XS Review 2024

Pros

- XS clients can access the reliable MetaTrader 4 and MetaTrader 5 platforms with several flexible account types

- I'm satisfied that the multiple payment methods will make the broker accessible to global traders

- I'm pleased with the strong regulatory oversight from CySEC and ASIC, plus negative balance protection

Cons

- Global traders registered with the offshore entity won't receive the same fund protections as the other licensed branches

- There are also no copy trading tools for new traders or for those who want to become strategy providers

- I think XS trails behind competitors when it comes to education and research, with no notable tools available for clients

XS Review

XS Online Trading is a broker belonging to the XS Group that provides CFD trading on 100+ instruments. The brand offers a proprietary WebTrader terminal and a bespoke mobile app, alongside MT4 and MT5. In this XS review, our experts cover the broker’s trading fees, regulatory status, accepted payment methods and more to give our verdict on whether XS.com is a good option.

Key Takeaways

- We like that XS is authorized by multiple regulators, including CySEC & ASIC

- Tight spreads and transparent trading fees are available

- We appreciate that it is quick and easy to open an account

- XS.com could do more in terms of research and education

- Our team would have liked to see extra tools like copy trading

Assets & Markets

2 / 5The list of instruments available at XS is fairly limited. We think the range of stocks and shares, in particular, is fairly narrow compared to our favorite alternatives. With around 100 assets, the brokerage doesn’t compare with big brands like CMC Markets and Plu500 which offer thousands of products.

Supported instruments:

- 4 precious metals including gold and silver

- 13 global indices such as US30, FTSE100 and AUS200

- 5+ digital currencies including Bitcoin and Ethereum

- 60+ international stocks including Alibaba, BNP, Disney and McDonald’s

- 13 commodity futures including copper, wheat, natural gas and crude oil

- 44 major, minor, and exotic currency pairs such as GBP/USD, AUD/CAD, and NZD/USD

Account Types

Our team like the straightforward account structure; Standard or Raw.

Both profiles provide access to all instruments and trading platforms and leverage up to 1:500 (entity dependent). The main difference comes from the pricing structure, with the Standard profile likely the best pick for beginner day traders and scalpers while the Raw account may suit discretionary traders.

Standard Account

- Commission-free

- Spreads from 0.7 pips

- $200 minimum deposit

- Maximum 100 orders open

- Minimum order size 0.01 lots

Raw Account

- Raw spreads from 0 pips

- $6 commission per round lot turn

- $500 minimum deposit

- Maximum 100 orders open

- Minimum order size 0.01 lots

A swap-free version is also available on the Standard account, though this is available for Muslim traders only. We recommend opting for this if you are an Islamic trader looking to avoid swap fees.

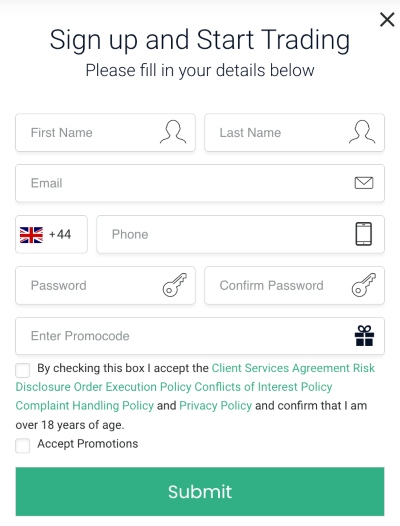

How To Register For An XS Account

I was able to register for a live account in about five minutes, though it may take a little longer to complete the standard verification process, which involves sending proof of residency and identity.

- Complete the online application form

- Agree to the terms and conditions

- Re-direct automatically to the client dashboard

- Select ‘Hi, xxxx’ from the top right of the interface and click on ‘Verification Center’

- Complete the personal profile requirements and select ‘Next’

- Review your details, deposit funds and start trading

Deposits & Withdrawals

Deposits

We like the wide choice of funding methods offered by XS, including Skrill, Neteller, bank wire transfer, and credit/debit cards. Our team also rate the low minimum deposit requirements and fast processing times. This makes it easy for global traders to sign up and get started with XS.

