Citi Self Invest Review 2024

Pros

- Regulated by SEC with SIPC membership

- No minimum balance requirement for the Self Invest profile

- Easy to manage, move and transfer funds between Citi banking accounts

Cons

- Leveraged trading not available

- Deposits and withdrawals via bank wire transfer only

- No forex, futures, or crypto trading instruments

Citi Self Invest Review

Citibank is a financial services provider offering a range of investment plans and trading accounts for retail investors. Whether you are looking for self-directed investing, automated strategies, or advisory services, the brand has financial specialists and intuitive technology. This Citi Self Invest review will cover the features of each wealth management profile, trading opportunities, account fees, and more.

Company Details

Citigroup Inc is a leading global bank that was formed in October 1998 following a merger between Citicorp and Travelers Group. Today, the firm serves more than 200 million clients in over 160 countries.

Citibank is the US subsidiary of financial services multinational Citigroup, established in New York in 1812. The Citi Personal Wealth Management umbrella was designed to provide strategies to help retail traders fulfil their investment goals. The company offers a range of hands-off approaches and flexible, self-directed investing accounts. This includes:

- Citi Self Invest – Introduced in July 2021, the self-directed investing account is an expansion of the bank’s established facilities that helps retail clients achieve their financial goals through an intuitive platform. It provides the tools for ‘do it yourself’ traders to invest in stocks, mutual funds and ETFs.

- Citi Wealth Builder – The Citi Wealth Builder account is a managed investment service that uses robo-advisors to automate trading strategies. Portfolios are designed based on personal investment goals and preferences. A consultation is not required for every re-balance transaction, so it’s ideal for customers looking for a hands-off approach to trading or those just starting out.

- Citi Personal Wealth Management – The brand’s Personal Wealth Management account offers dedicated financial advisors. The program offers tailored investment guidance and more human interaction vs the other accounts.

Popular Alternatives To Citi Self Invest

-

1

FOREX.comActive Trader Program With A 15% Reduction In Costs

FOREX.comActive Trader Program With A 15% Reduction In Costs

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$1000.01 Lots1:50NFA, CFTCForex, Stocks, Futures, Futures OptionsMT4, MT5, TradingView, eSignal, AutoChartist, TradingCentralWire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, PLN -

2

NinjaTrader

NinjaTrader

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$00.01 Lots1:50NFA, CFTCForex, Stocks, Options, Commodities, Futures, CryptoNinjaTrader Desktop, Web & Mobile, eSignalACH Transfer, Debit Card, Wire TransferUSD -

3

eToro USAInvest $100 and get $10https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro USAInvest $100 and get $10https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$10$10SEC, FINRAStocks, Options, ETFs, CryptoeToro Trading Platform & CopyTraderACH Transfer, Debit Card, PayPal, Wire TransferUSD -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States.

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$00.01 Lots1:50NFA, CFTCForex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA)OANDA Trade, MT4, TradingView, AutoChartistWire Transfer, Visa, Mastercard, Debit Card, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

