TradeEU Review 2024

Pros

- Experienced traders will be pleased to see that hedging and EA trading strategies are permitted

- I appreciate that TradeEU offers several fee-free payment methods including bank wire, credit cards and e-wallets

- I like that there's a free demo account for beginners to get acquainted with the platform

Cons

- I also think it's a shame that there's no copy trading tools for beginners to learn from other users' strategies

- Only EUR is supported as the account base currency, which I think is pretty inconvenient for global traders

- TradeEU doesn't score well when it comes to educational resources and trading tools, with very few resources on offer

TradeEU Review

TradeEU offers CFD trading on 250+ assets spanning stocks, indices, forex, commodities, and cryptos. The CySEC-regulated brokerage also provides the popular MetaTrader 5 platform and mobile app. This TradeEU.com review will assess the broker’s spreads and commissions, leverage availability, minimum deposits, and sign-up bonuses. Find out if our team recommend opening an account with TradeEU.

Key Takeaways

- MT5 integration

- EUR trading account

- €250 minimum deposit

- Commission-free trading

- Best for traders in Europe

- Multiple accounts to suit different strategies

- Discretionary account opening charge

- High inactivity fee

- No live chat

Company Details

TradeEU is owned and operated by Titanedge Securities Ltd, registration number HE411909. The firm is authorized by the Cyprus Securities and Exchange Commission (CySEC), license number 405/21.

The vision of TradeEU is to make trading simple for investors of all experience levels. Daily market reviews, asset analysis and webinars can support trading decisions. The broker also offers floating spreads from 0.7 pips and leverage up to 1:30 for retail traders.

Platforms & Tools

3 / 5TradeEU offers the well-regarded MetaTrader 5 (MT5) platform. The terminal is suitable for both beginners and experienced traders, though new users may want to start with a demo account to get familiar with the features.

MT5 is a powerful platform with advanced analysis tools and customizable functions, including chart views, asset watchlists and multiple order types. Key functionality includes:

- 21 timeframes

- Three chart types

- 44 analytical objects

- Strategy backtesting

- 6 pending order types

- Level 2 market depth data

- MQL5 programming language

- 38+ in-built technical indicators

The terminal can be downloaded to desktop devices or accessed via major browsers.

How To Make A Trade

It is straightforward to open new trades on the MT5 platform.

Press the ‘New Order’ icon in the toolbar at the top of the screen. A new window will open. Enter the asset symbol, input the volume you want to trade (in lots), add stop loss or take profit parameters (optional), plus any comments (optional). Finally, confirm whether you want to ‘buy’ or ‘sell’.

Mobile App

The MT5 app provides all the features and functions of the desktop terminal, with smaller screen compatibility for smartphone and tablet devices. This includes full trading control, access to all order types, historical trade information, and all account options.

The MT5 mobile application is available to download on Apple (iOS) and Android (APK) devices.

Assets & Markets

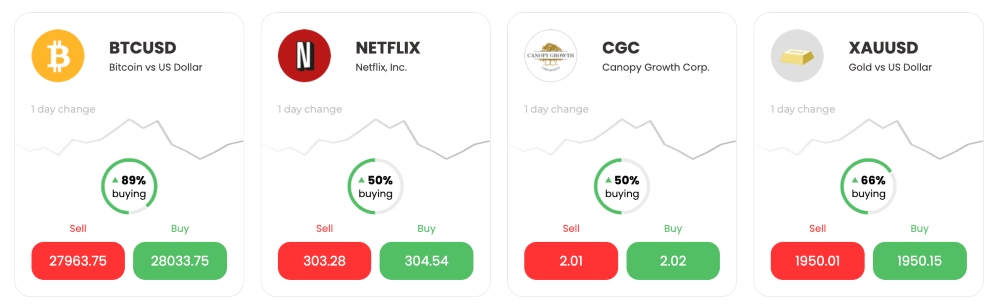

3 / 5TradeEU offers a modest selection of CFDs in five asset classes:

- Stocks – popular company shares including Facebook, Google, Netflix, and Apple

- Forex – major, minor and exotic currency pairs including EUR/USD, GBP/USD, USD/JPY, and GBP/CHF

- Cryptocurrency – leading digital currencies in USD pairs including BTC/USD, ETH/USD, and LTC/USD

- Indices – US, European and Asian stock indices including S&P 500, FTSE 100, and Hang Seng

- Commodities – metals, agriculture and energies including crude oil, gold, silver, wheat, and corn

Fees & Costs

2 / 5TradeEU offers commission-free trading across all account types with in-built spreads. These start from 2.5 pips on the Silver account, 1.3 pips on Gold, and 0.7 pips on Platinum. Swap fees apply for positions held overnight (after 9 PM GMT).

When we used TradeEU, we were offered spreads of 0.7 pips on the EUR/USD, 1 point on Apple stocks, and 1.2 points on Google stocks. These aren’t the cheapest fees around but they are similar to many alternatives.

