Trading 212 Review 2025

Pros

- Up to 5.2% interest on uninvested cash is available, appealing to hands-off investors

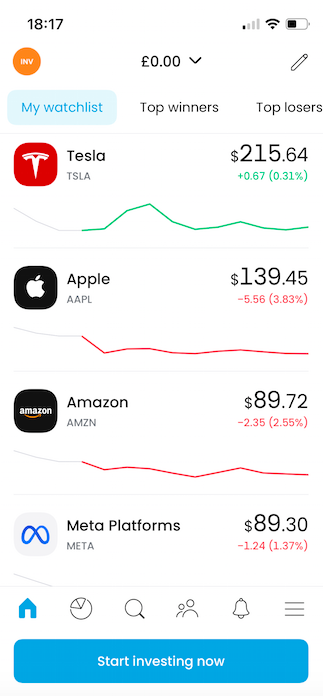

- A sleek mobile app lets you trade on the go. It’s well-designed and offers features similar to the web platform, making it convenient if you prefer mobile trading

- One of the standout features of Trading 212 is its commission-free trading, meaning you can buy and sell stocks, ETFs, and other financial instruments without incurring traditional brokerage fees

Cons

- There’s no copy trading, a significant drawback given Trading 212's client base is largely beginners and brokers like eToro offer this feature

- While Trading 212 offers leveraged trading through CFDs, there are restrictions on leverage for certain instruments. If you want high leverage for your strategies, you will find these limitations constraining

- There is no support for algorithmic or automated trading, nor third-party apps like MetaTrader 4, which will deter advanced traders. IC Markets ticks these boxes

Trading 212 Review

In this Trading 212 review, I’ll delve into the key features, offerings, and overall user experience, shedding light on its strengths and weaknesses. I’ll explain the ratings I have given the broker in each area, based on my own experience trading on the Trading 212 platform using real money.

Regulation & Trust

4 / 5Founded in 2004 in Sofia, Bulgaria, Trading 212 has a long track record and expanded its operations by establishing an office in London, UK, in 2013, which currently serves as its de facto headquarters.

Trading 212 is a legitimate platform, being subject to regulation by reputable financial authorities such as the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and Bulgaria’s Financial Supervision Commission (FSC).

Investors in the UK benefit from protection up to £85,000 in case of broker insolvency, and EU/worldwide clients are covered up to €20,000.

On the downside, Trading 212 is not listed on a stock exchange – unlike the some trusted brokers like IG, which is a reassuring sign of financial transparency.

Also, its abrupt move to increase requirements in 2020 without appropriate warning is a concern. This saw leverage on stock CFDs decrease to 1:2, and put clients with open trades at risk of automatic closure of positions if they didn’t have enough available capital, potentially having a significant negative impact on portfolios.

Accounts & Banking

3 / 5Trading 212 gets a high score for its account and banking options thanks to its choice of trading solutions, wide range of currencies and flexible payment options.

Live Accounts

Depending on where you live, Trading 212 offers three account types:

- CFD – for leveraged trading that allows going long or short, suitable for short-term strategies like day trading

- Invest – for share dealing

- ISA – for long-term investing

Unlike eToro which requires you to maintain a USD balance, Trading 212 lets you hold funds and trade (excluding CFDs) in any of the supported currencies: USD, EUR, GBP, CAD, CHF, DKK, NOK, PLN, SEK, CZK, RON, BGN, and HUF.

Having said that, each country offers only two or three account base currencies, typically the local currency along with EUR. For instance, in Poland, the available account base currencies are limited to PLN and EUR.

This is a welcome feature as it lets you deposit and withdraw funds in the same currency as your bank account, helping avoid conversion fees, and providing further flexibility if you use a digital bank that supports multi-currency bank accounts offering favorable currency exchange rates and cost-effective international bank transfers.

When trading in stocks denominated in a specific currency, such as USD for Amazon or GBP for British American Tobacco, you can directly invest in the respective currency.

Currency conversion is available seven days a week at the live interbank rate, along with a fixed 0.15% FX fee.

Importantly, I found the process of opening a live account with Trading 212 quick and easy, and my account underwent verification within 24 hours.

Demo Account

The complimentary demo account is a fantastic feature and lets you explore the various platforms and markets in a simulated environment with up to $50,000 in virtual funds. You can also choose less if you want to manage a more realistic balance.

