Upside Potential Ratio (Calculation & Python Example)

The Upside Potential Ratio is a financial metric used to evaluate the performance of an investment relative to its risk, with a specific focus on the upside, or positive return, potential.

This ratio is particularly useful in assessing investments where the concern is not just the volatility, but the nature of the volatility – emphasizing gains over losses.

Key Takeaways – Upside Potential Ratio

- The Upside Potential Ratio measures the potential for positive returns.

- It compares the portfolio’s upside potential against its downside risk.

- It’s used to evaluate investment performance by focusing on favorable outcomes.

- This ratio aids in identifying investments, funds, or portfolios that offer optimal return possibilities for a given level of downside risk

- Helps with risk-adjusted return analysis.

- We provide an example in Python.

Calculation

The Upside Potential Ratio is calculated by dividing the excess return over a minimum acceptable return (MAR) by the standard deviation of returns below the MAR.

Mathematically, it is represented as:

Upside Potential Ratio = Excess Return over MAR / Standard Deviation of Returns below MAR

Excess Return

This is the average return of the investment minus the MAR.

The MAR is typically a benchmark rate, like the return on a risk-free asset or a certain target return rate set by the investor.

Downside Standard Deviation

Unlike other ratios that use total standard deviation, the Upside Potential Ratio focuses only on downside volatility – the standard deviation of returns that fall below the MAR.

Significance

Focus on Positive Performance

The ratio emphasizes upside potential.

So, that makes it a preferred metric for investors who are more interested in the potential for positive performance than just overall risk.

Risk-Adjusted Returns

It considers both the potential for excess returns and the downside risk.

Accordingly, the Upside Potential Ratio offers a more nuanced view of risk-adjusted returns than traditional metrics.

Strategic Decisions

Investors can use this ratio to identify assets or funds that have a higher potential for upside gains relative to their downside risk.

This can help in portfolio construction and asset allocation.

Fund of funds (i.e., a fund that invests in hedge funds and not assets directly) may use metrics like the Upside Potential Ratio.

Advantages

Asymmetric Risk Assessment

It provides a more accurate measure for investments where the risks are not symmetrical, such as in skewed or leptokurtic (positive kurtosis) return distributions.

Investor-Centric

This ratio aligns well with the perspectives of investors who prioritize potential gains and are more concerned about downside risks than just total volatility.

Limitations

MAR Dependency

The choice of MAR can significantly influence the ratio, making it somewhat subjective based on investor preference or benchmark selection.

Data Sensitivity

Like many financial ratios, it is sensitive to the data period selected for analysis.

This can lead to varying results across different time frames.

Complexity

The calculation, especially the downside deviation part, is more complex than traditional measures like the Sharpe Ratio (which is simply excess returns over volatility).

This makes it less accessible to casual investors.

Upside Potential Ratio in Python (Example)

To calculate the Upside Potential Ratio in Python, you need to first compute the:

- upside potential (average returns above a certain threshold, typically the risk-free rate) and

- downside risk (standard deviation of negative returns below the threshold)

The Upside Potential Ratio is then the quotient of these two values.

