Cyprus Securities and Exchange Commission (CySEC) Brokers 2026

The Cyprus Securities and Exchange Commission (CySEC), a top European regulator with ‘green tier’ status in our Regulation & Trust Rating, ensures brokers maintain a secure environment for active traders like you and me.

Dig into the top CySEC-regulated trading platforms, personally tested by our experts and updated for 2026.

Best CySEC Brokers

Over 20% of the brokers we've evaluated out of our 139-strong database are authorized by the CySEC so the competition was tough. However, these 6 providers emerged as the absolute best following our rigorous tests:

-

1

XM

XM -

2

AvaTrade

AvaTrade -

3

IC Markets

IC Markets -

4

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

5

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

6

FBS

FBS

Here is a summary of why we recommend these brokers in March 2026:

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- FBS - Founded in 2009, FBS is an award-winning CFD broker operating in over 150 countries with a client base exceeding 27 million traders. Traders are supported at every stage of their journey with 24/7 assistance, market analytics, trading calculators, and competitive pricing with zero commissions.

CySEC Brokers Comparison

| Broker | CySEC Regulated | EUR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| XM | ✔ | ✔ | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| AvaTrade | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| IC Markets | ✔ | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Pepperstone | ✔ | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist | 1:30 (Retail), 1:500 (Pro) |

| Eightcap | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:500 |

| FBS | ✔ | ✔ | $5 | CFDs, Forex, Indices, Shares, Commodities | FBS App, MT4, MT5 | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

Cons

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

FBS

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Shares, Commodities |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Account Currencies | USD, EUR |

Pros

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

- 24/7 customer support that performed excellently during testing is available, alongside a $5 minimum deposit, high leverage options, and a huge variety of 200+ funding options, making it ideal for traders with small accounts.

- FBS offers lightning-fast execution speeds from just 10 milliseconds, placing it among the industry leaders for highly active traders like scalpers who demand rapid order processing.

Cons

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

- Despite enhancing the selection of currency pairs, now providing over 70, FBS still trails industry leaders like BlackBull Markets in its market offering with a particularly narrow selection of commodities and indices.

- Although the FBS app offers a terrific mobile trading experience for aspiring traders and MT4/MT5 cater to advanced traders, the absence of cTrader and TradingView, which are increasingly offered by alternatives like Pepperstone, will deter day traders familiar with these platforms.

Methodology

To rank the top CySEC-authorized brokerages, we:

- Leveraged our near-daily updated directory of 139 brokers to locate those claiming a CySEC license.

- Confirmed their credentials on CySEC’s register of Regulated Entities, removing any that aren’t authorized.

- Blended the results with our firsthand tests and 200+ data points to list the 10 best.

How Can I Check If A Broker Is Regulated By The CySEC?

Verifying whether a broker is CySEC-regulated is a simple but vital step to ensure your trading safety.

It’s also a more intuitive process after CySEC gave their website and search facility a much needed upgrade in December 2024, now sporting a modern and user-friendly design.

Here’s a step-by-step walkthrough of the steps I took to check that eToro was regulated.

I’d expect a firm of eToro’s standing to be registered and authorized to conduct its business in every global jurisdiction it trades.

Its compliance department will be one of the firm’s most active divisions and will have staff who should ensure every t is crossed and every i is dotted.

