Brokers With DKK Accounts

DKK accounts allow you to hold your trading portfolio in Danish krone. They offer a smooth trading experience for residents of Denmark, Greenland and the Faroe Islands looking to deposit and withdraw in their stable local currency.

See our pick of the best brokers with DKK accounts, personally tested by our expert analysts.

Best Brokers With DKK Accounts

These are the top 5 brokers that accept DKK accounts:

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- Markets.com - Established in 2008, Markets.com is a long-standing, multi-regulated broker with oversight from the CySEC and FSCA. It offers unique features to track hedge fund moves and insider trades, while providing stock signals to alert traders to market opportunities. Its choice of accounts (Classic to Professional) caters to all levels of active trader. 72.3% of retail accounts lose money.

- Saxo - Saxo Markets is a multi-award-winning trading brokerage, investment firm and regulated bank. With a huge 72,000+ trading instruments, plus investment products and managed portfolios, clients have no shortage of opportunities. The trusted brand also offers transparent pricing and top-tier regulatory protection from 10+ agencies including FINMA, FCA & ASIC.

Brokers With DKK Accounts Comparison

| Broker | DKK Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Zacks Trade | ✔ | $2500 | Stocks, ETFs, Cryptos, Options, Bonds | FINRA |

| Trade Nation | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | FCA, ASIC, FSCA, SCB, FSA |

| Markets.com | ✔ | $200 | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds | CySEC, FSCA, SVGFSA |

| Saxo | ✔ | - | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Customizable proprietary trading platform and mobile app

- Regulated by FINRA with access to the Securities Investor Protection Corporation

- Demo account

Cons

- High minimum requirement of $2,500

- No forex, commodities or futures trading

- Shortcomings regarding platform loading times and technical glitches

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Full range of investments via leveraged CFDs for long and short opportunities

- There is a low minimum deposit for beginners

- The trading firm offers tight spreads and a transparent pricing schedule

Cons

- Fewer legal protections with offshore entity

Markets.com

"Markets.com is best suited to retail investors who trade frequently but don’t want to calculate commissions, thanks to its spread-only pricing (EUR/USD around 1.3 pips). It especially appeals to short-term traders who value fast execution, flexible asset choice spanning 2,200+ instruments and proprietary tools like hedge fund confidence indices and insider trade alerts."

Christian Harris, Reviewer

Markets.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds |

| Regulator | CySEC, FSCA, SVGFSA |

| Platforms | Web Platform, MT4, MT5, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK, CHF, PLN, CZK |

Pros

- Markets.com’s Hedge Fund Confidence and Insider Trading tools pulls SEC filings into the dashboard within 24 hours of disclosure, helping to spot fund moves and C-suite buys before most retail newsfeeds updated.

- Switching between the proprietary web platform (great for alerts and quick analysis) and MT5 (strong for algorithmic EAs) was smooth in our tests; positions synced across desktop, web, and mobile without gaps or re-quotes.

- Markets.com provides commission-free trading on most assets with spreads starting from around 0.6 pips on major forex pairs, making it cost-effective for casual traders.

Cons

- The proprietary web platform felt a bit basic once we pushed into advanced charting with fewer drawing/indicator options than full TradingView or MetaTrader.

- During sign-up, we hit unclear account type explanations and got stuck in an email verification loop that locked us out for an hour - way less streamlined than other brokers we’ve tested.

- While CySEC and FSCA oversight is solid, the SVGFSA entity offers 1:500 leverage under a light-touch framework, meaning protections like compensation schemes and strict conduct rules lag behind the strictest regulatory standards.

Saxo

"Saxo is best for active traders and high-volume investors with an unrivalled selection of instruments alongside premium market research and fee rebates. The 190 currency pairs with tight spreads also make Saxo great for forex traders."

