AdroFx Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best STP/ECN Broker 2022 - Forex Awards

- Most Innovative Broker 2022 - Forex Awards

- Fastest Growing Forex Broker Europe 2022 - International Business Magazine

Pros

- Quick, responsive customer support from knowledgeable staff who provide personalized responses during testing

- 60+ currency pairs is a great range that beats out many rivals and provides plenty of opportunity for forex traders

- Strong automated trading support with VPS access on MT4 offered free for Pro account holders and affordable access from $10 for other accounts

Cons

- Mediocre selection of research tools with limited insights into upcoming events that could help beginners identify opportunities, especially compared to alternatives like eToro

- Low trust score with weak regulatory oversight and short track record compared to established day trading brokers like IG

- Expensive withdrawals for most payment methods, including a 1.9% charge on cards, which can be avoided at most top day trading brokers

AdroFx Review

In this AdroFx review, we assess the broker in every important department for day traders. We unpack the ratings we’ve given AdroFx following our hands-on tests, alongside the key pros and cons, plus comparisons with suitable alternatives.

Regulation & Trust

AdroFx gets a low trust score because it’s based offshore and registered with weak regulators:

- Vanuatu Financial Services Commission (VFSC)

- St Vincent and the Grenadines Financial Services Authority (FSA)

- Business Services of Saint Lucia Act (BSSLA)

This means you may not get robust investor protections. For example, you may not be entitled to compensation if the broker’s business fails, something that’s normally provided in heavily regulated jurisdictions like Europe, Australia and the UK.

Additionally, having only been established in 2018, AdroFx has not been around as long as many of our most trusted brokers. IG, for example, has over 50 years in the industry and a great reputation.

On the plus side, AdroFx does implement some important protections. Negative balance protection ensures you can’t lose more funds than are in your account, and with clients’ funds segregated from business funds, there’s some protection against mismanagement.

That said, these measures should be the bare minimum for reliable brokers, so they don’t significantly boost our trust score.

If you want a highly trusted broker, we recommend one of the alternatives below.

