Panic of 1907 – Causes & Lessons for Today’s Portfolios

The Panic of 1907, also known as the Knickerbocker Crisis, was a major financial crisis that occurred in the United States in the early 20th century.

The panic not only led to a significant economic and market downturn but also played a vital role in shaping modern financial regulations and the establishment of the Federal Reserve System.

We look at the causes and consequences of the Panic of 1907 and draw lessons that investors, traders, and portfolio managers can apply to today’s economy and financial markets.

Key Takeaways – Panic of 1907: Causes & Lessons

- The Panic of 1907 was a major financial crisis that led to an economic downturn and shaped modern financial regulations, including the establishment of the Federal Reserve System.

- Lessons from the Panic of 1907 include the importance of diversification, strong regulatory frameworks, and the role of a lender of last resort during times of distress.

- Investors and policymakers can learn from historical crises like the Panic of 1907 to identify common patterns, prevent future crises, and protect portfolios during financial turmoil.

Key Facts About the Panic of 1907

- Duration: The panic began in October 1907 and continued through the end of the year, with the most intense period lasting around three weeks.

- Stock Market Decline: During the panic, stock prices declined sharply. The Dow Jones Industrial Average fell about 50% from its peak in early 1906 to its low point in late 1907.

- Bank Failures: The panic resulted in numerous bank failures. Over 20 trust companies and banks collapsed, including the Knickerbocker Trust Company, which played a significant role in triggering the panic.

- Liquidity Crunch: The panic created a severe liquidity crunch, making it difficult for individuals and businesses to access cash. This led to widespread bank runs as depositors rushed to withdraw their funds, further exacerbating the crisis.

- J.P. Morgan’s Intervention: To prevent what appeared to be progressing toward a total collapse of the financial system, financier J.P. Morgan played a pivotal role in stabilizing the situation. He organized a group of bankers to provide liquidity and support troubled institutions.

- Impact on the Economy: The Panic of 1907 resulted in a significant economic downturn. Industrial production declined, leading to layoffs and reduced wages. Unemployment rates increased, and many businesses faced financial hardships.

- Influence on Financial Regulations: The panic played an important role in shaping financial regulations. It highlighted the need for a central banking authority and eventually led to the establishment of the Federal Reserve System in 1913.

The Panic of 1907: An Overview of the Crisis

The Panic of 1907 was a financial crisis marked by a sharp decline in stock prices, widespread bank runs, and the collapse of many financial institutions.

The crisis began in October 1907 and continued for several months, with the most intense period lasting approximately three weeks.

The panic originated from a failed attempt to corner the market on United Copper Company stock, which led to the collapse of the Knickerbocker Trust Company and a subsequent loss of confidence in the banking system.

Understanding the Causes of the Panic of 1907

The Panic of 1907 can be attributed to a combination of factors, including a fragile financial system, excessive risk-taking, and insufficient liquidity.

The economy was already under stress due to previous financial panics, a lack of a central banking authority, and a restrictive monetary policy.

The failure of the United Copper Company cornering attempt exposed weaknesses in the financial system, leading to a domino effect of bank failures and a loss of confidence among depositors.

Lessons from the Panic of 1907

The Panic of 1907 offers valuable lessons for modern investors, such as the importance of diversification, the need for a strong regulatory framework, and the benefits of a lender of last resort.

Investors can learn to mitigate risk by diversifying their portfolios, while regulators can work to ensure that financial institutions maintain adequate capital and liquidity levels.

Additionally, the crisis highlighted the need for a central bank to stabilize the financial system during times of distress.

How the Panic of 1907 Shaped Modern Financial Regulations

The crisis underscored the need for a stronger regulatory framework to prevent future financial panics.

The US is a country that was founded on the skepticism of centralized power and long had a more individualist, laissez-faire approach to financial regulation and institutions.

But with all of the previous panics that had occurred (e.g., 1837, 1873, 1893, as the most notable), it was evident that the approach was unbalanced and created too much systemic risk.

