The #1 Determinant of Success in Trading and Investing

Your personal savings rate and consistency in saving is the number one reason why people succeed in their trading and investing endeavors.

If you don’t save anything, you won’t have anything to work with.

To show why, let’s look at a simple example of someone routinely, without fail, putting $1,000 into the market each month, adjusting for inflation over time. Salaries usually rise with inflation even if their skills don’t – and skills should rise over time – so this is realistic.

And let’s say they kept their strategy as simple as possible…

They bought the S&P 500 and that’s it.

No wondering about where interest rates will go, what the market is valued at, any market timing considerations, geopolitics, domestic policies, oil prices, and so on…

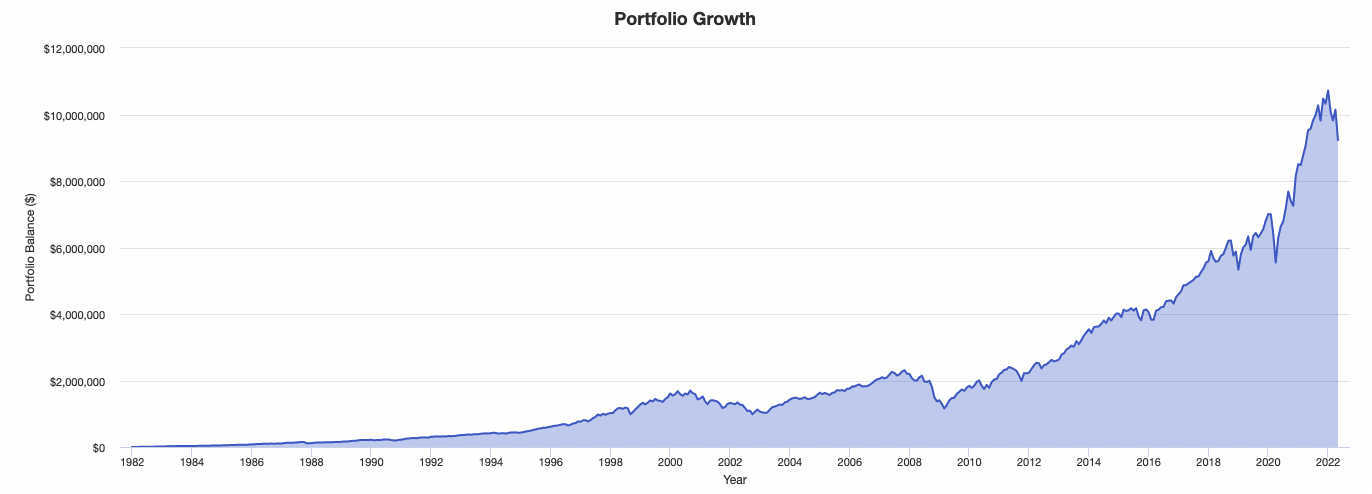

They simply put $1,000 into the S&P 500 each month for the past 40 years. About as simple as it gets in a world where everyone is trying to get a leg up on the index somehow.

How much would they have?

$9.2 million.

Portfolio Returns – Past 40 years, $1,000 invested per month

| Portfolio | Initial Balance | Final Balance | CAGR | TWRR | MWRR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S&P 500 | $1,000 | $9,230,173 | 25.40% | 11.35% | 10.43% | 15.31% | 35.79% | -37.04% | -50.89% (-49.86%) |

0.55 | 0.79 | 1.00 |

The high CAGR (annual returns) statistic is due to the continued contributions.

The shorter the time period, the higher the CAGR is going to be based on fixed contributions.

As the portfolio grows, the $1,000 in contributions will be less and less ratio-wise and thus have less of an effect on the calculation of the annual return.

