Brokers With KES Accounts

The Kenyan shilling (KES), regulated by the Central Bank of Kenya (CBK), is the country’s official currency and a popular base currency for trading accounts among active Kenyan traders.

It is one of the most commonly used currencies in East Africa, particularly for trade within the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA) regions, especially in sectors like agriculture, technology, and finance.

Jump into DayTrading.com’s pick of the top brokers with KES accounts to find a platform that best supports your trading preferences.

Best Brokers With KES Accounts

Following our in-depth tests, these are the 2 top brokers that support KES accounts:

Here is a summary of why we recommend these brokers in January 2026:

- Crypto.com - Crypto.com is one of the biggest names in cryptocurrency trading, developed with the aim to expedite the world's transition to DeFi technologies. The crypto exchange offers token lending, pre-paid cards, NFTs and more. The firm was established in Germany in 2016 and its quality is proven by its 150 million users.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

Brokers With KES Accounts Comparison

| Broker | KES Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Crypto.com | ✔ | Varies by payment method | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU |

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Crypto.com

"Crypto.com is a snug fit for aspiring crypto traders who want to buy, sell and trade over 400 digital tokens. Its strike options and prediction markets spanning financial, economic, election, sport, and cultural events via its CFTC-regulated entity also make it a secure option for US traders interested in binary-style contracts on an intuitive app."

Christian Harris, Reviewer

Crypto.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) |

| Regulator | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU |

| Platforms | Own |

| Minimum Deposit | Varies by payment method |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, PLN, CZK, AED, SAR, HUF, BRL, KES |

Pros

- Crypto.com uses a cold wallet solution that integrates multi-signature technology and geographic distribution to enhance security. This approach ensures robust protection of user assets with highly secure offline storage.

- The Crypto.com Exchange platform offers sophisticated bots, including Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. These tools allow traders to automate strategies, including leveraged perpetual trades, minimizing manual effort and slippage.

- Crypto.com has expanded beyond crypto in some regions, offering over 5000 stocks and ETFs for traders looking to build diverse portfolios and opportunities in different sectors.

Cons

- Customer support primarily relies on chatbots and email, with limited reliable phone support from our testing. This can lead to delays in resolving urgent issues, such as account access or transaction problems, which can be frustrating for crypto day traders who need quick assistance.

- The app's high bid-ask spreads on many coins can be costly for traders placing market orders. Wide spreads mean the price you pay when buying is noticeably higher than the price you receive when selling, cutting into profits, especially on lower-volume trades.

- Withdrawal fees apply to crypto transfers and fiat withdrawals, and these can be significant for active traders making smaller transfers. The minimum withdrawal limits are also relatively high, which restricts flexibility for managing smaller portfolios or quick liquidity needs.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

How Did We Choose The Best Brokers?

Through a detailed evaluation, we’ve curated a list of leading KES trading platforms:

- Our comprehensive ranking process involved leveraging our database of 231 online brokers and trading platforms, ensuring that only the best were considered.

- We excluded platforms that did not fulfill our demanding requirements for providing KES-denominated accounts.

- We utilized a robust scoring system to rank each platform, which incorporated over 100 quantitative metrics and qualitative evaluations informed by our in-depth testing.

What Is A KES Account?

A KES trading account is an account denominated in Kenyan shillings used for conducting financial transactions or trading in the currency.

It lets you buy and sell derivatives, commodities, or currencies in KES without constant currency conversion.

This type of account is beneficial if you are engaged in trade with Kenyan entities or within the East African region, as it helps minimize exchange rate risks and simplifies transactions by operating in the local currency.