Trusted Alternatives To AdroFx

Accounts & Banking

Live Accounts

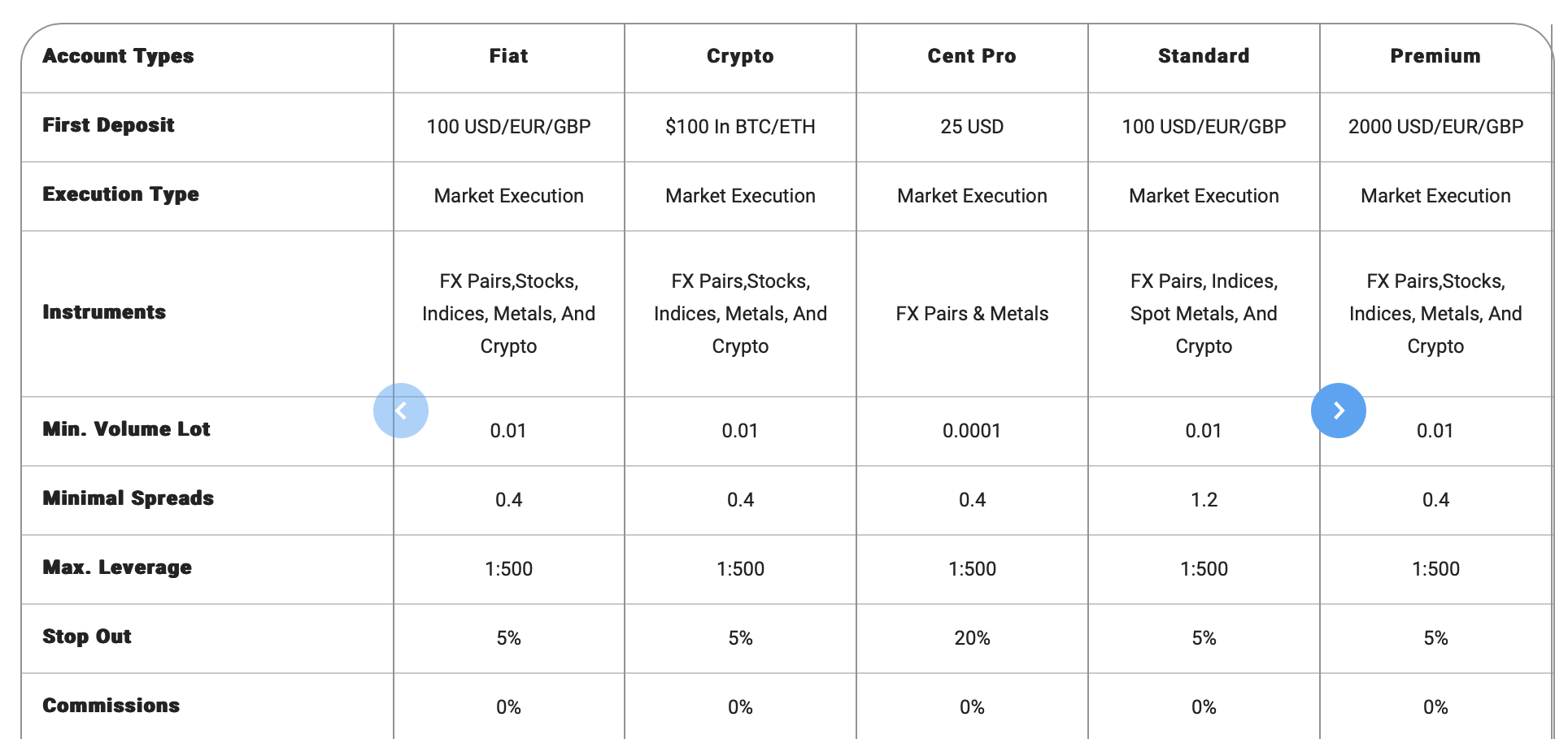

AdroFx has a range of accounts that will suit many traders with different styles and budgets, and there are some notable positives including micro accounts for trades from 0.0001 lots and premium accounts with spreads from 0.4 pips.

The downside is that with eight accounts to choose from, I found the system needlessly complex compared to brokers like Pepperstone which pack similar features into just two or three accounts.

AdroFx’s accounts are split into three that use the Allpips platform and five that use MetaTrader 4. The MT4 platform doesn’t support copy trading but does have Expert Advisors (EAs), which aren’t available on Allpips accounts.

The lowest minimum deposit comes at $25 each for Allpips Cent Pro and MT4 Micro accounts. The Fiat and Crypto Allpips accounts have a $100 minimum deposit in USD/EUR/GBP or BTC/ETH, respectively. The Standard and Micro Pro MT4 accounts’ minimum deposit also comes in at $100 each.

The higher minimums for the Premium ($2000) and Pro ($10,000) MT4 accounts buy you much tighter spreads from 0.4 pips. Customer service also informed me that Pro accounts get a free VPS and priority execution.

AdroFx’s ECN/STP execution is a model we like because it removes the conflict of interest that can be present in market maker brokers that act as counterparties to clients’ trades.

This is especially important for day trading as small price movements and even tiny amounts of slippage can be the difference between profit and loss.

More good news for day traders is that all strategies are permitted, and with a swap-free account available, Muslim traders can access markets without paying interest.

On the downside, I was frustrated by the lack of reliable data on order executions. AdroFx quoted me a maximum of 2 seconds, which is sub-optimal for day trading, but offered no indication of average speeds.

