Alternatives To Trading Central

Trading Central is a popular market research and analytics tool, but there are some excellent alternatives available. This review ranks the best alternatives to Trading Central, comparing everything from features to user interface and accessibility.

In our list of top Trading Central alternatives, three providers stand out:

- Seeking Alpha – A highly rated provider with excellent data feeds, tools and strong customer service. The firm also offers instant alerts, portfolio-building tools, and stock ideas.

- TradingView – A beginner-friendly trading platform that offers advanced charting and an active social trading community. TradingView is also integrated with many leading brokers.

- Statmetrics – A mobile app with market data and news, charting and technical analysis, portfolio backtesting capabilities, and risk-return metrics.

Seeking Alpha

Seeking Alpha is one of the leading alternatives to Trading Central. The research platform for retail and professional traders offers similar features to Trading Central.

The firm was founded in 2004 by former Wall Street analyst David Jackson and has since received the “Best of the Web designation” by Forbes, reaching over 10 million registered users and over 17 million unique viewers every month.

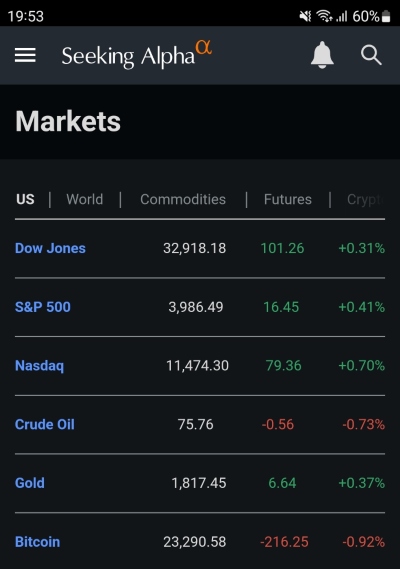

Markets

Seeking Alpha provides analysis of a huge range of financial products, including popular US stocks for dividend investing and ETFs.

Some 280 unique articles are published on Seeking Alpha every day, covering a wide range of assets. The site also provides data on thousands of financial assets, including price data, earnings, financials, valuation, growth statistics, momentum, capital structure, dividend information, and ownership statistics.

While the total number of assets covered is not disclosed, Seeking Alpha does cover all major stocks, including US, UK, European and Japanese markets, as well as commodities and cryptocurrency data.

Analysis

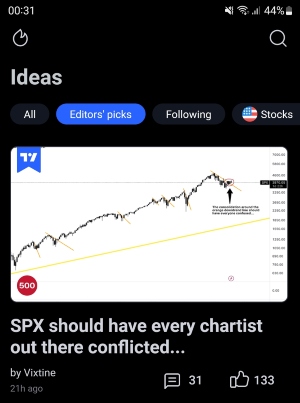

Unlike Trading Central, analysis articles can be provided by any accepted contributor. This allows for a wide range of analyses to be published every day covering a wide range of topics, though quality does not always live up to professional standards. This is mitigated somewhat by the site highlighting the higher quality pieces as editor’s picks.

By subscribing to the paid Seeking Alpha Premium membership, you gain unlimited access to premium content, including over 1 million investing ideas, earnings call transcripts, author and article performance metrics, quant ratings, ten years of downloadable financial statements and other enhanced features, including a reduction in the number of advertisements.

The highest-tier Seeking Alpha Pro membership gives hand-picked, high-conviction investment theses, idea screeners using a pro filtering engine, exclusive short ideas and newsletters, no ads and VIP customer service.

Technical Tools

Seeking Alpha provides fewer built-in technical indicators than Trading Central, with a greater emphasis on financial statistics rather than technical analysis.

The main technical tool offered is simple charts. Traders can look at the price chart of an asset up to 5 years in the past, or 10 with a premium account.

A long list of other statistics and data can be added to an asset’s charts, including total return and revenue, EBITDA, net income, gross profit margin, enterprise value, and more.

Platform Compatibility

Seeking Alpha is a web-based platform that is incompatible with regular trading platforms. Unlike Trading Central, you will not be able to add Seeking Alpha’s data stream or news feeds to trading platforms like MetaTrader 4/5. However, you can link your portfolio to the Seeking Alpha account, allowing you to easily find analysis for your investments.

Seeking Alpha does have a bespoke mobile platform allowing you to read analyses and track asset data on the go. From the mobile app, you can view your portfolios, read long and short ideas, read news articles, watch and chart markets, and access educational resources.

User Interface

Seeking Alpha has an intuitive design with a good balance between information per page and ease of use. The design is clean with key information on the homepage and easy navigation. The mobile app is similarly designed.

On the downside, the interface is not as intuitive as Trading Central, which offers a slick dashboard and simplified menus.

Cost

Seeking Alpha’s basic functions are free to access. Traders can look at charting data, read news articles and access the education area. However, free users are limited to 5 articles per month.

The Premium subscription gives unlimited access to articles for $239 per year for new subscribers. Otherwise, it costs $19.99 per month billed annually, or $29.99 per month billed monthly.