This opportunity enables you to test trading strategies and manage positions, and is a great place to start for new day traders.

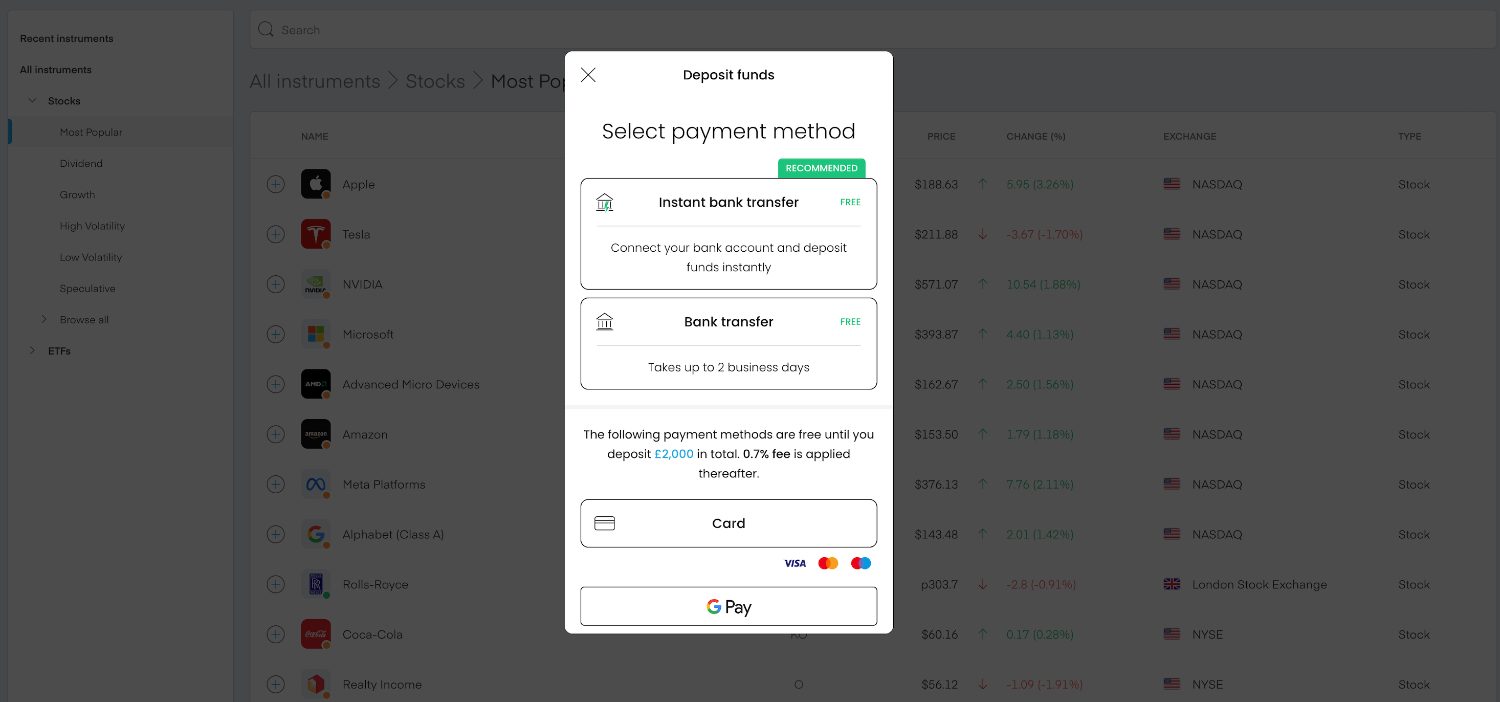

Deposits & Withdrawals

Options to deposit and withdraw funds into Trading 212 are secure but limited. These options mainly include bank wire transfers and card payments.

Disappointingly, electronic wallets may not be accessible in all countries, and the information about their availability in specific regions is not always transparent.

For example, Wise, Skrill and Neteller aren’t available in the UK. Google Pay can be used to fund accounts, but PayPal only becomes available when funding a CFD account and not a stock account. I’d like to see more consistency here.

Card and Google Pay payments are processed immediately from my experience, while bank wire transfers can take up to two business days.

There is no support for crypto deposits or withdrawals. Similar to other brokers, you can only deposit money from accounts that are in your name.