However, a check takes no time at all…

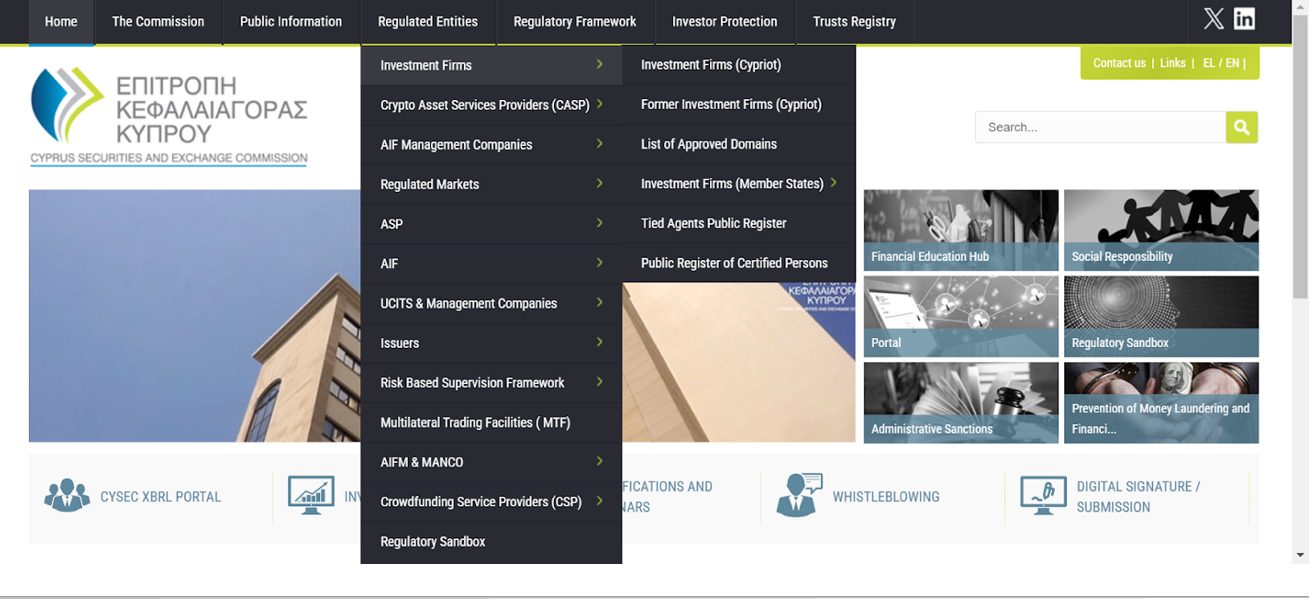

Step 1: Visit CySEC’s Official Website

The first step is to go to the official CySEC website.

Step 2: Navigate To The ‘Regulated Entities’ Section

Look for the ‘Regulated Entities’ tab on the homepage in the menu. Hover over it, and a dropdown list will appear with categories like:

- Investment Firms (CIFs)

- Administrative Services

- Payment Institutions

For brokers, select ‘Investment Firms (CIFs)’

