reviews submitted by our visitors.

If you have traded with Fxview we would really like to know about your experience - please submit your own review. Thank you.

I’ve been trading with Fxview for a few months and honestly haven’t had issues with slippage and execution. Plus, their support has been pretty responsive whenever I’ve reached out. Overall, great experience so far!

I’ve been trading with Fxview for a while and chose the Premium ECN account mainly for the low spreads and commission, it just makes more sense for how I trade. I like that they offer different account types instead of forcing you into one setup. Whether you’re new or experienced, there’s something that fits. So far, I haven’t had any issues, and the trading conditions have been solid.

Been trading for years, and Fxview just feels right. Tight spreads, super-fast execution, and no hidden costs—exactly what I need for a smooth trading experience.

Setting up the API with Fxview was easy and the integration was smoother than I’d expect – whether I’m using the REST/FIX API, they work seamlessly. The fast, reliable connections make trading with Fxview much more efficient and convenient for me.

Using Fxview’s Premium ECN Account has been a great experience. Ultra low spreads really make a difference and the trades execute super fast. It feels like I have more control over my trading. I highly recommend it to every serious trader.

I started my year by opening a live account with fxview, and it’s been a really good experience. Deposits are fast and easy, with lots of ways to add money to your account. The $50 minimum deposit is great for anyone starting small. I was a bit worried about slippage at first, but I haven’t had any issues. Overall, I’m happy with it.

The MT5 backtesting on Fxview has been great for tweaking my strategies, and execution is super fast. Really happy with the setup!

Recently switched to zero commission account on fxview and have to say that it has been a great choice, spreads are competitive and i don’t need to worry about cost. The order is executed smoothly. Quite happy with them.

Support has been great so far. They get back to you pretty quick and give you what you need without any hassle. Definitely feels good knowing you’ve got help when you need it!

I’ve been trading on Fxview’s Raw ECN account. The spreads are tight, and the commissions are super low, way lower than most brokers I’ve tried. It’s made trading much smoother and more affordable.