Testament to Trading 212’s appeal to beginner traders is its low minimum deposit, letting you open an account with as little as $1.

Up to $2,000 cumulative deposit is free. Disappointingly, after $2,000 cumulative, there is a 0.7% deposit fee, which is a significant charge for traders using large accounts.

The good news is that withdrawals are free – unlike eToro for example, which charges for withdrawals unless you’ve reached a certain balance level.

Withdrawing funds is also as straightforward as depositing them, and there are no minimum thresholds for withdrawing funds via debit or credit cards.

In my first-hand experience using Trading 212, withdrawals to my debit card took just two business days at most.

Assets & Markets

3 / 5Trading 212 gets a decent rating for its investment offering owing to the large suite of tradable assets, especially stocks, though it still trails best-in-class brokers in this department.

While the platform boasts an impressive portfolio of approximately 11,000 instruments, encompassing over 9,000 stocks, this assortment is less extensive compared to rival brokers.

IG and eToro, for example, both provide a broader range of stock markets for trading, and IG far surpasses Trading 212 for its CFD selection – a popular instrument with day traders. Admittedly this won’t be an issue for many beginners, but it may deter advanced traders.

Trading 212 also does not support cryptocurrency trading, nor does it support spread betting, trading bonds, call and put options, futures, or interest rates.

One really unique feature, however, is the capability to construct portfolios through the platform’s ‘Pie’ function.

Each security, whether it’s a stock or ETF, is represented as a slice within the pie, and these portfolios can be effortlessly rebalanced through automation.

A single pie can accommodate up to 50 securities, and you have the flexibility to create multiple pies.

Managing pies is easy even for beginners, as you can fine-tune the target weight assigned to each slice or investment within the pie.

The platform’s rebalance button allows for easy adjustments, and you can restore the original weights of your portfolio with the press of a button.