Minimum deposits and processing times:

- Neteller – $15 minimum deposit, $15,000 maximum deposit, instant processing, EUR and USD accepted

- Skrill – $15 minimum deposit, $15,000 maximum deposit, instant processing, EUR and USD accepted

- Credit/Debit Card – $50 minimum deposit, $5000 maximum deposit, instant processing, EUR and USD accepted

- Giropay- $15 minimum deposit, $5000 maximum deposit, up to one working day processing, EUR accepted

- Bank Wire Transfer – $200 minimum deposit, no maximum deposit, one-to-seven-day processing, EUR and USD accepted

- Klarna – $15 minimum deposit, $5000 maximum deposit, processed in one working day or less, EUR, GBP, PLN, CZK, and USD accepted

XS does not charge any deposit fees. However, it’s worth noting that a 3% fee applies for account funding with no trading activity.

Overall, we found the deposit options to compare favorably with the competition, and we were particularly pleased to see the low minimum deposit of $15 on most payment methods.

How To Make A Deposit

- Log in to the client portal

- Select the green ‘Deposit’ icon on the top right side of the dashboard

- Choose a payment method

- Follow the on-screen instructions and select ‘Deposit’

Note, account verification must be completed before you can add funds.

Withdrawals

XS processes withdrawals via bank wire transfer, credit/debit card, Skrill, and Neteller. Klarna and Giropay are not available. Similar to deposits, the broker does not charge any withdrawal fees.

We also note the fast bank wire transfer processing times, which quote a processing time of one working day vs the typical three to five days at alternative brands. This is a big advantage if XS can assure such speedy transactions, though we suspect that some international wire transfers may be held up for longer by the bank.

I was frustrated to find that a minimum withdrawal limit applies to all methods, especially given that this is higher than the $15 minimum available.

- Neteller – $50 minimum withdrawal, $2500 maximum, instant processing, EUR, GBP, and USD accepted

- Credit/Debit Card – $50 minimum withdrawal, $5000 maximum, instant processing, EUR, GBP, and USD accepted

- Skrill – $50 minimum withdrawal, $50,000 maximum, one business day processing, EUR, GBP, and USD accepted

- Bank Wire Transfer – $200 minimum withdrawal, no maximum, one working day processing, EUR, GBP, and USD accepted

Fees & Costs

3 / 5Our team rates that XS.com doesn’t have any hidden fees and offers competitive spreads and commissions.

Fees vary between the two live account types. The Standard profile offers spreads from 0.7 pips, with no commissions. While using XS, we got competitive spreads of 1.1 pips on the EUR/USD and 1.2 pips on the GBP/USD. The Raw account, on the other hand, offers tight spreads from 0 pips, though a $6 commission fee applies for round lot turn.

Fortunately, both pricing structures stack up against similar brokers, though the best model will depend on your trading strategy. High-volume scalpers, for instance, may prefer the Raw account with ultra-low spreads.

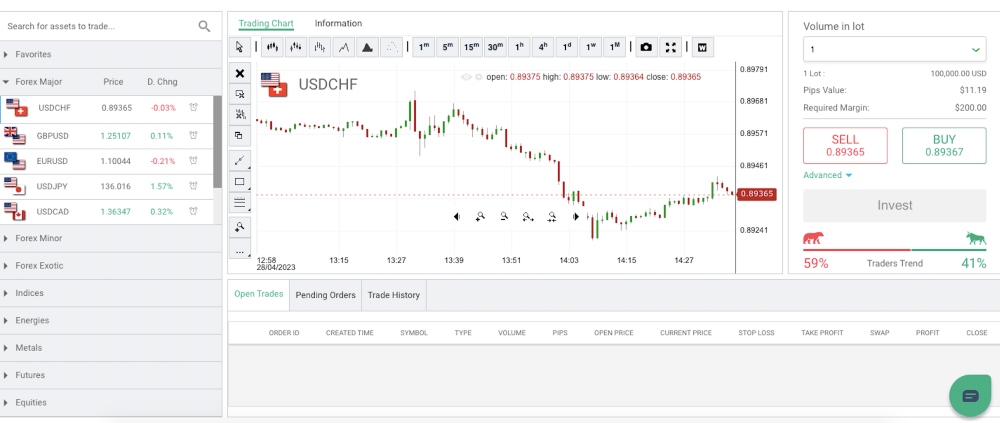

Platforms & Tools

2.5 / 5XS offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary WebTrader. The third-party terminals can be downloaded to desktop devices or used directly through major browsers.

We always appreciate having access to the powerful features of the MetaTrader platforms, including 30+ pre-installed technical indicators, three chart types, real-time price quotes, and access to expert advisors (EAs) for automated trading. MT4 is commonly used for forex trading, while MT5 is designed for multi-asset trading.

