Best Brokers With Bracket Orders

Brokers with bracket orders allow traders to lock in price targets and risk management when executing a trade by simultaneously setting stop loss and take profit orders.

A bracketed order essentially allows you to program the parameters of your trade in advance, making it a useful way to avoid micromanaging your exit point. It’s also a helpful way to maintain structure and discipline by pre-defining your price limits.

We’ve identified the best brokers that support bracket orders. We’ve personally verified that every platform offers some form of bracket order.

List Of Best Brokers With Bracket Orders

These platforms stand out from the crowd if you want bracket orders:

1. Interactive Brokers

Why We Picked It

Interactive Brokers distinguishes itself with its advanced order options, catering to active day traders, notably bracket orders which can be set up in its trading software in six straightforward steps.

You’ll need to: Enter a buy limit order > attach a bracket order > bracket order transmitted > market price falls, original limit buy order fills > market price rises, limit sell order fills > alternative scenario: market price falls, stop sell order fills.

What we love about Interactive Brokers is that while primarily geared towards advanced traders, it still offers the most complete learning resources relating to bracket orders we’ve seen, including an easy-to-follow video tutorial, helping newer traders get set up with this order type.

Minimum Deposit: $0

Regulators: FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

2. NinjaTrader

Why We Picked It

NinjaTrader is a specialist futures broker with its own trading software that supports bracket orders. Similar to Interactive Brokers, it only requires a few steps to set a bracket order.

You’ll need to: Select your custom ATM (combination of orders) strategy in the Super DOM window > set the stop loss and take profit levels in the Custom Strategy Parameters > click Market on either side to place an entry order > when it’s filled the bracket order will be submitted to the exchange and show in the SuperDOM display.

What we love about NinjaTrader is that it’s particularly strong if you want advanced charting, which many day traders do, sporting an above-average selection of 10+ chart types and hundreds of indicators, all available in an increasingly intuitive workspace.

On the downside, it trails Interactive Brokers in the trust department with IB boasting an extensive 40+ year track record and authorization from seven ‘green-tier’ regulators, with NinjaTrader operating for 20+ years and holding licenses from two ‘green-tier’ regulators.

Minimum Deposit: $0

Regulators: NFA, CFTC

3. Moomoo

Why We Picked It

Moomoo earns a podium finish for its user-friendly mobile trading app and bracket orders that can be set up in four straightforward steps.

You’ll need to: Navigate to a security’s Detailed Quotes page and press Trade > toggle to Pro and press Amount then Attached Order and then Bracket > Enter the parent order then input the Profit Taker Limit Price and Stop Loss Stop Price, and select Time in Force > press Buy or Sell and then confirm the Market Order Reminder and Order Detail.

What we love about Moomoo is that more than Interactive Brokers and NinjaTrader, it streamlines the trading experience with a beginner-friendly app, alongside straightforward pricing and thousands of Chinese, Hong Kong, Singaporean, Australian and US stocks, catering to aspiring traders.

Minimum Deposit: $0

Regulators: SEC, FINRA, MAS, ASIC, SFC

How Did We Choose The Best Bracket Order Brokers?

We hand-picked our list of the top trading platforms with bracket orders, all meeting certain criteria:

- Achieved an overall rating of at least 3.8/5 during our exhaustive review process.

- Support specific ‘bracket orders’ in their platforms and/or apps which we personally verified.

- Authorized by a ‘green-tier’ regulator and have at least 5 years in the online trading industry.

What Is A Bracket Order?

A bracket order is simply an order (usually a market order or limit order) that is placed at the same time as both a stop loss and take profit order.

The ‘bracket’ thus refers to the price limits at either side of the order, with the lower limit defined by the stop loss and the higher limit by the take profit.

It’s used to lock in your price targets and risk management at the time you set up your trade. It works well when combined with technical analysis to determine expected price ranges.

While traders have long used this technique to plan out trades, the term ‘bracket order’ refers to a specific order type in which the buy/sell, stop loss and take profit orders are all placed at the same time.

As a day trader, this saves you the effort and complication of setting these orders manually and also reduces the risk of a sudden price movement occurring before all the orders are placed.

Note that nowadays, you might find that brokers effectively support bracket orders without using this specific term, as they allow you to manually set risk management and take profit parameters while placing an order.