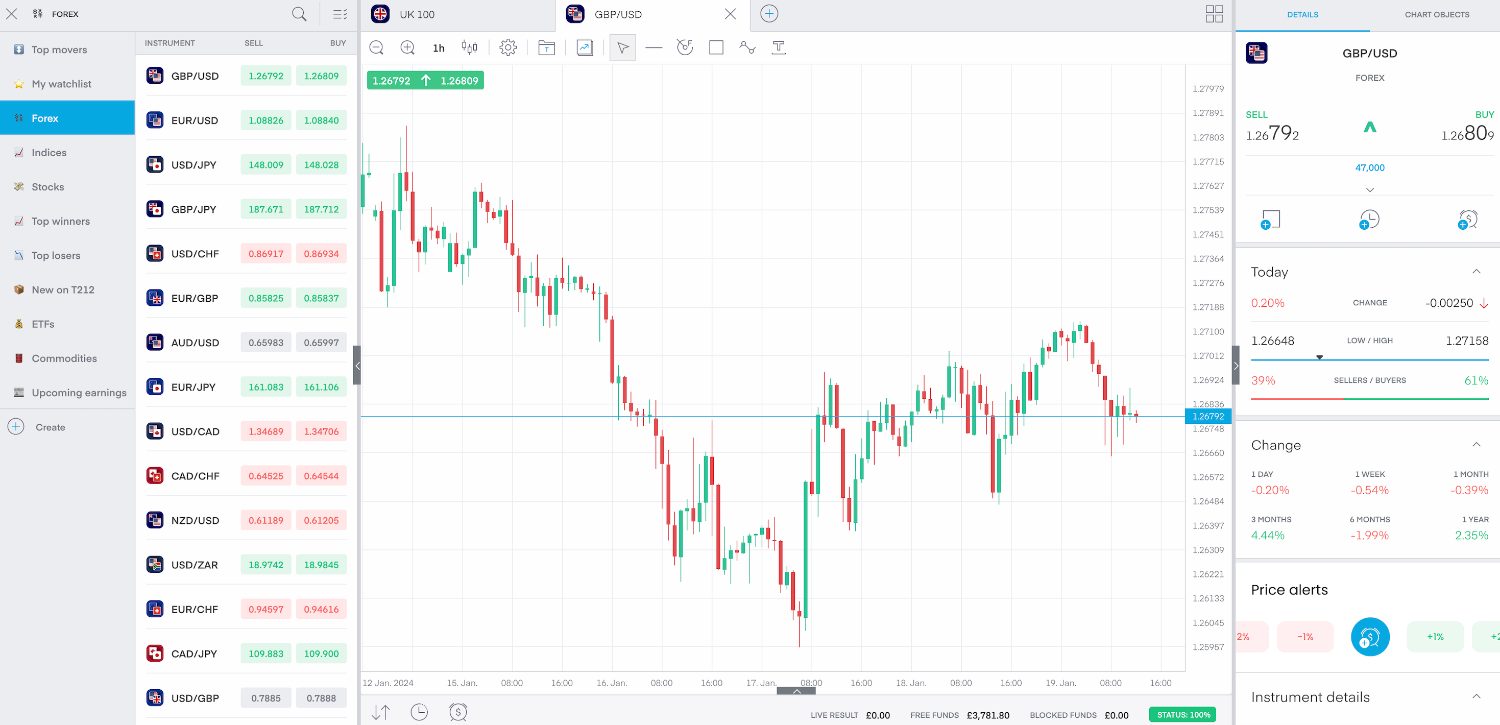

Fees & Costs

3.5 / 5Trading 212 gets a high rating for its fees & costs thanks to its commission-free pricing structure, however its spreads trail the cheapest brokers.

While Trading 212 offers relatively tight spreads, which is crucial for day trading, some brokers provide lower-cost trading options, notably IC Markets.

Still, the platform stands out by providing commission-free trading for stocks and ETFs, and there are no fees for deposits (up to a limit), withdrawals, or charges for dormant accounts.

The broker employs a spread-based pricing structure for forex trading and announced 50% tighter spreads on forex CFDs at the close of 2021. As an example, the GBP/USD currency pair is offered with an average spread of 0.00028 pips.

You should be mindful of fees associated with trading on global exchanges, such as the $0.0000207 transaction charge on all NYSE stocks mandated by the Securities and Exchange Commission (SEC). Helpfully, exchange costs are disclosed on the order screen before confirming a position.

It’s important to note that when trading in an instrument denominated in a currency different from your account, a conversion fee is applied, calculated at the spot exchange rate plus a 0.15% FX fee (which varies between accounts).

International day traders should be aware of these factors when engaging in global exchange trading.

Additionally, overnight swap fees are applicable.

I see the biggest advantage of Trading 212 is its commission-free trading for stocks and ETFs, making it an attractive option if you are seeking a cost-effective trading solution for these assets.

