Scott Burns Couch Potato Portfolio

The Scott Burns Couch Potato Portfolio is a simple, easy-to-understand investment strategy that has gained popularity among investors looking for a hands-off approach to growing their wealth.

This portfolio was developed by financial columnist Scott Burns, who recognized the need for a simple investment method that required minimal effort and expertise.

In this article, we will explore the Couch Potato Portfolio’s allocation, advantages, and disadvantages, as well as discuss who might benefit most from this investment approach.

Key Takeaways – Scott Burns Couch Potato Portfolio

- The Couch Potato Portfolio is a simple and hands-off investment strategy that allocates 50% to stocks and 50% to bonds.

- Its advantages include lower fees, reduced complexity, diversification, and minimal maintenance.

- However, the portfolio may have limited potential returns, inflation risk, and lacks customization options. It is best suited for investors who prioritize simplicity and ease of management.

- We ran a backtest looking at its performance and comparing it to the S&P 500 across various dimensions.

Couch Potato Portfolio Allocation

The Couch Potato Portfolio is simply built on a 50/50 allocation between stocks and bonds.

This simplicity lies at the heart of the portfolio’s success, as it eliminates the need for extensive research and constant rebalancing.

To implement this strategy, investors can simply allocate 50% of their investment funds to a low-cost, broad-based stock index fund (such as the S&P 500 index fund) and the remaining 50% to a bond index fund (such as a total bond market index fund).

This allocation can be adjusted according to individual risk tolerance, but the 50/50 split remains the most common configuration.

Couch Potato Portfolio Advantages

The simplicity of the Couch Potato Portfolio offers several benefits, such as:

Lower fees

By using low-cost index funds, investors can minimize the fees they pay to fund managers, which can significantly impact long-term returns.

Reduced complexity

The simple allocation strategy requires minimal knowledge of the stock market, making it accessible to novice investors.

Diversification

The 50/50 split between stocks and bonds provides a level of diversification that can help protect against market volatility.

Minimal maintenance

With no need for frequent rebalancing or complicated calculations, the Couch Potato Portfolio is a low-maintenance investment strategy.

Couch Potato Portfolio Disadvantages

Despite its simplicity, the Couch Potato Portfolio does have some drawbacks, including:

Limited potential returns

The conservative allocation may result in lower returns compared to more aggressive investment strategies.

Inflation risk

With a significant portion invested in bonds, the portfolio may be more exposed to inflation risk, potentially eroding purchasing power over time.

Moreover, when inflation runs warmer than expected, both stocks and bonds are hit.

No customization

The simple 50/50 allocation may not suit all investors’ risk profiles or financial goals.

Who Is the Couch Potato Portfolio Best For?

The Couch Potato Portfolio is ideal for investors who value simplicity and ease of management above all else.

It is particularly well-suited for those who are new to investing, lack the time or inclination to actively manage their investments, or are approaching retirement and looking for a more conservative allocation.

However, investors with more aggressive growth goals or a higher risk tolerance may find the Couch Potato Portfolio too conservative for their needs.

Overall, it’s important to consider individual financial goals and risk tolerance before adopting any investment strategy.

Couch Potato Portfolio Performance

We ran a test to see how the portfolio has performed over time against the S&P 500 (a common benchmark).

We ran the test from 1972 forward.

Here are the results.

Performance Summary

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Couch Potato Portfolio (50/50) | $10,000 | $799,946 | 8.91% | 9.04% | 30.67% | -17.40% | -23.87% | 0.50 | 0.76 | 0.89 |

| S&P 500 | $10,000 | $1,554,061 | 10.33% | 15.75% | 37.82% | -37.04% | -50.89% | 0.42 | 0.61 | 1.00 |

The Couch Potato Portfolio has better risk-adjusted performance because of the 50/50 split providing better diversification.

It has lower volatility, better returns relative to its volatility, lower drawdowns, a higher Sharpe ratio, and a higher Sortino ratio.

