FXCentrum Review 2024

Pros

- Flexible trading platform options with the popular MetaTrader 5 as well as a bespoke platform

- Very competitive pricing with no commissions and spreads from 0.2 pips

- Good selection of forex, stocks and commodities to trade with over 3000 instruments

Cons

- Clients from USA and Poland not accepted

- Few educational resources or additional tools for advanced traders

- Bonuses have difficult withdrawal requirements

FXCentrum Review

FXCentrum, also known as FXC, is a Seychelles-based multi-asset trading broker. Investors can trade 3000+ instruments including forex, stocks and indices. The brokerage offers a bespoke platform plus access to the industry-renowned MetaTrader 5 and ZuluTrade terminals. This review will cover the registration and login process, live account options, trading fees, scam warnings, and more. Find out if it’s safe to sign up with FXCentrum.

FXCentrum Headlines

FXCentrum was established in 2019 and is owned by its parent company, WTG Ltd. The broker is licensed to operate out of the Seychelles where it is regulated by the Financial Services Authority (FSA).

Created by experts from technology and finance, the brand boasts over 15,000+ successful withdrawals and more than $500,000 paid out in bonuses to new or existing users.

But while the company aims to provide a secure investing environment with reliable customer support, there have been negative user reviews. In addition, the broker’s basic investing tools may not suit experienced traders.

Platforms

FXCentrum offers its proprietary FXC Trader platform, plus access to the popular MetaTrader 5 (MT5) and ZuluTrade terminals. All platforms are available via web browsers or can be downloaded to desktop devices, compatible with Windows or Mac. The broker’s website provides download links for each platform.

We outline the functionality of each terminal below.

FXC Trader

FXCentrum’s in-house terminal was created for beginners and provides access to the full suite of global trading markets. The platform offers simple controls, market monitoring, plus live reports with real-time data and analysis. The solution also features comprehensive charts and graphs.

The search and filter navigation is user-friendly and can help investors find suitable assets. There is a useful information section that details market opening times, minimum and maximum lot sizes, available leverage and more. International day traders can benefit from local language settings, with platform compatibility in 20+ languages.

Integrated video content is also available to help traders get started, including an introduction to the platform and details of how to set up trades.

MetaTrader 5

FXCentrum provides access to the well-known MetaTrader 5 (MT5) platform. MT5 is aimed at seasoned traders and provides a string of advanced investing tools and analysis features. Users benefit from professional technical and fundamental analysis, live signals and copy trading, plus a built-in news feed. Algorithmic trading capabilities and backtesting are also available.

MetaTrader 5 provides two position accounting systems, advanced Market Depth, two market orders, six pending orders, two stop orders, and a trailing stop. 38 technical indicators, 44 analytical objects, 21 timeframes, and support for an unlimited number of charts are also available.

MT5 is compatible with desktop and mobile devices. A download link can be found on the FXC website.

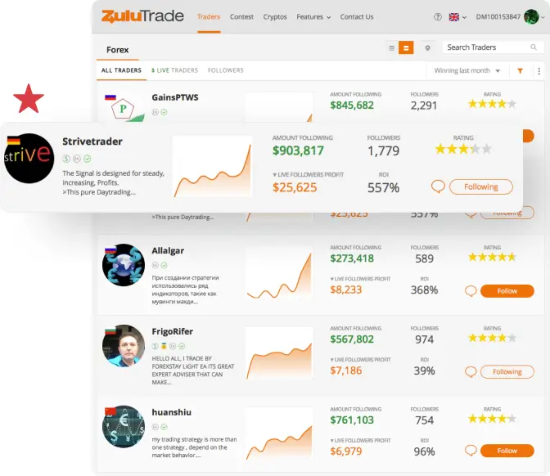

ZuluTrade

FXCentrum recently introduced the popular copy trading platform, ZuluTrade. The terminal is ideal for those looking for a more hands-off approach to investing. You can learn trading concepts from more than 100,000 registered investors, allowing you to trade with limited market knowledge.