How Do I Place A Bracket Order?

To place a bracket order, you’ll first need an account with a broker that supports this order type.

Our list of the best brokers with bracket orders above only includes trustworthy firms with competitive pricing, excellent market access and trading tools, so it’s the ideal place to find one.

Once you’ve signed up with a suitable broker, navigate to the trading platform and find the instrument you want to trade.

You can then use charts and technical analysis to determine your entry point and the parameters of your brackets. This will depend on a range of factors such as:

- The timeframe of your trade

- The instrument’s volatility

- Your risk appetite and price target

Bracket orders can be used in many different strategies, and they are useful for day traders who trade ranges.

In the case of a buy order, the stop loss could be set just below a support level and the take profit near the resistance level, to prevent excessive losses if the price breaks below support while also locking in profits if the price moves upward.

To set a bracket order:

- Open the trading platform

- Select the instrument you wish to trade and open the order tab

- Select ‘bracket order’ if this order type exists

- Set your stop loss and take profit orders

- Press ‘confirm’ to place your order

Example

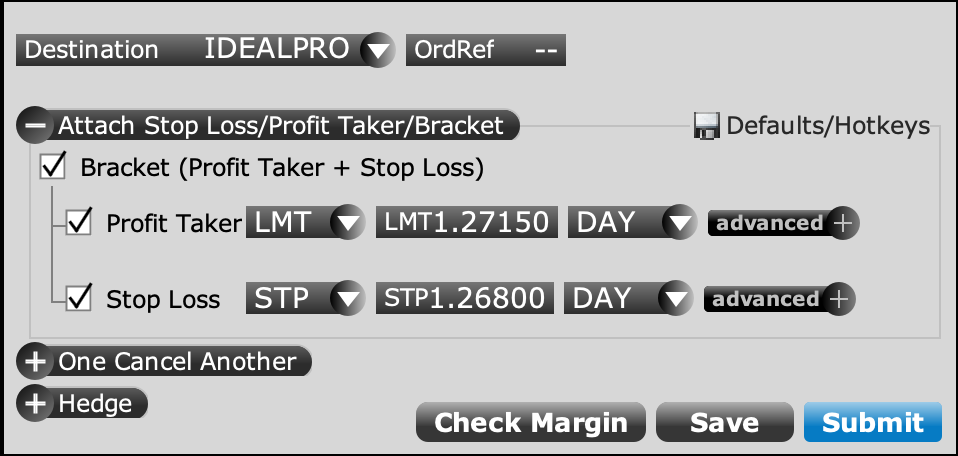

In the example below I found GBP to be on a downward trend against USD with the price ranging bouncing between lower highs and lower lows.

I decide to open a trade when the price reaches around 1.27000 as I expect it to retrace closer to previous highs around 1.27200 before continuing on its downward trend.

I open the trade at 1.26980, setting a stop loss at 1.26800 and a take profit order at 1.27150.

Later that day, the price retraces as expected, filling my take profit order and netting me a 17-pip profit.

Pros & Cons Of Bracket Orders

Pros

- Streamlines the trading process by defining the stop loss and take profit on execution, meaning that all orders go through at once.

- Setting the exit points when you first place the trade saves you from micromanaging your position and can help you stick to your trading plan.

- Bracket orders can help you trade in a more disciplined manner as you research the parameters of the trade in advance and don’t need to choose when you exit.

Cons

- Setting the ‘brackets’ in advance can cause you to miss out on opportunities if the price moves more than expected in the desired direction.

- Our investigations have found not all brokers support this type of order, reducing the pool of platforms you have to choose from.

- You need a good level of trading knowledge to identify suitable price levels for the orders.

FAQ

What Is A Bracket Order?

A bracket order is an order type in which stop loss and take profit orders are placed at the same time as the main order.

This sets a ‘bracket’ around the order that will limit losses or lock in profits depending on the price movement.

Which Is The Best Broker That Has Bracket Orders?

Interactive Brokers is the best broker with bracket orders following our investigations.

Its sophisticated trading software makes it straightforward to set a bracket order, while its superior pricing and investment offering coupled with fast and reliable order execution make it a stand-out choice for day traders.