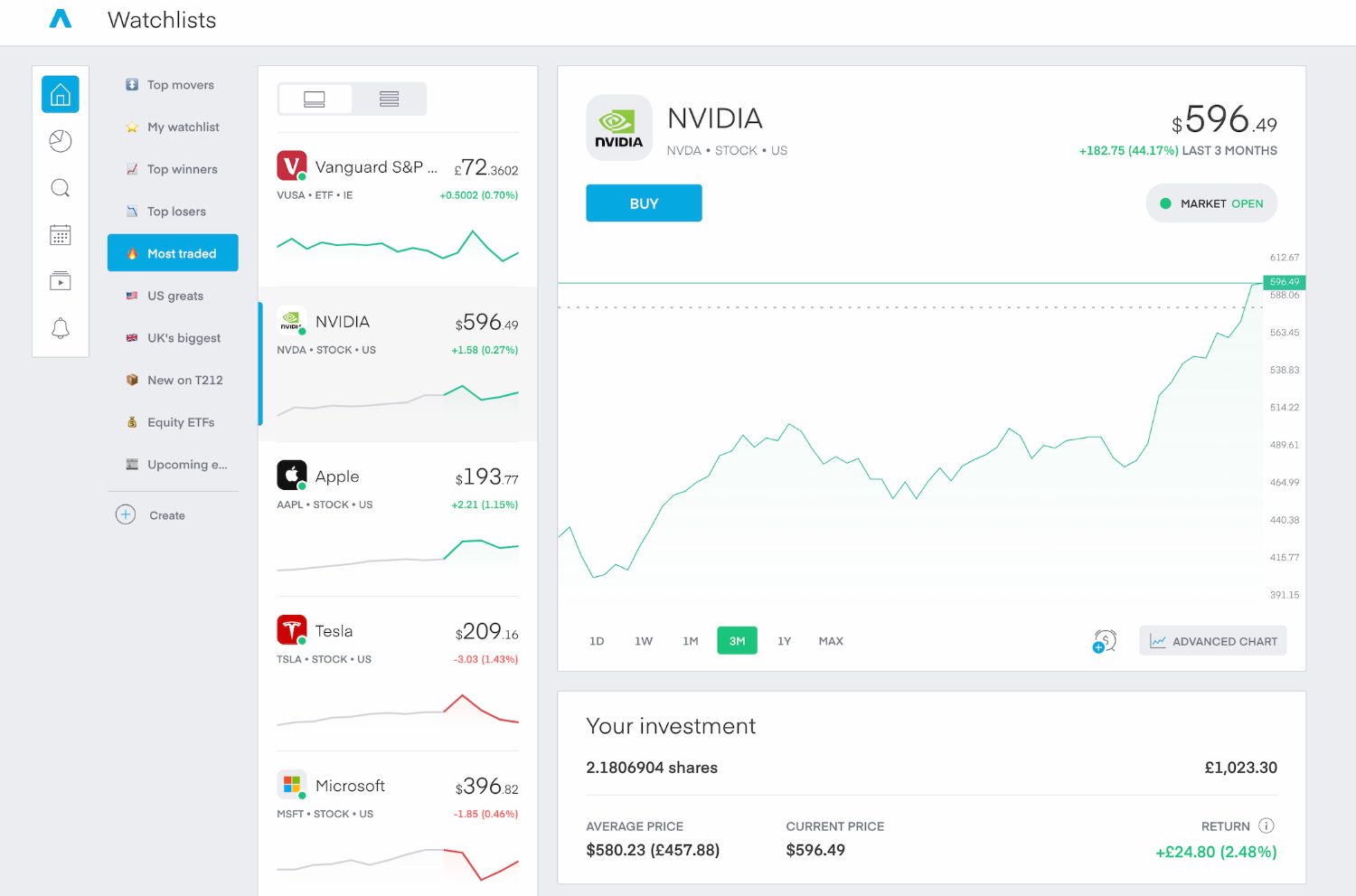

Platforms & Tools

3.5 / 5Trading 212 gets a high score for its platforms and tools thanks to its beginner-friendly app that delivers a terrific user experience. That said, it lacks the advanced charting tools serious day traders may need.

Trading 212 provides a proprietary trading platform designed for an optimal mobile user experience. I was impressed by the platform’s simplicity of navigation, offering a range of features, charts, and analysis tools without feeling cumbersome. The intuitive design is a notable advantage, featuring fully customizable tiles and viewpoints.

The platform offers alerts, notifications, and portfolio and fee reports, providing direct access to investment performance. Its strength lies in the ability to place trades in various ways and execute multiple operations on the same trading pair simultaneously.

While experienced day traders might prefer more advanced charting platforms like MetaTrader 4 (MT4) or cTrader, beginner traders should appreciate the custom-built, bespoke feel of the Trading 212 app.

Available for free download on iOS and Android devices, the app provides the complete functionality present on the web app. The customized mobile app is specifically designed for small screens, incorporating features like zoom and scroll for an enhanced user experience.

Yet while the Trading 212 app delivers a stable user experience with clear navigation and data visualizations for day traders, it doesn’t quite measure up to the mobile trading applications offered by competitors.

For example, in my opinion and first-hand experience testing both, eToro provides a more intuitive and powerful trading solution for mobile and tablet devices.

Research

2.5 / 5Trading 212 gets an average rating for its research because it lacks many of the tools offered by its competitors.

In particular, there’s no market screening, technical analysis, or social/community research, which can help to elevate the trading experience for traders of all levels.

Its standard quote pages are nicely presented with fundamental data including financial statements and ratios, but there’s no additional research data such as company news, client sentiment, or even an earnings calendar.

The lack of social analysis means you can’t view the percentage of customers buying or selling specific shares within the day or week.

IG, by comparison, provides most of the above and even has its own video channel that presents live videos three times a day and features pre-open bulletins, live charting analysis, and forward-looking insights. The content covers CEO interviews, market insights, technical analysis, and educational content.