Features include:

- Simulation – Test selected traders’ performance before committing to copying trades

- Automator – Set rules to update stops/limits, close profitable trades or trigger alerts for significant market movements

- Access To ZuluGuard Protection – A useful risk management tool designed to protect investors against wild price swings

- Social Trading Network Chat – Review signal providers, explore trends, ask questions and view the profiles of registered traders

Products & Markets

FXCentrum offers 3000+ global instruments:

- Forex – Trade 50+ major and minor currency pairs including GBP/EUR and USD/GBP

- Stocks & ETFs – Speculate on some of the biggest global brands such as Apple, Microsoft and Google

- Indices – Trade on 10+ of the world’s largest stock indices including NAS100, DAX40, FTSE100 and US30

- Commodities – Invest in a range of soft and hard commodities including Gold, Silver, Cotton, Cocoa and Brent Oil

Trades are executed via STP and ECN solutions, creating a reliable and low-cost investing environment. Retail clients have access to large liquidity pools with no dealing desk delays.

Spreads & Fees

FXCentrum provides commission-free trading under all account profiles. Instead, fixed or floating spreads are charged, which vary by account type but start from 0.2 pips. Below is a cost comparison across popular assets:

- Standard Zero – Starting EUR/USD spread 0.3 pips, GBP/USD from 0.5 pips and S&P and Gold from 0.7 pips

- Retention Special Zero – Starting EUR/USD spread 0.2 pips, GBP/USD from 0.4 pips and S&P and Gold from 0.65 pips

Dormant accounts are also liable for a $10 monthly charge. A swap fee of $0.14 is applied to trades held overnight.

FXCentrum Leverage

As an overseas company, FXCentrum can offer substantial margin trading opportunities due to limited regulatory restrictions. Investors can select a leverage ratio when registering for a new account. The maximum margin available across all accounts is 1:1000. This means a $10 deposit would provide traders with $10,000 in purchasing power.

Although high leverage can increase profit potential, it also magnifies losses. With that in mind, ensure you have appropriate risk management strategies in place.

Mobile App

The FXC platform is available as a mobile app. Accessible on both Apple and Android devices, the mobile application features all the functionality of the desktop terminal on a nifty interface designed for use on smaller screens. Clients can execute trades in one click.

The MT5 terminal also offers mobile compatibility. Traders can access several analytical tools, powerful forex trading functionality, interactive charts, historical price data and more. The MT5 app also features real-time quotes, financial news, customizable graphs and technical analysis.

Payment Methods

Deposits

Starting deposit requirements vary by account type, the minimum being $10 or equivalent currency. Other accounts are subject to an initial funding value of $1000. The broker accepts several deposit options with USD and EUR available as account denominations.

Fees do not apply, although there may be third-party charges. Payment processing times vary but FXC assures fast-tracking and instant fund availability after confirmation.

Payment methods include:

- Credit/Debit Card – MasterCard or Visa

- Bank Wire Transfer – Local transfers or Swift payments

- Online Transfers – Perfect Money, Nlinenara, Astropay and Ozow

Deposits can be made via the client zone. Simply select your chosen finance method within your profile interface.

Note, exchange rates may apply if you are depositing outside of a local currency.

Withdrawals

Minimum withdrawal limits of $10 or €10 apply. Processing times vary by method, however, the broker aims to process all requests within 24 hours. Weekend dates and public holidays may cause delays.

There are no withdrawal charges for the first payment each calendar month, but a second withdrawal will incur a $10 fee. Any further withdrawals come with a 2.5% fee. This is a real drawback versus competitors.

FXCentrum Demo Account

A demo account is available to new or existing FXCentrum clients. Paper trading accounts are a great way to practice strategies risk-free and learn platform features and tools. Users can access up to $100,000 in virtual funds within a simulated environment.

On the downside, the demo account is only available for forex trading – clients cannot practice investing in other instruments.

