Best Brokers With Unlimited Leverage In 2026

Important: In some jurisdictions, brokers are not allowed to give retail traders access to unlimited leverage.

If you’ve ever traded with a small account and wished you could open positions like the big players, you may have stumbled across the phrase “unlimited leverage”. The idea that a broker will let you trade positions thousands of times bigger than your actual balance is a tempting prospect for anyone with a high-risk appetite.

Dig into DayTrading.com’s selection of the best brokers for trading with unlimited leverage.

Trading with unlimited leverage is extremely high risk and can result in large losses. Always read the broker’s terms and conditions, as we’ve found unlimited leverage often scales down as your account balance grows.

Top 1 Brokers Offering Unlimited Leverage

Based on our hands-on tests, these brokers stand out if you want access to unlimited leverage when trading:

Why Are These Brokers The Best For Unlimited Leverage?

Here’s why we rate these platforms as the top providers for traders seeking unlimited leverage:

- Exness is the best unlimited leverage broker in 2026 - In our testing, once we hit the $1,000 equity cap and completed the 10-trade/5-lot requirement, unlimited leverage unlocked seamlessly on forex pairs. Execution was fast, spreads were tight, and the system scaled leverage down automatically once our balance grew - a clear safety net for those who push the limits.

How Safe Are The Top Unlimited Leverage Brokers?

Trading with unlimited leverage comes with huge risks. We looked at account protection and risk management tools to see how safe these brokers are for active traders:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Exness | ✘ | ✔ | ✔ |

Are The Top Unlimited Leverage Brokers Good For Experienced Traders?

Only experienced traders should use leverage with no caps. Here’s where the leading unlimited leverage brokers excelled in our tests for seasoned traders:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

Compare Detailed Ratings Of Top Unlimited Leverage Brokers

See how the top unlimited leverage trading platforms performed in each main testing area:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Exness |

Compare Trading Fees

Fees are important when trading with unlimited leverage. Compare costs across our top picks:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Exness | ✘ | $0 |

How Popular Are The Top Unlimited Leverage Trading Platforms?

With demand for unlimited leverage trading growing, we measured user numbers at our top providers:

| Broker | Popularity |

|---|---|

| Exness |

Why Use Exness For Unlimited Leverage Trading?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

How DayTrading.com Chose The Best Unlimited Leverage Trading Platforms

One thing we’ve learned over the years is that broker marketing pages rarely tell the full story. Unlimited leverage might look great in theory, but how it plays out in practice is what really matters. That’s why we made a point of testing these accounts ourselves.

Here’s how we approached it:

- Started with a small live deposit: You can usually fund accounts with $0-$500. That’s enough to meet most brokers’ unlimited leverage conditions, and it reflects how most retail traders would realistically approach it.

- Pushed the margin rules: We’ll deliberately open positions across volatile markets – gold, NAS100, crude oil, even EUR/USD during news releases – to see how much margin is actually required, and whether the broker restricts order sizes in practice. With Exness, for instance, we tested whether unlimited leverage really unlocked after the 10-trade/5-lot requirement (it did).

- Measured execution speed and slippage: We track the speed at which orders are processed and compare the quoted price with the actual price. At one firm we assessed, we noticed that execution was impressively fast, even when stacking multiple orders, whereas at another, we picked up a few pips of slippage during high volatility.

- Tracked equity thresholds: Most brokers only allow unlimited leverage below $1,000. So if you grow an account past that mark you can watch how leverage scales down. With one platform we used, our leverage dropped from “unlimited” to 1:2000 the moment we crossed into four figures.

- Stress tested stop-outs: We let positions run against us to see how the broker handles margin calls. At one provider, for example, we found that positions closed cleanly when margin hit 100%, with no unexpected negative balance, but the lack of margin requirement meant it only took one bad move to get there.

- Ranked providers by ratings: Our experience with each firm tested fed into our overall ratings, alongside over 200 other data points and hands-on testing insights. This gave us a final list of brokers to use for leverage trading with no limits.

How Brokers Structure Unlimited Leverage

When you first see “unlimited leverage” on a broker’s website, it sounds like they’re handing you a blank cheque. In reality, it almost always comes with conditions from our experience – usually tied to account size, trading history, or even the time of day.

Take Exness as a case in point. They’re often the poster child for unlimited leverage, but they don’t just switch it on for anyone. You need to have an equity balance under $1,000, plus a track record of at least 10 trades and 5 standard lots traded before the option even appears.

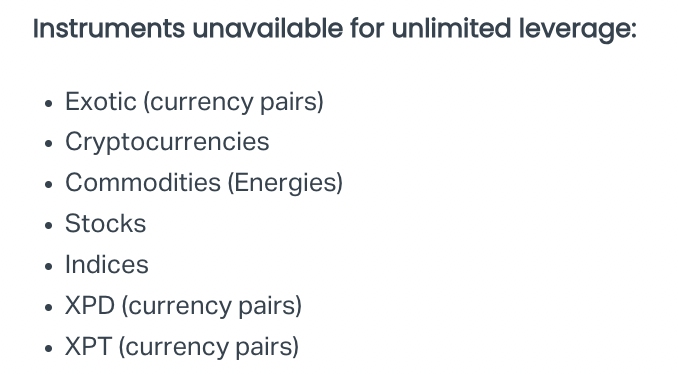

Once unlocked, it only applies to some forex pairs – not cryptos, stocks, indices or commodities. That’s a sensible guardrail, but it’s also a reminder: unlimited leverage is designed for small accounts, not big ones.

