Brokers With KRW Accounts

The South Korean won (KRW) is the official currency of South Korea, issued by the Bank of Korea. As one of Asia’s prominent currencies, it plays a significant role in the global forex market.

A trading account in KRW can be advantageous due to South Korea’s export-driven solid economy, particularly electronics, automobiles, and semiconductors.

Trading in KRW also exposes you to the dynamics of emerging markets. It could allow you to take advantage of fluctuations tied to geopolitical events or shifts in South Korea’s economic landscape.

Leap into DayTrading.com’s choice of the top trading platforms with South Korean won accounts.

Best Brokers With KRW Accounts

After our hands-on tests, these are the 1 top brokers supporting KRW accounts:

This is why we think these brokers are the best in this category in 2026:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

Brokers With KRW Accounts Comparison

| Broker | KRW Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

How Did We Choose The Best Brokers?

Through a rigorous evaluation process, we identified the leading KRW brokers:

- We utilized our vast library spanning hundreds of brokers and trading platforms.

- We discarded platforms that did not meet our high standards for offering KRW-denominated accounts.

- We ranked each platform using a scoring system that considers 100+ quantitative metrics and qualitative assessments derived from our in-depth testing.

What Is A KRW Account?

A KRW account is a trading account where transactions are conducted in South Korean won.

Although rare based on our evaluations, this account type can offer several benefits, such as avoiding foreign exchange conversion fees, hedging against exchange rate fluctuations, and efficiently investing in domestic assets like stocks and IPOs.

If you’re actively involved in South Korea’s financial markets, or based in South Korea, a KRW account can offer significant benefits and convenience.