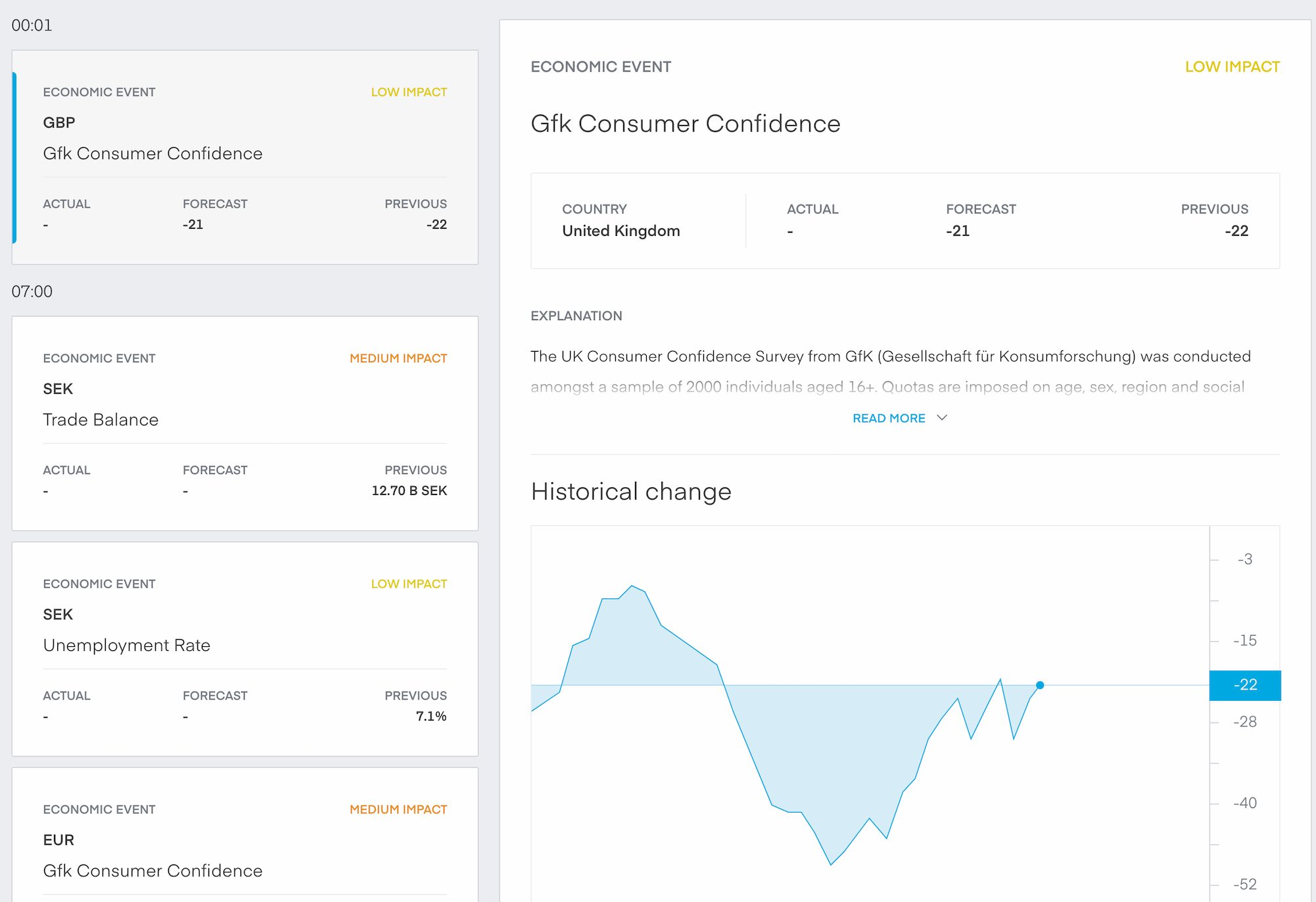

On the plus side, Trading 212 does have a useful economic calendar that lets you filter any upcoming high-impact news event.

Considering the platform’s target audience, my biggest disappointment with Trading 212 is that there’s also no copy trading, so beginners can’t automatically replicate the trades of experienced traders.

Education

2.8 / 5Trading 212 gets an average rating for its education because while it offers the essentials for new traders, it lacks in-depth content for seasoned traders.

Trading 212 provides easy-to-understand text and video tutorials for beginners, covering the basics of trading and how to use their trading platforms. The guides to charting are particularly useful for short-term traders.

However, live webinars are notably absent, which are a valuable addition if you are seeking more interactive learning opportunities or live market analysis.

There are also no advanced topics such as tax-efficient investing, day trading strategies, or macroeconomic data.