The Pro subscription comes with the most features and is priced at $499 per year.

This pricing model can make Seeking Alpha considerably more expensive than Trading Central, which is often provided for free through a broker. However, Seeking Alpha offers a better range of stock market insights, alerts and screeners.

TradingView

TradingView is an established trading, charting and social investing platform. It was established in 2011 and is used by more than 30 million traders globally. The social investment site has led to millions of trading ideas and community research pieces being shared.

As a highly rated platform, it also provides a suite of technical analysis tools for traders to use. Moreover, some brokers such as eToro incorporate TradingView into their own platforms.

Markets

TradingView is a platform that covers thousands of assets in all popular global markets, including those in the US, UK, Japan and Europe. Traders can learn about and trade stocks, crypto, forex, indices, futures and bonds through TradingView.

Analysis

The analysis on TradingView is mostly provided by community members. The platform works as a social network for traders, allowing for posts about sentiment, analysis of stocks and many more trading topics to be posted by any member. These posts can be delivered through short tweet-like posts called “minds”, in public chats, private chats, and through live streams. This is quite different from the style of content delivered by Trading Central.

There is also an economic calendar available, allowing traders to keep up with upcoming events.

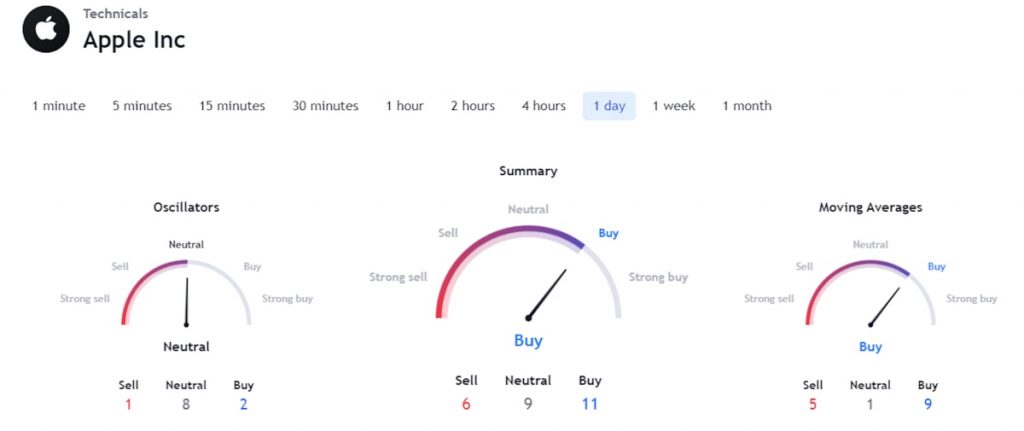

Technical Tools

TradingView provides a huge range of technical analysis tools, indicators and signals, as well as an overall compiled signal feature. TradingView users can apply 10 different timeframes to their charts, ranging from 1 minute to 1 month.

Analysis is given through 11 oscillators and 15 moving average indicators; 7 different pivots in 5 different styles can also be calculated. Indicators include the exponential moving average (20 period), relative strength index (13), MACD level, Ichimoku baseline, and classic and Fibonacci pivots.

Signals are given purely from the technical analysis performed on the data, unlike Trading Central which employs more complicated means (e.g. AI prediction and professional curation).

TradingView also provides asset ratings based on analyst reports. These include predicted price forecasts, buy/sell signals, EPS and revenue estimates.

Platform Compatibility

TradingView itself is a trading platform, and so has both trading and research capabilities built in. This makes it one of the best alternatives to Trading Central for retail investors.

While TradingView cannot be integrated into other dedicated trading platforms, it does provide API widgets to brokers, allowing them to integrate TradingView into their sites in a similar way to Trading Central’s service.

TradingView offers a mobile app that is available on the Apple iOS App Store and Android Google Play Store. It is great for those looking to keep up to date with trade ideas and global financial news. The app has a user-friendly, sleek design and gives access to charts, social trading and technical analysis tools.

User Interface

TradingView’s design is easy to navigate and use and is viewed by many as more intuitive than Trading Central while still providing powerful tools.

While TradingView is available on internet browsers, it also has a desktop application. This can be downloaded for Windows, macOS and Linux directly from the TradingView website. It comes with native multi-monitor support, allowing for flexibility when researching, analysing and trading.

Cost

TradingView is a freemium service, an alternative model to Trading Central.

The free, basic plan limits charting capabilities, allowing only 1 chart per tab, with no custom intervals or range bars, and no option to export chart data. Indicators per chart are limited to 3, and only a single custom indicator template may be saved. Auto chart patterns are not included, and the data flow speed is limited. Basic plan users are not permitted to publish their own trading ideas or to access video ideas. They also lack multi-monitor support and are not able to access TradingView’s customer support.

