Sky Alliance Markets Review 2024

Pros

- MT4 integration

- Demo account

- Copy trading

Cons

- Weak customer support

Sky Alliance Markets Review

Sky Alliance Markets is an Aussie-headquartered forex and CFD broker. The firm offers 75+ instruments in five asset classes, alongside 1:400 leverage, a free demo account and a copy trading tool. This Sky Alliance Markets review will examine the website’s account options, payment methods, customer support, and regulatory status. Our traders also explain how to sign up for a Sky Alliance Markets account and start trading.

Key Takeaways

- Sky Alliance Markets has a $100 minimum deposit, demo account and copy trading

- Leveraged trading is available on the MetaTrader 4 platform and mobile app

- The account opening process is slow and cumbersome

- Customer support services are lacking

Company History & Overview

Sky Alliance Markets Pty Ltd is a financial brokerage based in Sydney, Australia, founded in 2005. The broker uses a no-dealing desk model (NDD), meaning retail investors benefit from access to live interbank pricing.

Sky Alliance Markets is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services License (AFSL).

Trading Platform

Sky Alliance Markets offers MetaTrader 4 (MT4) via desktop download or mobile app.

MT4 is a leading third-party terminal for forex trading, but its intuitive design extends to all tradable assets. Developed in 2005 by MetaQuotes Software, its popularity amongst traders can be credited to its various user-friendly features, including charting and analysis, automated trading (EAs), and a large community of online traders. Day traders can also access three order execution modes and four pending orders.

How To Use MT4

- Create a Sky Alliance Markets live trading account

- Download MetaTrader 4 (direct download link available on the broker’s website)

- Sign in to the MT4 platform with your registered credentials

- Start trading on the broker’s 75+ assets

Once you have signed in, there are three main windows; market watch, the terminal, and the main charting screen. The market watch window gives you the option to choose a list of assets to monitor. The terminal shows your trading activity, including open positions or any profits you make. The main screen shows live charts (up to four at a time) of the assets you choose to monitor.

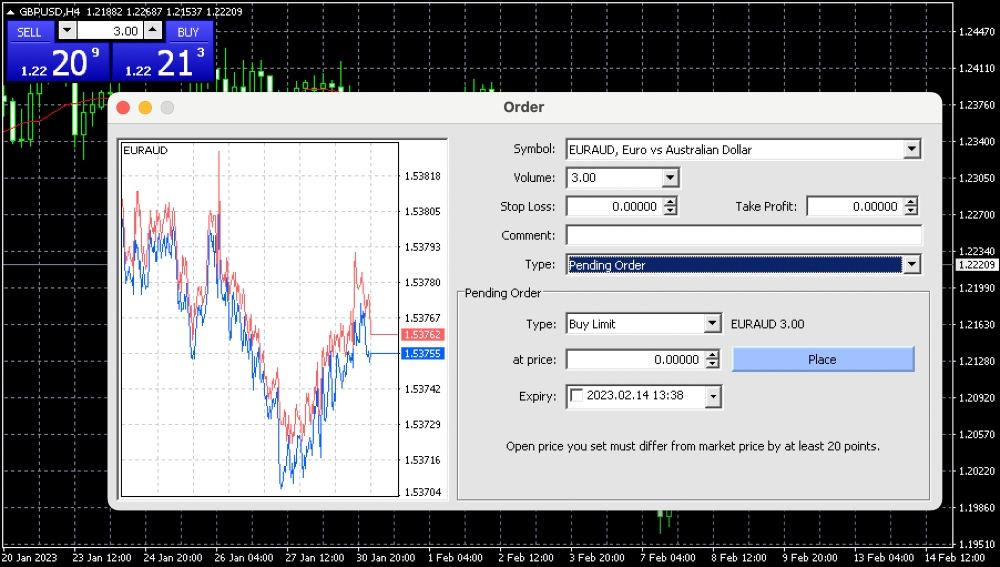

How To Place A Trade

- Log in to the MT4 platform

- Click on the ‘New Order’ icon in the top toolbar

- Choose the asset you want to trade such as AUD/USD

- Input the trade details such as position size and risk parameters such as stop loss or take profit (optional)

- Select ‘Buy’ or ‘Sell’ to open a position

Markets & Instruments

Sky Alliance Market’s product lineup is not the largest vs other brands, with just 75+ assets available:

- Futures – Trade the US Dollar Index (USIDX) as a futures contract

- Indices – 8 major global indices including UK100, GER30, and AUS200

- Cryptocurrency – 5 popular cryptocurrencies including Bitcoin, Bitcoin Cash and Ethereum

- Commodities – 3 precious metals and 2 energies including Gold, Silver, and Brent Oil

- Forex – 57 forex pairs including majors (such as EUR/USD), minors (such as AUD/JPY), and exotic pairs (such as AUD/ZAR)

Sky Alliance Markets Fees

Sky Alliance Markets is fairly typical in terms of its trading fees. Users that have registered for an ECN account are liable for a $7 commission per round lot turn plus tight spreads from 0 pips on the EUR/USD currency pair. Traders using the Standard profiles can trade commission-free, with spreads from 1 pip on the EUR/USD pair.

