Financial Supervision Authority (KNF) Brokers 2026

The Financial Supervision Authority, or Komisja Nadzoru Finansowego (KNF), is Poland’s regulatory body overseeing the financial markets, including online brokers.

For day traders, the KNF plays a crucial role in safeguarding against fraud, enforcing strict regulations on trading platforms, and ensuring compliance with EU standards.

Traders with KNF-authorized providers are also covered by the KDPW Investor Compensation Scheme, which provides up to 90% of lost funds, capped at €20,100, if your broker becomes insolvent.

Poland’s KNF is classified as ‘green tier’ under DayTrading.com’s Regulation & Trust Rating, reflecting its strong investor safeguards and active oversight of brokerages.

Explore our selection of the top KNF-regulated brokers in Poland. We’ve meticulously verified that every platform we recommend is listed on the KNF’s ‘Entities Search‘, ensuring its legitimacy.

Best KNF Brokers

Following our latest evaluations, these 1 Polish-regulated trading platforms emerged as a cut above the rest:

Here is a short overview of each broker's pros and cons

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring day traders.

KNF Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| XTB | $0 | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | xStation | 1:30 (EU) 1:500 (Global) |

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Account Currencies | USD, EUR, GBP |

Pros

- The xStation platform continues to impress with its user-friendly interface and intuitive features, including customizable news feeds, sentiment heatmaps, and trader calculator, reducing the learning curve for newer traders.

- Opening an XTB account is a hassle-free, entirely online process that takes just a few minutes, making the entry into day trading smooth for new traders.

- XTB has boosted its interest rate on uninvested balances and added zero-fee ISAs (On ETFs and real shares, or 0.2% with transactions over €100k) for UK clients with a huge range of markets available.

Cons

- XTB discontinued support for MT4, limiting traders to its proprietary platform, xStation, potentially deterring advanced day traders familiar with the MetaTrader suite.

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

Firms are either ‘brokerage houses’ or registered for ‘outward passporting’ under the EU’s crossborder initiative.

Methodology

To discover the top brokers operating under KNF regulation, we:

- Reviewed our list of 140 brokers to identify those asserting KNF authorization.

- Checked their details against the KNF’s online registry to confirm their authorization.

- Integrated the findings of our hands-on testers and 100+ data points to develop a ranking of the best KNF-authorized brokers.

How Can I Check If A Broker Is Regulated By KNF?

Ensuring the KNF regulates a broker is a straightforward process that we use to validate the credentials of every recommended platform.

You can do it in three easy steps:

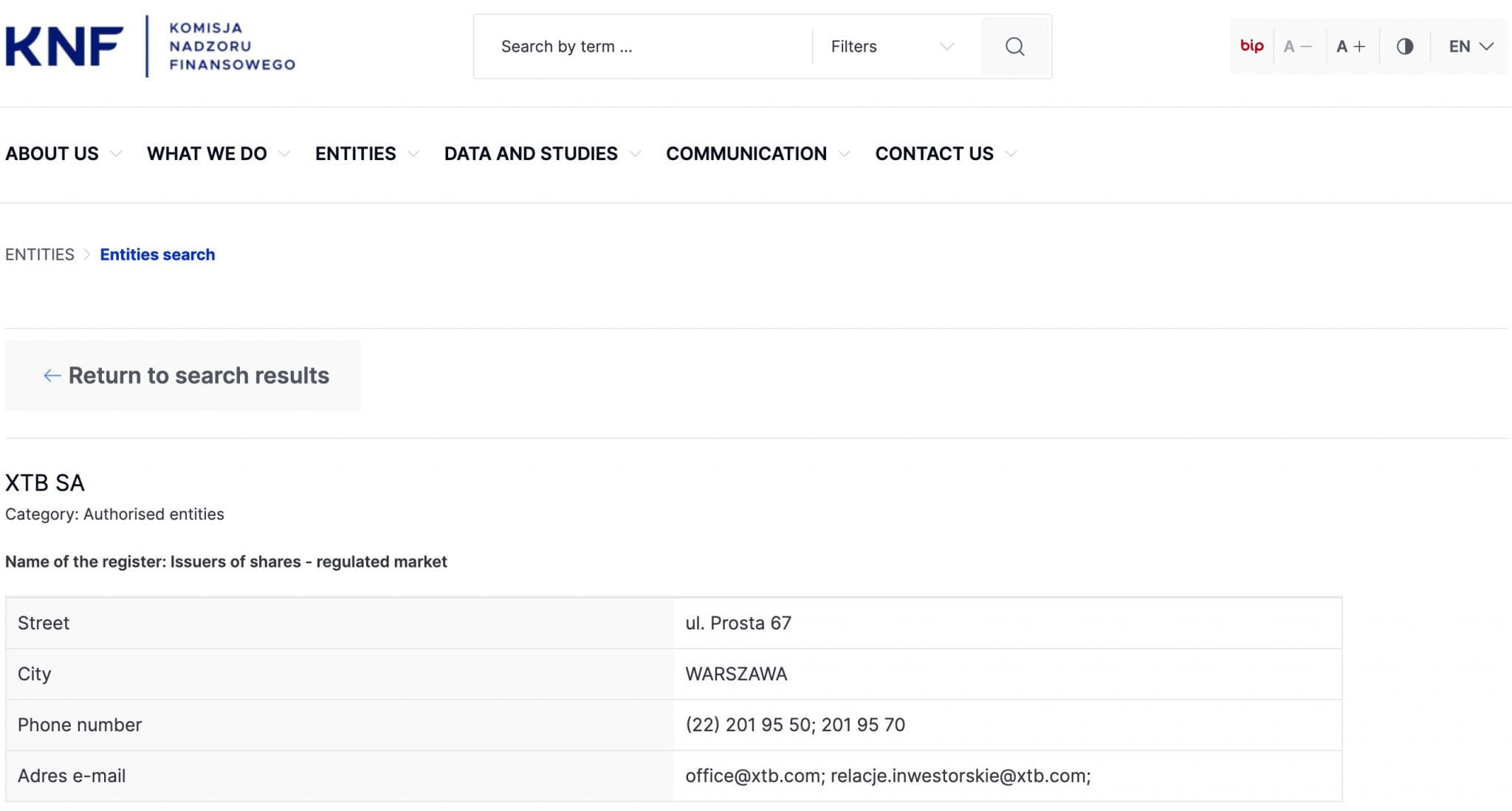

- Access the KNF ‘Entities Search’ on its website.

- Input the broker’s name into the search field.

- If needed, refine the search results by category to view information such as the full business trading name(s), registered office addresses, and brokerage activity information.

To illustrate how this works, you can see below that I verified that XTB is authorized by the KNF.Taking just a couple of minutes – it’s a quick and easy process that all Polish traders should follow before depositing złoty to a new online trading account.

What Rules Must KNF-Regulated Brokers Follow?

Day trading brokers regulated by Poland’s KNF must primarily adhere to rules regarding client protection, proper segregation of funds, capital adequacy requirements, reporting obligations, best execution practices, conflict of interest management, and compliance with MiFID II regulations, all of which aim to ensure market integrity and safeguard investor interests.

To be granted a KNF license, a brokerage must satisfy the following fundamental requirements and safeguards:

- Client Protection: Brokers must prioritize client interests, provide clear information on services and risks, and maintain proper client account segregation.

- Capital Adequacy: Maintain sufficient capital reserves to cover potential market fluctuations and risks associated with brokerage activities.

- Best Execution: Obligation to seek the best possible price for clients when executing orders, considering price, cost, and speed, which are essential for day traders operating in fast-moving markets.

- Conflict of Interest Management: Clear disclosure and procedures to manage potential conflicts of interest arising from their business activities.

- Reporting Requirements: Regularly submit detailed reports to KNF regarding trading activity, client accounts, and financial health.

- MiFID II Compliance: Adhere to the Markets in Financial Instruments Directive II guidelines on market conduct and transparency, including order-book transparency and client suitability assessments.

- Anti-Money Laundering (AML) Compliance: Implement robust AML procedures to combat money laundering and terrorist financing activities.

- Customer Suitability: Assess client risk profile and ensure investments are appropriate for their needs and financial situation, an important check given the high-risk nature of short-term trading strategies.

Trading platforms and financial institutions who fail to comply with these regulations and other stipulations may be subject to enforcement action by the KNF, which could result in fines, sanctions, or the revocation of their license.

A notable example is the KNF’s PLN 9.9 million fine (EUR 2.3 million) for ‘differential slippage’ against XTB, a Polish broker. This practice allowed XTB to pass losses from unfavorable price movements entirely to its clients while profiting from favorable price movements, effectively putting clients at a disadvantage.

Additionally, in June 2024, the KNF fined the publicly listed lender BNP Paribas Polska PLN 500,000 (EUR 115,400) for insufficient ongoing oversight of factual and legal activities.

Bottom Line

Polish traders are strongly advised to choose KNF-regulated brokers. This ensures the brokerage’s trustworthiness and establishes a fair and transparent trading environment, offering peace of mind and guidance as you navigate your day trading journey.

You can verify this in just a few minutes on the KNF website. Or, explore DayTrading.com’s list of the best day trading platforms regulated in Poland.

It’s essential to acknowledge that online trading involves risks, regardless of the broker’s regulatory status, and you could lose all the złoty you invest.

Article Sources

- Komisja Nadzoru Finansowego (KNF)

- KNF' Entities Search'

- KDPW Investor Compensation Scheme

- Polish Regulator Hits XTB with $2.7 Million Fine over Differential Slippage - Finance Magnates

- Poland's financial regulator KNF imposes PLN 500k fine on BNP Paribas BP - PAP Biznes

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com