Quantum Game Theory & Applications to Finance

Quantum Game Theory is an extension of classical game theory, which incorporates the principles of quantum mechanics.

Classical game theory has been a cornerstone in economic and social sciences.

The quantum version of game theory offers a different perspective, especially when it comes to understanding complex financial systems.

Key Takeaways – Quantum Game Theory & Applications to Finance

- Quantum Mechanics in Strategy:

- Quantum Game Theory introduces quantum principles like superposition, entanglement, and interference into classical game theory.

- Superposition allows players to exist in multiple strategic states simultaneously.

- Entanglement can lead to coordinated strategies between players, even without direct communication.

- Interference, on the other hand, can amplify or diminish certain outcomes based on strategic interactions.

- Revisiting the Prisoner’s Dilemma:

- The classical Prisoner’s Dilemma suggests that rational players will betray each other, leading to sub-optimal outcomes.

- With Quantum Game Theory, players can mix betrayal and cooperation strategies.

- Entanglement allows for coordinated decisions, potentially transforming the classical “betray-betray” outcome to a more cooperative one, resulting in more favorable scenarios for both players.

- Probabilistic Thinking in Finance:

- Quantum Game Theory emphasizes thinking probabilistically rather than deterministically.

- In finance, this means viewing predictions and decisions as part of a probability distribution rather than fixed outcomes.

- This approach acknowledges the inherent uncertainties in financial markets and encourages more nuanced and adaptable strategies, moving away from the traditional deterministic models that may oversimplify complex financial systems.

Basics of Game Theory

Traditional Game Theory

Game theory, in its classical form, studies the interactions between rational decision-makers.

It provides a framework to predict how players will act in strategic situations, ensuring the best outcome for themselves.

Transition to Quantum Game Theory

Quantum Game Theory integrates quantum mechanics into this framework.

This means that players can now make decisions based on quantum strategies.

This leads to potentially different outcomes than those predicted by classical game theory.

Key Principles of Quantum Game Theory

Superposition

In quantum mechanics, particles can exist in a combination of multiple states simultaneously.

This principle of superposition allows for more complex strategies in games.

Entanglement

Entanglement is a unique quantum phenomenon where particles become interconnected.

The state of one particle instantly affects the state of the other, no matter the distance between them.

In the context of game theory, this can lead to coordinated strategies between players.

Interference

Quantum systems can interfere with each other, either constructively or destructively.

This interference can be used strategically in games to amplify or diminish certain outcomes.

Reimagining Economic Models

Traditional economic models, based on rational decision-making, might not always capture the complexities of real-world scenarios.

Quantum Game Theory, with its ability to consider multiple simultaneous possibilities, can offer a more nuanced understanding of economic behaviors and market dynamics.

Understanding the Prisoner’s Dilemma

The Prisoner’s Dilemma is a classic example in game theory that illustrates why two rational individuals might not cooperate, even if it appears that it’s in their best interests to do so.

The game is set up as follows:

- Two prisoners are arrested for a crime.

- If both remain silent (cooperate), they serve a short sentence.

- If one betrays (defects) and the other remains silent, the betrayer goes free while the silent one serves a long sentence.

- If both betray each other, both serve a moderate sentence.

The Nash Equilibrium in the Prisoner’s Dilemma

The Nash equilibrium is a concept in game theory where each player’s strategy is optimal given the strategy chosen by the other player.

In the Prisoner’s Dilemma, the Nash equilibrium is for both prisoners to betray each other.

Here’s why:

- If Prisoner A thinks Prisoner B will remain silent, it’s in A’s best interest to betray, as A goes free.

- If Prisoner A thinks Prisoner B will betray, it’s still in A’s best interest to betray, as this results in a moderate sentence rather than a long one.

Given this reasoning, both prisoners end up betraying each other, leading to the sub-optimal outcome of both serving a moderate sentence.

This is sub-optimal because both would have been better off (serving shorter sentences) if they had both remained silent.

But because there’s too much risk in staying silent and risking a longer sentence, the optimal action for both is to betray despite it being suboptimal.