Deposits & Withdrawals

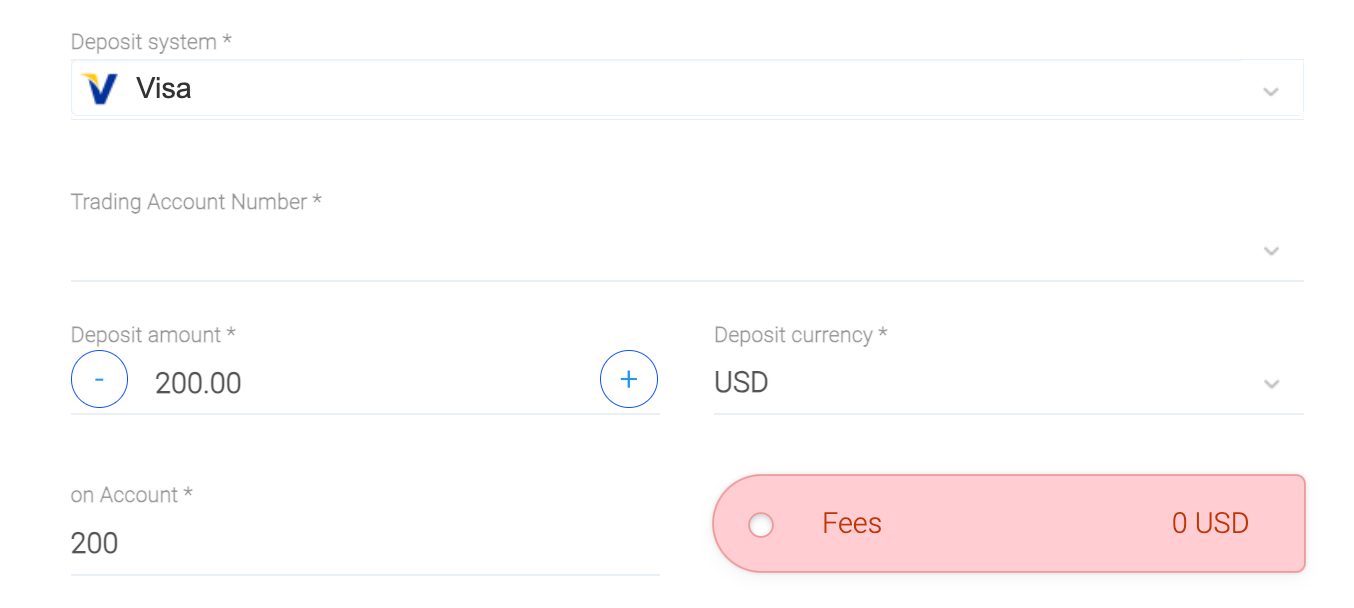

AdroFx users can quickly and affordably fund their accounts with a wide range of payment methods including traditional wire and card transfers, e-wallets and even crypto.

The positives are that all deposits are fee-free on the broker’s side, and all but bank transfers (1–5 working days) should be complete in 1 hour.

Withdrawals are also quick with all methods completing within a day. However, I found the fees for withdrawals expensive, including 1.99% on card withdrawals and a 1.9% plus a 0.00006 commission on Bitcoin.

These fees are very high and put AdroFx at a significant disadvantage compared to brokers with fee-free withdrawals like XTB. That said, there is a fee-free option: the SticPay e-wallet.

Bonuses

AdroFx offers a range of bonuses to traders – one area that an offshore brokerage offers value over more tightly regulated brokers where incentives are typically banned.

The promotions on offer include a 100% bonus if you deposit over $1,200, a 20% bonus for any other deposits, an insurance promo that refunds 30% of losing trades, and more.

Importantly, we urge traders to carefully research the terms for these incentives and never to sign up on the basis of a bonus scheme.

For instance, I read the terms and conditions of the 20% bonus and noted that the bonus funds themselves cannot be withdrawn and that certain strategies are prohibited, including scalping.

