Best Brokers With High Leverage 2026

Brokers with the highest leverage unlock the potential for bigger profits – but also greater risks. With maximum leverage, you can control larger positions than your initial deposit allows, amplifying gains but also losses.

We’ve seen a growing number of mainly offshore forex brokers cater to this high-risk, high-reward style of trading, making it key to pick a trusted provider. Dig into our top brokers for highly leveraged trading.

Top 6 Forex Brokers With Highest Leverage 2026

We've recorded the leverage at 232 brokers, and these 6 platforms have the highest leverage in December 2026:

Why Are These Brokers The Best If You Want To Trade With High Leverage?

Here is a quick rundown of why we think these high leverage forex, stock and CFD trading platforms are the best:

- Capitalcore is the top-rated high-leverage broker in 2025 - Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from multiple accounts with lower spreads and larger bonuses as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees on CFDs, though these don’t compensate for the weak oversight and paltry education and research.

- Plexytrade - Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

- Videforex - Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

- AZAforex - Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

- InstaTrade - InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Compare The Highest Leverage Brokers On Key Attributes

Find the right high-leverage trading platform for you with our comparison of core features:

| Broker | Maximum Leverage | Trading Instruments | Trading Software |

|---|---|---|---|

| Capitalcore | 1:2000 | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options | WebTrader, Pro |

| Plexytrade | 1:2000 | CFDs, Forex, Indices, Stocks, Commodities, Crypto | MT4, MT5 |

| Videforex | 1:2000 | Binary Options, CFDs, Forex, Indices, Commodities, Crypto | TradingView |

| AZAforex | 1:1000 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | Mobius Trader 7 |

| InstaTrade | 1:1000 | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures | InstaTrade Gear, MT4 |

| xChief | 1:1000 | CFDs, Forex, Metals, Commodities, Stocks, Indices | MT4, MT5 |

How Safe Are These Brokers Allowing Maximum Leverage?

When trading with high margin, it's vital to understand how a broker will safeguard your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Capitalcore | ✘ | ✔ | ✔ | |

| Plexytrade | ✘ | ✔ | ✔ | |

| Videforex | ✔ | ✔ | ✘ | |

| AZAforex | ✘ | ✔ | ✘ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| xChief | ✘ | ✘ | ✔ |

Compare Mobile Trading

See how these brokers catering to high-leverage traders perform on mobile after we tested their trading apps:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Capitalcore | Android, Webtrader | ✘ | ||

| Plexytrade | iOS & Android | ✘ | ||

| Videforex | Android | ✘ | ||

| AZAforex | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ |

Are The Top Brokers For High Leverage Good For Beginners?

Beginners should avoid using high leverage unless testing this risky strategy in a demo with tools for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Capitalcore | ✔ | $10 | 0.01 Lots (CFD/Forex), $1 (Binaries) | ||

| Plexytrade | ✔ | $50 | 0.01 | ||

| Videforex | ✔ | $250 | $0.01 | ||

| AZAforex | ✔ | $1 | 0.0001 Lots | ||

| InstaTrade | ✔ | $1 | 0.01 | ||

| xChief | ✔ | $10 | 0.01 Lots |

Are The Top Brokers For High Leverage Good For Advanced Traders?

Ultra-leverage brokers are geared towards advanced traders, but still look for tools to maximize opportunities:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Capitalcore | - | ✔ | ✘ | ✘ | 1:2000 | ✘ | ✘ |

| Plexytrade | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:2000 | ✔ | ✘ |

| Videforex | ✔ | ✘ | ✔ | ✘ | 1:2000 | ✘ | ✘ |

| AZAforex | - | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

Compare The Ratings Of The Highest Leverage Trading Brokers

See how the top forex brokers with highest leverage leverage scored in every category in our latest tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Capitalcore | |||||||||

| Plexytrade | |||||||||

| Videforex | |||||||||

| AZAforex | |||||||||

| InstaTrade | |||||||||

| xChief |

Compare Trading Fees

The fees for trading with substantial leverage can erode profits, so here's how providers measure up on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Capitalcore | ✘ | $0 | |

| Plexytrade | ✘ | - | |

| Videforex | ✘ | $10 | |

| AZAforex | ✔ | $0 | |

| InstaTrade | ✘ | - | |

| xChief | ✘ | - |

How Popular Are These Brokers With The Highest Leverage?

Many traders gravitate toward high-leverage brokers with the largest client bases:

| Broker | Popularity |

|---|---|

| InstaTrade | |

| xChief | |

| Videforex |

Why Use Capitalcore To Trade With Higher Leverage?