Swap fees also apply for positions held overnight, except for Islamic trading accounts.

Fortunately, there are no deposit or withdrawal fees at Sky Alliance Markets.

Leverage

Sky Alliance Markets offers high leverage up to 1:400 and a 50% stop-out level. However, maximum ratios do vary between asset classes. Also, regulatory restrictions may limit the leverage available depending on where you register for an account.

- Forex: Up to 1:400

- Indices: Up to 1:100

- Futures: Up to 1:100

- Commodities: Up to 1:200

- Cryptocurrencies: Up to 1:5

Mobile App

When we used Sky Alliance Markets, we were disappointed to find there was no proprietary mobile app. With that said, MT4 is available as a mobile application, currently available on Android devices only.

The MT4 application is user-friendly, with all the features of the desktop software. Day traders can open and close positions, create custom charts, amend watchlists and view live price quotes.

Keep in mind detailed analysis can be difficult on phone screens. A stable internet connection is also key to getting the most from the app.

Payment Methods

Sky Alliance Markets has a relatively low minimum deposit of just $100 or equivalent currency with the Standard account. It is also good to see that the broker does not charge a fee for account funding or withdrawals.

Accepted payment methods include:

- Cryptocurrency: Up to 24-hour processing time. BTC and USDT only

- Union Pay: Up to 24-hour processing time. CNY accepted only

- Payment Asia: Up to 24-hour processing time. PHP accepted only

- Neteller & Skrill: Up to 24-hour processing time. USD accepted only

- Credit/Debit card: Up to 24-hour processing time. USD, GBP, EUR, AUD, and NZD accepted currencies

- Bank wire transfer: Two to five business days processing time. USD, GBP, EUR, AUD, and NZD accepted currencies

How To Make A Deposit

- Log in to the Sky Alliance Markets customer portal

- Click ‘Transfers’ and then ‘Fund Account’

- Select the payment method

- Input details such as the card number and reference

- Enter the amount

- Press ‘Submit’

Demo Account

Sky Alliance Markets offer a free demo account. The registration form can be accessed from the top menu on the broker’s web pages by clicking on the blue ‘Demo Account’ icon. You will need to input your name and contact details to sign up.

Note, demo accounts are only available in USD virtual currency.

Bonuses & Promotions

At the time of writing, Sky Alliance Markets did not offer any financial incentives or bonus rewards to new or existing customers. This includes welcome deposit bonuses or no-deposit rewards.

This is aligned with the ASIC’s position on the use of bonuses to encourage risky investment decisions.

Sky Alliance Markets Regulation

Sky Alliance Markets is regulated by the Australian Securities and Investments Commission. The ASIC is a highly regarded body that ensures brokers comply with stringent rules, including negative balance protection and segregated accounts. Sky Alliance Markets keeps traders’ funds separate at the National Australia Bank.

The broker is also routinely audited and holds Indemnity insurance to protect global traders. Indemnity insurance covers retail investor losses generated due to negligent services or advice.

Account Types

Sky Alliance Markets offers four live trading accounts; Standard, Swap-Free Standard, ECN, and Swap-Free ECN. All accounts have five base currency options (USD, GBP, EUR, AUD, and NZD), leverage up to 1:400, and a minimum trade size of 0.01 lots.

The swap-free versions of the account types provide the same account conditions, with the removal of overnight holding charges.

Standard Accounts

- Commission-free

- Spreads from 1 pip

- $100 minimum deposit or equivalent currency

ECN Accounts

- Spreads from 0 pips

- $7 commission per round lot turn

- $1000 minimum deposit or equivalent currency

The ECN accounts are the best fit for active traders looking for competitive fees.

Corporate and PAMM/MAM accounts are also available upon request.

How To Open A Sky Alliance Markets Account

- Select the red ‘Live Account’ icon on the Sky Alliance Markets website or click the ‘Visit’ button in this review

- Enter sign-up details including language settings, account type, full name and contact information

- Complete KYC verification by providing proof of identity and address

- Await an email confirmation with login credentials

- Make a deposit using one of the supported methods

- Download the MT4 platform and start trading

Allow up to three working days for a new account request to be confirmed due to a ‘suitability’ review and identity verification approval. Unfortunately this is notably slower than many competitors.