The Appeal For Active Traders

It comes down to three things:

- Flexibility

- Opportunity

- Trading with smaller balances

If you’re trading with a $500 account, traditional leverage levels like 1:30 or even higher leverage like 1:100 can feel restrictive. You might only be able to open one or two micro positions at a time, which doesn’t leave much room for strategy.

With unlimited leverage, suddenly you’re able to size into trades that would otherwise be out of reach. In our own testing, we saw how a $500 account could comfortably open positions on gold (XAUUSD) or NAS100 without instantly maxing out the margin. That flexibility alone can make a huge difference for scalpers and short-term traders.

Another big draw is opportunity. High-volatility markets like crypto, oil, or indices often move 1–2% in a matter of minutes. With unlimited leverage, even a small account can turn those short bursts of volatility into meaningful results. That thrill of potential is exactly what appeals to risk-takers.

And then there’s the psychology. Let’s be honest; nobody opens a trading account because they want to grind out a slow 5% a year. Most of us are here because we want to see tangible results, ideally sooner rather than later.

Unlimited leverage feeds into that mindset by giving you the feeling of playing on a bigger stage, even if your balance is tiny.

When we tested a setup with a $300 account, the ability to open 0.5 lot positions on EUR/USD gave the whole experience a sense of weight and immediacy that just isn’t there with lower leverage caps.

That’s why brokers keep offering it: because for active traders unlimited leverage isn’t just a technical feature – it’s a fairly unique selling point provided by less than 5% of brokers from our research.

The Hidden Risks Nobody Likes To Talk About

Here’s the part that doesn’t make it onto flashy broker ads: unlimited leverage can be brutal if you don’t handle it with discipline. In fact, during our own tests, we managed to wipe out more than one small account simply by getting a little too comfortable with oversized positions.

The most obvious risk is account blow-ups. With unlimited leverage, your margin requirement is tiny, so it’s easy to stack positions without realizing how exposed you are.

On one $500 test account, we had EUR/USD, gold, and NAS100 trades open at the same time. A sudden spike in gold was enough to trigger a margin call and close the whole account in seconds.

Then there’s slippage and execution risk. If you’re using extreme leverage, even small price gaps can have an outsized impact. During one of our platform tests, a stop-loss slipped by just a couple of pips around a news release, but because we were running a 0.5 lot position on a $300 account, that “small slip” turned into a 15% hit instantly.

The third risk is more subtle: psychology. Unlimited leverage changes the way you think about trades. Instead of focusing on solid setups and risk management, it tempts you to swing for the fences.

I’ve caught myself rationalizing, “Well, it’s only a $200 account, so why not push for a big win?” That mindset is dangerous because the same leverage that gives you outsized opportunity also punishes even minor mistakes.

And let’s not forget the broker’s perspective. Unlimited leverage isn’t purely altruistic – it encourages more trading volume, which means more spread and commission revenue for them. That doesn’t make it “bad,” but it’s worth remembering that these offers are structured with the broker’s bottom line in mind, rather than yours.

Yes, unlimited leverage can feel like a golden ticket. But the risks are real, and I’ve seen firsthand how quickly things can unravel if you’re not careful.

When Trading With Unlimited Leverage Makes Sense

Unlimited leverage isn’t a free-for-all; it’s a tool, and like any tool, it works best in the right hands. From our tests and experience, there are a few scenarios where it can genuinely add value:

- Short-term scalping: Scalpers thrive on tiny moves in the market. With unlimited leverage, a small account can open positions large enough to make those small pips meaningful. In our tests, opening 0.5-lot trades on EURUSD with a $300 account allowed us to see real P/L swings without maxing out the margin. This is where leverage really earns its keep.

- Hedging small portfolios: For traders holding multiple positions, unlimited leverage can help balance exposure across instruments. For example, if you’re long NAS100 but want to hedge with gold, small accounts can open both positions without draining available margin. During one platform evaluation, we tried this and confirmed the system handled multiple positions cleanly, even under tight margin conditions.

- Testing high-volatility strategies: Unlimited leverage is great for experimenting with strategies that would otherwise be impossible with small balances. In one brokerage we tried zero margin requirements let us trial aggressive entries in crypto and indices without committing more than our account balance. The ability to take measured risks in a controlled manner can be invaluable for developing short-term trading strategies.

My practical rules of thumb are:Keep risk per trade extremely low (I suggest under 1%) even if your leverage allows huge positions.

Use tight stop losses and be disciplined – leverage magnifies mistakes as fast as profits.

Bottom Line

Treat unlimited leverage as a learning ground for strategy testing, not a shortcut to massive gains.

When used thoughtfully, unlimited leverage is not just flashy marketing – it can be a legitimate way to amplify small accounts, learn risk management, and test short-term strategies with real-world consequences.

To get started, jump to our pick of the top brokers for unlimited leverage trading.