Best CFD Brokers In India 2026

Contracts for difference (CFDs) are not authorized trading products in India, so you won’t find CFD brokers regulated by the Securities and Exchange Board of India (SEBI). Indian traders can use overseas CFD trading platforms, but this comes with significant risks, including potentially a lack of legal protection for your funds under Indian laws.

We’ve listed the best CFD brokers accepting traders from India. We’ve personally tested each CFD trading platform, with several catering specifically to Indian traders with INR accounts.

Top 6 CFD Brokers In India

Our findings show these 6 platforms are the best for CFD traders in India:

-

1

RoboForex

RoboForex -

2

XM

XM -

3

IC Markets

IC Markets -

4

AvaTrade

AvaTrade -

5

Trade Nation

Trade Nation -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Here is a short summary of why we think each broker belongs in this top list:

- RoboForex - RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping.

- XM - XM delivers for CFD traders with flexible leverage and a huge range of markets, including bespoke thematic indices for exposure to popular sectors like artificial intelligence. The MT4/MT5 platforms are also fast and dependable while a free VPS is available to qualifying XM traders running algo trading strategies.

- IC Markets - You gain access to over 2,250 CFDs, available for trading 24/5 across popular markets such as forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and advanced bridge technology, IC Markets ensures optimal conditions for scalpers, hedgers, and algo traders alike.

- AvaTrade - AvaTrade's 1250+ leveraged CFD products span a wide range of asset classes including stocks, indices, commodities, bonds, crypto, and ETFs. What we love is that you can speculate on rising and falling prices in the broker’s feature-rich web and mobile platforms with market-leading research tools to help you discover short-term trading opportunities.

- Trade Nation - Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

- Pepperstone - Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

Best CFD Brokers In India 2026 Comparison

| Broker | CFD Trading | INR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| RoboForex | ✔ | - | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

| XM | ✔ | - | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| IC Markets | ✔ | - | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:1000 (FSA Only) |

| AvaTrade | ✔ | - | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| Trade Nation | ✔ | - | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | TN Trader, MT4 | 1:500 (entity dependent) |

| Pepperstone | ✔ | - | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist | 1:30 (Retail), 1:500 (Pro) |

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| Stocks Spread | 0.01 |

| Leverage | 1:2000 |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

Cons

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| FTSE Spread | 1.4 |

|---|---|

| GBPUSD Spread | 0.8 |

| Stocks Spread | 0.002 |

| Leverage | 1:1000 |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| FTSE Spread | 1.0 |

|---|---|

| GBPUSD Spread | 0.23 |

| Stocks Spread | 0.02 |

| Leverage | 1:1000 (FSA Only) |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| FTSE Spread | 0.5 |

|---|---|

| GBPUSD Spread | 1.5 |

| Stocks Spread | 0.13 |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| FTSE Spread | From 0.4 |

|---|---|

| GBPUSD Spread | From 0.6 |

| Stocks Spread | Variable |

| Leverage | 1:500 (entity dependent) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Multiple account currencies are accepted for global traders

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

- Full range of investments via leveraged CFDs for long and short opportunities

Cons

- Fewer legal protections with offshore entity

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| FTSE Spread | 1.0 |

|---|---|

| GBPUSD Spread | 0.4 |

| Stocks Spread | 0.02 |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

How We Rate CFD Brokers In India

To list the best CFD providers for Indian traders we took our database of 139 online brokers, then:

- Identified those offering CFD trading

- Pinpointed those accepting Indians

- Sorted them by their overall rating

Our broker ratings consider 100+ quantitative data points and qualitative insights gathered by our industry experts during hours of hands-on testing, with a focus on key areas, notably:

Trust

Given that there is no regulatory framework authorizing and overseeing CFD trading platforms in India, it’s even more important for Indians who choose to deal in this risky financial product to choose a trusted overseas firm.

We only recommend CFD brokers we trust after considering several elements:

- Regulatory oversight: If they’re not authorized by India’s SEBI, we investigate whether they hold licenses with other respected regulators, such as the FCA in the UK, ASIC in Australia, or SEC in the US.

- Industry standing: We scrutinize their background, looking for regulatory breaches and complaints from traders, including our own team, that the platform doesn’t provide fair CFD trading conditions or pay out withdrawals.

- Years of experience: We find out how long they’ve been offering CFD trading, as we know brokers with many years in the industry, an active user base, and respected awards, are usually more reliable.

