Blueberry Markets Review 2024

Awards

- Finalist - Best Online Customer Service 2020 & 2021 - Finder Awards

Pros

- Free demo account for prospective users

- Multiple payment methods offered making the broker accessible to global traders

- MetaTrader 4 integration through desktop software, web trader and mobile app

Cons

- Narrow selection of CFDs in some asset classes

- Limited bonuses for new traders

- No proprietary trading app

Blueberry Markets Review

Blueberry Markets is a global forex and CFD broker headquartered in Sydney, Australia. It offers 300+ instruments including currency pairs, shares, indices, and commodities. A $100 minimum deposit and copy trading tool make the broker popular with beginners, while the ultra-low latency VPS appeals to experienced traders.

This review of Blueberry Markets unpacks live account options, forex spreads, MetaTrader 4 features, leverage, and more. Find out if our experts recommend trading with Blueberry Markets.

Company Details

Blueberry Markets was established in 2016, by owner Dean Hyde, a former Axi executive.

Since its incorporation, Blueberry Markets has served over 50,000 clients and has established itself as a popular trading broker in the Australian financial market. With deep liquidity, ultra-fast execution speeds and zero-pip spreads, the broker provides a competitive trading environment for a range of strategies.

Blueberry Markets holds licenses with the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

Trading Platforms

Blueberry Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The award-winning terminals will be familiar to experienced traders, providing a range of custom analysis tools, instant and pending orders, plus support for automated trading.

MT4 and MT5 are available for free download to Mac, Linux and Windows devices. Alternatively, there is a web-based terminal with no plug-ins required. Mobile-compatible apps are also available to download from the relevant app store.

MetaTrader 4

- VPS hosting

- Nine timeframes

- One-click trading

- Complete trading history

- 30 built-in technical indicators

- Customizable charts and drawing tools

- Four pending order types and trailing stops

- Direct access to Expert Advisors (EAs) or build your own trading bots

MetaTrader 5

- 21 timeframes

- 44 analytical objects

- One-click order execution

- Market search and grouping

- Thousands of trading plug-ins

- Integrated economic calendar

- 38 built-in technical indicators

- Automated trading capabilities

- Six pending order types and trailing stops

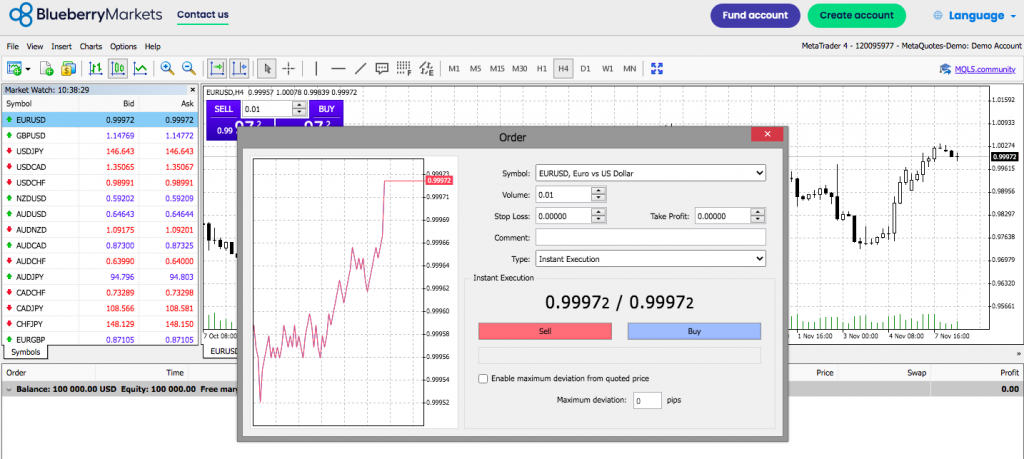

How To Place A Trade

Once your Blueberry Markets account has been verified, you can begin trading. You will need to fund your profile with a minimum deposit of $100 or equivalent currency.

Opening a new position is similar between MT4 and MT5. To make a trade:

- Download the MT4/MT5 platform or login via the webtrader

- Choose the asset/market you wish to speculate on using the drop-down list or search bar

- Click on ‘new order’ which is located second from the left in the top navigation bar. A ’new order’ screen will then pop out. Alternatively, execute a trade directly from charts by enabling one-click trading

- Enter the order details including order type (pending or instant), volume/size, and any risk management parameters (take profit or stop loss)

- Select ’buy’ or ’sell’

- Confirm the order

Assets & Markets

Blueberry Markets offers 300+ instruments:

- Invest in commodity CFDs including Gold, Silver, and Oil

- Trade 30+ of the world’s largest stock indices including the ASX, FTSE, NASDAQ and S&P

- Trade 200+ share CFDs on some of the world’s largest companies including Netflix, Tesla, and Amazon

- Take crypto CFD positions across five popular digital coins including Bitcoin, Litecoin, and Ethereum

- Speculate on 40+ majors and currency cross pairs including EUR/USD, GBP/USD, and EUR/JPY (0.01 lots – 40 lots on all forex pairs)

All orders are executed at market price (market execution) and in GTC (good till canceled) mode.