Demo Accounts

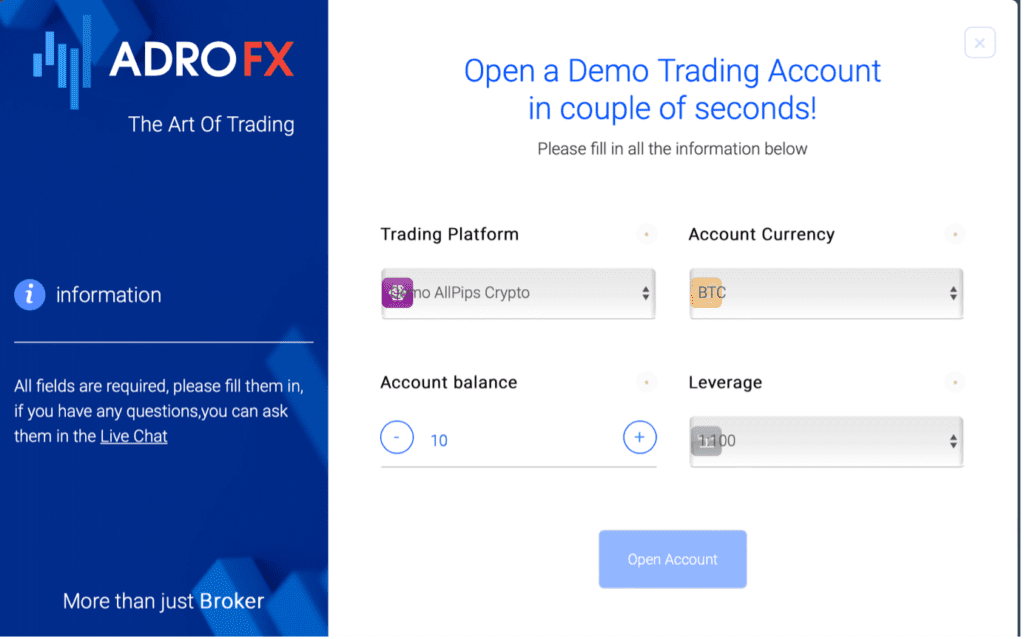

I was very pleased with how quick and easy it was to set up a demo account with AdroFx.

We consider this feature one hallmark of a good broker as it allows both beginners and experienced traders to try out their services and to use it as a day trading practice tool.

I was able to open my demo account in minutes by registering with basic information and verifying my email address, then simply selecting my choice of platform, demo account type and leverage.

Assets & Markets

With just over 100 instruments, AdroFx is seriously behind many competitors in this department, even though its main offering of forex is quite substantial.

The 60+ currency pairs are a decent range that covers all the majors as well as many minors and exotics like AUD/SGD and USD/TRY. We consider anything over 50 pairs to be good for a forex trader and in this respect, AdroFx is ahead of some more established brands like eToro, which offers around 40.

Unfortunately, I felt very limited by the other assets with only around 40 stocks (major US shares), a handful of indices (US, UK, European and Japanese markets), 4 cryptos (BTC, ETH, XRP, LTC) and 2 precious metals (gold and silver).

As a result, AdroFx is best for forex traders and beginners interested in other key markets. However, advanced day traders will find a much richer selection of instruments and more opportunities at category leaders like IG (19,000+) and Blackbull (26,000+).

Leverage

One advantage for experienced traders with a large risk appetite is the availability of leverage up to 1:500, which is far beyond the 1:30 allowed by most tier-one regulators.

Those who want to play it safer can also choose lower leverage.

I always recommend that traders take the utmost care and use strict risk management when trading with leverage since small price movements or unexpected spikes can lead to large losses.

