Stryk Review 2024

Pros

- The app is designed to make trading an easy and enjoyable experience for novice investors

- Excellent social investing feature with trading competitions and community forums

- The broker is fully regulated by tier-one financial agencies providing a secure environment

Cons

- Customer support is lacking with weak live chat in particular

- Financing fees and inactivity fees can add up and prove costly

- Stryk does not offer any trading education or analysis tools

Stryk Review

Stryk (formerly BUX X) is a mobile-based brokerage firm for CFD trading on popular markets like forex, stocks and indices. The European broker aims to provide safe and responsible investing via a social trading platform. This Stryk review will unpack all the information you need to make an informed decision about opening an account, including fees, deposits, withdrawals, platforms and regulatory status.

Key Takeaways

- Stryk is a good option for beginners looking for social trading features

- We liked the user-friendly mobile app with straightforward trade and account management

- While using Stryk, we felt it was best for short-term traders due to the leveraged derivatives and multipliers

- Experienced traders may be disappointed by the lack of advanced analysis features and market research

- Our experts found that customer support is lacking with a slow and unresponsive live chat service

What Is Stryk?

Stryk (rebranded from BUX X) is a European platform that is based in the Netherlands and prides itself on making trading accessible for everyone. It has over 2.6 million users in Europe from 13 different countries.

On Stryk, you trade CFDs (Contracts For Difference), which allow you to speculate on the price of a stock, forex pair, index or commodity without owning the underlying asset. With CFDs, you only trade the difference in price between your entry and exit points.

Our team were pleased to see that many of the key features previously offered at BUX X are now available on the Stryk app. This includes a free, unlimited demo account which includes 1,000 Stryks (the broker’s virtual money), plus social trading features.

Assets & Markets

With Stryk, users have access to over 800 markets including stocks, indices, forex, commodities and cryptocurrencies. Overall, the range of assets is good, though not as extensive as other social trading brokers like eToro.

CFD instruments include 13 major world indices including the FTSE 100 and S&P 500, 23 major, minor and exotic currency pairs, 5 cryptocurrencies such as Bitcoin and Ethereum, plus 5 commodities including gold and oil. Hundreds of US and European stocks are also available, including Tesla, Volkswagen and GSK.

Fees & Pricing

Stryk charges a competitive fee for positions entered and exited. This fee is a percentage of the total trade size, with varying rates for different instruments. If you are trading with leverage, the fee will be calculated using the entire trade size, not just your margin. Importantly, the brand stacks up well against alternatives in terms of competitive and transparent pricing.

Pricing is dependent on the base currency of the account holder and the exact fee will be displayed underneath the trade button before you initiate the trade.

Trade fees for the different instrument classifications are provided below.

- Currencies and Indices (excl. China A50 and Singapore): between 0.05% and 0.10% (minimum fee £0.50)

- Commodities (excl. Gold): 25% (minimum fee £0.50)

- Stocks: between 0.20% and 0.30% (minimum fee £0.50 excl. Italian stocks or £1.00 Italian stocks)

- Indices China A50 and Singapore: 20% (minimum fee £0.50)

- US Volatility Index: 60% (minimum fee £0.50)

- Gold: 12% (minimum fee £0.50)

- Interest Rates and Bonds:05% (minimum fee (£0.50)

Other Fees

Trade fees are not the only CFD charges associated with Stryk investing. Below are some of the other costs to look out for.

Financing Fee: If you use leverage on Stryk and hold a position overnight, you will be charged interest known as a financing fee. This fee is charged daily at 23:00 GMT and is displayed clearly in the details of each product. The financing fee is based on the relevant Alternative Reference Rates (ARR). It is added to long positions and subtracted from short positions to a fixed 0.0139% daily spread. If you do not use a multiplier, you will not be charged a financing fee.

Let’s look at an example of how this works:

Suppose you invest £100 in Apple stock and you use a leverage multiplier of 1:5. Your total trade size would be £500 and the financing fee is calculated from this value. If the local interest rate is 0.2%, this means you will pay an annual interest rate of 3.7% (0.2% + 3.5%). This interest rate will be charged to the total trade size (£500) and rounded up to the nearest £0.01. In this example, your daily financing fee would be £0.05.

Inactivity Fee: If your account is inactive for 90 days or more, you will be charged an inactivity fee of £5 per month. I found this reasonable since the typical monthly fee is anything from £10 at some other brokers.