Note, Blueberry Markets does not offer spread betting, futures, ETFs, options, or bonds.

Spreads & Fees

Our experts found that fees vary depending on the account type and instrument.

The Standard Account follows a commission-free model with costs built into the spread from 1 pip. When we used Blueberry Markets, we were offered a live spread of 1 pip on the EUR/USD and 1.1 pips on the GBP/USD.

The Direct Account offers raw spreads from 0.0 pips, with a commission fee of $7 per standard lot per turn. The EUR/USD is offered at an average of 0.1 pips and while the GBP/USD is offered at an average of 0.7 pips.

Both profiles require a minimum deposit of $100 or equivalent. A useful fee and profit calculator is also available on the broker’s website.

Blueberry Markets also charges a AUD 20 monthly fee to access ASX200 single-stocks on the MT5 platform, plus a 0.1% commission on the value traded. This cost will be waived if an investor’s commission charges exceed $20.

There are no inactivity fees applied to dormant accounts, though profiles are archived when the balance is less than 50 units of the base currency and no trades have been executed for over one month.

Swap rates apply for positions held overnight.

Leverage

Leverage options vary depending on the entity your account is registered with.

Under the VFSC-regulated entity, day traders can access leverage of up to 1:500. Applying the highest leverage would mean a $200 deposit will provide traders with $100,000 in purchasing power. A sensible approach to risk management is needed when trading with leverage..

Under the ASIC-regulated entity, investors can access leverage of up to 1:30. Margin trading restrictions also include maximum leverage of 1:20 for minor currency pairs and indices, and 1:2 for crypto assets. This is in line with the ASIC Product Intervention, which came into practice in March 2021.

All Blueberry Markets accounts have a stop-out level of 50%.

Mobile App Review

When we used Blueberry Markets, we were disappointed to see no proprietary mobile app. This is a downside vs competitors such as Oanda and FP Markets.

Nonetheless, the MT4 and MT5 mobile applications offer reliable trading services found on the desktop platforms. Users can open accounts within five minutes, deposit and withdraw funds, conduct technical and fundamental analysis, and manage trading positions. The apps are also optimized for smaller screens so you can manage your account and trade on the go.

You can download the MT4 and MT5 apps to iOS, Android, and Huawei devices from the relevant app store.

Payment Methods

Deposits

Traders can fund live accounts with various payment methods. The broker does not charge any fees, however, third-party charges may apply.

Funding options include:

- POLi – AUD only, instant processing time, no fees

- BPAY – AUD only, instant processing time, no fees

- Skrill – EUR or USD, instant processing time, no fees

- Dragonpay – USD only, instant processing time, no fees

- PayPal – AUD, EUR, GBP, NZD, SGD, USD, instant processing time, third-party fees apply

- Visa/Mastercard credit/debit cards – all currencies accepted, instant processing time, no fees

- BTC and USDT – USD only, 30-minute processing time though dependant on blockchain confirmation, third-party fees apply

- Neteller – USD only, one working day processing time (Australia) or two business days (international), Blueberry Markets may reimburse fees

- Bank Wire Transfer – all currencies accepted, one working day processing time (Australia) or two business days processing time (international), Blueberry Markets may reimburse fees

Note, payment method availability varies depending on your location.

Withdrawals

Traders must use the original deposit method to make a withdrawal. There are no minimum or maximum withdrawal limits.

Blueberry Markets processes all withdrawals within 24 hours if requests are made during working hours, Monday to Friday. The time it takes to receive funds back to the original account will vary. Typical processing times are between one and three business days, except for international bank wire transfers, which can take up to seven working days.

The broker does not charge any withdrawal fees, though third-party charges may apply. Skrill, for example, usually imposes a charge between 1% and 3%.

Blueberry Markets Demo Account

Access a free practice profile through the Blueberry Markets demo account, similar vs Pepperstone and IC Markets.

Retail traders can use $100,000 in virtual funds on the MT4 and MT5 platforms, alongside the full catalog of trading insights and learning materials. Build and test your strategies with real-time pricing before executing trades in the live environment. You can also experiment with leverage.

Deals & Promotions

We were not offered any joining bonuses or promo codes when we registered with Blueberry Markets.

However, a friends and family referral code is available to global clients. Traders benefit from $100 in account credit. The following requirements must be met to receive the bonus:

- A $1000 minimum deposit

- Trade at least 1 lot within 60 days

Regulation & Licensing

For Australian clients, Blueberry Markets is an authorized representative of Blueberry Prime Partners Pty Ltd (ABN 57 140 275 869) (AFSL number 364411) and is authorized to give general advice and deal on behalf of another in derivatives and foreign exchange contracts. Blueberry Markets Pty Ltd introduces clients to ACY Securities Pty Ltd trading as Blueberry Markets Group (ABN 80 150 565 781) (AFSL number 403863).

For all other clients, Blueberry Markets (V) Ltd is regulated by Vanuatu Financial Services Commission (Company number: 700697) holding License Classes A, B and C under the Financial Dealers Licensing Act. Unfortunately, this is not a well-regarded regulator, limiting the level of investor protection available.

