What Is the Future of the 401(k) and IRA?

The 401(k) is a retirement plan that provides tax incentives to individuals. The IRA, or Individual Retirement Account, is another retirement plan available to individuals.

Both of these plans offer tax benefits and the ability to save for retirement. While each has its own advantages, there are several similarities between them.

Both 401(k)s and IRAs enable workers to contribute pre-tax income towards their retirement savings. Contributions can be made from either an employer-sponsored plan or an individual account. Each type of account limits how much money can be contributed annually, based on the taxpayer’s filing status and overall adjusted gross income.

Both 401(k)s and IRAs allow contributions to grow tax-deferred until they are withdrawn at retirement age; this means that any earnings generated by investments inside the accounts will not be taxed.

The Future of the 401(k) and IRA

The 401(k) and IRA are likely to undergo an evolution like all products do.

In general, the 401(k) and IRA structures are something that people need to think more critically about.

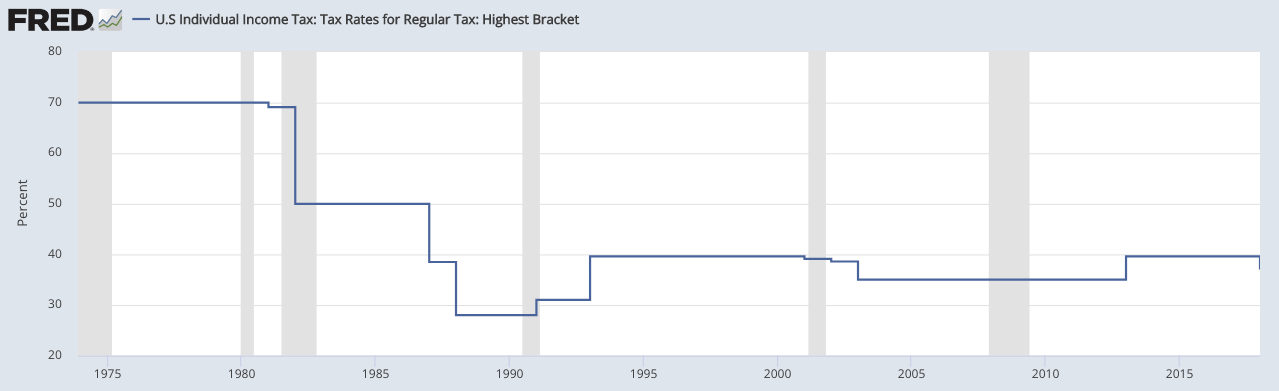

In the past, they’ve been useful for individuals because they effectively allowed them to arbitrage tax rates across different time periods because tax rates have fallen over the past 40 years in terms of the overall trend. The IRA was esblished in 1974 and the 401(k) was established in 1978.

It essentially allowed them to skip the formerly higher tax rates for a lower tax rate in the future.

U.S Individual Income Tax: Tax Rates for Regular Tax: Highest Bracket (IITTRHB)

But now if you project out the federal spending that has to occur going forward with core spending needs, then add in the non-debt liabilities that are increasingly coming due (healthcare, pension, other unfunded obligations) and compare that alongside the projected growth in productivity and growth in the labor force, there’s going to be a divergence.

The spending will grow faster than the output.

This means larger deficits and also means more pressure on fiscal policymakers to raise rates on existing taxes and try to implement new forms of taxes to cover more of the shortfall with actual output rather than debt and the monetization of it.

The 401(k) structure is good in that people put in a certain amount of money and then the employer often matches fully (a 100 percent rate of return on the initial amount put into the account), but if the tax component goes from a tailwind into a headwind, then it can potentially make the product less attractive.

So you’re putting in the money now at a lower tax rate and there’s a reasonable chance you’re paying a higher tax rate on the money in the future.

Nothing is known for sure. But it’s something that people have to be mindful of because one of the big attractions of the 401(k) and IRA for many is that you forgo access to your money (unless you’re willing to accept large penalties) in exchange for a tax benefit.

FAQs – Future of the 401(k) and IRA

What changes can people expect to see in the 401(k) and IRA structures?

It is difficult to predict exactly what changes will be made, but it is likely that there will be an evolution of both types of retirement plans.

Possible changes could include higher tax rates for contributions and on any earnings generated by investments within the accounts.

Will these changes make them less attractive products?

The appeal of these plans still largely lies in their ability to provide tax benefits and grow savings tax-free until retirement age.

However, if the tax component becomes a headwind rather than a tailwind, then this could reduce the attractiveness of these plans.

It is important to consider all factors when deciding which type of retirement plan works best for your individual needs.

Conclusion – Future of the 401(k) and IRA

The future of the 401(k) and IRA will be determined by the overall economic conditions, including taxation rates.

It is possible that the current structures could remain largely unchanged or potentially undergo an evolution as tax policies and other factors shift.

Regardless, it is important for individuals to understand how their financial goals and preferences fit into the bigger picture when deciding which type of retirement plan works best for them.

This can help ensure that they make informed decisions about their finances now and in the future.