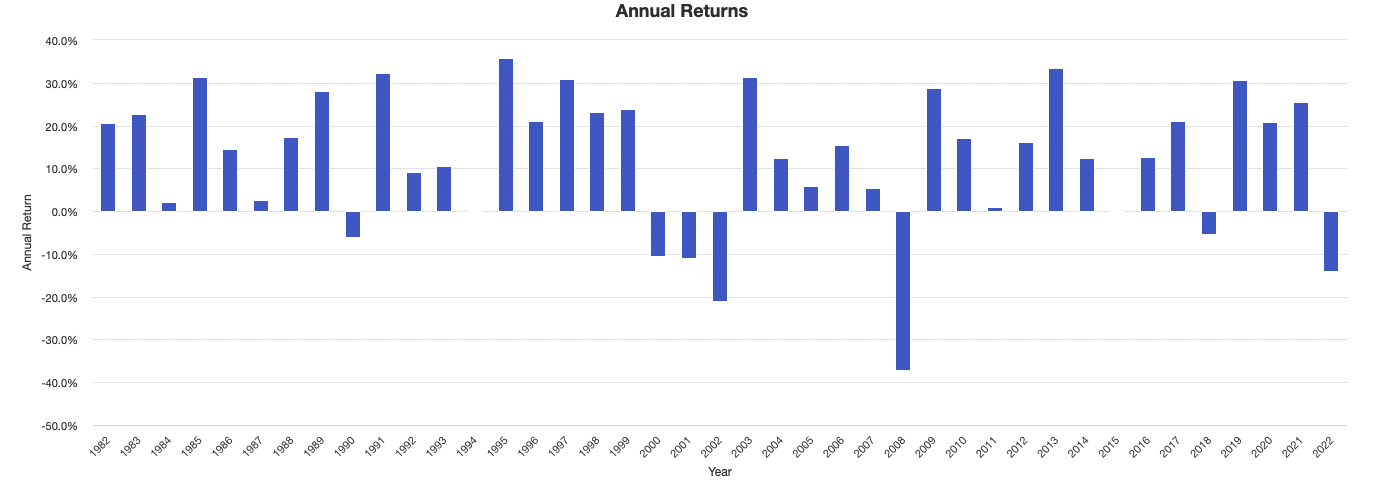

Some of the annual year-to-year returns in stocks are not great, but it’s the long haul that matters.

Despite all the bumps in the road over this time period:

- 1987 one-day crash of 22 percent

- 1990-91 recession

- 1997 Asian crisis

- 1998 Russian default/LTCM collapse

- 2000-02 tech bubble bust and recession

- 2008 financial crisis

- 2022 monetary policy tightening…

…it still netted good to very good overall results through a combination of regular savings put to work and quality investment gains.

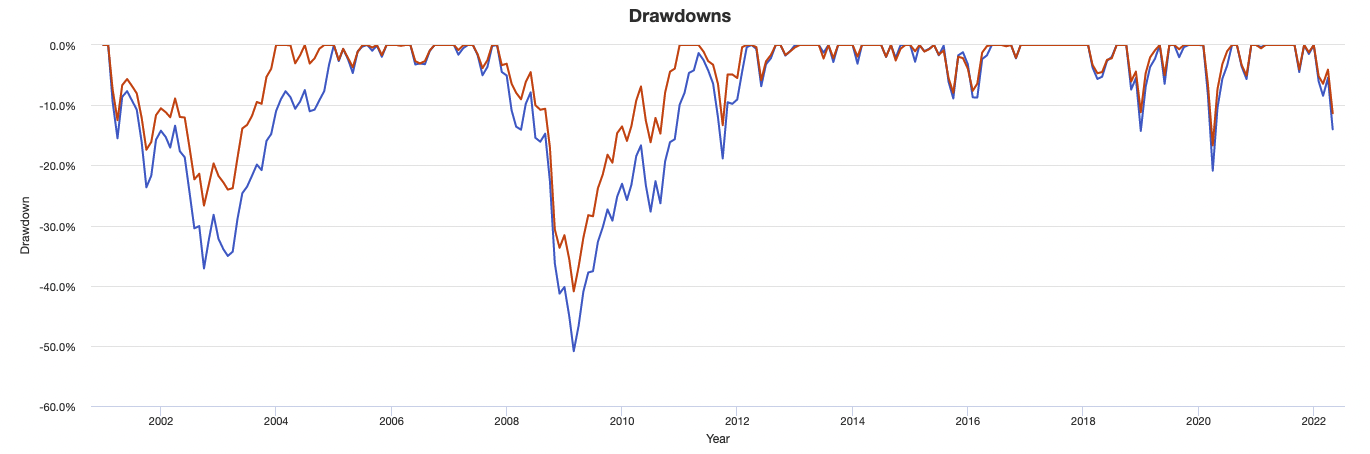

Of course, if the trader/investor diversified even slightly – went from all stocks to, say, 80 percent stocks, 10 percent TIPS (inflation-protected government bonds), and 10 percent gold – this would yield about the same in terms of aggregate returns.

But the 80/10/10 portfolio (blue line) would do so at less risk than the 100 percent stocks portfolio (red line) with somewhat lower drawdowns – despite the bulk of this risk (96 to 97 percent) still being heavily in stocks.

Consistency and savings rate is the number one ingredient

Your savings rate and your consistency with it will be the main ingredient in your financial success.

Regular, consistent contributions over a long period of time is the behavior that’s most likely to lead to success.

That means you don’t necessarily need to have a large salary. Most people think wealthy people must have very high salaries or have something else going for them (inheritance), but that’s not typically the case.

Ramsey Solutions did a study on millionaires and the trends in how they’re created.

They found that:

- Only 31 percent of millionaires averaged $100,000 per year in salary over the course of their careers.

- One-third never made $100,000 or more in any single working year in their career.

- Only 15 percent were in senior leadership roles.

Saving + consistency + long time horizon

This requires not just saving money consistently but also having a long enough timeframe.