Tobias Robinson, Reviewer

Saxo Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs |

| Regulator | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB |

| Platforms | TradingView, ProRealTime |

| Minimum Trade | Vary by asset |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, SEK, DKK, CHF |

Pros

- Excellent educational resources including podcasts, webinars and expert-led video insights

- Low fees with premium account tiers

- High-level research hub with curated market research, plus unique insights with 'Outrageous Predictions'

Cons

- High funding requirements for the trading accounts

- Access to Level 2 pricing requires a subscription

- Clients from some jurisdictions not accepted including the US and Belgium

How Did We Choose The Best Brokers?

To find the best trading platforms that offer DKK accounts we:

- Searched our directory of 140 online trading platforms

- Pinpointed all those that offer accounts denominated in the Danish krone

- Rated them using 100+ data points and findings from our hands-on tests

What Is A DKK Account?

A DKK account is a trading account where transactions and trades are handled in Danish krone.

This means that investments you hold and trade, including deposits and withdrawals, are in DKK.

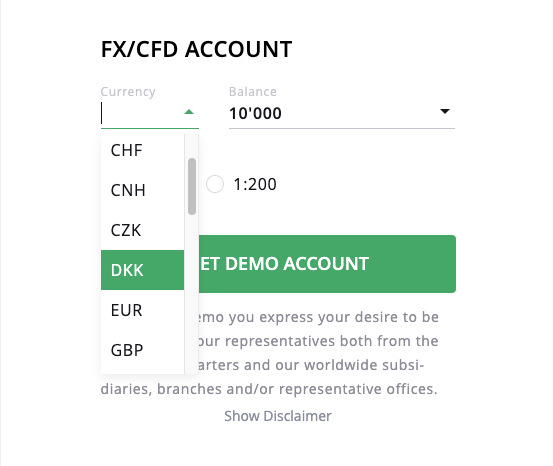

Below is an example of where I opened an account with Dukascopy:

Do I Need A DKK Trading Account?

A DKK account might work for you if:

- You live in Denmark, Greenland or Faroe Islands and hold money in DKK as it’s more convenient to hold an account in the same currency.

- You often trade currency pairs that include the DKK, including USD/DKK, EUR/DKK and GBP/DKK because there’s a smaller risk of conversion charges.

- You trade Danish or Nordic stocks listed on the Nasdaq Nordic as managing trades in a regional currency is often faster and cheaper.

How Can I Check If A Broker Offers An Account In Danish Krone?

You can follow these simple steps, which we also took to ensure our recommended platforms offer DKK accounts:

- Head to the ‘account types’ page on the broker’s website to find the available base currencies.

- Verify that DKK is listed as a supported currency in Denmark, Greenland or Faroe Islands.

- Register for an account and choose DKK as your base currency (though you may be required to choose your base currency later).

Pros & Cons of DKK Trading Accounts

Pros

- Our evaluations have found that brokers with DKK accounts often provide access to regional markets, offering a more tailored service to Danish traders. IG, for example, offers popular Danish shares such as Danske Bank, as well as DKK currency pairs like USD/DKK and EUR/DKK.

- DKK trading accounts can reduce conversion fees if dealing in krone, which is a notable benefit for active traders. XM, for example, charges a 0.5% fee for currency conversions when transferring between DKK and the account base.

- Since the Danish krone is still firmly pegged to the euro, traders can benefit from relatively small currency fluctuations with limited risk.

Cons

- Despite becoming increasingly popular, DKK accounts are still relatively uncommon (less than 10% of brokers we’ve evaluated), so you won’t have the widest choice compared to brokers with USD accounts, for instance, which are offered by virtually every trading platform.

- You may still face conversion fees when trading popular markets using a DKK account. Forex.com charges up to 0.5% if you want to trade US stocks, for instance, using a DKK account.

FAQ

Which Is The Best Broker With A DKK Trading Account?

See our list of the top-rated brokers with DKK accounts, thoroughly tested by our experts.

How Much Does It Cost To Open A Trading Account Based In Danish Krone?

Our tests have shown you’ll need up to 250 USD (around 1,747 DKK) to open a live trading account. That said, we’ve seen many top brands offering much lower.

For example, IG stands out for its beginner-friendly DKK account requiring no minimum deposit.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com