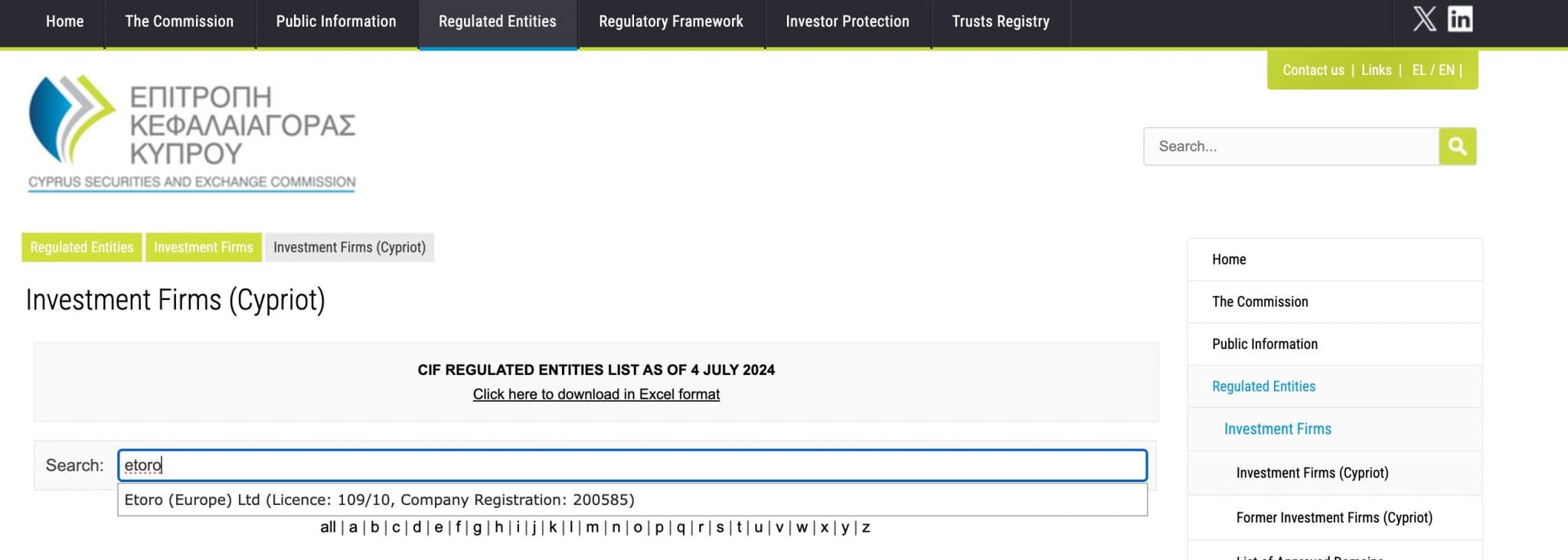

Step 3: Use The Search Function

You’ll be directed to a searchable list of licensed entities.

- Enter the broker’s name or their license number in the search bar

- Hit ‘Search’ to view the results

You can see where I punched eToro’s name into the search bar below.

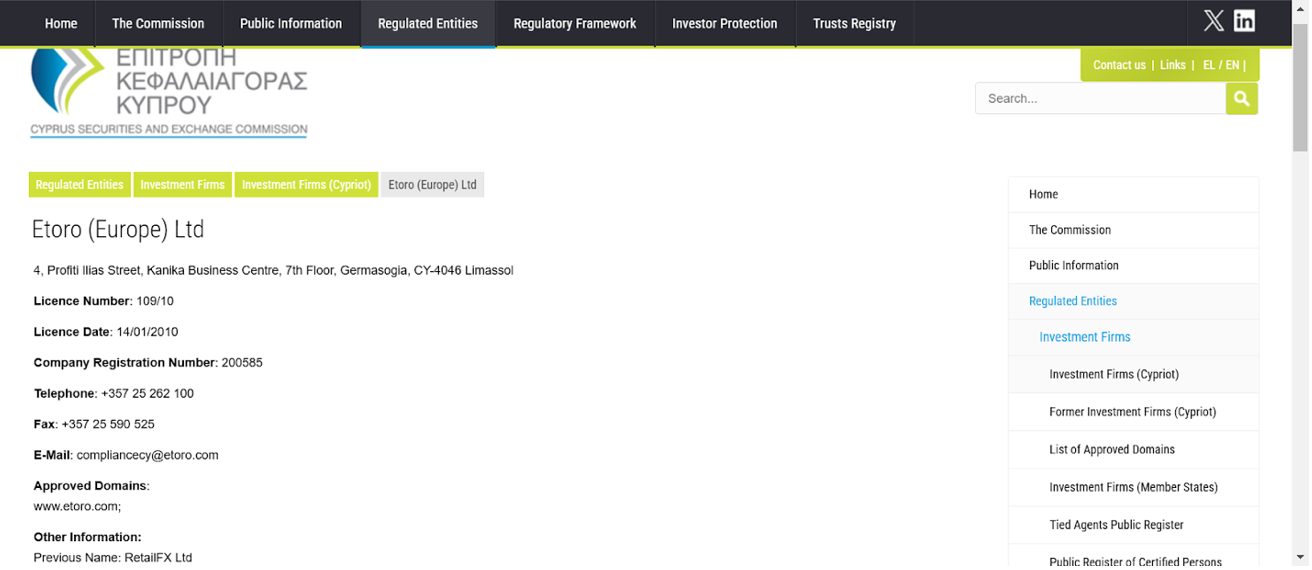

Step 4: Verify The Broker’s Details

When the search results appear, look for the broker’s name in the list.

Click on the broker’s name to view their license details, including:

- Registration number

- Status (eg active, suspended, or revoked)

