Finrax Brokers 2026

Finrax is a gateway for cryptocurrency payments providing multi-currency support and exchange so that merchants can process transactions in digital tokens. The payment solution is also proving popular with traders, providing instant deposits due to the undisrupted flow of funds. This guide lists the best brokers that accept Finrax deposits in 2026. We also unpack the pros and cons of using Finrax.

Best Finrax Brokers

Our exhaustive tests have shown that these are the top 2 brokers that support Finrax payments:

This is why we think these brokers are the best in this category in 2026:

- CMTrading - Established in 2012, CMTrading has emerged into a popular broker with active traders, particularly in South Africa. Sporting four account options (Basic, Trader, Gold, Premium) and the popular MT4 platform alongside the broker’s own Webtrader, it provides a compelling trading environment for short-term traders.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to day traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Compare The Best Finrax Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| CMTrading | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Webtrader, MT4, TradingCentral | 1:200 |

| FP Markets | $40 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | 1:30 (UK), 1:500 (Global) |

CMTrading

"CMTrading is well suited to traders in South Africa looking for highly leveraged trading opportunities on global financial markets through a user-friendly, web-accessible platform, with signals from reputable providers to help inform short-term trading decisions."

Christian Harris, Reviewer

CMTrading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FSCA, FSA |

| Platforms | Webtrader, MT4, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, ZAR |

Pros

- The CMTrading Academy has come a long way, offering a wealth of materials for traders at all levels. Video courses, webinars, and market analysis updates can help users deepen their knowledge.

- CMTrading operates under the oversight of the FSCA in South Africa, providing degree of operational security and accountability, ensuring the platform follows industry standards.

- CMTrading have added an incredibly intuitive AI chart feature which we’ve not seen elsewhere and offers signals in three simple steps: find an asset, take a screenshot of the chart, then upload it to the scanner for technical analysis and signals in seconds.

Cons

- While CMTrading offers a variety of assets, the overall selection is still significantly narrower than that of category leading brokers like BlackBull. The focus is primarily on forex, commodities, a few indices, and crypto.

- CMTrading's customer support is unavailable around the clock, which proved inconvenient during testing for traders in different time zones or those who encounter issues during non-business hours.

- Spreads are higher than those offered by some competing brokers like IC Markets based on evaluations. This could increase trading costs, particularly for high-volume day traders.

FP Markets

"FP Markets strikes an ideal balance between affordability and quality for active traders. They’ve managed to keep trading costs low while expanding their investment offering, charting tools, and research features, all while providing excellent support you can rely on for urgent trading queries."

Christian Harris, Reviewer

FP Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Minimum Deposit | $40 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (UK), 1:500 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- FP Markets has a seamless onboarding experience, standing out with crypto deposits and over 10 base currencies, catering to global traders.

- With MetaTrader, cTrader, Iress and more recently TradingView, FP Markets is one of the most accommodating brokers in terms of platform choice.

- FP Markets has integrated top-notch research tools from Trading Central and Autochartist, helping traders identify short-term opportunities based on chart patterns, indicators, and other technical factors.

Cons

- FP Markets’ Iress platform is only available to clients in Australia. It also primarily emphasizes stock trading over forex trading, and data fees can accumulate rapidly unless you're an active trader or maintain a high-balance account.

- While pricing in the Raw account is excellent, spreads in the Standard account trail the cheapest brokers with a 1.1-pip average spread on the EUR/USD compared to the 0.8-pip average at IC Markets.

- Although Traders Hub provides rich research, notably the Daily Report, Technical Report, Market Insights, and Fundamental Analysis, it needs to widen its daily content variety and keep its forex news updated to match category leaders like IG.

How Did We Choose The Best Finrax Brokers?

To list the top Finrax brokers, we:

- Searched our library of 500 online brokers, focusing on all those accepting Finrax payments

- Verified that they support Finrax deposits and withdrawals for online trading

- Ranked them by their overall rating, blending 100+ data points with our first-hand observations

What Is Finrax?

Finrax was established by directors Roberto Penchev and Miroslav Marinov. Founded in Bulgaria in 2018, the company moved bases to Estonia to gain a license, opening the subsidiary Finrax Exchange OÜ.

Today, the payment solution is available in 170+ countries, with 1.2m+ transactions processed, and 170M+ in monthly volumes.

For vendors, including online brokers, the company offers:

- International transactions

- Getting invoices paid

- Exchanging payment links

For end users, such as traders, benefits of the solution include:

- Low cost and secure transfers

- Send and receive payments in crypto

- Exchange crypto to fiat money immediately

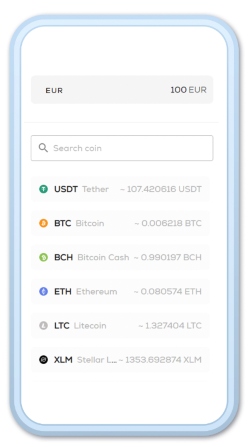

Finrax essentially allows traders to fund their online investing accounts using cryptocurrency. Users deposit via a variety of digital tokens, including Bitcoin, Ethereum, Metal, Civic Price, and AION. In total, 20+ cryptos paired with 30+ fiat currencies are available.