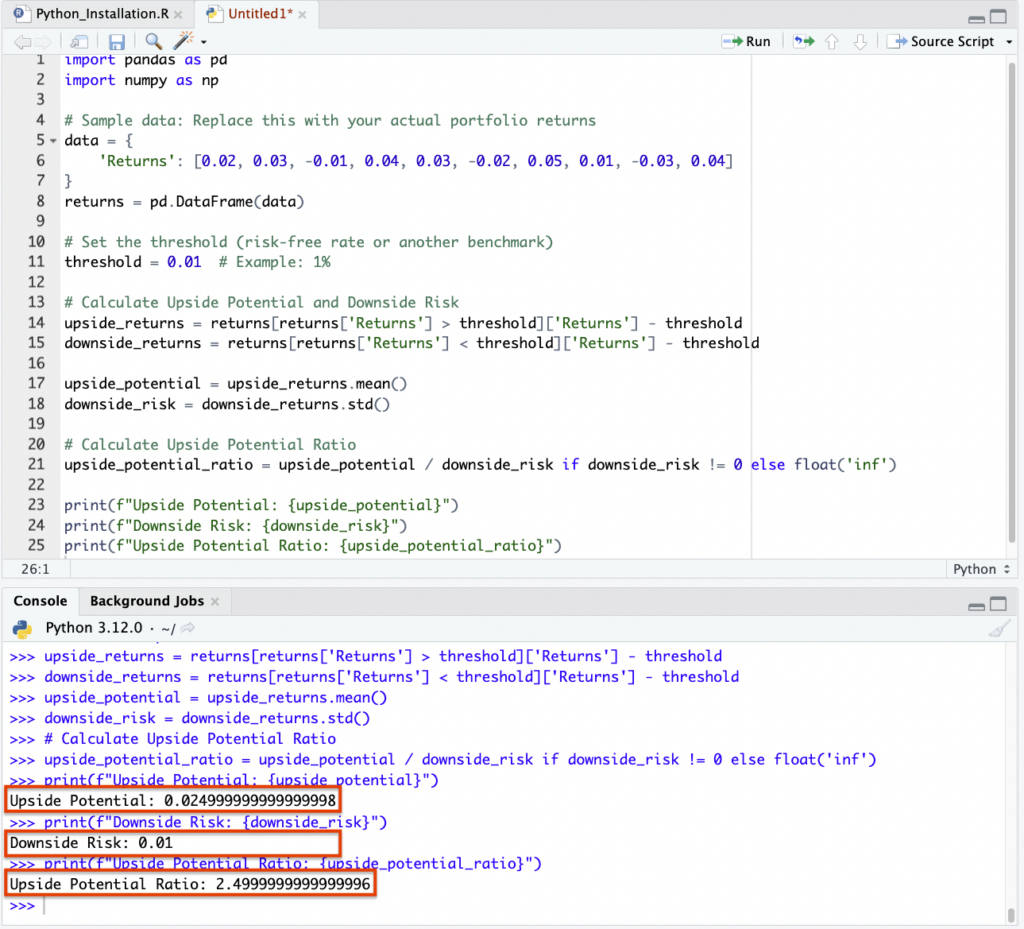

Here’s an example in Python, assuming you have a DataFrame returns with the portfolio returns:

First, we need to install the necessary packages – the standard pandas and numpy:

pip install pandas numpy

The Python script:

import pandas as pd import numpy as np # Sample data: Replace this with your actual portfolio returns data = { 'Returns': [0.02, 0.03, -0.01, 0.04, 0.03, -0.02, 0.05, 0.01, -0.03, 0.04] } returns = pd.DataFrame(data) # Set the threshold (risk-free rate or another benchmark) threshold = 0.01 # Example: 1% # Calculate Upside Potential and Downside Risk upside_returns = returns[returns['Returns'] > threshold]['Returns'] - threshold downside_returns = returns[returns['Returns'] < threshold]['Returns'] - threshold upside_potential = upside_returns.mean() downside_risk = downside_returns.std() # Calculate Upside Potential Ratio upside_potential_ratio = upside_potential / downside_risk if downside_risk != 0 else float('inf') print(f"Upside Potential: {upside_potential}") print(f"Downside Risk: {downside_risk}") print(f"Upside Potential Ratio: {upside_potential_ratio}")

So, what we have is a script that calculates the Upside Potential Ratio for the given returns.

It’s important to use a relevant and realistic threshold, such as the risk-free rate.

Overall, this metric is useful for assessing the potential for positive performance while considering downside risk.

You’ll get the following answers from this example:

Conclusion

The Upside Potential Ratio is a metric for assessing investment performance.

It’s best for traders/investors who are focused on maximizing positive returns while being conscious of downside risks.

Its unique approach to evaluating risk-adjusted returns makes it useful in portfolio management and investment analysis.

However, its effectiveness is contingent on the appropriate selection of the minimum acceptable return (MAR) and an understanding of its calculation and implications.