- Activities they are authorized to conduct

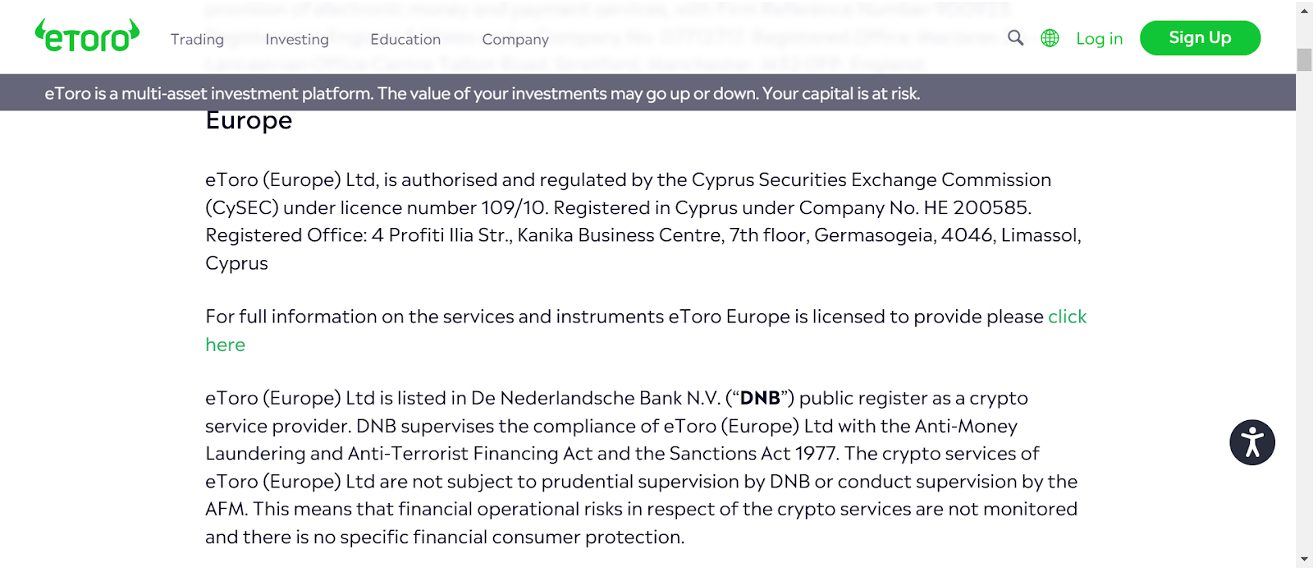

Step 5: Cross-Check Broker Information

Compare the details on CySEC’s website with the information on the broker’s website.

In our experience, legit brokers almost always prominently display their CySEC license number in their footer or ‘About Us’ section.

You can see below where I went to eToro’s website, found its regulation section, and then browsed this specific regulation page.

eToro states CySEC authorizes it under licence number 109/10, and this information should match what’s in the CySEC register.

As we can clearly see from the image in step 4, eToro (Europe) Ltd. is regulated by CySEC under license number 109/10, and further investigation reveals it has a clean bill of health.

It is licensed to conduct many forms of investment business throughout Europe and Cyprus.

Red Flags To Watch For

- No Matching Results: If the broker isn’t listed on CySEC’s website, they are not regulated by CySEC, even if they claim otherwise.

- Suspended or Revoked Status: Avoid brokers with inactive licenses.

What Is The CySEC?

CySEC, short for the Cyprus Securities and Exchange Commission, exists to keep the financial markets in Cyprus running smoothly and safely.

But its influence doesn’t just stop at Cyprus – thanks to its role in regulating brokers and financial firms that operate internationally, it extends across Europe and even globally.

Here’s what CySEC is all about:

- Protecting Investors – CySEC’s top priority is safeguarding your interests as a retail trader. They enforce strict rules on financial firms to ensure your money is handled responsibly and transparently.

- Regulating Financial Markets – CySEC oversees a wide range of financial activities, including popular products with day traders like forex, CFDs, and even cryptocurrencies. Its job is to make sure these markets operate fairly and without manipulation.

- Ensuring Compliance – Trading providers under CySEC’s watch must follow the law – period. From maintaining proper licenses to meeting operational standards, CySEC ensures brokers play by the rules.

- Promoting Market Stability – By cracking down on fraudulent activities and ensuring transparency, CySEC fosters trust and stability in the financial system. This benefits not only active traders but the overall economy.

CySEC acts as a watchdog, referee, and guide for financial firms and traders alike. It’s here to create a safe trading environment where everyone has a fair shot.

Who Is CySEC Answerable To?

While CySEC plays a significant role in regulating financial markets, it doesn’t operate in a vacuum.

It’s answerable to key entities that ensure its accountability and alignment with broader goals:

- The Cypriot Government – CySEC is an independent public authority, but it ultimately reports to the Cypriot Ministry of Finance. This connection ensures CySEC aligns with national financial and economic policies.

