Forex Trading In Germany

Forex trading in Germany is a significant component of the global market, with a daily trading volume reaching billions of euros. The country boasts the largest economy in Europe and a robust regulatory framework, contributing to the relative strength of the euro.

Let’s delve into the fundamental aspects of forex trading in Germany and an example trade scenario.

Quick Introduction

- Germany hosts a strong forex trading market, ranking among the top in Europe in terms of trading volume and participation.

- Forex trading in Germany is regulated by Federal Financial Supervisory Authority (BaFin), ensuring investor protection and market integrity.

- EUR/USD is the most actively traded currency pair in Germany, followed by other key pairs like EUR/GBP and EUR/JPY.

Top 4 Forex Brokers In Germany

Our latest tests as of February 2026, show these 4 platforms are best for forex traders in Germany:

How Does Forex Trading Work In Germany?

To begin trading currencies in Germany, you’ll need to sign up with an online brokerage, which acts as a bridge to the foreign exchange market. These brokers offer tools and FX apps for analysis and trade execution, such as MetaTrader 4 and cTrader.

Forex brokers usually provide access to a wide range of currency pairs, including majors (the most traded currencies globally), minors (major currencies excluding the USD), and exotics (one major currency and one currency from a developing or emerging economy), presenting plenty of short-term trading opportunities.

Is Forex Trading Legal In Germany?

Forex trading is legally permitted in Germany and falls under the oversight of the regulatory body BaFin.

BaFin oversees financial services, including currency trading, to uphold stringent standards, safeguard investors, and uphold market integrity.

Leverage in forex trading enables you to command larger positions with a smaller capital outlay, magnifying both potential gains and losses. Essentially, you borrow funds from your brokerage to expand your trading exposure.

In Germany, leverage restrictions are imposed by BaFin. These restrictions aim to protect retail traders by limiting the amount of leverage you can use when trading forex, including through popular derivatives from German CFD brokers.

BaFin has set maximum leverage limits for retail clients at 1:30 for major currency pairs (like EUR/USD) and 1:20 for non-major currency pairs (like EUR/JPY).

Additionally, BaFin introduced negative balance protection, ensuring that you cannot lose more than your initial investment.

Is Forex Trading Taxed In Germany?

Germany offers comparatively straightforward forex taxation laws. If you engage in trading currencies as a supplementary income, you are subject to a 25% capital gains tax along with a 5.5% solidarity surcharge.

Losses from forex trading can be used to offset capital gains tax, and any net losses can be carried forward to offset gains in future tax years.

However, if you are a professional trader you will be liable to pay ordinary income tax based on your tax brackets at the end of the fiscal year for your net profits.

When trading online in Germany you are required to report your forex trading profits and pay taxes on them to the Federal Central Tax Office, so it is important for you to keep accurate records of your trading activities for tax reporting purposes.

When Is The Best Time To Trade Forex In Germany?