- Despite not holding a license with the SEBI, Interactive Brokers consistently ranks as one of the most trusted CFD providers, with 7 ‘green-tier’ licenses, 40+ years in the industry, 2+ million clients, plus it’s listed on the NASDAQ, ensuring financial transparency.

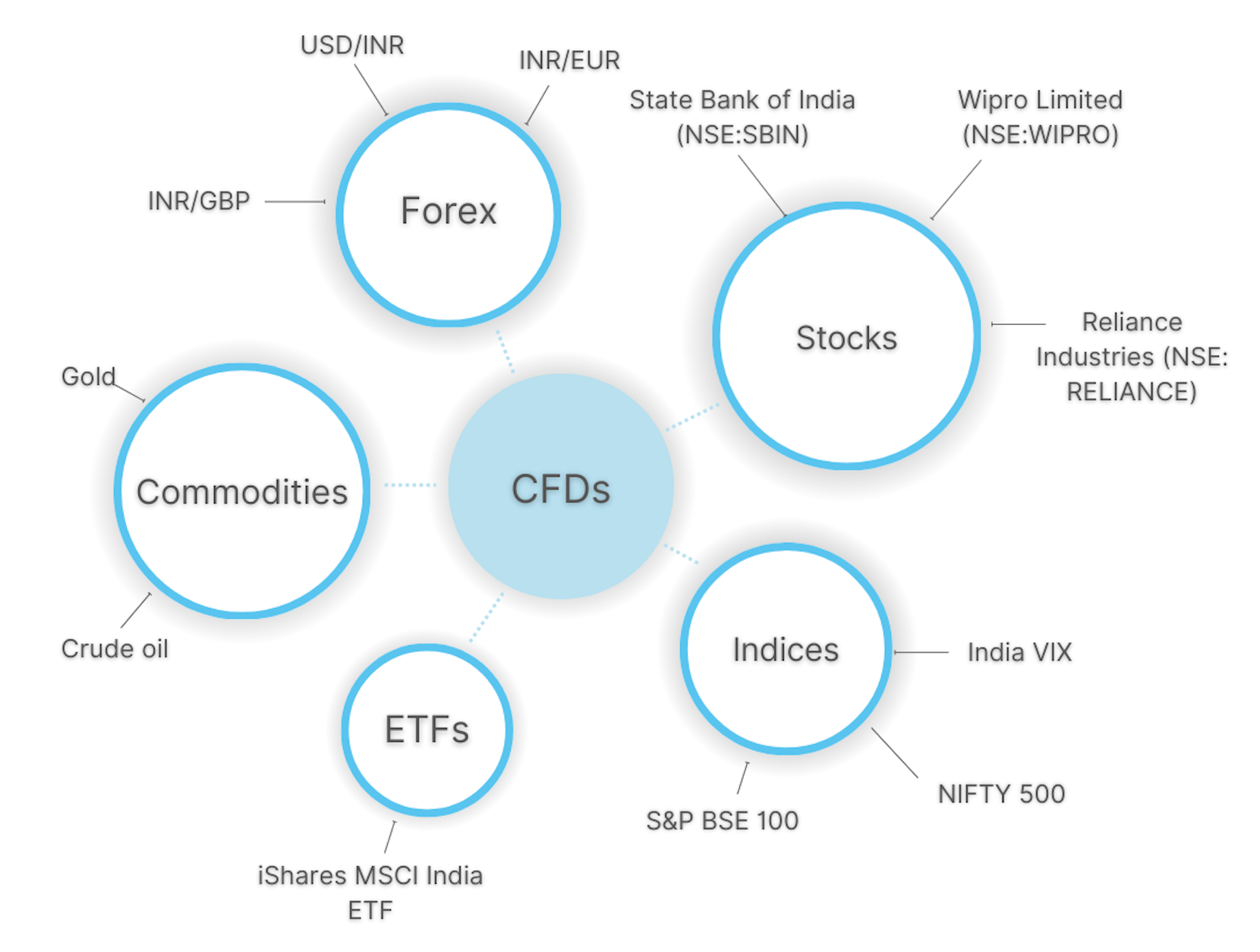

Tradable Assets

The Indian economy is classed as emerging but has a huge presence on the global stage. It is the 5th largest economy in the world by GDP, though Forbes predicts it will be the 3rd largest by 2027.

This scale is driven largely by the country’s population – 1.4 billion, the second largest globally – as most of its economy is domestic consumption.