- The European Union (EU) – As Cyprus is a member of the EU, CySEC must comply with EU financial directives, like the Markets in Financial Instruments Directive (MiFID II). These directives standardise European regulations and ensure CySEC’s practices meet EU-wide standards.

- The Public And Investors – CySEC is also accountable to the people it serves: investors, traders, and the broader financial community. CySEC ensures its actions are visible and understandable through regular reporting and transparency initiatives.

- International Regulatory Bodies – CySEC collaborates with organisations like the European Securities and Markets Authority (ESMA) and other global regulators. While not directly “answerable,” this partnership ensures its operations are consistent with international best practices.

By being answerable to these entities, CySEC is held to high-performance standards, transparency, and fairness.For active traders like us, this means you can trust that CySEC’s actions are guided by clear oversight and a commitment to protecting the financial ecosystem.

What Powers Does CySEC Have?

CySEC has the authority to ensure that the financial markets under its watch are fair, transparent, and above board.

Here’s a breakdown of its powers:

- Granting Licenses – CySEC has the power to approve or deny licenses for financial firms that want to operate in or from Cyprus. No license? No business. This means that brokers must meet strict standards before they can serve traders like me and you.

- Setting Rules And Regulations – CySEC doesn’t just enforce the rules – it creates them (with some direction from wider European bodies). It sets guidelines for how financial firms should operate, covering everything from advertising to client fund protection.

- Conducting Audits And Inspections – CySEC has the authority to dig into the books of the firms it regulates. Surprise audits and inspections? Absolutely! This ensures companies are staying compliant and not cutting corners.

- Imposing Penalties – Broke the rules? CySEC can hit trading platforms where it hurts through fines, license suspensions, or even revocations (more on brokers that have felt its wrath below). This keeps brokers accountable and sends a clear message: play fair or face the consequences.

- Investigating Fraud And Misconduct – If there’s any sign of market manipulation, fraud, or shady business practices, CySEC has the power to investigate. It can subpoena documents, question people, and take action to protect retail investors.

- Collaborating With Other Regulators – CySEC doesn’t work alone. Thanks to its connection with the EU and global regulatory networks, it collaborates with other watchdogs to tackle cross-border financial crime and ensure firms meet international standards.

What Rules Must A CySEC Broker Follow?

A broker must follow strict rules to carry the CySEC licence. These aren’t just suggestions but enforceable standards designed to protect traders like you and ensure fair, transparent markets.

Here are key rules a CySEC-regulated broker must adhere to:

- Obtaining Authorization – First things first, CySEC ensures that only reputable brokers can operate. To get a CySEC license, brokers must meet stringent criteria, demonstrating their reliability and financial stability. This licensing process weeds out shady operators, so you can trade with peace of mind knowing your brokerage is legit.

- Capital Adequacy Requirements – Brokers must maintain a minimum level of capital to prove they can handle market risks and unexpected losses. This ensures they stay financially healthy and stable.

- Segregation Of Client Funds – Imagine your trading funds are safely tucked away in a little vault, separate from the broker’s operational money. That’s precisely what CySEC mandates through the segregation of client funds. If anything were to happen to the broker, your money would remain protected and out of reach from any financial hiccups they might face.

- Transparency In Operations – CySEC-regulated brokers must provide transparent and honest information about their services, fees, risks, and trading conditions. Misleading advertising? Not allowed.

- Responsible Leverage Limits – Leverage trading can amplify your gains, but it can also magnify your losses. CySEC imposes leverage limits to keep things balanced, especially for retail traders, typically up to 1:30. This means brokers regulated by CySEC can’t offer sky-high leverage that might expose you to excessive risk, promoting a safer trading environment.

- Negative Balance Protection – Are you ever worried about losing more than you’ve invested? CySEC has your back with negative balance protection. This rule ensures you can’t owe money beyond your initial deposit. So, even if the market turns against your position, your losses are capped, keeping your financial well-being intact.

- Reporting And Auditing – CySEC doesn’t just grant licenses and walk away. It conducts regular audits and compliance checks to ensure brokers adhere to all regulations. These routine inspections help catch and rectify any issues early, maintaining a trustworthy trading environment.

- Best Execution Practices – Brokers must execute your trades at the best possible prices and conditions available at the time, ensuring fairness in how your orders are handled. This is essential for fast-paced traders like day traders.