Additional Tools

Education

The Sky Alliance Markets website offers free educational resources, though the information is very basic. This includes keyword glossaries and an economic calendar. Some information is yet to be translated from simplified Chinese, though it can be downloaded and translated via third-party translator sites.

Day traders can also access market insights and economic news, however, while using Sky Alliance Markets, we found most of the information was outdated and of limited use.

Copy Trading

The broker also offers copy trading. The ‘signal source function’ allows traders to select a professional investor to follow and mirror. The system supports an unlimited number of copied positions and reverse copy trading with no delays. Positions can be opened using a volume allocation or percentage allocation of invested funds.

Clients can request access to the copy trading tool by signing up on the website.

Trading Hours

Sky Alliance Markets follows standard trading hours, though this varies by instrument.

- Forex: Sunday 22:00 to Friday 22:00 (GMT+3)

- Futures: Sunday 23:00 to Friday 22:00 (GMT+3)

- Commodities: Sunday 23:00 to Friday 22:00 (GMT+3)

- Cryptocurrencies: Sunday 22:00 to Friday 22:00 (GMT+3)

- Indices: Varies by the local market. For example, the JPN225 index can be traded Sunday from 23:00 to Friday 22:00 and the FRA40 index Monday from 07:00 to Friday 21:00 (GMT+3)

Customer Support

Customer support at Sky Alliance Markets is limited. The support team can only be reached via email at client@skyallmarkets.com or info@skyalliancemarket.com.

It was disappointing to see no live chat or telephone support, which are offered by the majority of broker-dealers. There is also no information regarding contact hours.

Security & Safety

Sky Alliance Markets claims to use the ‘latest technologies to provide a security shield for customers’ financial safety’. However, what this means in practice is unclear.

On a more positive note, the MetaTrader 4 platform offers transaction encryption, data privacy protocols, and two-factor authentication when you log in.

Sky Alliance Markets Verdict

Sky Alliance Markets offers relatively competitive trading conditions with high leverage and ECN accounts. The trading firm is also regulated by the Australian Securities and Investments Commission (ASIC) which suggests the company is trustworthy.

However, Sky Alliance Markets does fall down in terms of its customer support, pricing transparency, and access to additional trading tools and features.

FAQs

Is Sky Alliance Markets Legit Or A Scam?

Sky Alliance Markets (AU) Pty Ltd is a legitimate trading broker. The firm is regulated by the Australian Securities and Investments Commission (ASIC) and uses segregated client accounts plus negative balance protection. An investor compensation fund is also in place.

Is Sky Alliance Markets A Good Broker?

There is nothing that stands out in the services offered by Sky Alliance Markets. The broker offers 75+ instruments, access to the MetaTrader 4 platform, and a copy trading tool. However, our review found inadequate customer support, slow account opening times, and unclear fee information.

Is Sky Alliance Markets Good For Day Trading?

The ECN account is suitable for intraday trading with tight spreads and low commissions. The MT4 platform also offers fast and reliable trade executions. In addition, 1:400 leverage can be used to amplify positions sizes.

Can I Practice Trading With Sky Alliance Markets?

Sky Alliance Markets offers a free demo account for new clients. Users can practice trading risk-free with virtual funds on the MT4 platform and app. You can sign up for a demo account on the broker’s official website. You will need to provide basic personal details and then wait for login credentials to be sent to your email address.

Does Sky Alliance Markets Offer A Wide Range Of Instruments?

Sky Alliance Market’s product list is limited, with only 75+ products available across five asset classes. This includes 57 currency pairs, 5 cryptocurrencies, and 8 major global indices. On the downside, there are no stocks.

Does Sky Alliance Markets Have A Low Minimum Deposit Requirement?

Sky Alliance Market’s minimum deposit for the Standard account is $100 or equivalent currency. Customers registering for an ECN profile will be required to deposit $1000. As a result, the Standard account is the best fit for beginners while the ECN account will meet the needs of active traders.

Top 3 Alternatives to Sky Alliance Markets

Compare Sky Alliance Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

Sky Alliance Markets Comparison Table

| Sky Alliance Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 2 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos, Futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:400 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Sky Alliance Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Sky Alliance Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

Sky Alliance Markets vs Other Brokers

Compare Sky Alliance Markets with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Sky Alliance Markets yet, will you be the first to help fellow traders decide if they should trade with Sky Alliance Markets or not?