On the downside, TradeEU charges hefty inactivity fees. These start at €50 for between 60 and 90 days of inactivity and climb to €500 per month after 300 days.

A €50 ‘examination of application’ charge may also apply for new account requests, though this is at the company’s discretion. This is unusual and a notable drawback.

Leverage

TradeEU offers leverage up to 1:30, which is aligned with CySEC rules and regulations. Leverage limits are in place to protect retail investors against significant losses.

- Major currency pairs – 1:30

- Minor currency pairs – 1:20

- Major indices – 1:20

- Commodities – 1:10

- Minor indices – 1:10

- Shares – 1:5

- Cryptocurrency – 1:2

Account Types

TradeEU offers three live trading accounts; Silver, Gold, and Platinum. These have been designed to suit different investment styles, customer needs, and experience levels, from beginner to advanced. All profiles offer leverage up to 1:30, a minimum trade size of 0.01 lots, and access to all 250+ instruments.

The main differences between the profiles are the access to tighter spreads and a personal account manager with Gold and Platinum. The majority of other features remain the same, including:

- Commission-free trading

- 50% margin stop-out level

- Hedging and EAs permitted

- MT5 trading platform and app

- Access to daily market analysis

Spreads by account type:

- Silver – Floating spreads from 2.5 pips

- Gold – Floating spreads from 1.3 pips

- Platinum – Floating spreads from 0.7 pips

How To Register For A TradeEU Account

It is relatively quick and easy to sign up for a TradeEU account:

- Complete the online registration form with personal details and account requirements

- Click on the activation link sent to your registered email address

- Login to the TradeEU client dashboard

- Deposit funds and upload personal documentation

- Start trading

Note that you will need to comply with AML and KYC requirements by uploading proof of identity and residency to access all trading activities.

Demo Account

TradeEU offers a free demo account to prospective customers. The simulated profile is loaded with €100,000 in virtual funds so you can practice investing risk-free.

You can switch between virtual and real accounts in the client dashboard.

Deposits & Withdrawals

Deposits

While using TradeEU, we were pleased to see free deposits and withdrawals.

The broker accepts credit/debit cards (Visa, Mastercard, and Maestro), bank wire transfers, and e-wallets (Neteller, Skrill, and WebMoney).

Credit/debit cards and e-wallet solutions offer instant account funding. Bank wire transfers can take up to three working days, which is similar to most brokers.

On the downside, EUR is the only base currency. Deposits made in another currency will be converted at the standard conversion rate.

How To Make A Deposit To TradeEU

- Log in to the client dashboard

- Select ‘Deposit’ from the main menu

- Enter your payment details in the secure pop-out window

- Click ‘Submit’

Note that to submit a new credit/debit card payment, you will need to complete an authorization form provided by the broker. This will be required each time a new card is used.

KYC documents are also required before deposits are accepted.

Withdrawals

TradeEU processes all withdrawal requests within 24 hours, which is competitive. With that said, you should allow at least three business days for funds to be received back to the original payment method.

Similar to deposits, TradeEU processes all withdrawals in Euros. However, fund requests made via a credit institution can be processed in EUR, GBP, or USD, though the client is still responsible for any charges.

Bonuses & Promotions

As an EU-regulated entity, TradeEU is not permitted to offer bonuses or financial incentives. This is aligned with other online brokerages operating in Europe.

The European Securities and Markets Authority stated in 2016 that “all bonus promotions used by brokerages that are tied to trading volumes are to be suspended” as they actively encourage retail investors to take risks with their money.

Regulation & Trust

3 / 5TradeEU is a registered trading name of Titanedge Securities Ltd. The broker is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 405/21.

This is a highly regarded financial agency, with multiple procedures in place to protect retail investors. Traders benefit from segregated accounts in top-tier banks, negative balance protection, and access to an investor compensation scheme with reimbursements of up to €20,000 in the case of business failure.

Additional Features

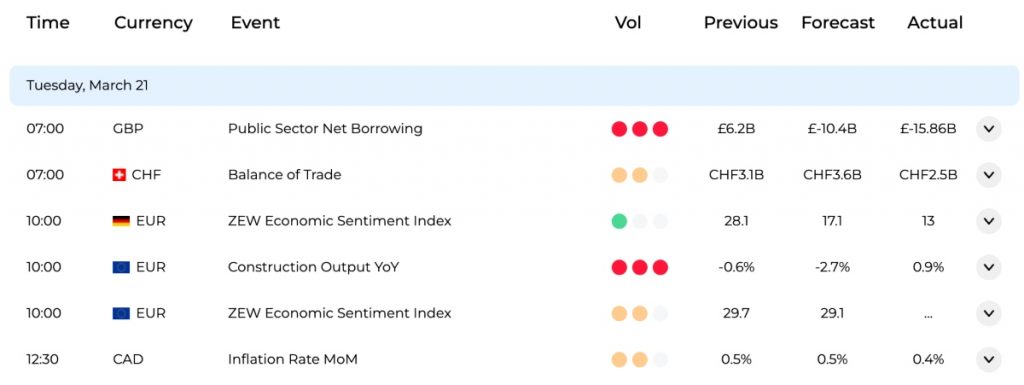

TradeEU falls short in terms of additional tools and market insights. With that said, there is a useful glossary of key terms, some asset analysis, and a basic economic calendar with upcoming events.

