RBK Money Brokers 2026

RBK Money is a payment acceptance service provider with over five million users. It offers a selection of online and in-person transaction methods, a user-friendly checkout experience, and anti-fraud monitoring.

Our review will examine the main aspects of the RBK Money service for traders, including its open-source API, payment methods, currency options, and gateway security. We also list the best brokers that accept RBK Money deposits in 2026.

Best RBK Money Brokers

From our testing, these are the highest-rated brokers that offer RBK Money payments:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

Here is a short overview of each broker's pros and cons

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Compare The Best RBK Money Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| Interactive Brokers | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| NinjaTrader | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| eToro USA | $100 | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | - |

| Plus500US | $100 | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | Variable |

| OANDA US | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist | 1:50 |

| FOREX.com | $100 | Forex, Stock CFDs, Futures, Futures Options | WebTrader, Mobile, MT4, MT5, TradingView | 1:50 |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

Cons

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Although support response times were fast during tests, there is no telephone assistance

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker offers a transparent pricing structure with no hidden charges

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

How Did We Choose The Best RBK Money Brokers?

To reveal the top RBK Money brokers, we:

- Pinpointed all the firms that accept RBK Money payments from our database of 500 online platforms

- Confirmed that they support RBK Money deposits and withdrawals for day trading

- Sorted them by their total rating, combining our personal observations with over 100 data points

What Is RBK Money?

The RBK Money brand was founded in Russia and incorporates the following companies: RBK Money Holdings Limited, RBK Money Limited, and Direct Payments Limited. The latter is regulated by the Financial Conduct Authority (FCA) in the UK as an Authorised Payment Institution. RBK Money is also partnered with a firm licensed by the Russian Central Bank.

The company provides several integration routes to active payment gateways into websites and also offers transaction links for businesses that are not online. The gateway has a microservice architecture with an open-source API and blockchain platform. Full documentation is available for developers on the firm’s website and through a public repository on Github.

Pros Of Trading With RBK Money

Card Binding

RBK uses card binding, which allows traders to check out rapidly by securely retaining card details for future transactions. The cards of the following payment systems are accepted by this provider:

- MasterCard and MasterCard Maestro

- Visa and Visa Electron

- American Express

- China UnionPay

- Diners Club

- MIR

- JCB

Availability

The company provides its services to 40,000 businesses across 60 countries, so it may be available with your preferred broker. Moreover, the firm provides its services to many high-profile business clients such as Hermes, Sony, and TUI, which points to its reliability.

Cons Of Trading With RBK Money

Limited Transaction Routes

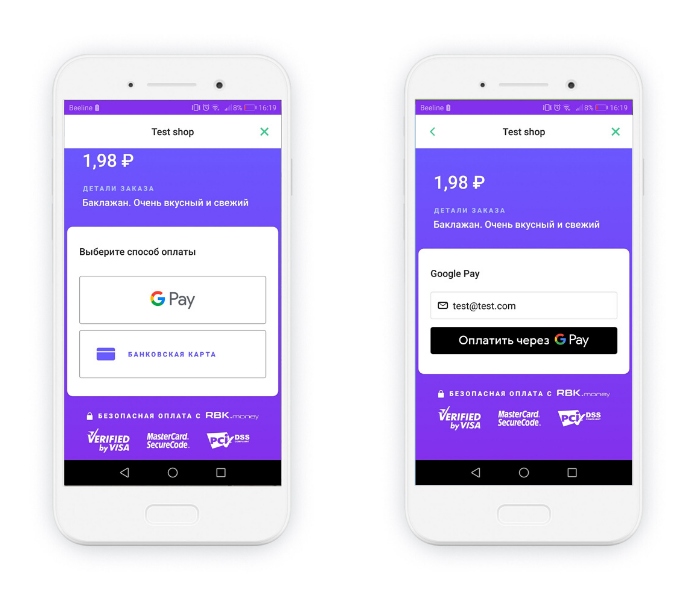

RBK.money offers a variety of bank cards for trading payments, alongside Apple Pay and Google Pay. The firm also advertises mobile commerce, online banking, cryptocurrency, and POS lending. However, some methods are not available to all users. The firm also does not support PayPal. These limitations may restrict the flexibility many traders require to transfer and receive funds.

Limited Currencies

The main settlement currency of RBK is rubles, as the majority of its client base is Russian companies, though euros and US dollars are also available. This restricted range of accepted tender may make the provider unsuitable for many traders that use other major currencies, such as pound sterling or Japanese yen.

In addition, the 2022 Russia-Ukraine war may have an impact of the availability of RBK Money to investors overseas.

No Wallet

Although the firm previously offered an RBK Money wallet, registration for this product ceased in October 2017 and support stopped completely in August 2018. Fortunately, customers can still extract funds from their wallets by contacting help@rbk.money with a withdrawal request.

Speed

Several online reviews point to the high speed of RBK Money transactions. However, the processing of deposit and withdrawal payments is also contingent upon your broker and issuing bank. As such, the time to receive or place funds could be a number of days depending on the entities involved. Traders can find processing times on broker websites or our reviews.

Security

The company safeguards client funds using an automated anti-fraud system and the Wallarm applications protection platform. Servers are monitored in real-time to detect and prevent attacks, and RBK.money’s systems comply with the PCI DSS 3.0 level 1 safety standard.

The firm uses secure sockets layer (SSL) encryption and a TLS protocol is followed for the transmission of data between the user and website. The 3D secure feature on payment cards is also supported by this provider.

In addition, RBK Money is a member of the BugBounty program, an initiative that rewards individuals for reporting website bugs and security vulnerabilities directly to the firm.

How To Deposit Using RBK Money

Traders can make deposits or request withdrawals via RBK Money, if it is offered, by heading to the payments page of their brokers’ website.

At Grand Capital, for example, you would need to click on the deposit page within the Private Office and select RBK Money from the available payment methods. Then enter the deposit amount and follow the instructions in the portal to complete the transaction.

Investors should also be aware that some brokers have additional ID verification steps in place, especially for withdrawals, and should retain identifying documentation as necessary.

Fees

The rates that RBK charge to brokers and other business clients depends on turnover, and the payment methods that are requested. Brokers with larger turnover volumes are subject to lower rates, and companies yielding more than $30,000 monthly can expect to pay around 2% for the service.

There are direct no fees for traders – it is the broker/business owner that is charged for the payment service. However, brokers may still pass on some of these costs to their clients for deposits or withdrawals. Prospective traders should check this when deciding on a brokerage to sign up with. Our reviews also detail payment fees.

Is RBK Money Good For Day Trading?

RBK Money provides payment services to clients across 60 countries, offering a card binding feature for traders and an open-source API alongside dedicated security systems to detect fraudulent transactions. Yet despite these benefits, some traders may be put off by the limited number of payment methods and currencies available, and by the absence of an integrated wallet.

See our list of brokers that accept RBK.money deposits in 2026.

FAQ

Is RBK Money Legitimate?

RBK Money is a legitimate payments provider and receives positive online reviews. It is also regulated by the Financial Conduct Authority (FCA) in the UK and by the Russian Central Bank.

Is RBK Money Safe To Use In My Trading Account?

This firm uses a range of technologies to ensure the security of investments, including an automated anti-fraud system, the Wallarm applications protection platform, secure sockets layer (SSL) encryption, and a TLS protocol for data transmission. It also supports 3D-secure for card payments and is a member of the BugBounty program.

Is It Cheap To Deposit To My Trading Account With RBK Money?

Traders are not subject to fees from this provider – the broker is charged for the service. However, some online brokers may take processing fees for deposits and withdrawals independently of the payment provider to cover their costs.