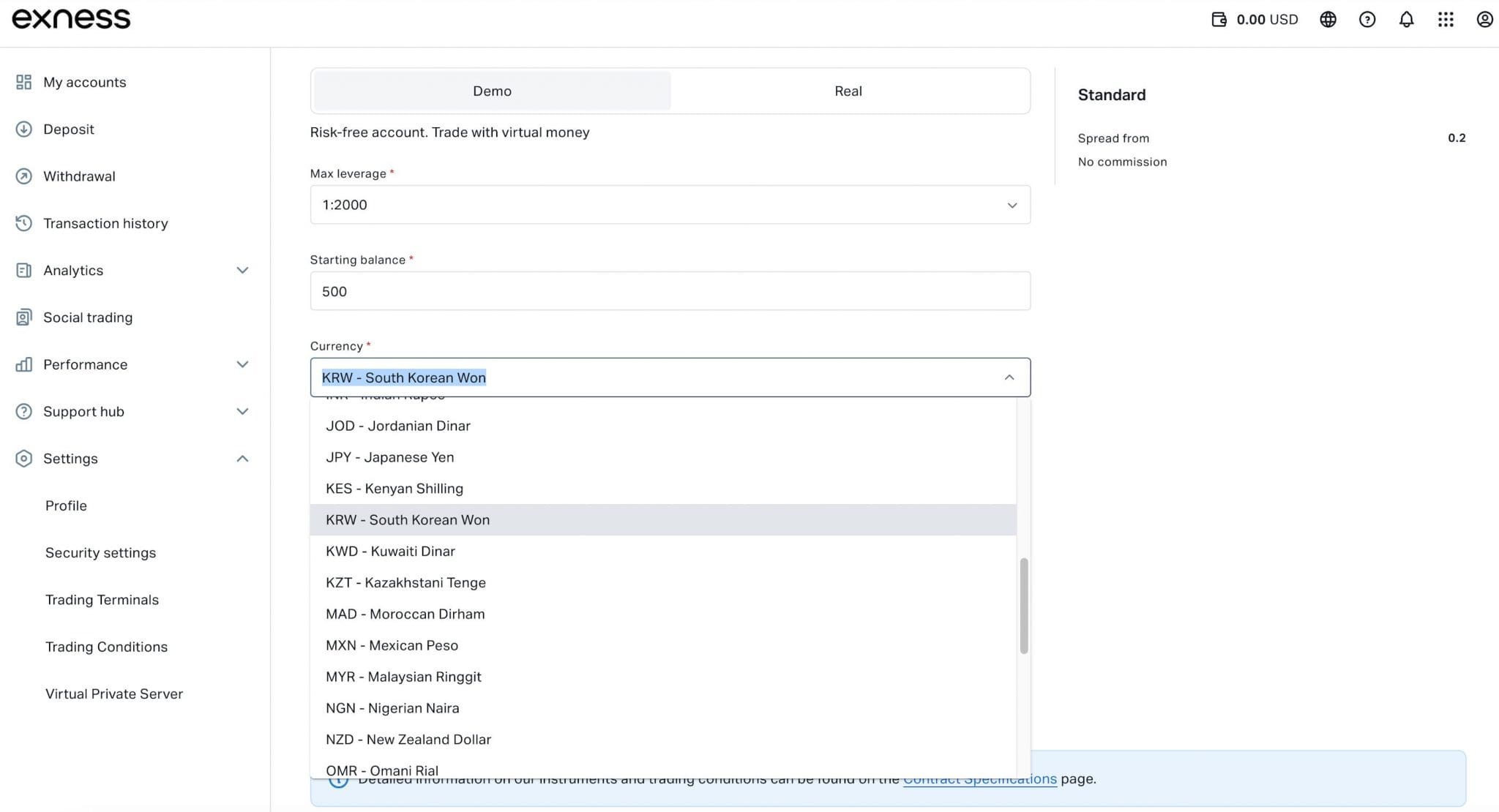

Following account verification, configuring your trading account to South Korean won takes just a few minutes and clicks.To illustrate how it works, below is a screenshot showing where I opened a KRW trading account at Exness.

Do I Need A KRW Trading Account?

A KRW trading account could be right if you fall into these brackets:

- You’re a South Korean resident looking for simplified tax reporting on your trading activities. You can streamline your accounting by avoiding the need to track foreign exchange gains or losses.

- You want to trade South Korean stocks more easily on the Korea Exchange (KRX), government bonds, and other financial instruments, allowing you to invest in South Korea’s expanding economy, driven largely by its booming technology sector.

- You want to reduce the potential negative impact of exchange rate fluctuations on your trading profits, mainly when trading South Korean assets or converting to other currencies, such as the US dollar if you want to deal in US securities.

How Can I Check If A Broker Offers An Account In Korean Won?

You can check if a broker offers an account in Korean won by following these straightforward steps, which we look for all our recommended brokers:

- Look for the ‘Account Options’ area on a trading provider’s website or app. This section should list the supported currencies for different account types.

- Ensure that the trading account supports ‘KRW’. This is essential for conducting trades in South Korean won.

- Start opening a trading account and select ‘KRW’ as your base currency. For any issues, contact the firm’s support team.

Pros & Cons Of KRW Trading Accounts

Pros

- Opening a trading account with KRW as the base currency eliminates the need for constant currency conversions between KRW and other currencies, helping Korean residents save on transaction fees and minimizing the risk of unfavorable exchange rate fluctuations.

- A KRW base account may provide direct access to South Korean financial instruments, making it easier to trade within the South Korean market without the hassle of currency exchange. That said, not all brokers with KRW accounts offer Korean markets based on our investigations.

- If you have exposure to KRW assets or businesses in South Korea, a KRW account can help protect your investments from currency risk. By aligning your investments with your base currency, you can reduce the impact of exchange rate volatility.

Cons

- A KRW base account may make trading international securities in non-KRW currencies harder, requiring conversions that could lead to extra fees and exposure to foreign exchange risks.

- KRW trading accounts are extremely sparse from our research, with less than 5% of all brokers in our directory supporting KRW as a base currency. In contrast, nearly every trading platform has a USD-based trading account.

- International markets and assets denominated in more widely traded currencies like USD tend to have higher liquidity. A KRW base account may restrict access to such high-liquidity assets, potentially affecting trade execution, which is key for day traders.

- Managing a KRW-based account, especially when dealing with cross-border investments, may involve specific tax rules or regulatory challenges.

FAQ

Which Is The Best Broker With An KRW Account?

Our experts have compiled a list of the best day trading platforms with KRW accounts. Explore our recommendations to find the ideal platform for your trading needs.

How Much Does It Cost To Open A Trading Account Based In Korean Won?

While the standard minimum deposit for KRW trading is up to USD 250 (approximately KRW 335,390), some brokers offer more affordable options.

Exness is one such leading broker. Its USD 10 (approximately KRW 12,225) minimum deposit requirement makes it an option for active traders who are just starting or have smaller account balances.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com