India’s economy is clearly an exciting place for global investment, so it’s no surprise that Indian traders want to use CFDs to speculate on its financial markets. Yet we’ve explored countless trading platforms and CFDs on Indian assets remain rare, though there are exceptions…

- IG is a stand-out option if you want to trade CFDs on Indian markets. The brokerage offers CFDs on a number of ETFs, including iShares India 50, Amundi ETF MSCI India UCITS, and Invesco India Exchange-Traded Fund Trust. IG also provides CFDs on relevant currency pairs, including USD/INR, GBP/INR and INR/JPY, plus stocks like the State Bank of India GDR (SBID).

Leverage Requirements

Leverage trading is one of the biggest draws of CFD trading. It allows you to multiply trading results (profits and losses) by putting down a relatively small amount of Indian Rupees, known as ‘margin’.

Let’s say I suspect there is about to be an announcement concerning increasing foreign investment towards Big Tech companies in India, such as Infosys, Wipro and TCS.As a result, I believe that the value of HSBC S&P India Tech UCITS ETF may rise and my broker offers me 1:5 leverage on a CFD for the asset.

If I have 20,000 INR in my account, this would allow me to take a long CFD position worth 100,000 INR (5 x 20,000).

Every one of our recommended CFD platforms offers leverage with clear margin requirements so you know how much money you need to put down and maintain in your account to keep positions open.

However, we’ve observed many CFD platforms offering very high leverage to Indian traders, significantly beyond the 1:30 available in tightly regulated jurisdictions like Europe and Australia. We do not recommend trading CFDs with this high leverage, especially if you’re a beginner – it significantly increases the risk of large losses.

- IC Markets offers leverage up to 1:1000 on CFDs, available to Indian traders with clear margin requirements; if your account’s margin level falls below 50% your positions may be closed out. Its ‘All in One’ calculator is also super easy to use and shows you the required margin depending on the asset and position size.

Pricing

Low-cost brokers are key for successful CFD trading, especially those adopting short-term strategies like day trading.

That’s why we’re consistently testing brokers, evaluating spreads, commissions, and any additional fees such as those for transferring Indian Rupees to CFD accounts based in another currency.

However, we also know that price isn’t everything. That’s why we weigh the cost against the quality of the tools provided, as a CFD broker that provides expert insights into events that may affect the Indian economy and its stock exchange, for example, may help investors identify short-term trading opportunities that can be capitalized on with CFDs.

- Pepperstone is a low-cost CFD provider, especially after reducing its fees in recent years. During testing, we found it continually delivers competitive spreads. For example on the USD/INR, spreads came in as low as 7 pips, but averaged 9 pips throughout the day.