As a result, lawmakers introduced measures such as the Federal Reserve Act of 1913, which established the Federal Reserve System as the central banking authority of the United States.

This development helped to create a more resilient financial system by providing a lender of last resort and a means to manage liquidity during periods of economic stress.

Of course, nothing is perfect and central banks are powerful in some ways but not in others.

Comparing the Panic of 1907 to Other Financial Crises

While the Panic of 1907 was unique in many ways, it shares similarities with other financial crises, such as the Great Depression and the 2008 financial crisis.

In each case, a combination of economic imbalances, excessive risk-taking, and weaknesses in the financial system contributed to the collapse.

By examining these similarities, investors and policymakers can identify common patterns and work to prevent future crises.

Often, when countries are developing new regulations, they’ll look at the best practices of other countries, with nuances made for their own system.

The Impact of the Panic of 1907 on The Establishment of the Federal Reserve System and the Modern Financial System

The Panic of 1907 played a pivotal role in the establishment of the Federal Reserve System, which has since become a cornerstone of the modern financial system.

The crisis highlighted the need for a central banking authority to maintain stability in the financial system, prevent bank runs, and provide a lender of last resort during times of economic distress.

The establishment of the Federal Reserve System improved the resilience of the financial system and helped to mitigate the duration and severity of future financial panics (if it’s capable of making the decisions well).

How Investors Can Protect Their Portfolios During a Financial Crisis

Investors can protect their portfolios during a financial crisis by diversifying their portfolios, maintaining a long-term perspective, and adhering to disciplined risk management practices (e.g., keeping individual position sizes within reasonable confines, rebalancing portfolios regularly, using options to eliminate tail risk when necessary).

Diversification across asset classes, industries, and geographies can help to reduce the impact of market volatility on a portfolio.