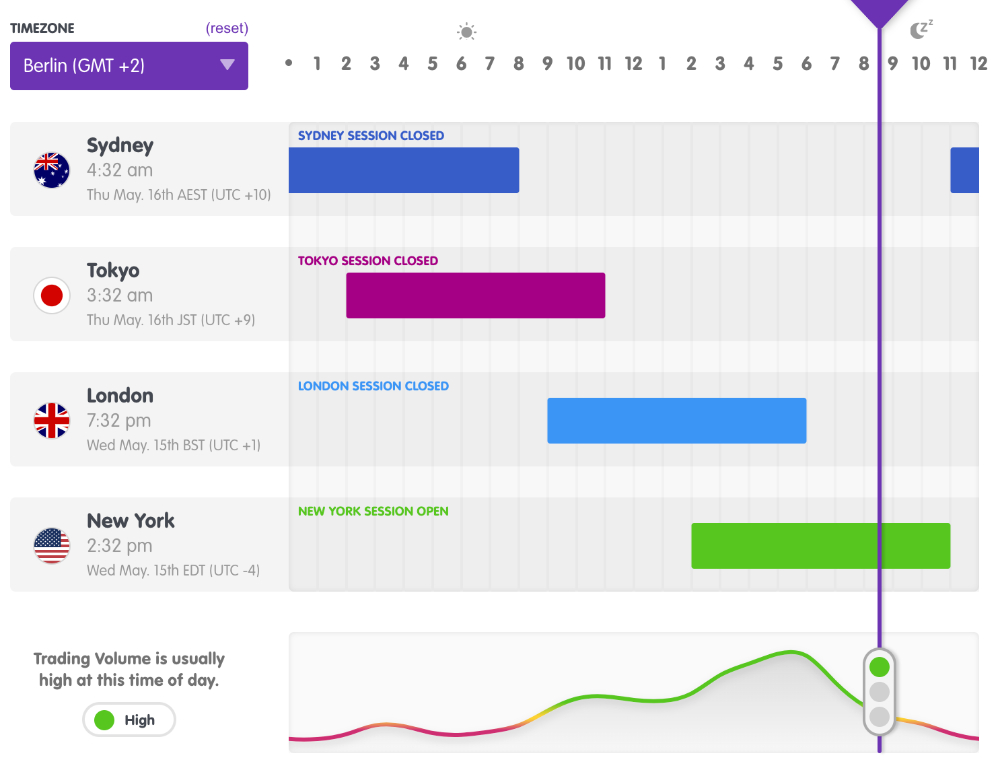

Forex trading sessions in Germany adhere to the global market hours, divided into four primary trading sessions:

- Sydney – Pacific Region

- Tokyo – Asian Region

- Europe – London

- America – New York

The prime trading window for euro pairs is usually between 2 pm and 4 pm (Frankfurt time) when the European and US trading sessions overlap. This period witnesses heightened liquidity and volatility, presenting ample day trading opportunities for EUR/USD.

The next best time to trade forex in Germany would be during the European session alone, which runs from 8:00 am to 4:00 pm (Frankfurt time). During this time, the Frankfurt market is active, along with other major European financial centers.

While trading activity may not be as high as during the overlap, it still offers sufficient liquidity and volatility for trading euro pairs.

Example Trade

To offer practical insight into forex trading for German investors, I’ll detail the steps I followed to execute a short-term (intraday) trade on the EUR/USD currency pair:

Economic Event Analysis

The European Central Bank (ECB) announced a decision to keep interest rates unchanged but hinted at potential policy tightening in the future due to improving economic conditions in the Eurozone. This announcement led to increased volatility in the EUR/USD pair.

Technical Analysis

After the ECB announcement, I conducted technical analysis on the EUR/USD chart. I observed that the pair was trading in an uptrend, with higher highs and higher lows.

Additionally, I identified key support and resistance levels to determine potential entry and exit points.

Position Sizing & Risk Management

Considering the heightened volatility due to the ECB announcement, I decided to implement thorough risk management.

I determined my position size based on my risk tolerance, ensuring that I didn’t risk more than 2% of my account balance on this trade. Additionally, I placed a stop-loss order below the nearest support level to limit potential losses.

Trade Entry

As the EUR/USD pair showed bullish momentum following the ECB announcement, I entered a long position at the breakout of a key resistance level.

This entry point provided confirmation of the uptrend continuation and offered a favorable 2:1 risk-reward ratio (risking 12.8 pips to make 25.6 pips).

Trade Exit

To manage the trade effectively, I set a profit target based on the recent swing high on the EUR/USD chart. As the pair reached the target level, I exited the trade to secure profits.

Additionally, I adjusted the stop-loss order to break even to protect against any adverse price movements.

Post-Trade Analysis

After closing the trade, I conducted a post-trade analysis to evaluate the performance and identify areas for improvement.

I reviewed the reasons behind the trade entry and exit decisions, assessed the effectiveness of risk management strategies, and noted any lessons learned for future forex trades.

Overall, the trade was successful, and I gained valuable insights into trading the EUR/USD pair during significant economic events.

Bottom Line

Germany stands out as Europe’s second-largest online forex trading market, following closely behind the UK. This positioning offers abundant opportunities for forex traders in Germany seeking diverse markets and ample liquidity.

The country also has some of the most stringent regulations in the financial market, such as the investor compensation scheme, offering coverage of up to €90,000 per client in the event of broker insolvency or bankruptcy. This scheme serves as a safety net, especially for smaller investors, shielding them from significant losses in such situations.

To get started, open an account with a top forex day trading platform in Germany.

Recommended Reading

Article Sources

- German Federal Financial Supervisory Authority (BaFin)

- European Securities and Markets Authority

- Bundeszentralamt für Steuern - Federal Central Tax Office

- Forex market time zone converter - Babypips

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com