Savings & Loan Crisis (1980s) – Causes & Lessons for Today’s Portfolios

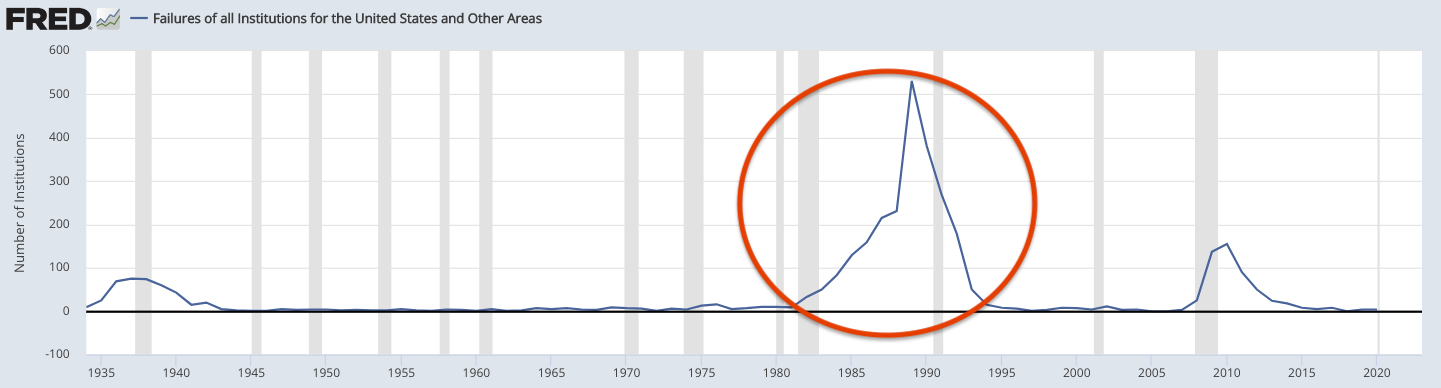

The Savings and Loan (S&L) crisis of the 1980s and early 1990s is a period of widespread banking failures in the US.

It was a disaster that led to the failure of nearly a third of the 3,234 savings and loan associations in the United States between 1986 and 1995.

Failures of all Institutions for the United States and Other Areas

Key Takeaways – Savings & Loan Crisis (1980s)

- Deregulation, rising interest rates, and fraud were the main causes of the Savings and Loan (S&L) crisis in the 1980s and early 1990s, leading to the failure of numerous S&L institutions.

- The crisis emphasized the importance of risk management, diversification, and regulatory oversight in investment portfolios.

- Excessive risks and lack of diversification can have disastrous outcomes, and appropriate regulations are necessary to prevent risky and fraudulent actions.

- Understanding the lessons from the S&L crisis helps investors make better investment decisions by emphasizing the need for diversification, risk assessment, due diligence, and learning from historical financial crises.

Key Statistics Related to the Savings & Loan Crisis (1980s)

- The Savings and Loan (S&L) crisis took place in the United States from the late 1970s to the early 1990s, with its peak in the late 1980s.

- More than 1,000 savings and loan institutions (S&Ls), or more than one-third of the S&Ls in the United States, failed during this period.

- Financial losses from the crisis are estimated to have totaled around $160 billion.

- The taxpayer cost of the crisis was approximately $132 billion, with the remaining losses being absorbed by the S&L industry itself.

- The crisis resulted in the insolvency of the Federal Savings and Loan Insurance Corporation (FSLIC) in 1989, leading to its absorption by the Federal Deposit Insurance Corporation (FDIC).

- The Resolution Trust Corporation (RTC) was created in 1989 to liquidate the assets of failed S&Ls and it closed its operations in 1995, after disposing of assets worth approximately $394 billion.

- The crisis led to severe economic impacts, including significant job losses. The real estate sector was particularly hard hit, with a substantial drop in property values across the United States.

- Major legal and regulatory changes were made in response to the crisis, including the passing of the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) in 1989, which implemented several measures to prevent a similar crisis in the future. (Though different types of crises eventually will.)

- More than 1,800 individuals were prosecuted in connection with the S&L crisis, leading to over 1,000 convictions for various crimes such as fraud, insider trading, and racketeering.

Causes of the Crisis

Deregulation

The first major cause of the crisis was deregulation.

The Depository Institutions Deregulation and Monetary Control Act of 1980 eliminated several restrictions on S&Ls, allowing them to compete more directly with banks by offering checking accounts and significantly higher interest rates on savings.

The Garn-St Germain Depository Institutions Act of 1982 further liberalized rules for S&Ls, enabling them to invest significantly in commercial real estate, which was riskier.

Rising Interest Rates

Rising interest rates in the early 1980s were a catalyst for the crisis.

As interest rates increased, so did the cost of mortgages, causing a decline in real estate values and an increase in defaults on loans.