Fees & Costs

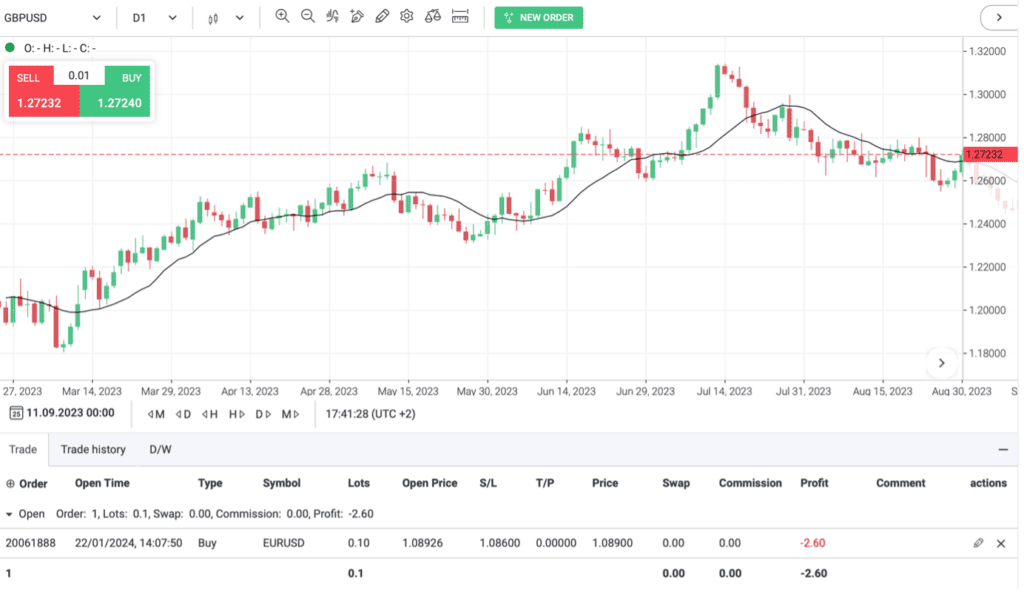

AdroFx offers a straightforward pricing model with zero commissions and competitive spreads, especially in its higher account tiers.

Average spreads on the Standard MT4 account start from 1.2 pips on major forex pairs, trailing the cheapest brokers.

However, the 0.4-pip minimum that Premium and Pro MT4 accounts provide is more competitive. The good news is that all Allpips accounts get this pricing with just a $100 minimum deposit.

Quotes of minimum pricing don’t tell the full story of a broker’s fees though, so I tested the broker during peak trading hours and was quoted 0.5–0.7 pips on EUR/USD and 0.6–0.9 pips for GBP/USD.

We deem these as competitive since there are zero commissions, and importantly, spreads are tight enough to make money from short-term trading strategies.

I was also pleased to see transparency on AdroFx’s website, with a price list containing all the relevant information including overnight swap fees.

Considering the negatives, the withdrawal fees are steep and can be avoided at many top-rated day trading brokers.

Casual traders should also be aware that 5 USD/EUR/GBP is charged monthly after six months of inactivity.

Platforms & Tools

AdroFx offers enough with its platforms to satisfy most traders even though it doesn’t stand out in this respect.

MetaTrader 4 is available on Windows desktop systems and Android or iOS mobile devices, while Allpips is a web trader that works on most browsers.

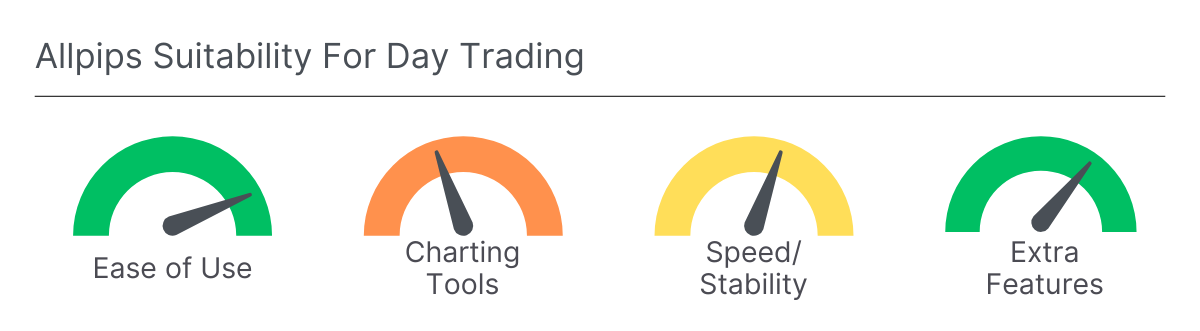

Below you can see how they shape up for day traders.