Having said that, we were impressed by the sleek, bespoke XS Web Trader platform, which provides an excellent assortment of analysis features and more charting styles than MetaTrader, including Heikin Ashi, dots, and area. These are available to view across nine timeframes.

Other features include full trading history, drawing tools, and 50+ technical indicators. Overall, our team think the WebTrader platform is easier to use than MT4/MT5, particularly for beginners.

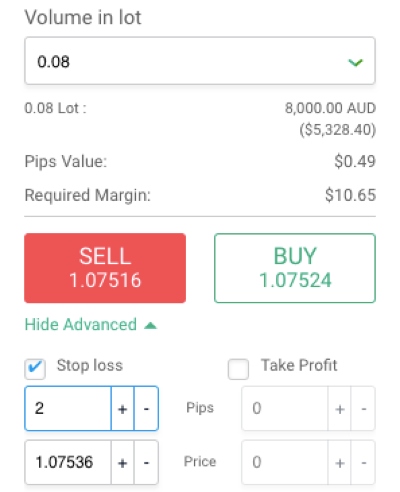

How To Place A Trade

- Select an instrument to trade from the side menu or favorites list

- Input the trade volume from the dropdown list in the new order window on the right

- Review the margin and pricing details and select ‘Buy’ or ‘Sell’

- Choose the ‘Advanced’ icon to add a stop loss or take profit risk parameter

- Select ‘Invest’ to open the position

Regulation & Trust

3.5 / 5It is reassuring that XS is regulated by trusted financial agencies. This adds a layer of legitimacy and credibility and means we can trade with confidence.

XS is a trade name of XS Group. The brand operates three subsidiaries, each with regulatory oversight. The level of protection and customer safeguarding varies, though ASIC and CySEC are reputable authorities with stringent compliance requirements. On the downside, customers trading under the FSA subsidiary may not be entitled to equivalent compensation schemes and safety standards.

Nonetheless, the brand segregates all client funds from business money and requires all new customers to provide identity verification in accordance with AML and KYC policies. In my experience, this is a fairly common policy for legitimate brokers. It is also reassuring to see additional measures such as negative balance protection and a policy of only working with major banks.

Regulation details:

- XS Ltd – Authorized and regulated by the Financial Services Authority of Seychelles (FSA), license number SD089

- XS Prime Ltd – Authorized and regulated by the Australian Securities and Investments Commission (ASIC), license number 374409

- XS Markets Ltd – Authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 412/22

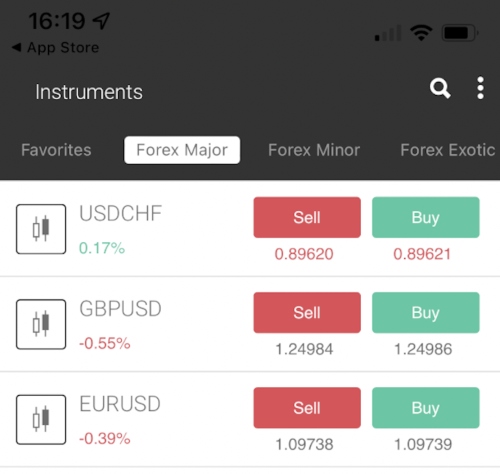

Mobile App

We were pleased to see the broker offers a proprietary mobile app, available to download on iOS or Android devices; there is a useful QR code on the broker’s homepage for direct app store access.

The XS mobile app provides full trading functionality, including watchlist creation and custom alerts. It is easy to navigate and allows traders to open and close trades at the click of a button.

MT4 and MT5 can also be downloaded to mobiles and tablets. The terminals can be downloaded for free to iOS and Android devices. The apps are not as modern as the XS app, though they are well-regarded for their stability and advanced functions.

Leverage

XS offers leveraged trading, with margin levels varying between entities. Those investing under the Seychelles subsidiary will be able to access the highest leverage up to 1:500 due to relaxed regulations. EU and Australian citizens, on the other hand, can trade with lower leverage up to 1:30.

We outline FSA leverage for XS customers as an example:

- Forex – Up to 1:500

- Precious Metals – Up to 1:200

- Energies – Up to 1:100

- Major Indices – Up to 1:100

- Minor Indices – Up to 1:50

- Commodities – Up to 1:50

- Stocks – Up to 1:50

- Cryptocurrency – Up to 1:20

Both accounts have an 80% margin call 20% stop-out level.

XS Demo Account

XS offers a demo account on all platforms, which is excellent news for prospective traders. We recommend that traders take advantage of the demo account so they can get to grips with the broker, the platform and assets on offer, trading with leverage, and so on.