"Capitalcore runs one of the most advanced binary options platforms we’ve tested, making it a stellar option if you need serious charting power, with TradingView integration offering over 5 chart types and 90 indicators. Its 'double up' and 'rollover' capabilities to replicate or extend short-term trades with a click, are also excellent for strategy development."

Christian Harris, Reviewer

Capitalcore Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Platforms | WebTrader, Pro |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots (CFD/Forex), $1 (Binaries) |

| Leverage | 1:2000 |

| Account Currencies | USD |

Pros

- The support team are available 24/7 and responded within minutes during testing with helpful responses.

- The Capitalcore platform provides comprehensive charting tools and a wide range of 150+ technical indicators, ideal for detailed market analysis.

- Capitalcore is one of the only brokers to charge zero swap fees, which may appeal to Islamic traders looking to comply with Islamic Finance.

Cons

- Capitalcore is not regulated by major financial authorities and has an unproven reputation, raising concerns about the safety of client funds.

- Capitalcore’s threadbare education and research seriously trail category leaders like IG, making it less suitable for aspiring traders.

- Platform support is limited to proprietary software, so there's no integration with the market-leading MetaTrader or cTrader, which offer built-in economic news and support automated trading.

Why Use Plexytrade To Trade With Higher Leverage?

"Plexytrade is a newcomer in the brokerage scene with attention-grabbing features like 1:2000 leverage, zero spreads on select instruments and fast execution speeds of less than 46 milliseconds. However, the absence of regulation is a significant concern, while the non-existent research and educational tools place it far behind industry frontrunners."

Christian Harris, Reviewer

Plexytrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- Plexytrade accommodates a range of trading methods and short-term strategies, including scalping, hedging, and automated trading.

- There are various VPS packages starting from $50 per month, but they become complimentary once specific deposit thresholds are reached.

- Plexytrade offers among the highest leverage we’ve seen, up to 1:2000, catering to advanced traders willing to forego regulatory protections.

Cons

- Plexytrade lacks regulation in major jurisdictions, significantly increasing the risks of opening an account and depositing funds.

- There are no social or copy trading features for inexperienced traders to replicate the trades of more experienced investors, trailing category leaders like eToro.

- With around 100 instruments, Plexytrade restricts the flexibility of investors who prefer to trade across various assets, especially compared to Blackbull with its 26,000 securities.

Why Use Videforex To Trade With Higher Leverage?

"Videforex will serve traders looking for an easy-to-use platform to speculate on the direction of popular financial markets through binaries, especially cryptos and stocks, with dozens of assets added. The integration of TradingView charts also caters to technical traders. However, it requires a trade-off – no regulatory oversight, making it a risky choice. "

William Berg, Reviewer

Videforex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Minimum Trade | $0.01 |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Traders can earn up to 98% payouts on 150+ assets with the broker’s binary options, bringing it in line with competitors like IQCent.

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

- Videforex regularly runs trading contests, offering practice opportunities and cash prizes to beginners and experienced traders, with position sizes from just ¢0.01.

Cons

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

Why Use AZAforex To Trade With Higher Leverage?

"AZAforex is best suited to active traders looking for a choice of American and Chinese options, with different payout structures to standard high/low options. It’s also excellent for mobile traders, offering a dedicated app that provides a more comprehensive experience if you’re trading on the go compared to the mobile-optimized web browsers most firms use."

Christian Harris, Reviewer

AZAforex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Platforms | Mobius Trader 7 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.0001 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, MYR, IDR, CHF, RUB, THB, VND, UAH, CNY |

Pros

- AZAforex provides high leverage of up to 1:1000, allowing for potentially greater returns with smaller capital. While this comes with increased risk, it's an attractive feature if you are an experienced trader looking for aggressive growth strategies.

- AZAforex supports a huge and growing variety of payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, providing flexibility for funding and withdrawals. This variety accommodates traders from different regions and preferences.

- Few brokers offer binary options as part of their portfolio. Still, AZAforex includes them, allowing you to speculate on short-term price movements with fixed risk and reward up to 90%.

Cons

- AZAforex offers basic trading guides and a blog but lacks robust educational tools such as video tutorials, webinars, or interactive learning resources. This makes it less appealing for beginners who need comprehensive learning support. A lot of the content is outdated, too.

- While functional during testing, the Mobius Trader 7 platform is proprietary and not widely used by other brokers. This creates risks of potential price manipulation or discrepancies in market data, as there's no external verification like with MetaTrader or cTrader.

- AZAforex still operates without regulation from a recognized financial authority, which raises concerns about transparency, fund safety, and accountability. You may have no recourse in disputes, making it riskier than regulated brokers.