Deals & Promotions

At the time of writing, FXCentrum offered several promotions and incentives, including an ‘up to 100% deposit bonus’. But while appealing, upon review there were stringent withdrawal requirements (total bonus / 2). So if you deposit $1000 and select the 100% bonus offer, you will need to trade 500 lots before you can withdraw any profits from the bonus ($1000 / 2 = 500 lots).

The broker also regularly offers no deposit bonuses and live competitions. This allows investors to play against like-minded day traders with a chance to win USD account credit prizes.

SFSA regulatory guidelines do not impose restrictions on bonuses or financial incentives. However, always review terms and conditions as there may be unrealistic thresholds and trading requirements.

Regulation & Licensing

FXCentrum is a registered entity of WTG Ltd. The broker is licensed and regulated by the Seychelles Financial Services Authority (SFSA), under license number SD055. Although good to see some retail trader protection in the event of broker malpractice or insolvency, plus negative balance protection, the watchdog is not a top-tier regulator.

It is unlikely that traders will receive the levels of support and protection provided by brokers that hold a license with the Cyprus Securities & Exchange Commission (CySEC) or the UK Financial Conduct Authority (FCA).

Additional Features

FXCentrum offers free educational content for retail traders. But while 10,000 hours of training materials are available, they are mostly aimed at beginners with limited access to advanced strategy builders and market analysis.

Traders can, however, access the latest global financial news, basic terminology, and online investing guides. YouTube webinars can also be found directly via the website. Topics include trading psychology, the fundamentals of investing, utilizing a trading journal and how to trade forex pairs. An economic calendar is also available on the website but is not populated with relevant information.

It would be good to see content developed further, including via alternative mediums like podcasts, quizzes or peer forums.

FXCentrum Accounts

FXC offers several live account types. These are organized by platform, making it easy to find a profile suited to your experience level and financial goals. All profile types can also be converted into Islamic trading accounts.

Starting deposit requirements start from $10 or equivalent currency. Minimum and maximum spreads vary by instrument. Accounts can be opened in USD or EUR base currencies.

FXC Proprietary Accounts

Standard Zero

- STP execution

- Floating spreads

- Hedging allowed

- Commission free

- Maximum leverage 1:1000

- Starting deposit requirement $10

- Minimum order size 0.10 lots and maximum order size 100 lots

Retention Special Zero

- STP execution

- Floating spreads

- Hedging allowed

- Commission free

- Personal retention manager

- Maximum leverage 1:1000

- Starting deposit requirement $1000

- Minimum order size 0.10 lots and maximum order size 100 lots

MetaTrader 5 Accounts

Micro Zero

- Fixed spreads

- STP execution

- Hedging allowed

- Commission free

- Maximum leverage 1:1000

- Starting deposit requirement $10

- Minimum order size 0.10 lots and maximum order size 100 lots

Standard Zero

- STP execution

- Floating spreads

- Hedging allowed

- Commission free

- Maximum leverage 1:1000

- Starting deposit requirement $10

- Minimum order size 0.10 lots and maximum order size 100 lots

Retention Special Zero

- STP execution

- Floating spreads

- Hedging allowed

- Commission free

- Personal retention manager

- Maximum leverage 1:1000

- Starting deposit requirement $1000

- Minimum order size 0.10 lots and maximum order size 100 lots

Note, a personal retention manager is an FXC-certified account manager, supporting retail investors with platform features and trading basics. Additional support is also provided during the initial account setup, as well as ongoing trade execution guidance. Communication channels include telephone, email, WhatsApp, Telegram, and Viber.

How To Open An Account

It is quick and easy to register and open a new live account. All registration details must be completed via the FXCentrum client zone. This includes submitting the online registration form, identity verification documents and providing proof of residency. Here you can also select leverage, bonus size, and account denomination.

Verification must be completed via a registered email address. Once details have been approved, you can log in, make a deposit and start trading immediately. A useful step-by-step video guide is also available on the official website.

Opening Hours

Trading hours vary by instrument. Typically, the forex market is available to trade 24 hours per day between Sunday to Friday.