Overall, our experts were disappointed with the lack of trading tutorials, step-by-step platform guides, or courses to get started with online investing. There is also no copy trading, which is increasingly popular with retail investors and available at many leading alternatives.

Customer Support

2 / 5Customer support at TradeEU is adequate, though the brand has no live chat function, which is offered by top brokers like XTB and AvaTrade.

There are local telephone support numbers for a selection of EU countries, an email address, and an online inquiry form. The customer service team is available 24/7. Additionally, there is an FAQ section with basic self-help guidance and support.

Contact details:

- Email – support@tradeeu.com

- Online Inquiry Form – via the ‘Contact Us’ webpage

- Address – Panayides Building, 1st floor, Office no 11, 1 Chrysanthou Mylona Street, Ayia Zoni, 3030 Limassol, Cyprus

- Telephone – +35725263479 (Cyprus), +351300090048 (Portugal), +43720881165 (Austria), +31523796507 (Netherlands) and +46846502198 (Sweden)

Trading Hours

The broker follows standard market opening hours. Unfortunately, TradeEU does not offer extended hours, including pre-market or post-market trading.

A useful trading hours and public holiday page is available on the broker’s website. Upcoming market closures and amendments to opening hours are published here.

Security & Safety

TradeEU offers a secure trading platform with robust safety standards. All data transmissions are fully encrypted using firewalls and Secure Sockets Layer (SSL). Trading servers are located in SAS 70-certified data centers.

Payment transactions are authorized with Level 1 PCI compliance. Retail investors can also add two-factor authentication to their accounts.

TradeEU Verdict

The services at TradeEU are basic but the firm does provide everything you need to get started with CFD trading. The MT5 platform and CySEC oversight are also good signs that the broker is reliable. On the downside, inactivity fees are high and only Platinum account holders benefit from the best spreads.

Overall, there are alternative brokers with a wider range of products, lower fees and more competitive trading conditions.

FAQ

Is TradeEU Expensive?

TradeEU offers commission-free trading on its 250+ instruments, however spreads vary by account type and product. These start from 2.5 pips on the Silver profile, 1.3 pips on Gold, and 0.7 pips on the Platinum account. But while this is relatively competitive, non-trading fees are expensive. There is a €50 discretionary charge for new application requests, plus a high inactivity fee ranging from €50 to €500 per month.

Does TradeEU Offer High Leverage?

TradeEU offers leverage up to 1:30, which is in line with EU regulations. There are brokers with higher leverage but they may operate without robust regulatory oversight. Trading with high leverage also increases the risk of large losses.

Is TradeEU Legit Or A Scam?

TradeEU is a secure forex and CFD broker. Our review confirms that the broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) and provides negative balance protection, access to compensation schemes, and uses segregated accounts for client and company funds. In addition, TradeEU encrypts all data transmissions and payments are made with PCI Level 1 compliance.

What Platform Does TradeEU Offer?

TradeEU offers the MetaTrader 5 (MT5) platform. There is no proprietary software, though the third-party terminal offers a suite of analysis tools, custom charts and graphs, price watchlists, news streams, and automated trading capabilities. MT5 is also available as a mobile app.

Is It Easy To Open An Account With TradeEU?

Yes, it is fairly straightforward to register with TradeEU. New users must complete an online application form and upload identity documentation in line with regulatory requirements. You can start trading once your application has been reviewed and approved.

Is TradeEU A Good Or Bad Broker?

TradeEU is an average CFD and forex broker. The brand offers a stable platform in MT5, a reasonable selection of instruments including stocks, indices, forex, commodities and cryptos, plus a choice of accounts to suit different trading strategies. The firm is also regulated by the CySEC.

On the downside, TradeEU falls down when it comes to useful tools like copy trading and doesn’t offer the lowest fees or live chat support. Inactivity charges are also high.

Top 3 Alternatives to TradeEU

Compare TradeEU with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

TradeEU Comparison Table

| TradeEU | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 2.9 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs on Stocks, Forex, Indices, Metals, Energies, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €250 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 9 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by TradeEU and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TradeEU | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

TradeEU vs Other Brokers

Compare TradeEU with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of TradeEU yet, will you be the first to help fellow traders decide if they should trade with TradeEU or not?