- Anti-Money Laundering (AML) Compliance – Financial security goes beyond just protecting your trades. CySEC enforces strict AML policies, requiring brokers to verify your identity (Know Your Customer or KYC) and monitor transactions for suspicious activities. This helps prevent financial crimes and keeps the trading ecosystem clean and secure.

- Compensation Scheme Membership – In the unlikely event that a CySEC-regulated broker faces insolvency, you’re covered by the Investor Compensation Fund (ICF). This scheme can reimburse you up to €20,000, providing an extra layer of financial protection and peace of mind. This is a useful protection, though it’s lower than in other jurisdictions (it’s up to £85,000 in the UK).

- Adherence To MiFID II – As part of the EU, CySEC brokers must comply with MiFID II regulations, which govern everything from trade transparency to investor protection across the European Economic Area.

- Swift Action Against Misconduct – If a broker steps out of line, be it through fraud, manipulation, or any other misconduct – CySEC is quick to act. They can impose hefty fines, suspend licenses, or even revoke them entirely. This strict enforcement ensures brokers maintain high ethical standards and operate fairly.

- Complaints Handling – Even with all these protections, issues might occasionally arise. CySEC provides robust dispute resolution mechanisms, allowing you to raise concerns and seek resolutions effectively. If a broker fails to address your complaint satisfactorily, CySEC can intervene to help resolve the matter.

These regulations create a safer trading environment for us to trade. They ensure brokers operate with integrity, protect our funds, and provide the transparency we need to make informed decisions.So, when you see a broker regulated by CySEC, you know they’ve passed a high bar of trustworthiness and accountability.

Does CySEC Have Teeth?

The Cyprus Securities and Exchange Commission has regulatory “teeth”, meaning it has the authority and the tools to enforce compliance among brokers and other financial entities.

Yet while CySEC is active, we’ve seen its penalties can be lenient compared to other major regulators, notably the FCA (UK) and ASIC (Australia).

Fortunately, CySEC has been ramping up enforcement in recent years to shed perceptions of being overly forgiving. Here are some notable examples:

- Exelcius Prime Ltd (2024): CySEC imposed a total fine of €740,000 on Exelcius Prime Ltd for various infractions, including providing unauthorized investment advice, non-compliance with organizational requirements, and failing to act in the best interests of clients.

- TradeEU.com and Titan Edge (2024): In late 2024, CySEC fined TradeEU and Titan Edge Capital for non-compliance issues such as inadequate disclosure practices and failure to implement measures to protect retail investors .

- Enforcement Actions (2023): CySEC imposed fines totaling €2.2 million in 2023 for various violations, including failures in compliance, transparency, and investor protection measures.

- FXORO (2023): FXORO faced a €360,000 penalty for breaches of investment laws, highlighting the firm’s failure to meet its regulatory obligations. This action underscores CySEC’s focus on investor protection and ensuring firms adhere to legal standards.

Bottom Line

While not as respected as FCA in the UK or ASIC in Australia, for traders in Europe, CySEC offers a reliable regulatory framework that prioritizes transparency, investor protection, and market integrity.

Its strict licensing requirements, regular audits, and ability to impose penalties ensure that brokers adhere to high operational and ethical standards.

With safeguards like segregated accounts, compensation schemes, and detailed compliance measures, day traders can feel more secure while navigating the volatile world of CFDs and forex.

Ultimately, choosing a CySEC-regulated broker ensures that one of Europe’s leading regulatory authorities governs your trading activities, offering peace of mind and fostering trust in the financial system.

To find the right provider for your needs, see DayTrading.com’s pick of the best CySEC trading platforms.

Article Sources

- Cyprus Securities & Exchange (CySEC)

- Regulated Entities - CySEC

- Investor Compensation Fund (ICF) - CySEC

- Markets in Financial Instruments Directive (MiFID II)

- Cypriot Ministry of Finance

- EU Financial Regulation

- Exelcius Prime Ltd CySEC Enforcement Action - Cyprus Mail

- TradeEU.com and Titan Edge CySEC Enforcement Action - Finance Magnates

- FXORO CySEC Enforcement Action - Finance Feeds

- 2023 CySEC Enforcement Action Total Fines - Finance Magnates

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com