The inactivity fee requires that there has been no trading activity on your Stryk account for the last 90 days, the Stryk app hasn’t been opened in 90 days and you do not have any open positions in your portfolio. If there are insufficient funds in your account, the account will be reduced to zero.

Note, inactivity charges will not be made to accounts with a current balance less than or equal to zero.

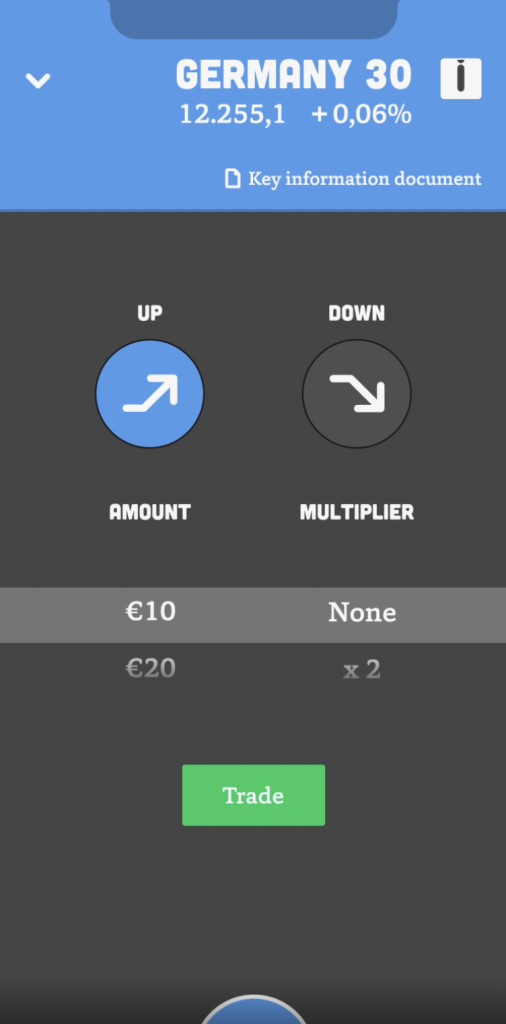

Stryk Mobile App

Stryk (formerly BUX X) is a mobile-only trading platform that aims to offer a fun and accessible way to trade online. It is available to download for Android (APK) on the Google Play Store and Apple (iOS) devices from the Apple App Store. On the downside, this means that Stryk is not available for PC or desktop computers and there is no chance of API trading.

Users start with the Stryk demo account (formerly known on BUX X as the “funBUX” demo) in which CFD trades are made using virtual funds. Once you decide you want to invest real money, you can switch to a live account via your dashboard. You can switch back to the demo account at any time.

Overall, our team found the app’s interface intuitive and user-friendly, with simple graphics. All key functions are easy to navigate, including funding and opening positions.

With that said, the user interface can get quite cluttered, and the bright blue graphics could be improved for those using dark mode. The app is also ultimately designed for beginners and rookie traders, so if you are looking for a broker that provides more details and sophisticated features, Stryk may not be for you.

Payment Methods

To make a deposit or withdrawal at Stryk, simply go to the wallet icon, select CASH and then DEPOSIT/WITHDRAW. You will be provided with a list of different methods depending on your country of residence. After your initial deposit, your details will be stored so that withdrawals can be made to that same account.

I was pleased to see that there are no charges for deposits or withdrawals from within the European Economic Area (EEA), though your bank may charge if you are using a non-EUR bank account. In addition, if your card is issued outside of the EEA, there is a transaction fee of 1.75%.

Deposits made using credit cards are typically processed instantly, except for bank transfers which can take up to 5 days.

Withdrawals via credit or debit card are processed within 3 working days, whilst bank transfers may take up to 5 days.

Leverage

With Stryk (formerly BUX X), it is common to use leverage or a multiplier to increase your market exposure. Leverage is essentially a tool by where a broker lends you funds to increase your position sizes and potential profits.

For example, if you invest £500 in BP stock and use a leverage of 1:3, your total trade size will be £1,500. You will then have exposure to the profits or losses of the £1,500 trade value rather than £500.

Leverage can mean quicker profits, though care should be taken as losses are also magnified. Fortunately, we like that Stryk ensures that clients never lose more money than they originally invested. Our team were also pleased to see that Stryk offers a maximum multiplier of 33 on currency pairs, as per European regulations.

