Brokers With CNY Accounts

The Chinese yuan (CNY), the main unit of China’s renminbi (RMB), is an attractive currency for trading accounts.

Supervised by the People’s Bank of China (PBoC), the country’s central bank, the CNY is often seen as a global trade currency due to China’s massive economy and role as a leading exporter.

Jump into DayTrading.com’s choice of the best brokers offering CNY trading accounts.

Best Brokers With CNY Accounts

Our latest tests point to these 2 brokers that support CNY accounts being the best:

Here is a short summary of why we think each broker belongs in this top list:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

Brokers With CNY Accounts Comparison

| Broker | CNY Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| JustMarkets | ✔ | $1 | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | CySEC, FSA |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Fast order executions from 0.01 seconds

- Trustworthy and regulated by CySEC

- Welcome bonus for new traders

Cons

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

How Did We Choose The Best Brokers?

We have compiled a list of top-tier CNY brokers following a comprehensive evaluation process:

- We leveraged our evolving database spanning hundreds of brokerages, ensuring we bring you up-to-date information.

- We eliminated any providers that did not meet our standards for offering CNY-denominated accounts.

- We used a scoring system that ranked each platform on 100+ quantitative metrics and qualitative evaluations.

What Is A CNY Account?

A CNY account is a trading account where deposits, withdrawals, and trades are processed in the Chinese yuan.

They open up a world of opportunities in the Chinese market, potentially diversifying your portfolio and capitalizing on the growth of the Chinese economy by providing direct market access, reducing transaction costs, hedging currency risk, and offering the potential for capital appreciation.