S&Ls, who had a lot of their assets tied up in long-term, fixed-rate mortgages, suffered significant losses when these mortgages lost value.

Fraud and Mismanagement

Fraud and mismanagement also played a significant role in the crisis.

The loosened regulations enabled a series of risky, fraudulent, and in some cases illegal activities that ultimately resulted in enormous losses.

From 1986 to 1995, federal prosecutors convicted 1,072 S&L officials for various crimes such as fraud, racketeering, and insider trading.

The Impact of the Crisis

The total cost of the S&L crisis is estimated to have totaled around $160 billion, with taxpayers footing the bill for $132 billion and the S&L industry itself covering the rest.

The crisis resulted in the liquidation or merger of 747 S&Ls between 1989 and 1991 alone.

This coincided with the top in the commercial real estate bubble, and also the top in the market and economic bubble in Japan.

Lessons for Today’s Portfolios

The Importance of Risk Management

The S&L crisis underscores the importance of risk management.

Today’s investors must recognize that taking excessive risks can lead to disastrous outcomes.

The S&Ls were overly exposed to the real estate market, and when it collapsed, they were unable to absorb the losses.

The Role of Diversification

The crisis highlighted the importance of diversification.

A well-diversified portfolio can help investors avoid being overly exposed to a single sector or type of investment/asset.

As the S&Ls were heavily invested in real estate, when that market collapsed, they were disproportionately affected.

Regulations and Oversight Matter

The crisis serves as a reminder that regulations and oversight matter.

The deregulation of the S&L industry allowed many to engage in risky and fraudulent behavior.

This indicates the necessity for appropriate regulation and oversight in any investment environment.

Bear Markets Can Potentially Last for Decades

Bear markets can persist for extended periods, as shown by Japan’s experience after its market peak in 1989.

Japan’s stock market, known as the Nikkei, endured a multi-decade bear market, with intermittent rallies but no sustained recovery.

This serves as a reminder that bear markets can persist for years or even decades.

It highlights the importance of not making any given asset class too big of a part of your portfolio, patience, and risk management to navigate through such market periods.

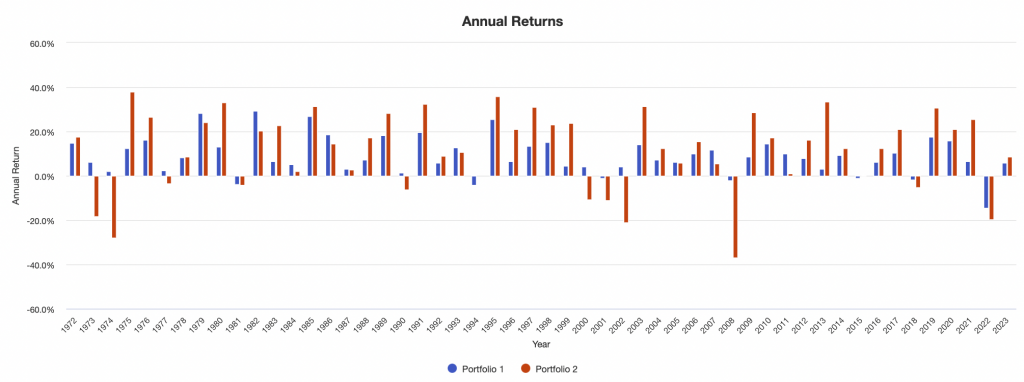

How Did Portfolios Do During This Period?

Of course, it depends on the portfolio, but portfolios that were well-balanced did quite well and didn’t miss a beat.

For example, take this simple three-asset portfolio:

Portfolio 1

- 35% Stocks

- 50% 10-Year Treasury Bonds

- 15% Gold

Versus:

Portfolio 2

- 100% Stocks

In 1990, in the midst of the ongoing S&L crisis, the 100% Stocks portfolio (“Portfolio 2”) lost about 6% for the year.

But even the diversification within a broad range of stocks didn’t bring down the index overall.

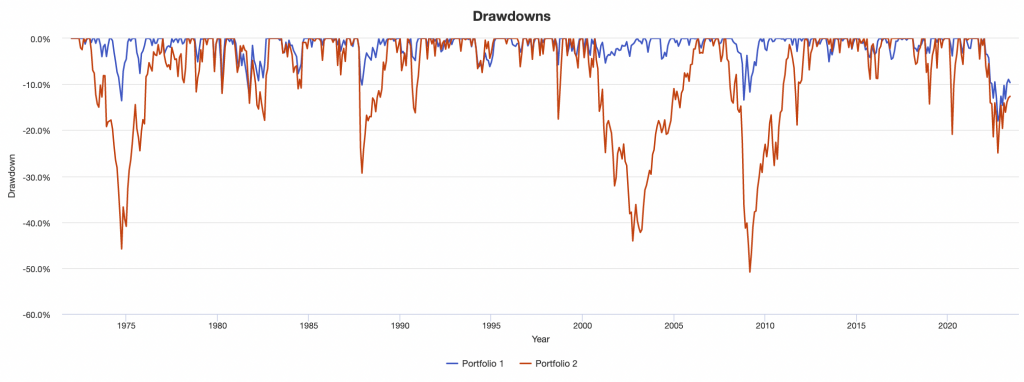

Drawdowns

We can also look at drawdowns over time.

