Building a Futures Portfolio

How do you build a diversified portfolio that actually provides quality returns?

Some market participants don’t like diversifying because they get less of the high-return stream (e.g., stocks) and instead trade it off for a lower-return stream (e.g., bonds or commodities).

However, with derivatives and overlays you don’t have this kind of trade-off.

With an overlay, you get the benefit of the higher return while also diversifying the exposure in the portfolio.

If you get the “engineering” part right, you have higher expected long-run returns at a better reward/risk ratio, and may even reduce your overall risk.

Futures is a popular way to do this that’s also available to most individual traders/investors.

Accordingly, we talk about how to build this out and manage it below.

Key Takeaways – Building a Futures Portfolio

- You can build a diversified portfolio using futures for, e.g., stocks and gold while holding bonds directly for stability.

- Futures offer leveraged exposure, but come with carrying costs that must be factored into return expectations.

- Use options overlays (e.g., covered calls) to reduce carry costs and modestly hedge downside.

- Keep leverage disciplined.

- Backtest and stress test your limits, and don’t chase exposure beyond what’s sustainable.

- Futures come in large contract sizes, so precise allocation is difficult.

- Micro contracts help but may lack liquidity.

- Growth from market gains or savings should be matched with careful position management to avoid overleveraging.

Building a Simple Futures Portfolio

Core Allocation: Stocks, Gold, and Bonds

This futures portfolio is built around three asset classes:

- Stocks via the E-mini S&P 500 futures (ES)

- Gold via Gold futures (GC)

- Bonds via direct capital allocation, not futures

Let’s say this is our baseline position:

- Buy 2 ES contracts

- Buy 1 GC contract

- And allocate personal capital into bonds

This creates diversified exposure across equities, commodities, and fixed income, with futures used selectively to maximize capital efficiency.

Understanding Futures Exposure and Leverage

Futures Offer Notional Exposure, Not Free Leverage

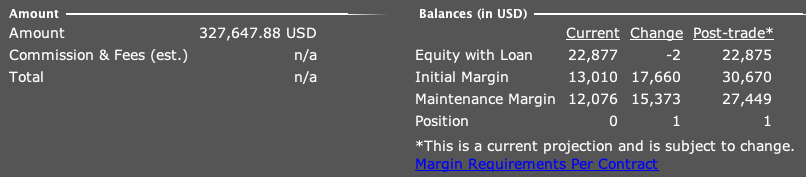

Futures allow you to control a large notional amount of an asset with a relatively small margin deposit. For example, an ES contract might represent exposure to $300,000+ of S&P 500 value with a margin requirement of only $15,000–$20,000.

This implies a 15-20x leverage, but it’s not free.

The Cost of Leverage: Carrying Costs

Futures carry implicit financing costs, often called carrying costs.

These costs are embedded in the term structure of futures prices:

- Look at prices of front-month contracts versus later-dated contracts

- The difference reflects the annualized cost to carry the asset

Calculating the Implied Carry

To estimate the carrying cost:

- Subtract the front-month futures price from a later-month contract

- Divide by the front-month price

- Annualize if needed based on the time spread between contracts

For example:

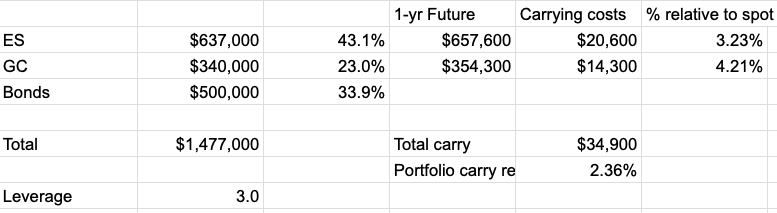

- Front-month ES (2 contracts): $637,000

- 1-year ES (2 contracts): $657,600

- Implied cost = (657,600 – 637,000) / 637,000 = 3.23% for 12 months.

If you do 3-month futures (they’re more liquid), be sure to annualize the cost.

But on an annual basis, you have carrying costs of slightly over $20,000 for this particular trade.

With gold, you have the same type of costs to calculate.

This cost should be factored into return expectations.

Table

This table summarizes this example futures portfolio made up of the S&P 500 (ES), Gold (GC), and Bonds, showing allocation weights, 1-year futures prices, and carrying costs.