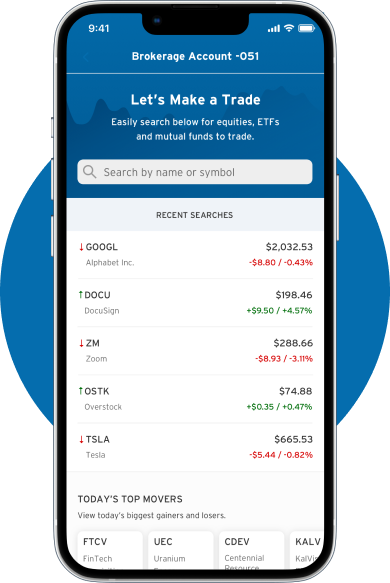

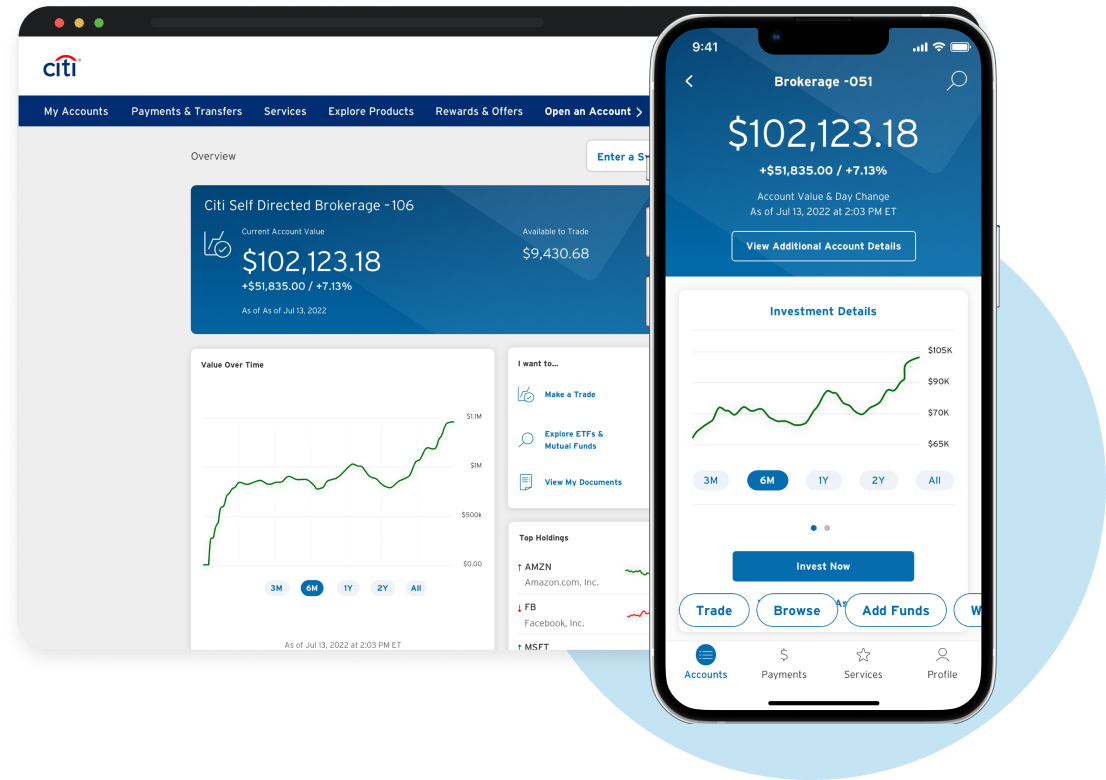

Trading App

The Citibank mobile app is the primary trading platform for all Citi investment accounts. The app can be downloaded to iOS or Android devices. Alternatively, you can access the WebTrader via major browsers.

A redesigned version was launched in November 2022 making it easier to participate in banking and investment activities within one terminal. Clients can link all bank accounts, credit cards, and trading accounts creating a holistic view of a user’s finances.

The terminal provides tools to invest in a range of assets alongside the resources to learn more about personal finances. However, experienced retail investors may be disappointed with the lack of charting functions and analysis tools vs alternatives such as Charles Schwab.

Features include:

- Intuitive online dashboard

- Access real-time price quotes

- Create your own custom watchlists

- Ticker symbol or name search bar

- View portfolio performance statistics

- Access to Citibank market news and insights portal

- Seamlessly transfer money between banking and investment accounts

- In-built Investor Learning Center with interactive educational materials

How To Place A Trade

- Select a security by searching for its name or symbol

- Initiate the transaction type (Buy, Sell or Sell All)

- Choose the order type (Market, Limit, or other)

- Add the transaction volume/quantity

- Click ‘Submit Order’

Products & Assets

Citibank Investment Group Corp provides access to global instruments, varying by account type:

- Citi Self Invest – US, international and emerging stocks, ETFs and mutual funds

- Citi Wealth Builder – ETFs that take into account the sustainability criteria of Environmental, Social and Governance (ESG) characteristics

- Citi Personal Wealth Management – A variety of investment and insurance products such as stocks, bonds, mutual funds, and retirement savings

All broker-dealer accounts, including Self Invest, do not support fractional shares, forex, or fixed-income trading.

Investments also count towards your overall Citi balance which enables you to unlock additional perks such as reduced account fees, preferred pricing on mortgages/home loans, lifestyle benefits, and more.

Other Services

Alongside your chosen investment account, Citi users can benefit from access to:

- Annuities

- Life insurance

- Real-estate planning

- Long-term care insurance

- Retirement savings; Traditional and Roth IRAs

Citi Fees

There are no charges to open a profile, however, ongoing fees apply.

Margin lending rates are particularly costly. As of 2022, the Citi Base rate was 8.50% with an additional fee based on the amount of funds borrowed. For example, a loan of less than $10,000 will use Citi’s Base rate reference (8.50%) plus a 2.75% spread.