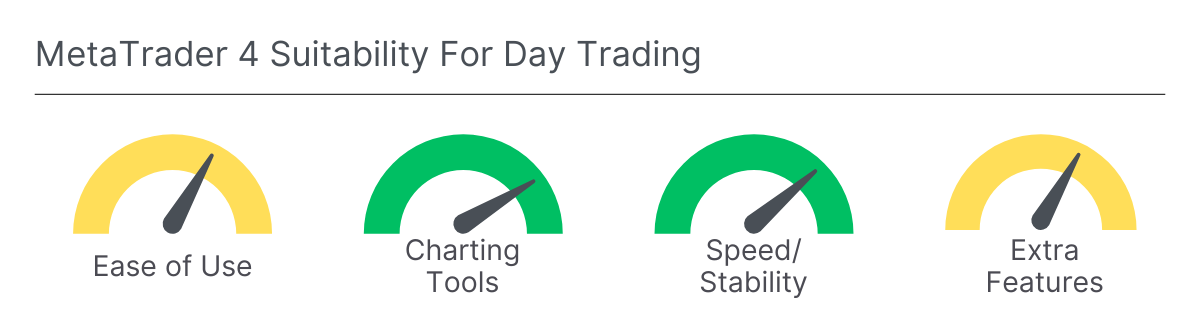

MetaTrader 4

MetaTrader 4 (MT4) has been a favorite among forex traders since 2005. It offers a decent charting package with 30+ indicators and timeframes designed for short-term trading, ranging from 1 minute to 1 month.

Its expert advisors (EAs) also make it popular with algo traders and there’s a chance to use virtual private server (VPS) hosting, which comes without charge to Pro account holders and starts from $10 per month for others.

The downside is that MT4 is starting to show its age, and it would have been nice to see a modern alternative like TradingView, which sports a sleeker design that makes for a more enjoyable user experience.

In conclusion, MT4 will suit experienced day traders who want expert advisors and advanced charts.

Allpips

I found the Allpips platform very basic, with just three chart types and six built-in indicators. Many rival brokers offer far more powerful bespoke platforms. AvaTrade, for example, has a sleek and customizable web trader with 60+ in-built indicators.

The Allpips copy trading solution is similarly lightweight compared to our favorite social trading brokers like eToro. Although there are some tools to filter master traders by past performance, the interface is clunky and lacks the social trading chats and detailed information that can be found on eToro’s app.

In conclusion, Allpips is best for beginners who want a no-frills, browser-based platform with copy trading.

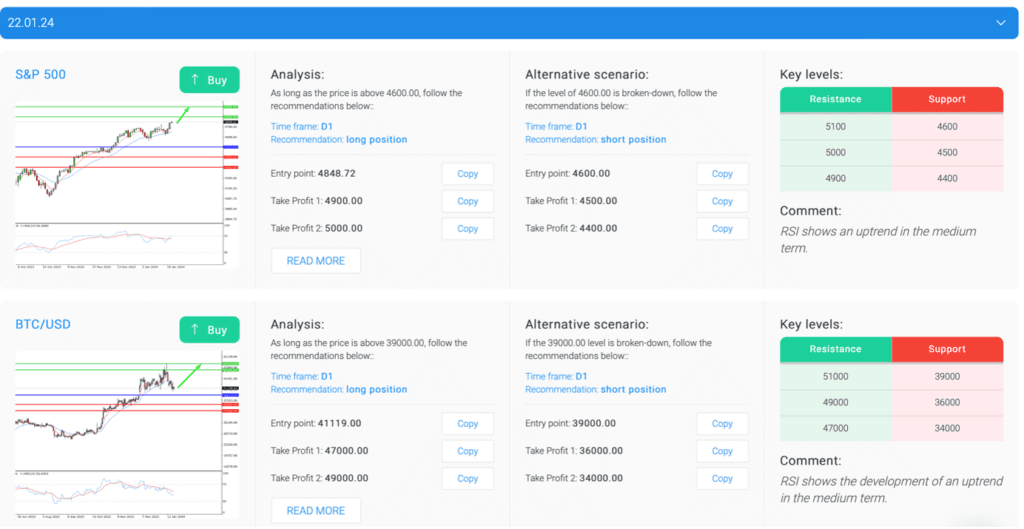

Research

AdroFx offers some helpful research tools including a blog, daily news and analysis, plus an economic calendar.

I particularly enjoyed the daily market analysis during my tests, which gave some interesting insights into major market movements of the last day.

However, I miss the in-depth commentary from brokers like eToro, which I find more useful for developing trading ideas for upcoming events.

The signals on AdroFx’s trading dashboard are another interesting addition that boosts the broker in the research department, providing a more manual form of copy trading, with some useful technical summaries.

AdroFx doesn’t do badly with its research tools, but there isn’t enough to compete with the best day brokers in this department, such as IG.