ES represents 43.1% of exposure, GC 23.0%, and Bonds 33.9%, totaling $1.477M in notional exposure with 3.0x leverage.

Carrying costs are calculated from the difference between spot and 1-year futures prices, with ES costing 3.23% and GC 4.21% annually.

The total portfolio carry is $34,900, or 2.36% relative to spot/front-month futures notional exposure. This reflects the annual cost of leveraged futures exposure in the portfolio.

Reducing Carry Costs with Options Structures

Why Use Options?

Options allow you to offset carry costs, cushion downside risk, and monetize volatility.

Covered Call Strategy on ES

If you’re long 2 ES contracts, you can sell, e.g., 2 out-of-the-money (OTM) ES call options. This:

- Generates premium income

- Offsets some of the carry cost

- Adds a buffer if ES moves sideways or modestly down

If the options are ~20% OTM, you might be willing to cap your equity upside at 20% per year and receive 1-2% in premium relative to the size of your equity position.

Overweighted Call Strategy

A more aggressive approach involves selling more calls than the number of futures contracts you own:

- Long 2 ES contracts

- Short 3 OTM call options on ES

This increases premium income, which can further defray the cost of holding leveraged futures.

But this nonetheless also caps upside and introduces additional risk if ES rallies sharply.

This strategy should only be used if:

- You’re willing to accept limited upside

- You’re managing the risk of being over-hedged

Bond Exposure Without Futures

Why Bonds Are Held Directly

In this portfolio, bonds aren’t traded via futures. Instead, you allocate cash into bond ETFs, Treasuries, or fixed-income instruments. (Can be a mix of nominal and inflation-protected securities.) After all, it needs to go somewhere.

This keeps the leverage ratio lower overall, providing:

- Stability

- Lower volatility

- Anchor against equity or commodity drawdowns

Direct capital allocation also avoids the roll mechanics and carry calculations that come with bond futures.

Keeping Leverage Reasonable

Know Your Notional vs. Margin

Understand the notional exposure you’re taking relative to your total capital.

For example:

- 2 ES contracts = ~$637,000 exposure

- 1 GC contract = ~$340,000 exposure

- If your capital is $500,000, you are at ~3x leverage.

Set Limits Based on Backtesting

Backtest and stress test this portfolio to see what kind of portfolio outcomes would be acceptable to you.

Keep your leverage ratio acceptable and consider hedging the stock and/or gold exposure with cheap OTM options to make sure the risk of unacceptable losses is nil.

You want to define:

- What max drawdown you’re willing to tolerate

- How much of your portfolio should be in margin-based exposure

- When to rebalance or reduce positions

Know How to Manage the Portfolio As It Grows

As your portfolio grows, either from market gains or new savings, it’s very important to manage position sizing and leverage deliberately.

There’s a natural temptation to continue expanding the futures portion of the portfolio, especially since futures offer large notional exposure with relatively small margin requirements.

But just because you can add more leveraged exposure doesn’t mean you should.

Your backtests and stress tests should guide where the limits are.

Decide in advance how much notional leverage is acceptable, and stick to that limit regardless of how much margin is available.

Challenges in Precise Allocation

Futures contracts also present challenges in precision. They’re sold in standardized sizes, which can make fine-tuned allocation difficult.

While smaller “micro” or “mini” futures exist, they often come with lower liquidity and wider spreads, which can introduce slippage, execution risk, and higher transaction costs.

That’s why this portfolio must be managed with care and discipline. Rebalancing, carry monitoring, and scenario planning aren’t optional, but imperative for long-term sustainability.

You’re managing risk, leverage, and the cost of exposure, all of which change as your portfolio evolves.

The goal is capital efficiency, not unchecked amplification.

Related: Leverage in a Portfolio

Final Notes: A Portfolio That Thinks in Risk, Not Just Return

Every futures position should be evaluated not just for its return potential, but for:

- Implied cost of leverage

- Downside tail risk

- Interaction with other positions

- How much capital cushion remains if things go wrong

This simple structure – 2 ES + 1 GC + direct bond capital – is just an example of how to build a diversified portfolio that can be built using futures.

It gives you efficient exposure across asset classes. But it requires awareness of carry costs, option hedging opportunities, and the discipline to avoid overleveraging.