All client funds are held separately from the firm’s capital in segregated trust accounts. Negative balance protection is also in place.

Additional Features

Our experts were pleased to see a range of additional tools and resources available to account holders. This includes a weekly newsletter, market news, and analysis articles with price projection outlooks and investment trends. Useful tools, such as an economic calendar and profit calculator, are also available to day traders.

There is also a comprehensive educational trading program, organized into experience levels; beginner, intermediate and advanced. The guides can help users learn the basics of investing, all the way to mastering advanced strategies. Integrated YouTube video content is provided alongside the courses.

DupliTrade

DupliTrade is a leading copy trading tool. The platform allows day traders to follow the signals and trades of experienced investors. You can review and choose master traders based on their performance history and trading experience. Select, modify, or remove strategies in a few clicks.

Note, you must fund a Blueberry Markets live account with at least $2000 to gain access to DupliTrade.

Forex VPS

Execute trades in 1-3 ms or less using Blueberry Market’s free low-latency forex VPS. MetaTrader systems can run for 24 hours without disruptions and downtime. Trading systems are hosted on data centres located near Blueberry’s main servers.

Live Accounts

Blueberry Markets offers two account types. Both profiles provide access to all trading instruments, have a minimum deposit requirement of $100, and a minimum trade size of 0.01 lots.

The main difference between the two accounts is the pricing model. The Standard Account offers commission-free trading with floating spreads, whereas the Direct Account provides raw spreads with a fixed commission per trade.

Seven account denominations are accepted including AUD, GBP, USD, EUR, and CAD.

A Professional/Premium Account is also available for high-volume traders. Users that meet a 10m USD notional trading volume per month benefit from:

- Access to a dedicated sales manager

- Tailored pricing, spreads and commissions

- A range of expert resources and exclusive insights

- Priority withdrawals, processed within a few hours

- Priority 24/7 customer support via live chat, phone, and email

It takes less than five minutes to register for a live Blueberry Markets account. Note, ID verification is required.

Blueberry Markets Trading Hours

Trading hours vary by instrument. Forex market opening hours are 24 hours per day between Sunday to Friday. Crypto, on the other hand, can be traded 24 hours per day, 365 days a year.

The Blueberry Markets server location is based in New York. The platform server time is set at GMT+2 when New York is observing Eastern Standard Time and changed to GMT+3 when New York is observing Daylight Savings Time.

A full calendar of market hours, events, and key expiry dates is available on the broker’s website.

Customer Support

Blueberry Markets can be contacted 24/7 through:

- Live Chat – Bottom right of each webpage

- Phone Number – +61279083946 or +61280397480

- Email Address – Australia support@blueberrymarkets.com, International global@blueberrymarkets.com

Alternatively, a comprehensive FAQ section is available on the broker’s official website, with details including client portal login support, swap rates, account funding methods, and more.

When we tested Blueberry Markets, the live chat service offered the fastest response times, with support provided in under a minute.

Safety & Security

Blueberry Markets is a relatively secure brokerage. Funds are handled with full data transmission security and held in segregated accounts. The MT4 and MT5 platforms are also secure, using industry-standard data encryption with all transmissions made via SSL. Both trading platforms also offer two-factor authentication (2FA), available in the login portal.

Blueberry Markets Verdict

When we used Blueberry Markets, we were impressed with the account opening process which took less than five minutes. Our experts also liked the copy trading platform, the MT4 and MT5 downloads, plus the free forex VPS. Overall, Blueberry Markets is a good all-round broker that will meet the needs of beginner traders and seasoned investors.

FAQs

Is Blueberry Markets Safe?

Blueberry Markets is a legitimate online brokerage with negative balance protection and segregated client funds. The broker holds licenses with the ASIC and VFSC and offers 2FA for client logins. Customer reviews are also generally positive.

That said, no brokerage is ever fully safe. Trading with any broker brings with it the risk you could lose all your money.

Is Blueberry Markets A Good Broker?

Blueberry Markets offers a competitive trading environment with 300+ assets, 1:500 leverage, and 24/7 customer support. The fee structure is also competitive, with tight spreads and low commissions. In summary, Blueberry Markets is a reliable and well-rounded trading broker.

Is Blueberry Markets Regulated?

Blueberry Markets is regulated and authorized by the Australian Securities & Investment Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

Is Blueberry Markets An ECN Broker?

Yes – Blueberry Markets is an ECN broker. Retail traders can access raw spreads with the Direct Account, along with a commission of $7 per standard lot per turn.

Top 3 Alternatives to Blueberry Markets

Compare Blueberry Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

Blueberry Markets Comparison Table

| Blueberry Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 3 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | Yes | Yes | Yes | No |

| Platforms | MT4, MT5, DupliTrade | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (ASIC), 1:500 (VFSC) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 13 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Blueberry Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Blueberry Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

Blueberry Markets vs Other Brokers

Compare Blueberry Markets with any other broker by selecting the other broker below.

The most popular Blueberry Markets comparisons:

Customer Reviews

There are no customer reviews of Blueberry Markets yet, will you be the first to help fellow traders decide if they should trade with Blueberry Markets or not?