There was a large drawdown in the stocks portfolio in 1987 with the infamous one-day crash in October of that year, but that wasn’t related to the S&L crisis.

FAQs – Savings & Loan Crisis (1980s): Causes & Lessons for Today’s Portfolios

What was the Savings and Loan Crisis of the 1980s?

The Savings and Loan Crisis of the 1980s and 1990s was a multi-year financial event that led to the failure of more than 1,000 savings and loan institutions in the United States.

This crisis was primarily caused by deregulation in the savings and loan industry during the 1980s, risky and fraudulent business practices, and a slowdown in the US real estate market.

It cost US taxpayers about $132 billion, and the total cost of the crisis is estimated to have totaled $160.1 billion.

What were the main causes of the Savings and Loan Crisis?

The primary causes of the Savings and Loan Crisis were deregulation, risky business practices, and a real estate downturn.

The deregulation of the savings and loan industry allowed these institutions to engage in commercial real estate lending, a much riskier activity than their traditional residential mortgage lending.

The Garn-St. Germain Depository Institutions Act of 1982 allowed savings and loans institutions to issue adjustable-rate mortgage loans and increased federal insurance for bank deposits.

This led to moral hazard, as risky investments were made with government-guaranteed deposits.

Additionally, a downturn in the real estate market meant that many savings and loans associations (S&Ls) had to mark down the value of their real estate assets and eventually became insolvent.

Mismanagement and fraud also played a significant role in the crisis.

How did the Savings and Loan Crisis impact the US economy?

The Savings and Loan Crisis had a significant impact on the US economy.

The Federal Savings and Loan Insurance Corporation (FSLIC), the insurer of the S&Ls, became insolvent as it had to repay depositors of the failed institutions, leading to a taxpayer-funded government bailout.

Additionally, the crisis slowed down economic growth, and it is estimated that the total cost of the crisis reached $160.1 billion, out of which taxpayers had to bear around $132 billion (some estimates place it at $124 billion).

The crisis also led to tighter regulations in the banking industry and marked a shift towards a more risk-averse approach in the financial industry.

It took several years for the banking industry to recover from the crisis and for consumer confidence in the financial sector to be restored.

What lessons can we learn from the Savings and Loan Crisis for managing today’s portfolios?

The Savings and Loan Crisis offers several important lessons for portfolio management.

First, it underlines the importance of diversification to protect against market downturns.

Many S&Ls were heavily invested in local real estate and suffered greatly when the market declined.

Second, it serves as a warning against overreliance on high-risk investments, especially those backed by government insurance.

Despite the possibility of high returns, these investments can result in significant losses in the event of a market downturn.

Finally, the crisis shows the importance of prudent risk management and due diligence.

Many S&Ls engaged in fraudulent or reckless behavior, ultimately leading to their downfall. It is important for investors to thoroughly research their investments and to be wary of investments that seem too good to be true.

How can I apply these lessons to my personal investment or trading strategy?

Applying the lessons from the Savings and Loan Crisis can help understand that diversification is key, and it’s important not to put all your eggs in risky and volatile sectors like real estate.

Risk assessment is another vital part of any trading/investment strategy.

Understand the risks involved with each of your investments and ensure they align with your risk tolerance and investment goals. Be wary of investments offering high returns with supposed low risk.

Lastly, do your due diligence. Research your investments thoroughly and don’t rely solely on advice from those who seem knowledgable. Make sure everything makes sense.

Watch out for financial promotions and things that aren’t tried and true.

How can understanding the Savings and Loan Crisis help me make better investment decisions?

Understanding the Savings and Loan Crisis provides insights into the potential risks in the markets.

By understanding the mistakes made during this crisis, you can better prepare and protect your investments from similar scenarios.

The crisis serves as a stark reminder of the importance of diversification, risk assessment, and due diligence in managing a portfolio.

Conclusion

The Savings and Loan crisis of the 1980s provides important lessons for today’s investors.

While it was a catastrophic event that led to significant losses, the lessons learned have helped shape the way we manage our portfolios today, like in other bubbles we’ve covered in other articles in this series (below).

By understanding the causes and impact of the crisis, investors can better position themselves to avoid similar pitfalls in the future.

Related Content on Historical Financial Bubbles and Disasters

- Tulip Mania

- South Sea Bubble & Mississippi Company

- Panic of 1837

- UK Railway Mania

- Erie War

- 1873-1896 Depression

- Panic of 1907

- Wall Street Crash of 1929

- 1973 Oil Crisis

- 1979 Energy Crisis