You will need to sign up for an XS account and verify your identity before you can get started with your paper trading profile.

Bonuses & Promotions

The broker does not offer any bonuses or financial rewards. This came as no surprise to us as XS’s EU and Australian entities, which prohibit these types of incentives, are an important part of the broker’s business.

However, it will be a disadvantage for international clients of XS’s offshore-regulated arm – incentives are common for this type of broker and entity.

Additional Features

Unlike many of its competitors, XS does not offer any additional trading tools, social trading or educational content. This is a disappointing oversight, as many traders favor brokers that come outfitted with a good range of tools and other features, and social trading is an increasingly popular feature that can help beginners and save a lot of time for traders.

We also feel that educational content is particularly important for new traders and were disappointed by the lack of it – though there is some positive news on this front, as XS is looking to partner with third-party providers to deliver webinars or materials for their customers.

Customer Support

3 / 5We were pleased to see that XS customer support is available 24/7. Contact options include email, online inquiry form, and live chat. There is no telephone option, though a call-back service is available if this is your preferred method. There is also some basic guidance available from the FAQ area.

Testing the broker’s live chat feature, I found that initial queries are answered by a chatbot before the option comes up to connect with a live agent. You will need to input your email address to reach this point. The agent responded to our query in less than 10 minutes, which is a reasonable response time.

- Email – support@xs.com

- Live Chat – Bottom right icon from broker’s website

- Online Enquiry Form – Available via the ‘Contact’ webpage

- Callback Request Form – Available via the ‘Contact’ webpage

Company Details

Our team was unable to find much information on XS’s company details. This is disappointing and demonstrates a lack of transparency.

However, we do know that the broker operates via three subsidiaries regulated by the Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, and the Financial Services Authority of Seychelles.

XS also provides B2B services including API access for firms to access their liquidity pools and advanced technology services.

Trading Hours

The XS server time operates on GMT +2 or GMT +3 (DST). Opening hours vary by market. For instance, currency pairs are available to trade from 12:01 AM Monday to 11:57 PM on Friday. Precious metals, on the other hand, can be traded between 1 AM Monday to 11:55 PM on Friday.

All timings, including market closures, will be reflected in the trading platform. To view:

- Select an instrument from the symbol list on the left menu

- Choose the ‘Information’ tab from the menu above the chart

- Scroll down to ‘Trading Hours’

XS Verdict

We feel XS provides all the basic requirements of a decent CFD broker, with competitive fees and access to either MT4/MT5 or a proprietary web terminal and mobile app. There is not much information about the company readily available online, but the oversight by ASIC and CySEC is reassuring, and we feel that the customer service and features like negative balance protection were positive aspects for this broker.

Although XS is not quite up there with our favorites, it can make strides in the right direction by adding more resources for traders such as educational content and copy trading.

FAQs

Is XS A Safe Broker?

XS appears to be fairly secure with regulation from ASIC and CySEC. The company also offers negative balance protection and segregates client funds from business money. Access to compensation schemes, however does vary between subsidiaries.

Is XS A Good Broker For Beginners?

XS offers some suitable tools for beginners including a demo account and a choice of payment structures via two account options. However, we feel the brand does not provide the most important features for beginners such as educational content or platform user guides to help new investors to get started.

Does XS Offer Reliable Trading Platforms?

XS offers their customers the option to trade on MetaTrader 4, MetaTrader 5, and a proprietary web terminal. Additionally, the brand provides a bespoke mobile app. All platforms are suitable for both beginner and experienced traders, offering a range of analysis features and custom charting.

Does XS Have A Mobile App?

Yes, XS offers a proprietary mobile app, available for free download to iOS and Android devices. The application is intuitive and easy to use, with clear navigation. We also like that the broker’s full suite of instruments are available on the application.

How Can I Fund My XS Trading Account?

XS accepts several payment methods including bank wire transfer, Visa and Mastercard credit/debit cards, and e-wallets such as Neteller, Skrill, and Klarna. Minimum deposit requirements vary, the lowest being $15, though we were disappointed to find that the broker implements a minimum withdrawal at a higher rate of $50.

Top 3 Alternatives to XS

Compare XS with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

XS Comparison Table

| XS | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 2.9 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Stocks, Indices, Metals, Energies, Crypto, Futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, ASIC, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by XS and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| XS | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

XS vs Other Brokers

Compare XS with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of XS yet, will you be the first to help fellow traders decide if they should trade with XS or not?