Revolut Review 2025

Pros

- Revolut offers one of the smoothest fully digital sign-up processes we’ve seen, kickstarted through a QR code and taking less than 5 minutes.

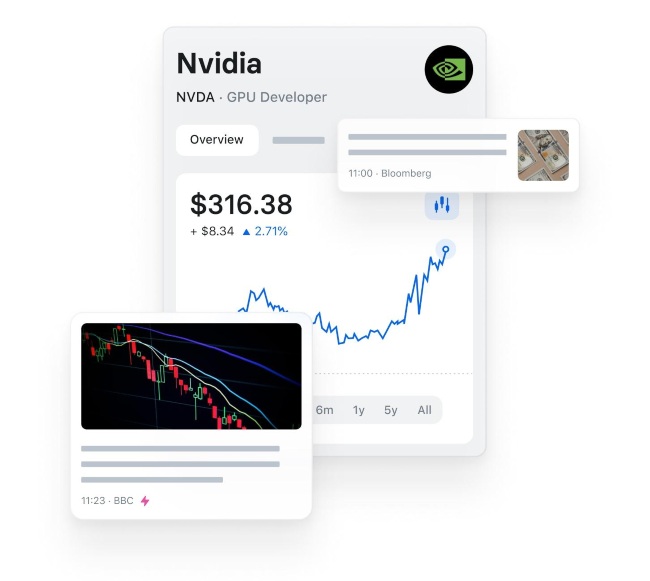

- The app delivers a superb investing environment with a slick design and a packed ‘Discover’ section with daily top movers, collections like ‘Technology’ and ‘Utilities’ and popular stocks.

- Revolut uses cutting-edge security features with multiple layers, from PINs and passcodes to biometrics and one-time passwords, with $590M saved in fraudulent transactions.

Cons

- While the range of shares, commodities and cryptocurrencies is growing, Revolut still lacks popular asset classes like ETFs and does not support margin trading, trailing alternatives like Trade Republic.

- Some users may find Revolut’s pricing structure confusing; while basic accounts have zero monthly fees, you may need to pay for foreign exchange beyond the specified limit and ATM withdrawals.

- The Revolut app is an excellent starting point for casual investors but testing reveals its charting package falls short for advanced traders with just two charts (line and candlestick) and six timeframes (1D to 5Y).

Revolut Review

Revolut is an established fintech company and super-app, best known for its innovative approach to digital money management. Now available in multiple countries and locations, the application provides basic financial management features and in recent years, the company has also turned its hand to retail trading services.

With the offer of low-cost, easy-access investing, our review breaks down the mobile platform’s features and trading fees.

We also give details on the customer support available and live account options. Find out whether to sign-up with Revolut today.

About Revolut

Revolut came onto the financial scene in 2015. Alongside the likes of Monzo and Starling, it has revolutionized the traditional finance and investment sectors.

The service aims to provide all the tools for users to easily manage, spend, borrow, invest, and protect their money. And the user-friendly approach has proved popular, with clients keen to take advantage of competitive exchange rates, travel insurance and the convenience of secure mobile finance solutions.

Global milestones include:

- 2017 – Launches Revolut Business, Revolut Premium, crypto trading in EEA

- 2018 – Granted a licence by Bank of Lithuania and launches Revolut Metal

- 2019 – The company launches its first commission-free equities trading service, provided by Revolut Trading Ltd

- 2020 – Launches in the USA. Reaches 14.5 million customers worldwide

- 2021 – Successfully raised Series E funding of $800m, to continue to build the first global financial super-app. Launched ‘Stays’, making it easy to book holidays directly from your Revolut app (no booking fees are charged by Revolut, but fees and charges from accommodation providers may apply. Read the Stays T&Cs)

Company Details

Today, over 45 million customers are using Revolut worldwide. The company’s services are available in more than 200 countries including the UK, USA, Australia, Singapore, and Japan, with 30+ supported in-app currencies.

A 2021 valuation pegged the company at 33 billion US Dollars, making it one of the most valuable British tech start-ups.

Revolut’s headquarters (HQ) office is located in London. The founder and current owner is British-Russian entrepreneur, Nikolay Storonsky.

App

The Revolut trading platform is an extension of its existing mobile fintech app, though a web version is also available. It is available for free download to iOS and Android devices from the the Google Play Store and Apple App Store.