Other fees by account include:

Self Invest Account

The Citi Self Invest account operates on a commission-free pricing model with no minimum balance requirement.

With that said, commission charges apply for buying and selling ETFs by phone. Additionally, management fees and expenses may also apply when trading ETFs.

Wealth Builder Account

You can explore the Citi Wealth Builder account for free to understand the suggested asset allocation based on your financial goals. If you choose to open an account, an annual fee of 0.25% of assets under management will apply, paid quarterly.

There is a minimum account balance of $1000.

Personal Wealth Management Account

The Citi Personal Wealth Management fee is determined by the Citi banking account linked to your investment profile or your total account balances. For example, Citigold account holders (more information below) will have their annual account fees waived. Standard Citi banking account customers will be liable for a $75 annual Personal Wealth Management fee for investment accounts and individual retirement accounts.

A minimum fee of $100 will apply if total account balances are less than $25,000. However, households will not be liable for charges of more than $350 per fee cycle.

There are some exceptions to fees including those with assets greater than $500,000.

Note, if you are depositing in a currency outside of your account denomination, you will be liable for a Citi IPB Reference Exchange Rate fee.

Margin Trading

Margin trading isn’t offered to Self Invest retail clients. Nonetheless, Citibank does offer eligible clients a margin loan against investments including equities, cash and equivalents, bonds, and mutual funds.

The brand also offers a securities-backed lending program to borrow against your portfolio to address liquidity concerns.

Payment Methods

Deposits

After opening a Citi investment account, retail traders can transfer funds from a linked Citibank checking/savings account. Alternatively, clients can initiate a wire transfer from an external bank account. The broker-dealer also supports Automated Customer Account Transfers (ACAT), which allows customers to transfer from brokerage accounts outside of Citibank.

Payments from a Citibank savings account will be processed immediately. External bank wire transfers can take up to three working days. If you have chosen a Citi-managed account, funds will typically be invested in the selected portfolio within five working days.

There are no fees for Citi Group transfers, CHAPS, SEPA, or Faster Payments.

How To Make An Internal Transfer Via The Mobile App

- Open the Citi app and login

- Select the ‘Payments’ tab via the bottom navigation menu

- Choose ‘Pay’

- Select your account under the ‘Transfer To My Account’ list

- Enter the amount to transfer

- Click on ‘Fund Account’

Withdrawals

Citi Self-Invest customers can withdraw funds at any time. Positions will need to be closed. Cleared funds can be withdrawn to your linked Citi banking account and processing times are instant.

If you need to liquidate some or all of your investments and withdraw funds from a managed profile, contact your personal investment advisor. Once you have liquidated your trading positions, you can transfer funds into your Citibank account and withdraw or transfer from there.

There is a daily limit of $2000 for ATM withdrawals using your Citi Card.

Citi Self Invest Demo Account

The broker-dealer does not provide a demo account service for any investment profile.

Although this is disappointing, particularly for new traders, you can open a Citi Self Invest profile with no minimum deposit requirement. Retail clients also benefit from access to educational resources, articles and guides.

In addition, the firm has a team of experienced wealth managers on-hand to answer platform questions or provide bespoke financial planning guidance.

Deals & Promotions

At the time of writing, Citibank was offering all new Citi Self Invest customers a cash bonus incentive. Rewards of up to $500 are available for all account registrations.

The promotion is account balance dependent and to receive the maximum bonus, you must deposit at least $200,000. The lowest bonus amount is $100, though this still requires a minimum deposit of $10,000.

Regulation & Licensing

All investment services offered by Citigroup Inc are regulated by top-tier authorities.

Citi Personal Wealth Management (CPWM) and Citi Personal Investments International (CPII) are registered subsidiaries of Citigroup Inc. CPWM and CPII offer investment products via Citigroup Global Markets Inc. (CGMI), a member of the Securities Investor Protection Corporation (SIPC) as an investment advisor. Additionally, the brand is regulated as a broker-dealer by the Securities and Exchange Commission (SEC).

Note, investment products are not insured by the FDIC.

Additional Features

Market & Planning Insights

Citi Investment account holders benefit from access to the latest market commentary, research, and weekly insights from the firm’s specialist wealth managers. Retail traders can absorb the latest investment banking news and access Citibank analyst world event reviews including those in the US and global economies such as India, Dubai, the UK, and Hong Kong.

Financial guidance is another service offered as standard by Citi. The investment banking facility provides bespoke and personalized investment relations based on revenue, risk profile, and experience. Whether you are looking to invest to save funds for healthcare, seeking property loans, or considering overseas investments in global corporations, Citi can provide support.