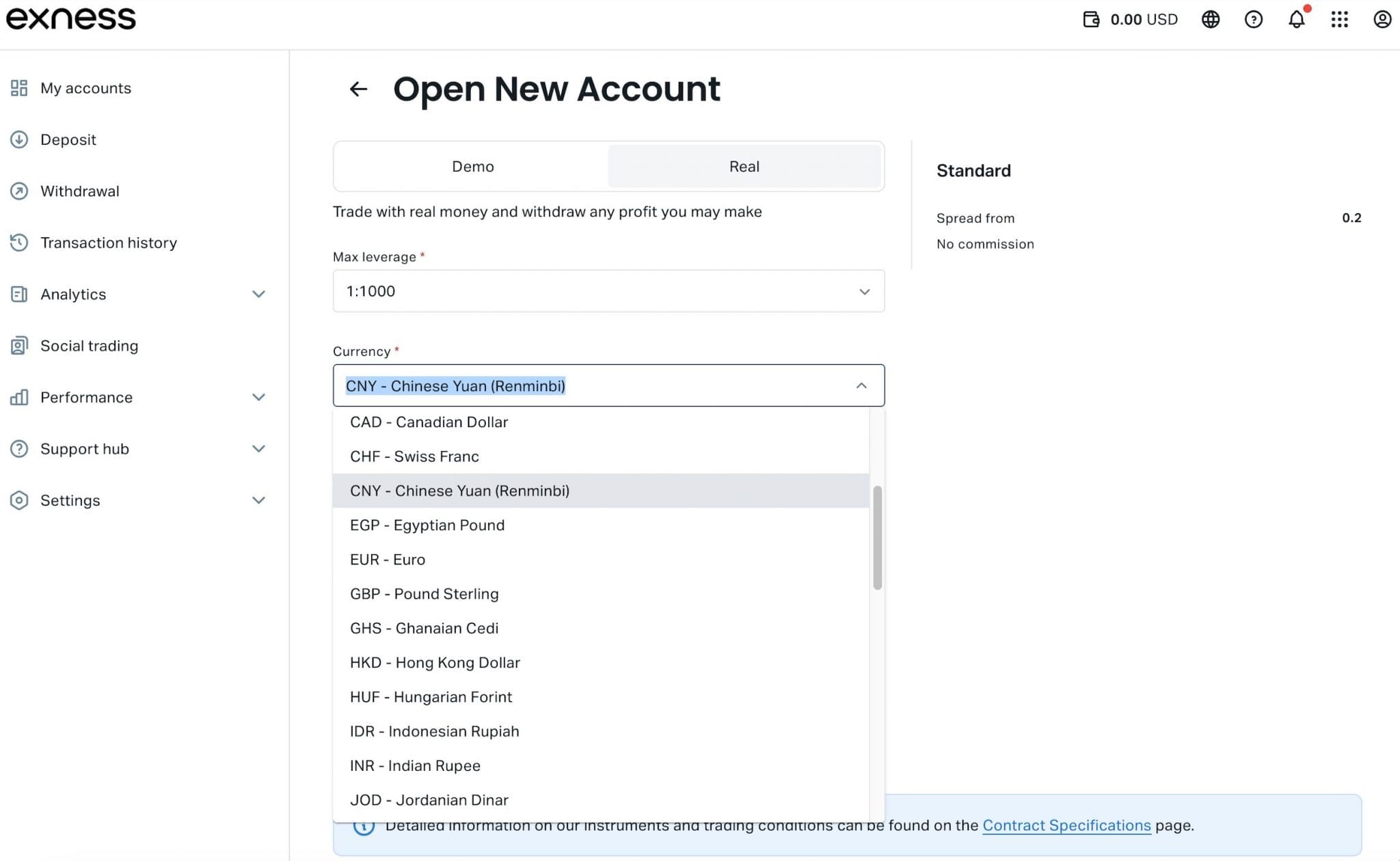

Once you have chosen a trading provider, opening a CNY account is extremely straightforward.To show you how it works, you can see below where I simply had to select ‘CNY’ from the list of available currencies while configuring my Exness account.

Do I Need A CNY Trading Account?

A CNY trading account could be right for you, if:

- You want a direct gateway to the vibrant Chinese stock market. With a CNY account, you can often seamlessly trade various Chinese financial instruments, such as stocks, commodities, and derivatives, on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE).

- You’re a Chinese trader who wants to mitigate the potential negative impact of currency fluctuations on your trading profits. You may be less exposed to the risk of exchange rate volatility. This can be particularly advantageous during periods of economic uncertainty or market volatility.

- You’re a Chinese resident looking for hassle-free tax reporting. CNY trading accounts streamline the accounting process and simplify tax obligations by eliminating the need to track and report foreign exchange gains or losses. This can save you time, effort, and potential costs associated with complex tax calculations.

How Can I Check If A Broker Offers An Account In Chinese Yuan?

You can typically check if a brokerage supports a CNY trading account by following these steps:

- Navigate to the ‘Account Options’ area of the broker’s website. Within this, you will often find a list of supported currencies for different account types. If you can’t, contact the firm’s customer support team.

- Verify that your trading account supports CNY as the base currency. This will ensure seamless transactions and accurate pricing in the Chinese currency.

- Choose CNY when configuring your account. Bear in mind that you may not be able to change your account currency once it’s selected, as is the case at Exness.

Pros & Cons Of CNY Trading Accounts

Pros

- By trading directly in CNY, you can avoid frequent conversions from other currencies, saving on exchange fees and reducing exposure to fluctuations in exchange rates.

- With a CNY account, you can often gain exposure to the Chinese economy. This adds a layer of geographic and currency diversification to your investment portfolio, which can improve risk management and returns.

- Payments and trades with Chinese entities are often settled faster, improving transaction efficiency and reducing delays in settlement times.

Cons

- Our investigations show the yuan is not as widely supported in trading accounts as major currencies like the USD, limiting its use for international transactions outside China.

- Certain yuan-denominated assets may have lower liquidity compared to more global markets, making it harder to quickly enter or exit positions without affecting prices, potentially impacting the returns of day trading strategies.

- Managing a CNY-based account, particularly in cross-border investments, can involve navigating complex tax regulations and potential regulatory hurdles.

FAQ

Which Is The Best Broker With A CNY Account?

Explore DayTrading.com’s pick of the best CNY trading platforms. These providers cater to the specific needs of traders in the dynamic Chinese market.

How Much Does It Cost To Open A Trading Account Based In Chinese Yuan?

While the typical minimum deposit for a CNY account is up to USD 250 (approximately CNY 1,775) from our investigations, some brokers offer more accessible options.

Exness, for instance, stands out with a starting deposit of only USD 10 (around CNY 70). This lower entry point makes Exness a particularly attractive choice for beginners or investors with limited capital.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com