When we used the Revolut platform, we thought it was user-friendly with simple navigation features and a customizable interface. All the key functionalities such as price alerts and limit orders can be viewed quickly and easily. One-click trading is also available.

On the downside, veteran traders that conduct detailed technical analysis may be disappointed by the lack of advanced charting capabilities. Though, our experts feel for longer-term equities investing the platform is suitable.

Key features of the investing platform include:

- Commission-free equities trading

- Set watchlists of assets of interest

- Six timeframes (1D, 1W, 1M, 3M, 6M, 1Y)

- Trade in fractional shares, from as little as $1

- Set notifications when stocks hit a pre-determined price

- Explore companies’ performance and stay up to date with live market news

- Build savings vaults in annual interest paid daily and hold cash in 25+ currencies

- Buy Bitcoin, Ethereum and other tokens with 30+ currencies. Make trades with a tap from just $1

Assets & Markets

Revolut offers a limited range of investment products, though we expect this to increase as the company expands its trading services:

- Invest in 2000+ global companies’ shares including Apple, Amazon, Tesla and Zoom

- Trade 30+ cryptocurrencies including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP), plus emerging tokens

In addition, fractional shares are offered. As the name suggests, fractional shares offer partial ownership. The key benefit is lower barriers to entry, meaning beginner investors or those with limited capital can start trading.

Dividend payments are also paid out to users. You can invest with as little as $1 in global company shares.

Note, ETFs, CFDs and options are not provided. Forex trading is also not supported.

Please note that Revolut is frequently updating its products and features, see the Revolut Terms and Conditions for the latest offerings.

The content of this review does not concern any customers that are based outside of the US.

Revolut’s cryptocurrency services in the US are provided directly by Paxos Trust Company. As a reminder, please note that cryptocurrencies are not FDIC or SIPC Insured and that investments in cryptocurrencies may lose value.

Account Types

Revolut offers several accounts to suit the needs of different investors. All profiles are considered general investment accounts. Our experts found that the key difference between the account types is the cost and trading fees, though access to additional features and benefits such as currency exchange limits, interest on savings and discounted international transfers, improves between the tiers.

Each account comes with a digital MasterCard which can be used abroad plus full access to the brand’s mobile application.

Junior ISAs, Lifetime ISAs, Stocks and Shares ISAs, and Joint Accounts are not currently supported, though the company has indicated that they may be available in the future.

Note that to use the online trading platform, you must open a Revolut account.

Standard Account – No Monthly Charge

- Trade crypto with zero commission up to $200,000 per month

- Exchange in 28+ fiat currencies up to $1000 per month with transparent fees visible in the Revolut app

- 10 zero-charge international transfers per month to any account (fair usage limits apply and weekend mark-ups apply)

- $1200 per month no fee out-of-network ATM withdrawals (third party providers may charge a withdrawal fee and weekend fees may apply)

Note that fees and limits may apply to offers depending on the plan type, capped amounts, and charges by third-parties. Check terms and conditions for the latest details.

Premium Account – $9.99 Per Month

- Premium card

- Priority customer support

- Earn 0.07% APY on savings

- Trade cryptocurrency commission-free up to $200,000 per month

- Exchange in 28+ fiat currencies up to $1000 per month with transparent fees visible in the Revolut app

- 10 zero-charge international transfers per month to any account (unlimited and fee-free in 30+ currencies (as exotic mark-ups apply, and only fee-free on weekends))

- $1200 per month no fee out-of-network ATM withdrawals (third party providers may charge a withdrawal fee and weekend fees may apply)

Metal Account – $16.99 Per Month

- Priority customer support

- Earn 0.07% APY on savings

- Trade cryptocurrency commission-free up to $200,000 per month

- Exclusive Revolut Metal card (metal card available on metal plan only)

- Exchange in 28+ fiat currencies up to $1000 per month with transparent fees visible in the Revolut app

- 10 zero-charge international transfers per month to any account (unlimited and fee-free in 30+ currencies (as exotic mark-ups apply, and only fee-free on weekends))

- $1200 per month no fee out-of-network ATM withdrawals (third party providers may charge a withdrawal fee and weekend fees may apply)

How Can I Sign Up For A Revolut Account?