Educational materials are satisfactory at Trading 212, but there’s nothing you can’t find elsewhere on the internet for free.

Overall, the section falls short compared to the excellent offerings by IG in particular, whose Academy provides an enjoyable learning environment for day traders of all levels.

Customer Support

2.5 / 5Trading 212 delivers satisfactory overall customer service, featuring swift assistance from its helpful live chat staff. However, I don’t like the way you have to ‘convince’ a chatbot to connect you with a human – it’s just a time-consuming hurdle. I also don’t like the lack of telephone support.

You can email the company via an online form, but that’s also time-consuming when you potentially want answers immediately.

Trading 212 claims its live chat is available 24/7, but I struggle to chat with a human at the weekend. There’s no peer-supported help forum either.

Overall, the platform can really work on improving its support if it’s to match alternatives like CMC Markets with its award-winning customer service.

Should You Trade With Trading 212?

Regulated by multiple financial supervisory authorities, Trading 212 offers a secure and intuitive way for beginners to invest in commission-free stocks and ETFs.

Opening an account, depositing and withdrawing funds is easy, and the trading platform is easy to use – albeit basic.

Its biggest drawbacks are the limited product portfolio, the absence of popular asset classes like crypto, bonds, or options, average charting tools, and no live education or market analysis.

As a result, more experienced traders should look elsewhere for a more complete package.

FAQ

Is Trading 212 Legit Or A Scam?

The level of protection varies depending on the country of account registration, and in the case of Trading 212, established in 2004, its longer track record and extended regulatory compliance are positive indicators of its legitimacy, particularly during past financial crises.

Can I Trust Trading 212?

Trading 212 is considered a trusted online brokerage. It is regulated by credible financial authorities, and it has been operational for 20+ years.

However, trust in any financial platform should be based on up-to-date information, user reviews, and the platform’s current regulatory status.

We also have some reservations about its operating practices in recent years, namely its abrupt changes to margin requirements that could have harmed traders.

Is Trading 212 A Regulated Broker?

Yes, Trading 212 is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and Bulgaria’s Financial Supervision Commission (FSC).

Is Trading 212 Suitable For Beginners?

Trading 212 is suitable for beginners due to its user-friendly interface, educational documents, and features designed to help novice traders navigate the platform and learn the basics of online trading.

Does Trading 212 Offer Low Fees?

Trading 212 offers relatively low fees. In particular, commission-free trading for stocks and ETFs. Fees for other financial instruments, such as CFDs, are generally competitive though trail the cheapest day trading brokers, such as IC Markets.

Is Trading 212 A Good Broker For Day Trading?

Trading 212 is a reasonable platform for day trading stocks, but being regulated in the EU, a maximum leverage of 1:30 is restrictive for very active currency traders.

The lack of support for third-party charting apps like MetaTrader 4 also means it’s relatively limited in terms of indicators.

Does Trading 212 Have A Good Or Bad Mobile App?

Trading 212 offers an excellent mobile app for both Android and iOS devices and provides a convenient way to stay connected to the financial markets while on the go.

The app is fast and intuitive, and makes trading and managing portfolios easy.

Top 3 Alternatives to Trading 212

Compare Trading 212 with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Trading 212 Comparison Table

| Trading 212 | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 2.5 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, CySEC, FSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | No | Yes | Yes | Yes |

| Platforms | Web, App | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 | 1:50 | 1:200 | 1:50 |

| Payment Methods | 12 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Trading 212 and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Trading 212 | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

Trading 212 vs Other Brokers

Compare Trading 212 with any other broker by selecting the other broker below.

The most popular Trading 212 comparisons:

- Trading212 vs Interactive Brokers

- Trading 212 vs XTB

- Plus500 vs Trading 212

- Trading 212 vs Kraken

- Trading 212 vs eToro

Customer Reviews

2 / 5This average customer rating is based on 1 Trading 212 customer reviews submitted by our visitors.

If you have traded with Trading 212 we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Trading 212

Article Sources

- Trading 212

- Trading 212 UK Limited - FCA License

- Trading 212 Markets Ltd - CySEC License

- Trading 212 Ltd. - Bulgaria’s Financial Supervision Commission (FSC)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

The zero commissions might be appealing but the app is super basic – it’s not got the charting tools you need if you’re serious about day trading. I’ve also seen dodgy stuff about changes to margin rules which made me stop using them.