Transaction Times

The top Finrax brokers offer near-instant deposits with the payment solution.

With that said, the time also depends on the amount of money you are depositing and the coin you have selected. In addition, traders will need to ensure they have verified their account prior to requesting a withdrawal. This may require submitting proof of your address and identity.

Fees

Brokers that accept Finrax deposits will be charged blockchain fees for using it to facilitate cryptocurrency payments on their site. Firms will then either absorb those fees or pass them on to the trader. Which one your broker does is at their discretion, and therefore you should check this before opening a trading account to use Finrax.

Importantly though, using cryptocurrency to fund trading accounts can be a low cost option. This is because brokerages are looking to attract traders to their service, and therefore Finrax brokers are likely to keep fees down. Traders may only be asked to pay a small percentage of the transaction value.

Security

The firm implements KYT monitoring, so all deposits and withdrawals are checked to protect traders from bad actors. There are also advanced user access permissions in place which can be customized securely and keep funds safe. The firm is also compliant with EU regulations and for further safety, it offers payouts in stablecoins and Euros.

Using cryptocurrency to fund trading accounts is fairly low-risk since you don’t have to add bank account or credit card information to make a transaction. Many traders choose to use Finrax because of the financial security that it can offer. On the other hand, there is an inherent risk in using Bitcoin, in particular, as storage solutions can be susceptible to hacking.

Ensure the broker you are trading with is also trustworthy and reliable, as not every broker that accepts Finrax is going to be as secure as the payment method itself is. There have been reports of illegitimate offshore Finrax brokers using the payment method, for example. Therefore using a secure payment method is not enough; the broker itself needs to also be reputable.

How To Deposit Using Finrax

Begin by navigating to the deposits page on your broker, which may look different depending on where you are trading. For example, on Infinox this is under ‘Client Area’, but on others, it may be under ‘Payment Methods’ or similar. Then:

- Choose the currency to deposit. You will be redirected to Finrax’s payment portal where you can confirm the crypto to use

- Confirm your payment and check the conversion rate

- Once the transaction is approved, you can scan a QR code or copy and paste the address into your crypto wallet (you have 30 minutes to complete the transaction)

Withdrawals are done similarly and in the coin of your choice. Request your withdrawal in line with your broker’s limits and you should receive your payment within one working day. The funds will be withdrawn to your crypto wallet.

Pros Of Finrax Brokers

- Volatility – Volatility is one of the key risks associated with using cryptocurrencies, such as Bitcoin, partly due to the lack of regulation present in the market. However, Finrax does not expose traders to inherent crypto volatility and offers fixed exchange rates so that you get exactly what you expect.

- Fast Trading Deposits & Withdrawals – Crypto gateways are able to facilitate some of the fastest payments due to the undisrupted flow of funds. This means you don’t have to wait for blockchain confirmations for your funds to be processed.

- Token Support – Traders can deposit funds using various digital tokens, including Basic Attention Token (BAT), Bitcoin Cash (BCH), Civic Price (CVC), Augur (REP), Stellar (XLM), and Zilliqa (ZIL).

Cons Of Finrax Brokers

- Low Accessibility – It is not yet a widely accessible payment method for online trading – there are only a few brokers that accept Finrax deposits. This means that if you do decide you would like to use it, your selection of reliable Finrax brokers to choose from will be slim.

Is Finrax Good For Day Trading?

If you are looking to fund your trading account using cryptocurrencies, then the payment gateway is a good option. Your transactions will be fast if you select brokers that accept Finrax deposits, and you don’t have to add sensitive information like banking details to your brokerage account, which adds a level of security too.

Use our list of the top Finrax brokers to start trading.

FAQ

Can You Use Finrax For Trading?

Yes, brokers that accept Finrax deposits allow investors to use it to fund their trading accounts with cryptocurrencies rather than linking their bank accounts or credit cards.

The company is essentially a gateway for cryptocurrency payments, with multi-currency support inbuilt so that merchants like trading brokers can process payments made in digital tokens.

Is Trading With Finrax Too Volatile?

While funding your trading account using cryptocurrencies can expose you to high volatility, Finrax operates on pre-agreed rates protecting you from uncertain market conditions. This is a notable advantage over other crypto payment solutions.

How Long Do Deposits To Finrax Brokers Take?

Funding your trading account should take no longer than 15 minutes for the money to be deposited in full. Withdrawals should take no longer than 24 hours. However, this will also depend on the timeline of the brokerage in question.

Do Brokers That Accept Finrax Deposits Charge Transfer Fees?

This will depend on the trading broker. However the best Finrax brokers cover any fees so long as the payment value is above a certain value. This makes it a low-cost payment method for traders looking to deposit funds in digital currencies.