The other plans are the Pro, Pro+ and Premium plans, which each offer more features at progressively higher price levels. All of the paid levels offer increased data flow, better research and analysis options, greater freedom with using technical indicators, and more.

Subscription to the pro plan costs $14.95 per month, while the pro+ plan comes in at $29.95 per month and the premium plan costs $59.95 per month. Annual payments are cheaper per month at $12.95, $24.95 and $49.95 respectively.

Statmetrics

Launched in 2010, Statmetrics is financial research software and one of the popular Trading Central alternatives.

Compatible with Android devices, the solution offers investment research and in-depth market data to help investors make informed trading decisions.

Users can assess investment portfolios or drill down into specific assets. The application also offers statistical visualization tools and risk metrics.

Markets

Statmetrics offers insights into various global markets, including US, European, and Asian equities. This includes stocks listed on the NYSE and NASDAQ and big names like Apple and Microsoft. Users can also see data on currencies and commodities.

Investors can see the latest price data, highs and lows, plus overlay information from their existing brokerage accounts and trading platform.

Analysis

Analytical tools from Statmetrics allow users to perform in-depth technical analysis and assess the fundamental and quantitative features of potential trades. Users can measure security performance against defined benchmarks with risk and sector insights.

Importantly, traders can consolidate their investment history and assess performance to support future investment decisions. Statmetrics allows users to make transaction-based performance calculations via money-weighted methods (MWRR).

Statmetrics offers additional performance analytics beyond Trading Central with advanced hypothesis testing, correlation and regression analysis, and more.

On the downside, the tools are best suited to advanced investors with a good understanding of financial markets and trading terminology.

Platform Compatibility

Compared to Trading Central, Statmetrics is only available on Android devices. The app can be downloaded from Google Play, the Amazon Appstore, or directly from the firm’s website.

This does limit its usability compared to Trading Central, which is also available on web browsers and desktop platforms via broker integration.

User Interface

The user interface of Statmetrics is clean and relatively intuitive. The app uses a light and dark mode with clean charts and a straightforward menu at the top of the application. Widgets are navigation are also user-friendly.

On the downside, Statmetrics isn’t as slick as the Trading Central solution, which has a more modern feel.

Cost

Statmetrics offers a free trial and service to users, making it a popular alternative to Trading Central.

What Is Trading Central?

Trading Central is a one-stop-shop for investment research, news and analysis that provides broker API solutions to help traders analyse markets and plan trades. The popular features on offer include expert market analysis, advanced charting, strategy builders and asset ratings. This award-winning firm also provides automated analytics, 24/7 expert advisors, real-time economic updates and more.

Trading Central is partnered with brokers in over 50 countries, including well-known firms such as eToro. The API solutions differ between brokers, but all iterations receive generally positive feedback from traders.

However, the firm does not offer its services directly to retail traders, only partnering with online brokers. Fortunately, traders who wish to access similar services but are not signed up with a Trading Central broker have some excellent alternatives to choose from.

Final Word On Trading Central Alternatives

While a great resource, there are some excellent alternatives to Trading Central, from the detailed, market-based analysis of Statmetrics, to the social and technical analysis and charting tools provided by TradingView or Seeking Alpha’s wealth of financial data. All of these firms allow you to try out their resources for free, with optional premium upgrades, so give them a go to find the one that suits you best.

FAQ

What Is The Best Alternative To Trading Central?

This depends on your needs and the trading system you use; If you are looking for analysis articles on a wide range of assets, then Seeking Alpha may be your best bet. If you are looking for analysis and technical tools integrated into a platform, then TradingView would be preferable. The intuitive design and financial focus of Seeking Alpha may suit stock traders who favor fundamental analysis.

Are There Any Free Trading Central Alternatives?

In our review, we have detailed three alternatives to Trading Central that all provide their services for free. TradingView has the greatest free offerings of those we have reviewed, only locking some professional insights and ad removal features behind paywalls. The majority of the site’s research and analysis capabilities are available with a free account.

Which Trading Central Alternatives Provide The Most Technical Analysis Tools?

TradingView offers the most comprehensive suite of technical indicator tools, not only producing signals but also allowing traders to build custom indicators on charts. Although most of the capabilities are unlocked through the premium account offerings, with the free account more limited.

How Can I Try Alternatives To Trading Central?

There is nothing to stop you from combining Trading Central with one or more of its alternatives, such as Seeking Alpha or TradingView, especially since access to Trading Central is often offered free of charge by supporting brokers.

One of the Trading Central alternatives may have a feature that fills the gap in Trading Central; for example, Seeking Alpha’s fundamental data could be a good supplement to your usual stock analysis.

Which Trading Central Alternative Makes The Highest Profits?

Unfortunately, there are no tools or products on the financial markets that are guaranteed to make you money, and you should steer clear of any that claim they can. However, Trading Central alternatives do offer services that can help investors plan and execute profitable trades if they do careful research and make disciplined trading decisions. Among our top alternatives to Trading Central are Seeking Alpha and TradingView.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com