I found that opening a trading profile is quick and easy, though first you need to register for a Revolut finance account. Accounts are available to anyone over 18. When I registered, I was signed up and ready to invest in less than five minutes.

Once you have opened an account, simply download the mobile app, submit your details and wait for the information to clear.

When your account is live, you will have complete access to the firm’s payment and investment services. There are no charges associated with registration and there is no minimum deposit to open a Revolut account.

Revolut Fees

Trade crypto commission-free up to $200k per month on all Revolut plans. After this, you will be charged a crypto commission fee of up to 2.5% for standard plan customers and 1.5% for premium and metal account customers. US clients can buy and sell listed stocks commission free.

Exchange rate charges may apply if you are converting to a currency other than USD. Standard account customers can make up to $1,000 of exchanges at the basic rate each month (up to 1%). A higher fee applies outside foreign-exchange-market hours so bear this in mind when loading your day trading account (up to 2%).

Note, these fees do not apply to Premium and Metal account customers. International transfers to an external account in the same currency as the local currency of the recipient will cost 0.3% of the transfer amount, with a minimum cost of $0.30 and a maximum cost of $6 per transaction.

Revolut does not charge any fees for depositing or withdrawing funds. There is also no requirement to trade regularly as the platform does not charge inactivity fees.

Leverage

At the moment, Revolut does not offer any leveraged trading opportunities. This means you cannot purchase stocks with a small amount of capital and take a larger position in the market. It would be good to see this in the future as the company expands its online trading services.

Payment Methods

Revolut does not apply a deposit fee for any payment methods, although third-party charges may apply. Remember, you will need to fund your trading account from your Revolut finance account, which can be topped up via the accepted payment methods below.

Processing times will vary between payment type; international wire transfers can take up to five working days to clear.

When we used the Revolut platform we were pleased with the no minimum deposit, helping new traders to get started.

Accepted methods include:

- Wire Transfer

- Direct Deposit And Early Salary

- Revolut Transfer – From other Revolut users

- Apple Pay/Google Pay – Apple Watch also accepted

- Mobile Check Deposit – Electronic paper check upload to a Revolut USD account

- Credit/Debit Card – MasterCard, Visa and Maestro cards. Load money in the currency that your card is held in, for example, if you have a US account, load your account in USD. Conversion fees apply if not

Clients cannot make more than 50 transfers in 24 hours or more than 200 transfers in 7 days.

Demo Account

Revolut does not currently offer a demo profile for new investors. However, customers are able to open a live trading account without an initial funding requirement.

Simply sign up for a profile to enter the trading environment. You can gain full access to the platform for no cost. We would recommend spending some time getting used to the app features before investing your own personal funds.

Regulation & Licensing

Revolut is registered as an e-money institution in all countries of operation. It is worth understanding which Revolut entity you receive services from, to ensure you are clear on the levels of protection and support.

Securities products and services are provided by Revolut Securities Inc, a member of FINRA and SIPC. Funds are held by Metropolitan Commercial Bank, Member FDIC, and are insured by the FDIC for up to $250,000.

Additional Features

When it comes to trading resources, Revolut falls short. While using the Revolut app, only basic market research and technical analysis could be conducted, which may not be suitable for more experienced day traders.

Nonetheless, the Revolut blog integrates product announcements, user stories and technical posts. Though limited in the way of trading education, there are some useful ‘how to’ posts and access to the latest market news.

Customers can also access several extras:

- Junior – Ages 6-17. Parent or guardian required to have a Revolut account. T&Cs apply.

- Early salary – customers can receive salary payments two days early through direct deposits to Revolut accounts. There are also no fees for this perk.

- Group bills – split and settle expenses with ease. The centralized app lets users input spending and divide bills in a few straightforward clicks.

- Budget & analytics – aggregate your finances and review your spending daily, weekly, monthly or annually. Get visibility of where you’re spending your money each month, from travel to eating out.

- Lounges & smart delays – get free lounge access when your flight is delayed. Vouchers are available for 48 hours and Revolut has links with 1,000 lounges worldwide.

Trading Hours

Trading hours will vary by instrument. Typically, you can trade during the open market hours, 9:30 AM to 4 PM (EST) on working days. Orders placed outside of the regular hours will be queued for the next trading day.