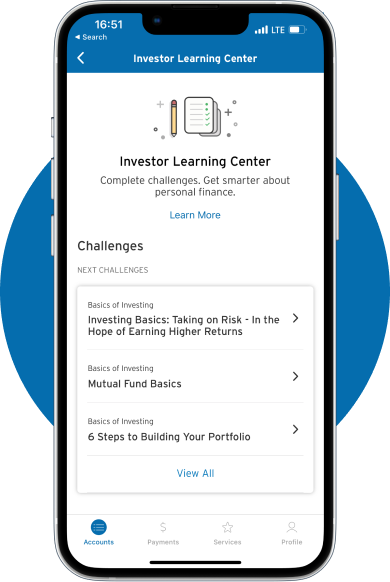

Education

All Citibank clients gain access to the brand’s in-built Learning Center. This includes articles, integrated videos, and planning tools. Topics include healthcare savings, investment interest rates, retirement banking, and more.

The Learning Center is available within the online investment portal or via the brand’s website.

Tiered Membership Status

Citibank rewards are not solely for banking activities. There are a few membership statuses that can unlock benefits based on your investment balance.

Citigold Private Client

To achieve Citigold Private Client status, retail clients must maintain a minimum average monthly balance of over $1,000,000 across deposit, retirement, and investment accounts.

Benefits include:

- Exclusive lifestyle perks such as MasterCard travel benefits

- Access to a dedicated customer service team, available 24/7

- Premier banking services including improved money movement limits

- Advanced wealth management planning services including real estate and trusts

- Access to a Citi Personal Wealth Management advisor, relationship manager, and specialists

Citigold

To achieve Citigold Client status, retail customers must maintain a minimum average monthly balance of over $200,000 across deposit, retirement, and investment accounts.

Benefits include:

- Access to financial education events and content

- Access to a dedicated customer service team, available 24/7

- Personal service and guidance from a Citi Personal Wealth Management Wealth advisor

- Exclusive lifestyle perks such as reduced-price concert tickets, restaurants, and a full-service travel agency

- Market insights and access to reach reports from 300+ international research and investment banking analysts

Citi Priority

To achieve Citi Priority ranking, retail clients must uphold a minimum average monthly balance of over $30,000 across deposit, retirement, and investment accounts.

Benefits include:

- Complimentary lifestyle rewards and discounts

- Access to professional guidance from Citi Priority advisors

- Access to investment resources to simplify trading decisions

- Customized financial guidance and tailored investment support

- Access to online tools, including a robust library of financial education articles and calculators

Citi Accounts

Citibank offers four account types for retail investors. These are designed to suit varying investment requirements depending on the level of help or advisory services desired.

Whichever profile you choose, investments count towards your overall Citi status which can unlock additional banking benefits.

Citi Self Invest

The commission-free profile provides retail investors full flexibility to trade as and when desired. This includes personal portfolio creation, an unlimited number of trades, and all account management actions.

- Commission-free

- No minimum balance requirement

- Trade stocks, ETFs, and mutual funds

- Access to the Investor Learning Center

- Access to financial insights and live market news

Citi Wealth Builder

The automated profile provides a simple approach to trading. Your portfolio will be managed and rebalanced systematically. It is designed to keep your strategy on track following pre-defined criteria.

- 0.25% advisory fee

- Simple performance tracking

- Ability to incorporate ESG factors

- $1000 minimum balance requirement

- Create individual assortments dedicated to different goals

- Professional portfolio based on risk appetite, timeframe, and objectives

Citi Personal Wealth Management

This profile provides exclusive access to Citibank’s financial advisors to create personalized financial plans. The wealth management service provider will work with you to create a long-term strategic plan, aligned with your personal goals but led by a Relationship Manager.

- Dedicated wealth manager

- Access to financial planning tools

- Run planning scenarios and test trade ideas

- Account minimums and fees vary by service type

- Comprehensive investment plan and asset allocation

- Access to a wide range of investment products including stocks, bonds, and mutual funds

Citibank Private Client

The Citigold Private Client account type has been developed for high net-worth individuals who maintain a minimum monthly balance of at least $1,000,000 in linked deposit, retirement, and investment accounts.

Customers can access a dedicated wealth team including a personal Wealth Advisor. You can also benefit from premier banking services, privileges, and full customization of portfolio development.

Other Accounts

Additional Citi investment accounts include traditional or Roth IRAs. Users can benefit from tax and savings advantages which can help with reaching retirement goals.