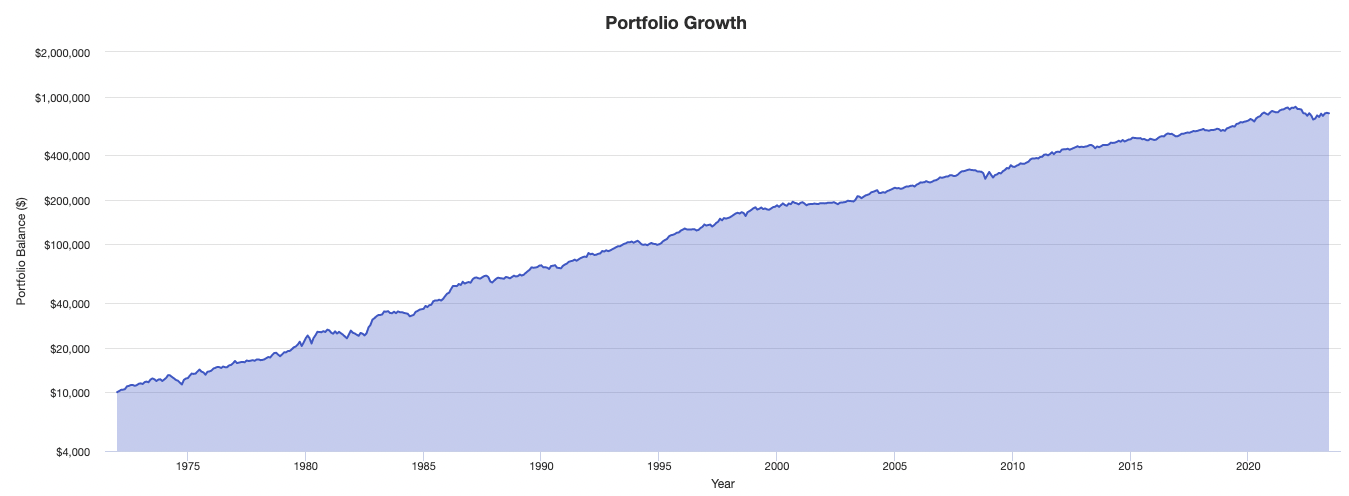

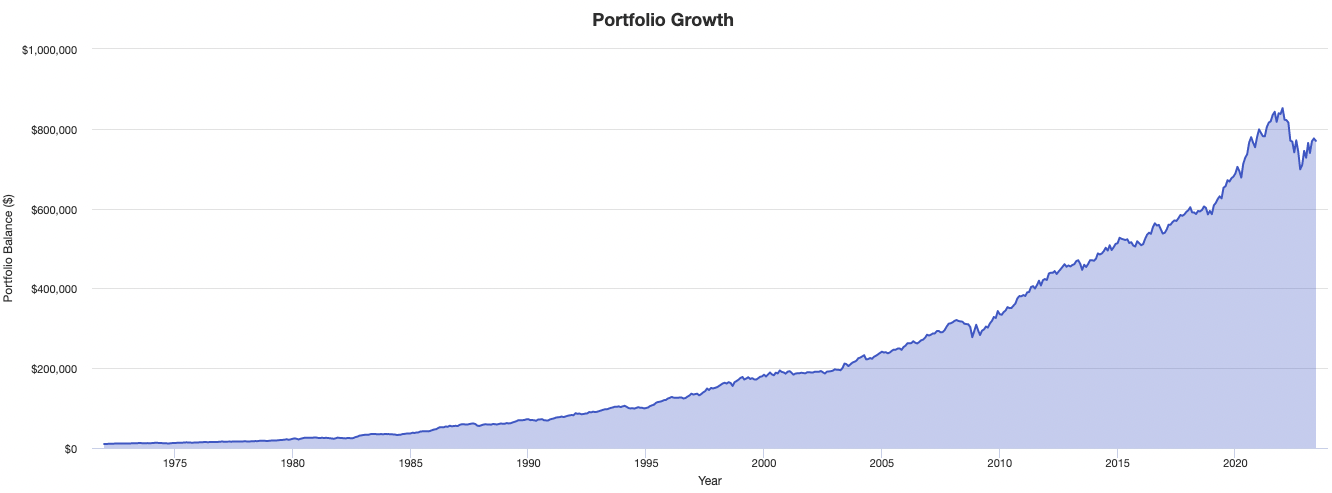

For example, here’s an example mix of a three-asset portfolio:

- 35% stocks

- 50% 10-year Treasury bonds

- 15% gold

Growth shown on a logarithmic scale:

Shown on a normal scale:

Despite such events like the 1973 oil embargo, 1970s inflation, 1987 stock market crash, 2000 dot-com bubble bursting, 2008 financial crisis, and 2020s inflation, there were only minor bumps in the road in a relatively simple portfolio.

From a distance, the wiggles that may have seemed “big” in the present moment weren’t material.

A longer-term strategy can help traders/investors avoid making impulsive decisions during times of market stress.

The Role of Central Banks in Preventing Financial Crises

Central banks play an important role in preventing financial crises by implementing monetary policy, supervising and regulating financial institutions, and acting as a lender of last resort.

Through these functions, central banks aim to maintain price stability, ensure the smooth functioning of the financial system, and promote sustainable economic growth.

By adjusting interest rates, managing liquidity, and implementing macroprudential measures, central banks can help to mitigate the risk of financial crises and promote financial stability.

Lessons from the Panic of 1907 for Improving Financial Stability

The Panic of 1907 provides lessons for improving financial stability, such as the importance of maintaining adequate capital and liquidity levels, being wary of speculation and the impacts it has on key intermediaries, implementing effective risk management practices, and promoting better transparency within the financial system via risk and financial disclosures.

What Can Today’s Traders and Portfolio Managers Learn from the Panic of 1907?

Today’s traders and portfolio managers can learn several lessons from the Panic of 1907.

- The importance of maintaining liquidity and managing leverage to withstand market shocks.

- The significance of establishing effective communication channels among financial institutions and financial institutions and regulators to prevent panic and restore confidence.

- The need for regulatory reforms to address systemic risks and enhance market stability.

- Understanding the interconnectedness of global financial systems and the potential for contagion is important.