Discounted Maximum Loss (Worst-Case Risk Measure)

Discounted Maximum Loss (DML), sometimes referred to as a Worst-Case Risk Measure, is a financial metric used to assess the most severe potential loss in an investment or portfolio, adjusted for the time value of money.

It evaluates the worst possible scenario for an investment over a specified time horizon, taking into account the probability and timing of potential losses.

Key Takeaways – Discounted Maximum Loss (Worst-Case Risk Measure)

- Future Risk Projection: Discounted Maximum Loss estimates the worst-case financial loss of an investment, adjusted for future value discounting.

- It incorporates both the severity and timing of potential losses.

- Strategic Planning Aid: This measure is useful for long-term financial planning and risk management.

Calculation

Components

- Maximum Loss: The largest possible loss in the value of the investment or portfolio over the defined period.

- Discount Factor: This component adjusts the maximum loss for the time value of money, recognizing that future losses are less impactful in present-value terms.

Process

To calculate DML, the maximum potential loss is first identified.

This loss is then discounted back to its present value using a discount rate, which could be a risk-free rate or a rate reflective of the investment’s risk profile.

Significance

Risk Assessment

DML provides a view of risk by considering both the magnitude of the potential loss and its timing.

This offers a more realistic assessment of the worst-case scenario.

Decision-Making

This measure is valuable for risk-averse traders/investors or those with a focus on capital preservation, as it helps in understanding the extreme downside risk of an investment.

Strategic Planning

For portfolio managers, DML is a tool in strategic planning, particularly in stress testing and scenario analysis for risk management.

Applications

Risk Management

DML is used to quantify and manage the risk in portfolios. It helps in determining the adequacy of capital reserves and liquidity needs.

Portfolio Optimization

Incorporating DML into portfolio optimization can help in constructing portfolios that are resilient to market downturns (if keeping the DML within acceptable bounds is a goal).

Financial Planning

For financial planners, DML can be a component in designing investment strategies that align with clients’ risk tolerance and long-term objectives.

Advantages

Focus on Extreme Scenarios

DML emphasizes the worst-case outcome. This is essential for understanding and preparing for potential catastrophic losses.

Time Value Consideration

By discounting the potential loss to its present value, DML provides a more nuanced view of risk that accounts for the timing of potential losses.

Limitations

Prediction Challenge

Estimating the maximum potential loss involves significant uncertainty and requires assumptions about future market conditions, which can be challenging.

Dependence on Discount Rate

The choice of discount rate can significantly influence the DML calculation, and selecting an appropriate rate is critical for accuracy.

Complex Calculation

The process of calculating DML can be complex, requiring an understanding of financial modeling and the investment’s risk characteristics.