How To Get Started

Firstly you will need to sign up for a Citi Self-Invest Account. To register, select ‘Open An Account’ on the Citi Invest website.

Note, to open a Citi Self Invest account, you must have an eligible Citibank checking/savings account, or a Citibank credit card.

The application process is in-depth, so our experts would recommend allowing at least ten minutes to sign up. You must provide details of your investment knowledge and declare your employment status. The broker-dealer complies with AML and KYC Federal laws, therefore you will also need to provide ID verification and proof of address.

Once registered:

- Download or open the Citi mobile app

- Login with your registered username and password

- Fund your account

- Select ‘Explore Products & Offers’

- Click on ‘Investing’

- Select ‘Self-Directed Trading’

Trading Hours

Investment services are available Monday to Friday 8 AM to 9 PM (ET) and Saturday 9 AM to 7 PM (ET).

Citibank does not offer pre-market or after-hours (also known as extended hours) trading.

Customer Service

Citibank Investment offers hotline phone support for new or existing customers. Alternatively, users can schedule an appointment with their local bank branch.

It is a shame that there is no live chat functionality, however, the website does offer a detailed FAQ section and plenty of self-help guides and information.

- Citi Self Invest Phone Number – 1-877-693-4543

- Citi Wealth Builder Phone Number – 1-833-828-4533

- Citi Personal Wealth Management Services – 1-800-846-5200

Alternatively, you can write to one of the Citi Investment banking office locations; Citi Investment Bank-Wealth Management, 90 Park Avenue, New York, NYC 10016.

Financial Advisors are available Monday to Friday 9 AM to 7 PM (ET) and Saturday 9 AM to 7 PM (ET).

Premium account holders will have 24/7 access to a personal Wealth Manager.

Security & Safety

Citibank offers a suite of advanced security features and services to protect clients’ funds. The trading platform uses 128-Bit SSL encryption technology. This means hackers or other third parties cannot intercept your information or transactions in a readable manner.

Investment accounts can also be secured with biometric logins, two-factor authentication (2FA), and one-time passwords (OTP). Additionally, you can add security words and questions to your account, which are required as confirmation before any actions can be taken online.

Citi Invest Verdict

Citibank investment accounts are a great way to trade popular assets alongside traditional banking activities. It is good to see a range of account options to suit the needs of all retail investors. The option of the automated Wealth Builder portfolio is also ideal for those getting started. More experienced investors, however, may find the overall service lacks advanced trading tools and analysis features.

FAQs

Does Citibank Offer Investment Accounts?

Yes, Citibank offers four main investment accounts via its Citi Personal Wealth Management subsidiary. Options range from self-directed investing accounts to fully managed profiles. There is no minimum deposit with the starter account.

What Is Citi Wealth Builder?

The Citi Wealth Builder account offers a managed investment service that chooses a trade plan and strategy based on your goals. Also known as a robo-advisor, it is a hand-off approach to trading that uses auto-rebalancing as markets fluctuate.

Is The Citi Self-Invest Account Good?

The Citi Self Invest account is a great option for retail investors looking to get involved with trading on a simple to use mobile application. The platform enables traders to have full control while investing in stocks, ETFs, and mutual funds. Make use of the in-built Learning Center and research insights for additional support.

What Is Citi Self Invest?

Citi Self Invest is one of the trading accounts offered by Citibank. It provides the tools for retail traders to access stocks, mutual funds, and ETFs with no commissions and no minimum account requirements.

Is Citibank A Good Investment Bank Platform?

Citibank provides a wealth of educational support, research, and insights to support investors. Additionally, all users can make use of the team’s financial advisors for tailored guidance. More experienced traders, however, may feel the platform is lacking in advanced trading tools.

Top 3 Alternatives to Citi Self Invest

Compare Citi Self Invest with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular online brokerage. It is also quick and easy to open a new account.

Citi Self Invest Comparison Table

| Citi Self Invest | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 4.4 | 4 |

| Markets | Stocks, ETFs, Mutual Funds, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | $1 |

| Regulators | SEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SEC, FINRA |

| Bonus | – | – | – | Deposit Bonus Up To $4000 |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Own |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 2 | 6 | 6 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Citi Self Invest and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Citi Self Invest | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Citi Self Invest vs Other Brokers

Compare Citi Self Invest with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Citi Self Invest yet, will you be the first to help fellow traders decide if they should trade with Citi Self Invest or not?