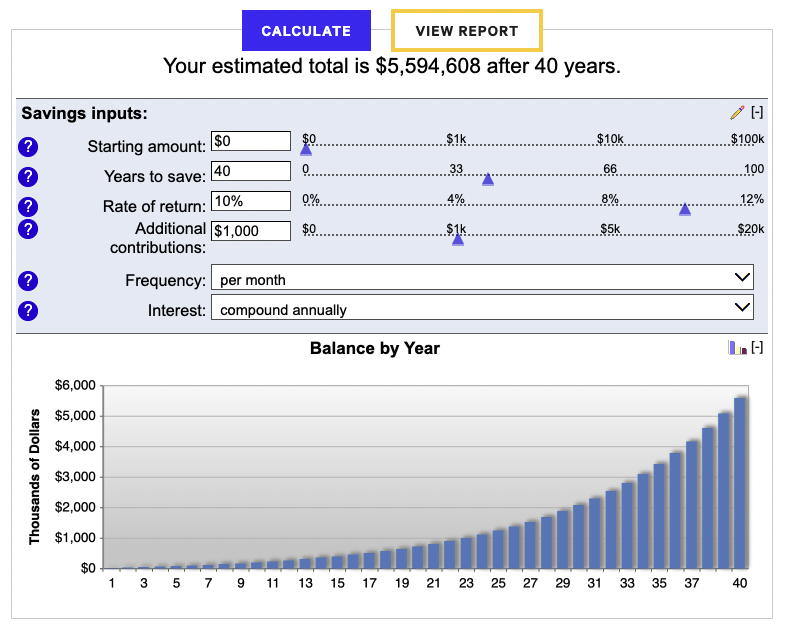

When most people think of $1,000 per month, they might think of it as $12,000 per year, but they usually don’t think much beyond that.

Even if they do think out 40 years, they might think $12,000 * 40 = under half a million dollars.

However, compounded returns work on a curve, not a straight line.

So even a thousand dollars saved and invested each month over one’s working lifetime is likely to end up as millions of dollars.

If you were to put in $1,000 per month each month for 40 years at 10 percent, that’s $5.6 million.

Assumptions that go into these calculations

The $9.2 million figure stated earlier in the article is what actually happened.

The $5.6 million figure is what would happen with a 10 percent return.

Some might disagree that those results are likely.

For example, the next 40 years are not likely to have the same interest rate tailwind or the structural growth rate in the US or European economies to get the 10+ percent needed to get to the $5-$10 million from that kind of monthly contribution.

However, you’re still likely to end up in the millions.

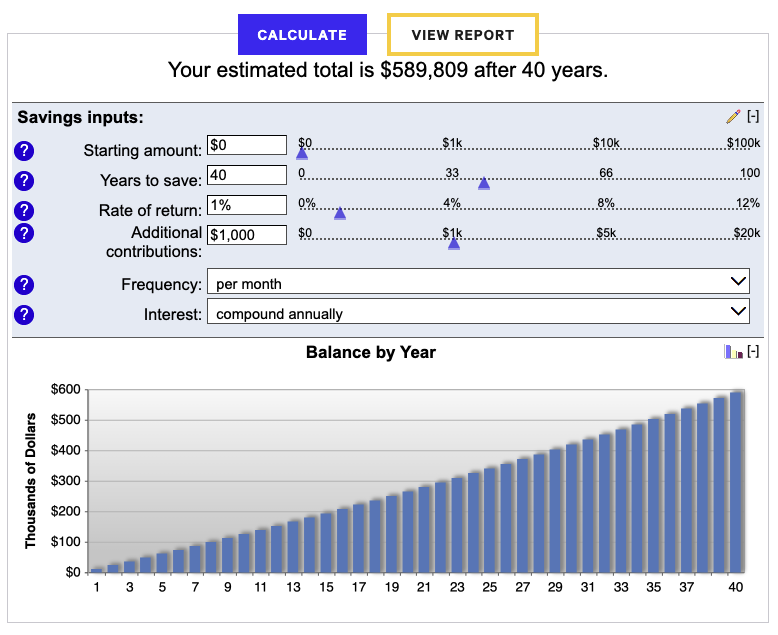

Now, even if that $5.6 million figure is 90 percent wrong because one’s investments couldn’t even fetch a 1 percent annualized return per year – which would be about $590,000 – you’d still have $560,000. That’s still a lot better than nothing.

Conclusion

The biggest determinant of success in trading and investing is your ability to save and how consistent you can be with it.

If you save nothing, you’ll have nothing to trade or invest with.

The more you save and the more consistent you are with that saving, the more money you will have to work with and, accordingly, the greater your chances of success will be.

So if you want to be successful in trading and investing, it’s the number one thing to be mindful of.

In the end, even if your strategy wasn’t amazing and netted just a few percent in annualized returns, that’s still better than saving nothing and getting nothing.

Appendix

__