Education

I was pleased to find a range of educational resources at AdroFx. These include ebooks, video lessons and handy guides, and I like that there’s content for traders of all experience levels.

This content ranges from basic guides on using MT4 to in-depth strategy guides on fractals, the dual stochastic strategy and more.

It would be good to include interactive lessons or content like podcasts that top brokers like IG offer, but overall this is a reasonable offering.

Customer Support

I have been impressed by AdroFx’s customer support, which is available 24/5 via live chat, telephone and email.

Many brokers nowadays are able to respond to queries within minutes, but only quality brokers are able to provide useful answers that quickly.

On each of the five occasions I tested AdroFx’s support I received personalized answers to my questions within three minutes. Crucially, the staff who assisted me were knowledgeable and helpful, and none of the responses were copy-pasted from elsewhere on the site.

Should You Trade With AdroFx?

AdroFx has several advantages for traders, from a choice of accounts to reliable customer support and high leverage.

However, the lack of strong regulation is a real concern, the investment offering is slim and the research tools and educational materials trail the best brokers.

Overall, it offers an attractive package for beginner forex traders, but it doesn’t compete with the top day trading brokers.

FAQ

Is AdroFx Legit Or A Scam?

AdroFx has been in business since 2018, but be aware that this is not a strongly regulated broker so you will have few protections if something goes wrong.

Can I Trust AdroFx?

AdroFx has been operating for several years, but we’ve given it a low trust score because of its weak regulatory oversight.

You should do your own due diligence, be aware of the risks, and only invest what you can afford to lose.

Is AdroFx A Regulated Broker?

AdroFx is authorized by the Vanuatu Financial Services Commission (VFSC), the St Vincent and the Grenadines Financial Services Authority (FSA), and the Business Services of Saint Lucia Act (BSSLA).

These are offshore regulators that are not well regarded and do not provide strong investor protections compared to top-tier regulators like the Australian Securities & Investments Commission (ASIC) or the UK Financial Conduct Authority (FCA).

Is AdroFx Good For Beginners?

AdroFx has clearly designed its offering with beginners in mind, from the commission-free trading model to the demo account, copy trading and educational resources.

That said, our first-hand experience using other brokers shows that alternatives like eToro and IG offer a more complete package for beginners.

Does AdroFx Offer Low Fees?

AdroFx’s pricing is reasonable, particularly in its higher-tier accounts with spreads from 0.4 pips and no commissions.

However, it’s more expensive than the cheapest brokers and its withdrawal fees and inactivity penalty lower its fee score.

Is AdroFx A Good Broker For Day Trading?

AdroFx has several advantages for day traders, notably the competitive spreads and access to the MetaTrader 4 platform with its charting features and support for algo trading.

However, questions remain over its execution speeds, average research tools and slim product portfolio with limited opportunities for advanced day traders.

Does AdroFx Have A Mobile App?

AdroFx does not have its own mobile app, but traders can download MetaTrader 4 (MT4) on iOS and Android mobile devices.

Best Alternatives to AdroFx

Compare AdroFx with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

AdroFx Comparison Table

| AdroFx | Interactive Brokers | World Forex | |

|---|---|---|---|

| Rating | 2.9 | 4.3 | 4 |

| Markets | Forex, CFDs, Indices, Shares, Metals, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $25 | $0 | $1 |

| Minimum Trade | 0.0001 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | VFSC, FSA, BSSLA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | 100% Deposit Bonus | – | 100% Deposit Bonus |

| Platforms | Allpips, MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:1000 |

| Payment Methods | 12 | 6 | 7 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by AdroFx and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| AdroFx | Interactive Brokers | World Forex | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

AdroFx vs Other Brokers

Compare AdroFx with any other broker by selecting the other broker below.

Customer Reviews

3 / 5This average customer rating is based on 1 AdroFx customer reviews submitted by our visitors.

If you have traded with AdroFx we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of AdroFx

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’ve been day trading on AdroFX for several months now. What I’ve liked is the free demo account and bonus which meant I could practice setups before using real money. But I did find the wide range of accounts super confusing. Also I’m fairly new to trading so wanted to use the education section but the videos are really dry and poorly designed, so I quickly gave up.