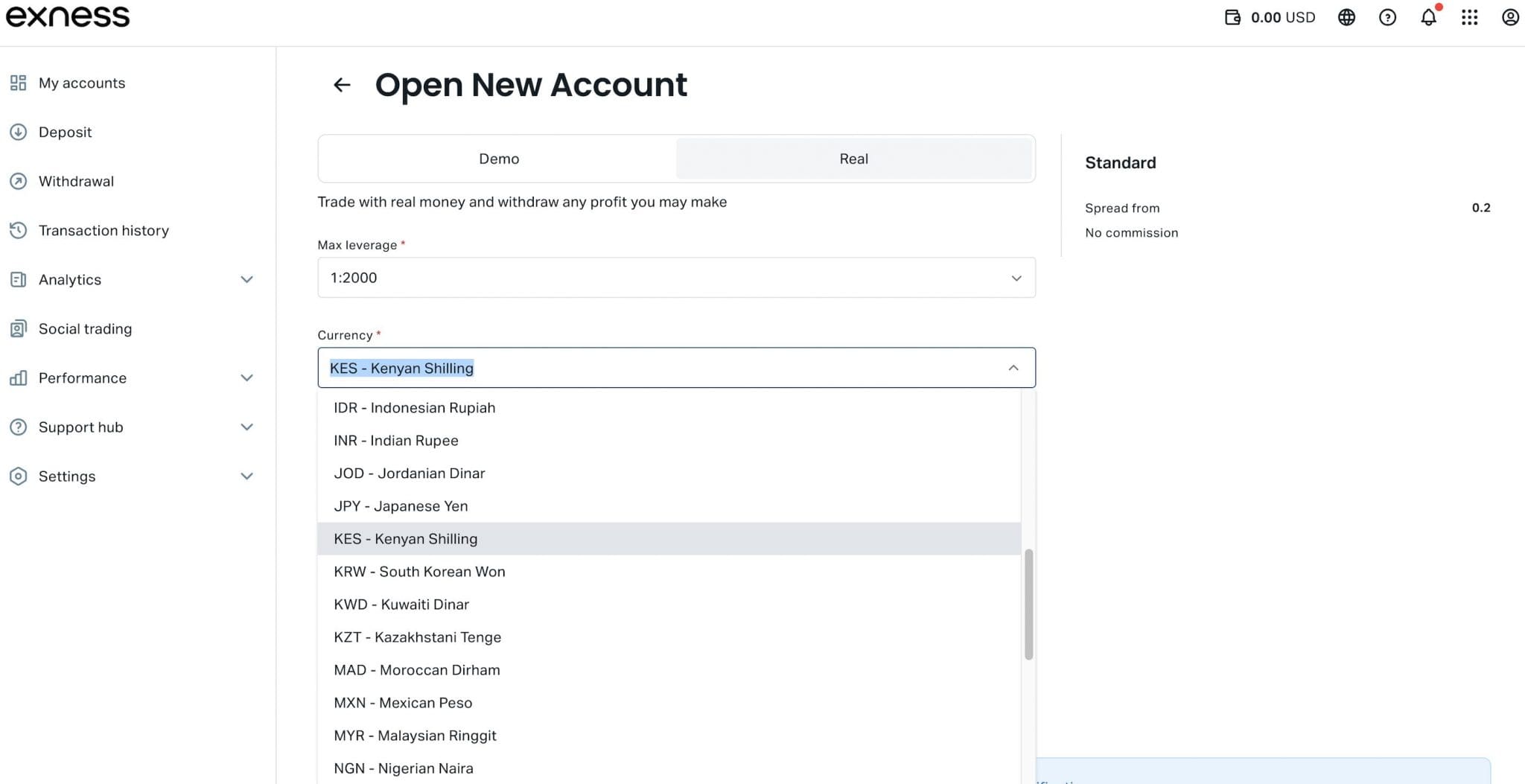

Setting up a KES trading account is straightforward. You can see below where I did this during the sign-up stage at Exness.

Do I Need A KES Trading Account?

A KES account may suit your needs for several reasons:

- A KES trading account empowers you to easily trade Kenyan stocks, government bonds, and other financial instruments on the Nairobi Securities Exchange (NSE).

- A KES trading account provides Kenyan traders with simplified tax reporting. By avoiding the need to track foreign exchange gains or losses, accounting can be streamlined to simplify tax obligations.

- By trading local assets, Kenyan traders can mitigate the potential adverse effects of exchange rate fluctuations on trading profits.

How Can I Check If A Broker Offers An Account In Kenyan Shillings?

It takes minutes to find out whether a brokerage supports an account in Kenyan shillings:

- To determine the available currencies for your trading account, locate the ‘Account Options’ section on the broker’s website. This section will usually list the supported currencies for various account types.

- To trade in Kenyan shillings, ensure your trading account supports ‘KES’ as the base currency.

- To open a trading account, select ‘KES’ as your base currency. This will enable you to trade in Kenyan shillings.

Pros & Cons Of KES Trading Accounts

Pros

- A KES-denominated trading account can help you streamline your trading process by eliminating the need for frequent currency conversions. This saves you on transaction fees and mitigates the risk of adverse exchange rate fluctuations.

- A KES account provides access to investment opportunities within Kenya’s growing economy, particularly in sectors like finance, agriculture, and technology. Operating in local currency can offer greater convenience and potentially higher returns.

- A KES trading account lets you take advantage of local interest rates, which can be beneficial when managing liquidity or earning returns on deposits.

Cons

- A KES base account may present challenges when trading international securities denominated in non-KES currencies. Currency conversions could involve additional fees and expose you to foreign exchange risk.

- Trading international securities denominated in more widely traded currencies like USD or EUR can often benefit from higher liquidity. A KES base account may restrict your access to such high-liquidity assets, potentially impacting the execution of your trades, which is key for day traders.

- Managing a KES-based account, especially when dealing with cross-border investments, may entail specific tax rules or regulatory hurdles, depending on your country of residence.

FAQ

Which Is The Best Broker With A KES Account?

Following a thorough evaluation, DayTrading.com’s experts have carefully identified the best day trading platforms with KES accounts.

Explore our recommendations to discover the right platform for your trading endeavors.

How Much Does It Cost To Open A Trading Account Based In Kenyan Shillings?

Although the typical minimum deposit for KES trading is approximately USD 250 (around KES 32,160), some brokers offer more accessible options.

Exness is one such top broker, with a minimum deposit of USD 25 (around KES 3,215), making it an ideal choice if you are new to day trading or have a limited account balance.

Article Sources

- Central Bank of Kenya (CBK)

- East African Community (EAC)

- Common Market for Eastern and Southern Africa (COMESA)

- Nairobi Securities Exchange (NSE)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com