It was disappointing to see no session timetable available on the broker’s website. This is particularly useful to stay up to date with upcoming public holidays, daily break sessions and market closures.

Customer Service

FXCentrum offers limited customer support options. Up to 24-hour response times are promoted on the website so bear this in mind if you have an urgent query. There is, however, a fairly decent FAQ section, with several useful self-help topics including details on investor relations, how to verify your identity online and minimum deposit requirements.

Contact details:

- Telephone – +44 7520642606

- Email Address – support@fxcentrum.com

- Online Contact Form – Located within ‘contact us’ webpage

- Live Chat – Logo located in bottom right of the website. Services are hosted by Facebook Messenger. We noted very slow response times

- Social Media – Accounts including Twitter and Facebook are live, although posts aren’t up to date

Security

FXC provides a relatively safe and transparent investing environment. This includes negative balance protection and password-protected member areas. It is not clear whether the broker segregates client funds, however, all payments are protected with 3D Secure.

We would also advise implementing additional platform security features, such as two-factor authentication (2FA). This added layer of security uses a verification code every time you log in to your account via an authenticator app or email address prompt.

FXCentrum Verdict

This FXCentrum review has highlighted the pros and cons of trading with the online broker. We were pleased with the low minimum deposit requirements, range of account types, choice of terminals, and demo account solution. However, the official website is basic, some services are limited, and there is minimal regulatory oversight, which highlights concerns around transparency and legitimacy. Monthly withdrawal charges plus the lack of crypto trading or MetaTrader 4 access also means FXCentrum doesn’t compare with alternatives.

FAQs

Does FXCentrum Have A Mobile App?

Customers have access to the FXC Trader proprietary application plus the MT5 mobile app. Both solutions provide access to all the features and functionality found on the respective desktop platforms. Deposits, withdrawals and bonuses can also be managed from mobile trading applications.

What Is The Minimum Deposit Requirement For An FXCentrum.com Account?

Starting deposit requirements vary by account type. Nevertheless, some accounts have initial funding requirements of just $10 or equivalent currency.

Is FXCentrum A Scam?

In our opinion, FXCentrum is not a scam. With high leverage opportunities, low minimum deposits and competitive fees, it could be a good starting place for some new traders. And although regulated offshore, the broker does provide negative balance protection. Keep an eye on peer review sites such as Trustpilot for the latest feedback.

Does FXCentrum Have A Demo Account?

FXC offers a paper trading account to new or existing customers. Access up to $100,000 in virtual funds to practice investing risk-free. A simple sign-up form can be found on the broker’s website.

Is FXCentrum Regulated?

FXC is regulated and licensed by the Seychelles Financial Services Authority (SFSA). This is an offshore authority and may not provide the levels of protection provided by trusted agencies like the Cyprus Securities & Exchange Commission (CySEC), the UK Financial Conduct Authority (FCA), or the Australian Securities & Investments Commission (ASIC).

Top 3 Alternatives to FXCentrum

Compare FXCentrum with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

FXCentrum Comparison Table

| FXCentrum | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 4 | 4.3 |

| Markets | CFDs, Forex, Stocks, ETFs, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $1 | $0 |

| Minimum Trade | 0.1 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | SFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Bonus | $160 no deposit bonus | – | 100% Deposit Bonus | – |

| Education | No | Yes | No | Yes |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:1000 | 1:50 |

| Payment Methods | 8 | 6 | 10 | 6 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

World Forex Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXCentrum and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXCentrum | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | No |

FXCentrum vs Other Brokers

Compare FXCentrum with any other broker by selecting the other broker below.

Customer Reviews

2 / 5This average customer rating is based on 1 FXCentrum customer reviews submitted by our visitors.

If you have traded with FXCentrum we would really like to know about your experience - please submit your own review. Thank you.

No one should invest in this company. First it will say invest $100, after that it will say invest more. Then whoever you invest more they will withdraw your money. After that, no one will talk to you. This happened to me. So I tell every investor in the world not to invest in Fxcentrum.