Why Use InstaTrade To Trade With Higher Leverage?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

Cons

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

Why Use xChief To Trade With Higher Leverage?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

Cons

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

- The broker trails competitors when it comes to research tools and educational resources

How Did DayTrading.com Rank The Top Brokers For High Leverage?

We investigated and recorded the maximum leverage available at every broker in our evolving database, which includes 232 providers as of December 2026.

From there, we ranked them by the highest leverage while also considering overall broker quality, using a mix of:

- Hard Data: Over 200 metrics, including maximum leverage, pricing, execution, and regulation.

- Real Testing Insights: Hands-on testing by our experienced traders and industry experts, evaluating platform usability, reliability, and trading conditions.

What Is High Leverage?

Higher leverage allows you to control much larger trades with a small deposit, multiplying both profits and risks. This makes it popular with day traders looking to grow their accounts.

Based on our analysis of 232 trading platforms, we consider anything above 1:500, or 500x, as ‘high’ leverage, with some brokers offering 1:1000 or more. There are even brokers with unlimited leverage.

Here’s how it works:

If you deposit $100 and your broker offers 1:1000 leverage, you can control $100,000 in trading capital.

- If you buy $100,000 worth of gold and its price rises by 1%, your profit is $1,000.

- Without leverage, the same 1% price move on a $100 trade would yield just $1 in profit.

What Are The Rules On Trading With High Leverage?

Since high-leverage trading carries significant risk, financial regulators impose leverage limits on online brokers to protect retail traders. However, these restrictions vary by region and asset class, meaning leverage caps differ depending on where a brokerage is based.

Leverage Limits By Major Regulators

Many ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating, such as ASIC (Australia), CySEC (Europe), and the FCA (UK), impose strict limits on leveraged CFD trading for retail traders, with the typical maximum 1:30.

Meanwhile, the CFTC and SEC in the US impose even stricter rules, banning leveraged CFD trading for American retail traders.

Retail Vs Professional Leverage

The limits above only apply to retail traders. Professional trading accounts – available to those who meet high financial and experience requirements – can access much greater leverage, often up to 1:500.

To qualify as a professional, you must meet stringent criteria, such as proving a high trading volume, industry experience, or holding significant financial assets.

High-Leverage Offshore Brokers = Higher Risk

Many brokers advertising leverage above 1:500 or even 1:1000 are often weakly regulated offshore entities. These providers may operate under lax oversight, exposing traders to:

- Higher counterparty risk: Fewer investor protections in case of fraud or bankruptcy

- No negative balance protection: Potential for losses exceeding deposits

- Weaker legal recourse: Limited ability to recover funds in disputes

FAQ

What Is The Highest Leverage Available At Forex Brokers?

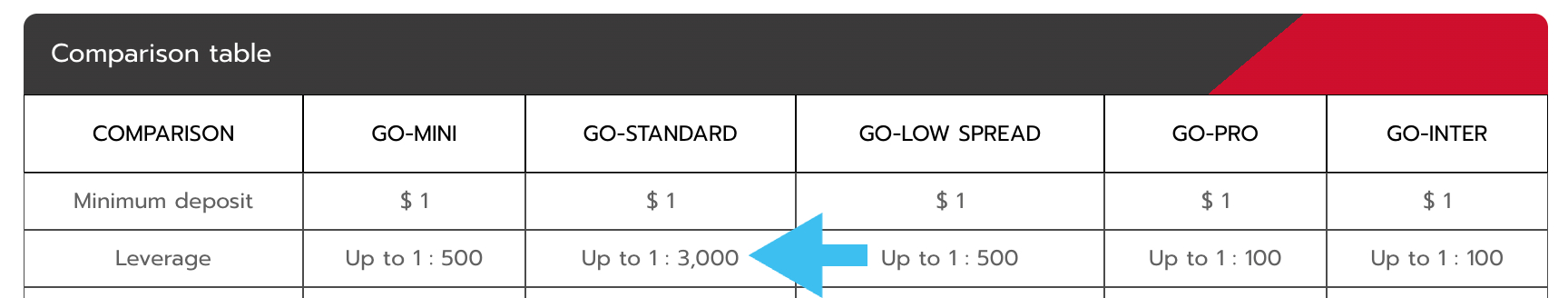

Based on our latest research, the maximum leverage you can trade forex with is 1:3000, provided by GoFX.

To trade with this much leverage, you need to open its ‘GO-STANDARD’ account, as you can see below.

Is Trading With High Leverage Safe?

No. Trading with high leverage is extremely high risk as both profit and loss are multiplied.

Our investigations also reveal that most of the highest-leverage trading platforms operate offshore in weakly regulated jurisdictions, raising further safety concerns. Some of these brokers don’t offer key protections, such as negative balance protection, which should prevent your account from falling below zero.