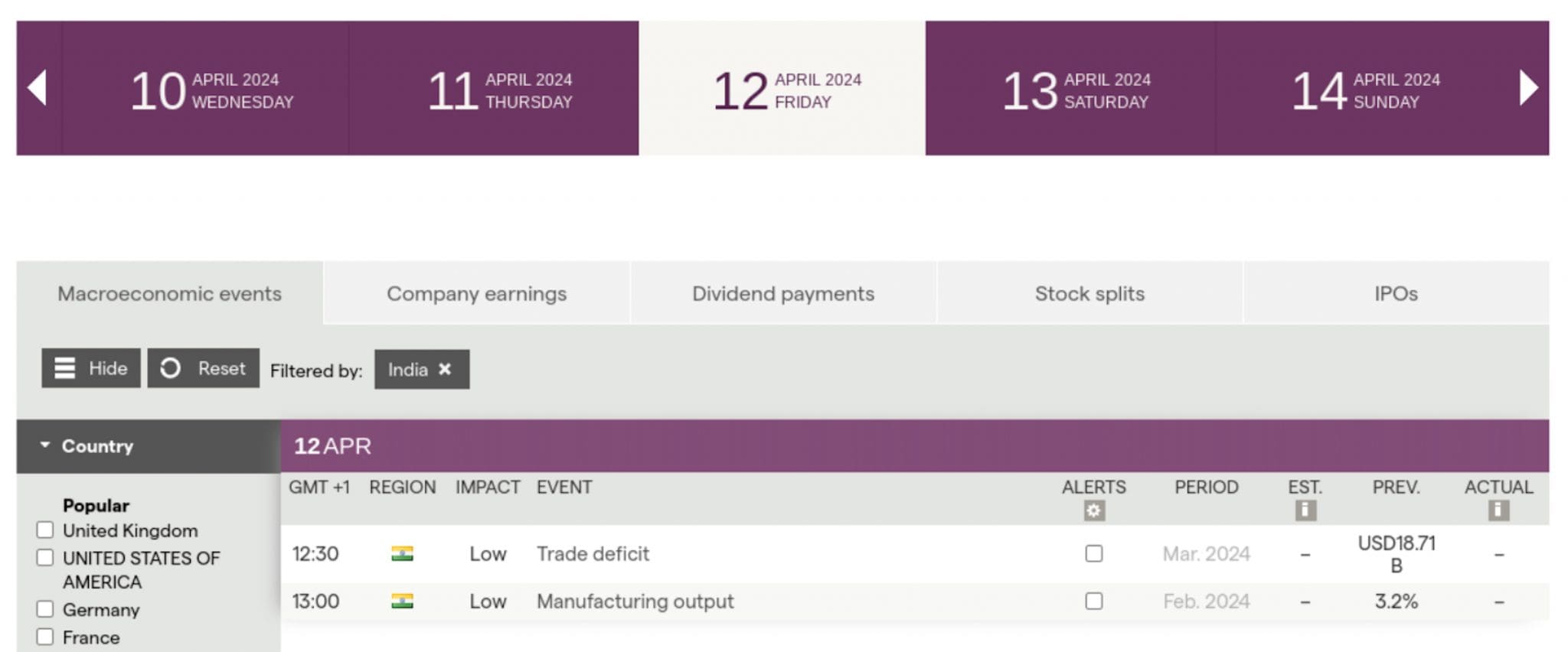

Trading Tools

A CFD trader needs the right tools to successfully execute positions. The world of trading platforms can feel overwhelming as the number of options available and their unique features are time-consuming to compare.

Fortunately, we’ve taken the legwork out of it. Our analysts have spent countless hours testing major platforms and apps, marking them for criteria such as their intuitive design (key for beginners) and the strength of their charting package (key for advanced traders).

CFD brokers that provide research tools that you can tailor to regions, such as India, also stand out, providing insights that could inform short-term trading decisions.

- IG offers a fantastic selection of trading tools, from third-party favorites like MT4 to its incredibly intuitive web platform. Its comprehensive economic calendar also allows you to filter to India, providing updates on trade deficits, manufacturing output, unemployment rates, CPI and more.

Account Funding

We only recommend CFD trading platforms in India with an affordable minimum deposit of below 250 USD, around 20,000 INR. We also investigate the payment methods available, including the availability of local transfer solutions.

For example, the top payment methods used by Indians are wire transfers and bank cards, according to Statista – available at all our top-rated CFD brokers.

Popular Indian e-wallets, however, such as RuPay and MobiKwik, are not widely available in our experience – brokers tend to prioritize globally recognized payment methods, such as PayPal instead.

- Exness offers convenient account funding for Indian traders, notably bank cards and wire transfers. It also supports an INR-based CFD trading account with a low minimum investment of 10 USD, around 850 INR. Islamic trading accounts are also provided.

FAQ

Which Is The Best CFD Broker In India?

Refer to our list of the best CFD brokers in India to find the right trading platform for you.

However, it’s important to note these brokers are not authorized by an Indian regulator, substantially increasing the risk for Indian traders.

Who Regulates CFD Brokers In India?

There is no regulatory framework in India permitting CFDs – the Securities and Exchange Board of India (SEBI) does not authorize CFD brokers.

There are many international brokers offering CFDs to Indian traders and even providing INR-based accounts and opportunities to speculate on underlying Indian assets. However, Indians may be forgoing any legal protections and should seek professional advice to ensure they are operating within India’s laws.

What Is The Minimum Deposit Needed To Open A CFD Trading Account In India?

Our analysis shows the vast majority of CFD brokers accepting Indian traders require a starting deposit of below $250, or 20,000 INR.

That said, Interactive Brokers stands out as the highest-rated platform with no minimum investment, catering to Indian CFD traders on a budget.

Recommended Reading

Article Sources

- Muslim Population in India is Nearly 20 Crore in 2023: Govt in Lok Sabha, The Economic Times

- India Will Grow To Become The World’s Third-Largest Economy By 2027, Forbes

- MAKE IN INDIA 2.0, Goverment of India

- Securities & Exchange Board of India

- 22 Technology Companies in India to Know, Built In

- Most Common Payments by Type in India, Statista

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com