Stryk Regulation

Stryk is a trading name of BUX Europe Limited, a company registered and licensed by the Cyprus Securities and Exchange Commission (CySEC). BUX Financial Services Limited is also regulated by the UK Financial Conduct Authority (FCA). As such, our team are confident that the broker can be trusted to follow the strict guidelines in place to protect client money.

The Investor Compensation Fund (ICF) also ensures that users are protected up to EUR 20,000 in the event of insolvency. As per ESMA rules, Stryk also offers negative balance protection to ensure client accounts never fall below zero.

Additional Features

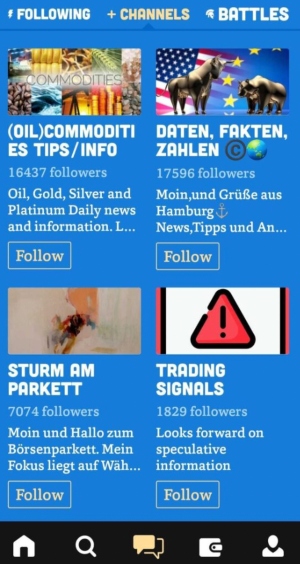

Stryk’s key feature is the online social community, consisting of ‘Channels’, ‘Battles’ and ‘Star Traders’. Our team found that this was a great tool for making online trading fun and interactive.

Channels are used for sharing news and opinions, where traders can post content and share open trade positions with peers. Traders can also create groups with up to 100 participants.

Battles are a way to test your trading skills in a competitive environment with other traders. The trader with the highest returns wins. You can start your own Stryk Battle or join others. You can join up to 5 battles at any one time.

Star Traders essentially acts as a copy trading platform, where users can follow the trades of successful traders. This is a good option for beginners.

Overall, our team were impressed with the features of the app, where traders can enter competitions as a fun way to improve trading skills. With that said, we would have liked to have seen some more trading education and resources, commonly offered by other social trading brokers such as Axi.

Customer Support

Stryk offers customer support via email, live chat and telephone. However when we tested the live chat, we received a response after 1 hour, which is quite disappointing compared to reputable brokers.

- Email Address: eu@strykapp.com

- Telephone: +357 2506 0197

Taxes

Profits made from CFD trading are taxable in most countries. Importantly Stryk will not deduct tax automatically, so it is up to you to declare any earnings with your local authority.

We recommend visiting a local, independent tax advisor for specifics on local tax laws and advice on filling out your return.

Dividends

When you invest in a stock or an index with Stryk, you may have the right to receive or obligation to pay dividends. If you open a long position, you will be entitled to receive dividends and if you hold a short position, you may have the obligation to pay. The dividend amount you pay will be relative to the total trade size.

Stryk Verdict

Stryk (formerly BUX X) offers a fun and user-friendly mobile interface with a social community feature. The assets on offer are extensive, covering commodities, forex and stocks. However, our team found limited technical analysis features or research tools, and customer support is not as reliable as other brands.

FAQs

What Is Stryk?

Stryk is a mobile-only CFD trading app. Its goal is to make trading accessible to everyone and it does this by providing a simple, user-friendly interface for trading CFDs on stocks, forex, commodities and indices. It also offers a social platform with trading competitions and user forums.

Can I Trade Crypto On Stryk?

Yes, Stryk offers CFDs on popular digital assets including Bitcoin, Ethereum, Litecoin, Bitcoin Cash and Ripple. The maximum multiplier for all cryptos is 2.

What Markets Are Available On Stryk?

Stryk (previously BUX X) is a CFD trading platform with access to European and US stocks, forex, hard and soft commodities and major indices, including the US volatility index.

Should I Trade With Stryk?

If you are a beginner or rookie trader, Stryk may be a good place to start. It is user-friendly and simplistic, with a focus on making trading fun for its users. However, more experienced traders may find the lack of features frustrating.

Top 3 Alternatives to Stryk

Compare Stryk with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

Stryk Comparison Table

| Stryk | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 2.4 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Stocks, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $100 |

| Minimum Trade | $10 | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:5 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Stryk and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Stryk | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | Yes |

Stryk vs Other Brokers

Compare Stryk with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of Stryk yet, will you be the first to help fellow traders decide if they should trade with Stryk or not?