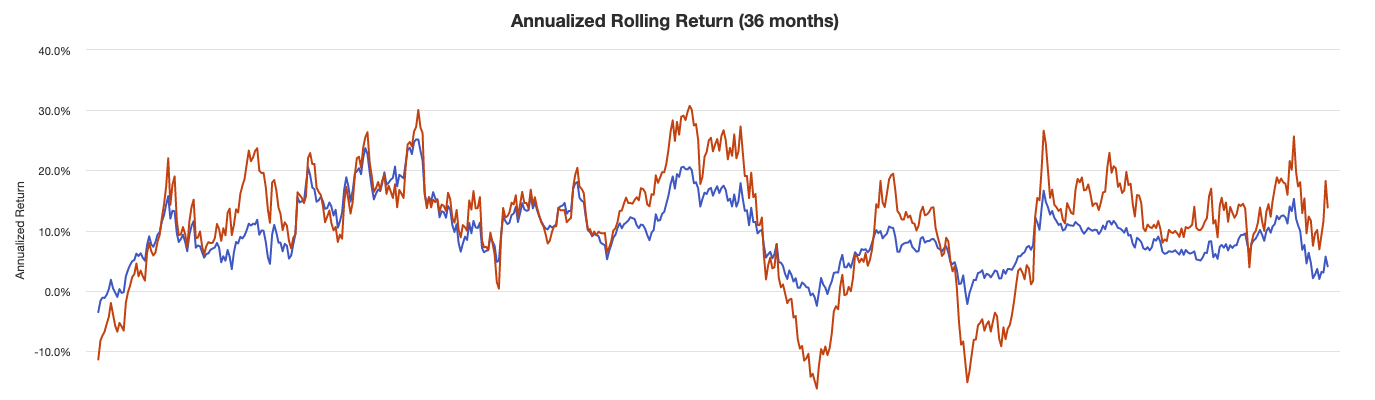

We see it doesn’t have the big ups and down (blue line) like the S&P 500 (red line) that’s purely equities.

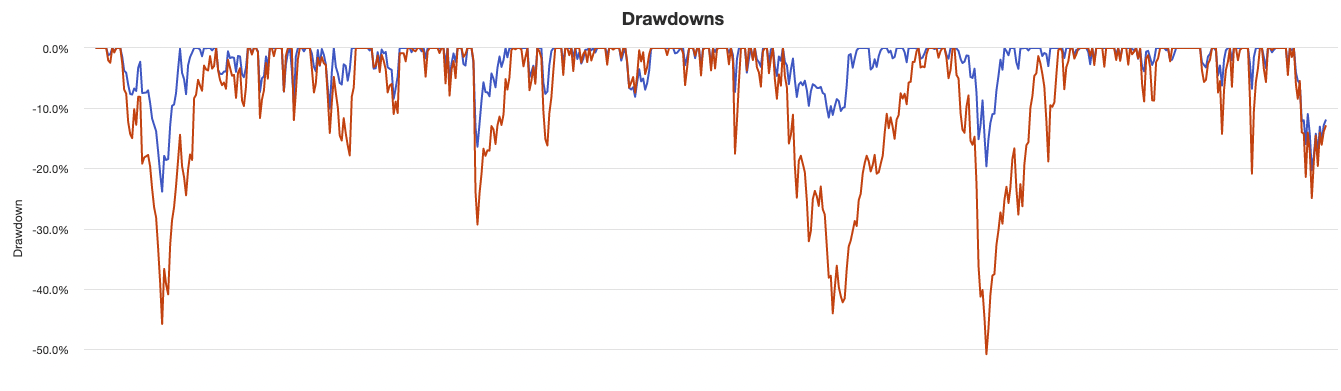

This chart shows its shallower drawdowns:

We have more complete summary statistics below:

Couch Potato Portfolio Performance Statistics

| Metric | Couch Potato Portfolio | S&P 500 |

|---|---|---|

| Arithmetic Mean (monthly) | 0.75% | 0.93% |

| Arithmetic Mean (annualized) | 9.35% | 11.71% |

| Geometric Mean (monthly) | 0.71% | 0.82% |

| Geometric Mean (annualized) | 8.91% | 10.33% |

| Standard Deviation (monthly) | 2.61% | 4.55% |

| Standard Deviation (annualized) | 9.04% | 15.75% |

| Downside Deviation (monthly) | 1.53% | 2.96% |

| Maximum Drawdown | -23.87% | -50.89% |

| Stock Market Correlation | 0.89 | 1.00 |

| Beta(*) | 0.51 | 1.00 |

| Alpha (annualized) | 3.30% | 0.00% |

| R2 | 79.16% | 100.00% |

| Sharpe Ratio | 0.50 | 0.42 |

| Sortino Ratio | 0.76 | 0.61 |

| Treynor Ratio (%) | 8.89 | 6.69 |

| Calmar Ratio | 0.20 | 0.55 |

| Active Return | -1.42% | 0.00% |

| Tracking Error | 8.75% | 0.00% |

| Information Ratio | -0.16 | N/A |

| Skewness | -0.21 | -0.52 |

| Excess Kurtosis | 1.23 | 1.92 |

| Historical Value-at-Risk (5%) | -3.65% | -7.14% |

| Analytical Value-at-Risk (5%) | -3.54% | -6.55% |

| Conditional Value-at-Risk (5%) | -5.23% | -10.11% |

| Upside Capture Ratio (%) | 56.40 | 100.00 |

| Downside Capture Ratio (%) | 45.36 | 100.00 |

| Safe Withdrawal Rate | 4.05% | 4.31% |

| Perpetual Withdrawal Rate | 4.57% | 5.81% |

| Positive Periods | 405 out of 616 (65.75%) | 384 out of 616 (62.34%) |

| Gain/Loss Ratio | 1.11 | 1.02 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are based on monthly values. | ||

FAQs – Couch Potato Portfolio

Can I adjust the 50/50 allocation in the Couch Potato Portfolio based on my risk tolerance?

Yes, you can adjust the allocation to suit your risk tolerance and investment goals.

Some investors may choose a more aggressive approach with a higher percentage allocated to stocks, while others may prefer a more conservative allocation with a higher percentage in bonds.

How often should I rebalance my Couch Potato Portfolio?

One of the benefits of the Couch Potato Portfolio is its low-maintenance nature.

Ideally, as covered in a separate article, one should review and rebalance your portfolio once a year or when the allocation between stocks and bonds drifts significantly from your target percentages.

This helps maintain your desired level of risk exposure.

Can I use the Couch Potato Portfolio for my retirement savings?

Yes. The Couch Potato Portfolio is a suitable option for retirement savings due to its simplicity and diversified allocation.

You may consider adjusting the allocation as you approach retirement, increasing the bond portion to preserve capital and reduce risk.

Can I implement the Couch Potato Portfolio with exchange-traded funds (ETFs) instead of index funds?

Yes, you can use ETFs to create a Couch Potato Portfolio. The key is to select low-cost, broad-based ETFs that track the stock and bond markets.

Be sure to compare expense ratios, trading fees, and liquidity to make an informed decision when selecting ETFs.

Is the Couch Potato Portfolio tax-efficient?

Generally, the Couch Potato Portfolio is tax-efficient due to its use of low-cost index funds or ETFs, which typically have lower turnover rates and generate fewer taxable events.

However, taxes will still apply to any dividends or interest income received, as well as capital gains realized when selling shares.

To maximize tax efficiency, consider holding the Couch Potato Portfolio in tax-advantaged accounts like an IRA or 401(k).

How does the Couch Potato Portfolio compare to other popular passive investment strategies, such as the Three-Fund Portfolio or the Bogleheads approach?

The Couch Potato Portfolio is simpler than other passive investment strategies, making it more accessible for novice investors or those who prefer a hands-off approach.

While the Three-Fund Portfolio and Bogleheads approach offer more diversification through exposure to international stocks and additional asset classes, they also require a little more effort to maintain and may incur higher fees. (This is generally true the more complex and active you make something.)

Overall, the choice between these strategies will depend on your financial goals, risk tolerance, and desired level of involvement in managing your investments.

Related

- Harry Browne Permanent Portfolio

- Golden Butterfly Portfolio

- Yale Portfolio (David Swensen Lazy Portfolio)

- Paul Merriman Ultimate Buy & Hold Portfolio

- Gone Fishing Portfolio

- 3-Fund Bogleheads Portfolio