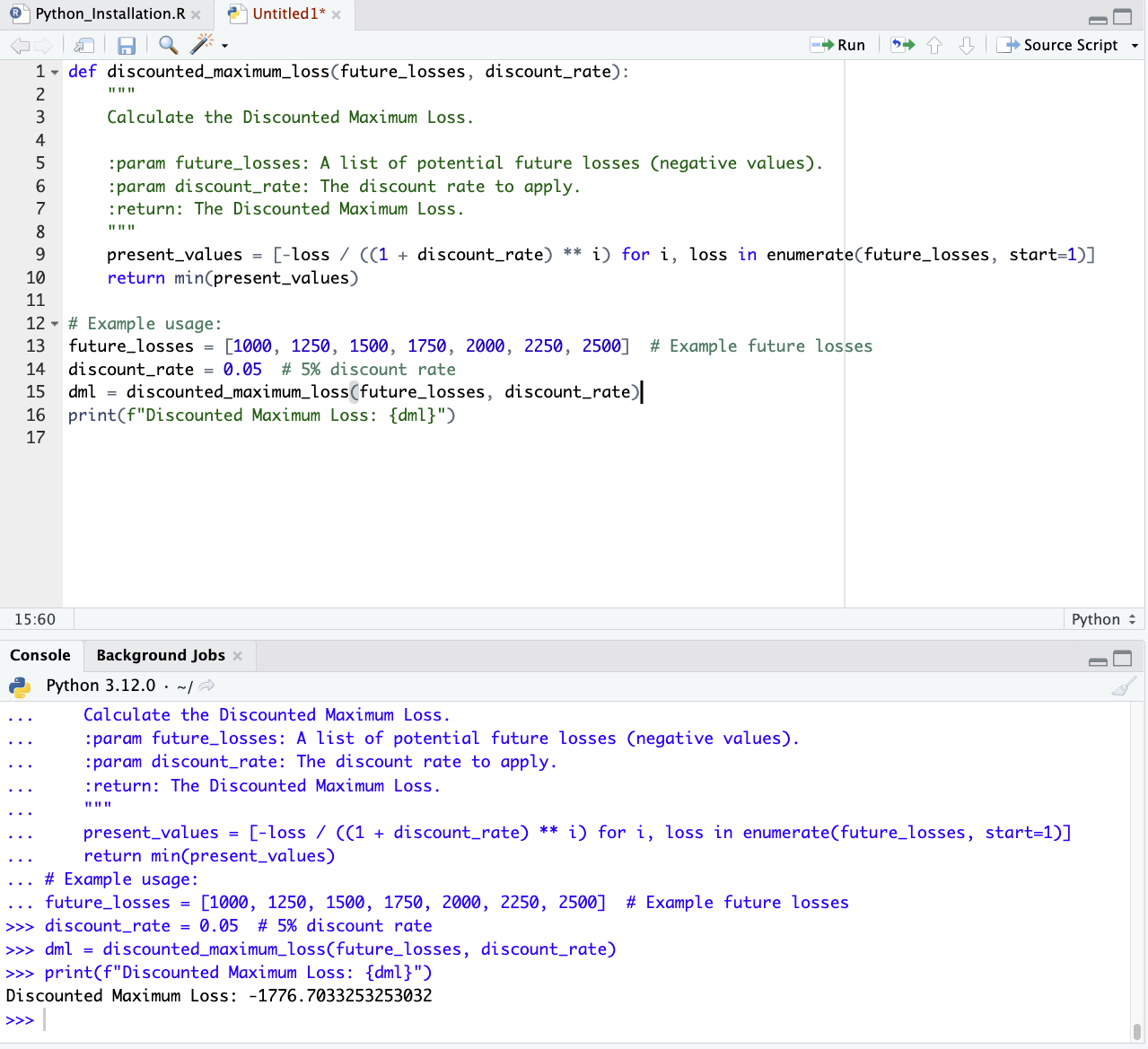

Python Code for Discounted Maximum Loss

To calculate the Discounted Maximum Loss in Python, you’ll typically need a series of potential future losses and a discount rate to adjust these losses to their present value.

The DML is essentially the present value of the worst-case future loss.

Here’s a simple Python function to demonstrate this calculation:

import numpy as np

def discounted_maximum_loss(future_losses, discount_rate):

"""

Calculate the Discounted Maximum Loss.

:param future_losses: A list of potential future losses (negative values).

:param discount_rate: The discount rate to apply.

:return: The Discounted Maximum Loss.

"""

present_values = [-loss / ((1 + discount_rate) ** i) for i, loss in enumerate(future_losses, start=1)]

return min(present_values)

# Example use:

future_losses = [1000, 1250, 1500, 1750, 2000, 2250, 2500] # These are example future losses

discount_rate = 0.05 # 5% discount rate

dml = discounted_maximum_loss(future_losses, discount_rate)

print(f"Discounted Maximum Loss: {dml}")

So, in this code, we have:

- future_losses is a list of potential future losses (expressed as positive numbers for simplicity, then negated in the calculation).

- discount_rate is the annual discount rate.

- The function calculates the present value of each potential loss and returns the smallest value (which represents the maximum loss after discounting).

We show this executed below:

Naturally what we have here is just a basic example.

Real-world applications will require more complex modeling in determining the future losses and the appropriate discount rate.

Conclusion

Discounted Maximum Loss is a risk assessment tool that combines the concept of maximum potential loss with the time value of money.

It offers a nuanced view of worst-case risk in financial investments.

It has valuable for risk management, portfolio optimization, and strategic financial planning.

It’s best for those focused on understanding and mitigating extreme downside risks.

The DML’s effectiveness depends on accurate loss estimation and appropriate discount rate selection.