Customer Support

If you encounter issues or need help with account questions, you can get in contact with the team through the in-app live chat service, available 24 hours a day Monday to Sunday. This can be used on mobile devices and via the website.

Premium and Metal plan customers benefit from priority service. Alternatively, reach out via email at feedback@revolut.com, though response times are slower.

Via The Website

- Sign in to your account from the top right of your screen

- Open the ‘Help’ section

- Scroll down until you see the ‘Chat’ option

- Select ‘Start new chat’ or continue with an ongoing support chat

Via The Mobile App

- Once logged in to your account, tap on your profile on the top left of your screen

- Open the ‘Help’ menu

- Scroll down until you see the ‘Chat with us’ option

- Select ‘New chat’ or continue with an ongoing support chat

Note, when contacting the company via live chat, initial services are provide by a chat-bot.

The company is also active on Twitter, LinkedIn and has a YouTube channel.

Safety & Security

Our experts are pleased with the level of security to protect traders. According to a Nilson report in November 2021, the company’s award-winning anti-fraud system successfully kept fraudulent transactions under 0.01%, which is lower than the industry average.

The company works 24/7 to keep accounts safe. The mobile investing platform uses two-factor authentication (2FA) via SMS. Alternatively, Revolut gives you the option to login to your account using your fingerprint.

The firm has also introduced 3D secure (3DS) payments and more KYC protocols to counteract fraud and online crime. You can turn off certain features of your payment card to mitigate the risk of fraud. This includes disabling e-commerce payments or contactless payments.

Verdict

Revolut is an established brand in the financial markets. The trading platform, an addition to the firm’s personal and business finance solutions, offers a convenient one-stop-shop. Our review rated the user-friendly interface, various account profile options and commission-free trades available.

We would recommend Revolut to longer-term investors and those interested in trading equities or digital currencies. For more experienced traders looking for a wider product range and more advanced trading tools, we would recommend alternative brokers and fintech companies.

For general information purposes only and does not constitute financial advice. If you have any questions about your personal circumstances please seek professional and independent advice. Revolut is not a financial adviser.

FAQ

How Does Revolut Work?

Revolut is a one-stop shop for all things money. From your everyday spending, to planning for your future with savings and investments. The company has established itself as a top-rated trading app, with commission-free investments available, rivalling the likes of Robinhood.

Can I Have 2 Revolut Trading Accounts?

Yes, you can open multiple Revolut accounts, however you cannot open multiple trading accounts to use the free monthly trades.

Is There An Overdraft Available With A Revolut Account?

It is not currently possible to add an overdraft to your Revolut account. The company does, however, offer personal loans. For more information, get in touch with the customer service team.

What Should I Do If My Revolut Trading Account Is Not Working?

If you have issues with your Revolut trading account, get in touch with the customer support team via live chat, the telephone helpline or email. Customer service agents can also help with account queries.

Top 3 Alternatives to Revolut

Compare Revolut with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Zacks Trade – Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

Revolut Comparison Table

| Revolut | Interactive Brokers | Dukascopy | Zacks Trade | |

|---|---|---|---|---|

| Rating | 3.1 | 4.3 | 3.6 | 3.9 |

| Markets | Stocks, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, ETFs, Cryptos, Options, Bonds |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $2500 |

| Minimum Trade | $1 | $100 | 0.01 Lots | $3 |

| Regulators | FINRA, SEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | FINRA |

| Bonus | – | – | 10% Equity Bonus | – |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | Own |

| Leverage | – | 1:50 | 1:200 | – |

| Payment Methods | 7 | 6 | 11 | 3 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Zacks Trade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Revolut and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Revolut | Interactive Brokers | Dukascopy | Zacks Trade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Revolut vs Other Brokers

Compare Revolut with any other broker by selecting the other broker below.

The most popular Revolut comparisons:

- Revolut vs Nexo

- Pionex vs Revolut

- Revolut vs Coinbase

- Revolut vs Binance

- Kraken vs Revolut

- Revolut vs SoFi Invest

- Crypto.com vs Revolut

- Revolut vs Trade Republic

- OKX vs Revolut

- Plum vs Revolut

- XTB vs Revolut

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Revolut yet, will you be the first to help fellow traders decide if they should trade with Revolut or not?