Quantum Game Theory: A New Perspective

Quantum game theory introducing quantum mechanics into classical game theory allows for new strategies and outcomes that aren’t possible in classical games.

Superposition

In quantum mechanics, a system can exist in a combination of multiple states simultaneously.

In the context of the Prisoner’s Dilemma, this means a prisoner can simultaneously choose to both betray and remain silent until their decision is observed.

Entanglement

This is a phenomenon where the states of two systems become linked, such that the state of one instantly influences the state of the other.

If the decisions of the two prisoners are entangled, the decision of one prisoner can influence the decision of the other, even if they are not communicating.

Improved Equilibrium with Quantum Game Theory

By introducing quantum strategies, the Prisoner’s Dilemma can have different outcomes:

- Players can use superposition to mix betrayal and cooperation strategies. This means that the decision to betray or cooperate isn’t fixed but exists in a state of flux until observed.

- If the prisoners’ decisions are entangled, they can coordinate their strategies in a way that maximizes their joint payoff.

With these quantum strategies, it’s possible to shift the game’s equilibrium away from the classical “betray-betray” outcome to one where both prisoners cooperate more often, leading to the optimal outcome of shorter sentences for both.

In essence, quantum game theory can potentially transform the sub-optimal Nash equilibrium of the classical Prisoner’s Dilemma into a more favorable outcome.

This highlights what a new perspective can bring to decision-making and strategy.

Main Takeaway

The main takeaway from quantum versus classical approaches is the importance of thinking in a probabilistic way and not in a deterministic way.

When you see a trader/investor give an opinion that the future state of a stock/economy/any financial variable is likely to be [insert specific outcome], it might be a decent opinion, but it’s just one very small slice of the probability distribution.

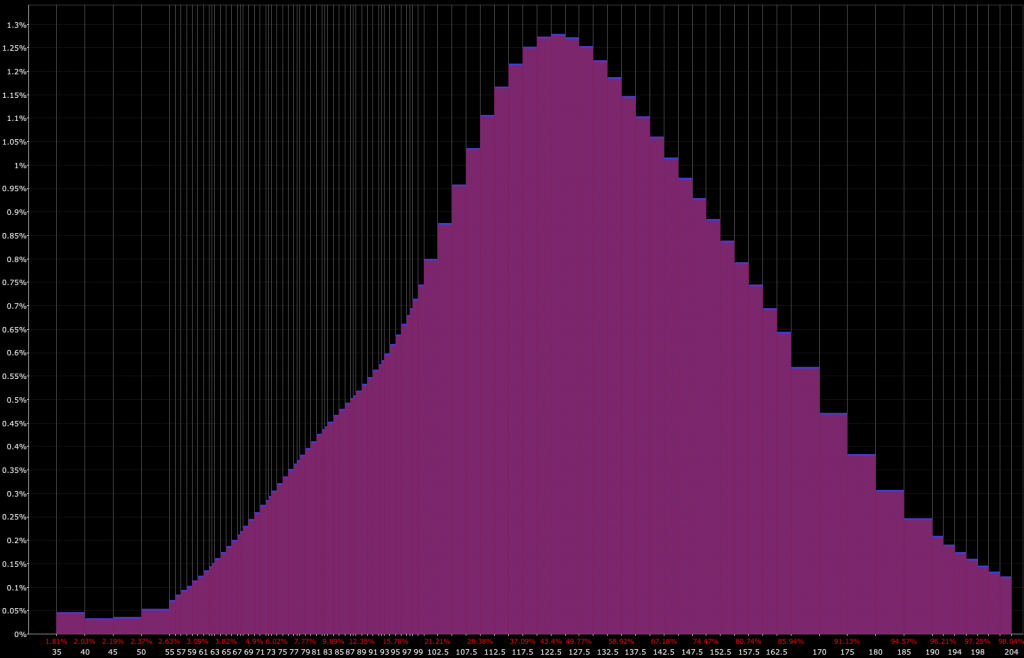

A probability distribution – i.e., X price by Y date – will look like this:

So if somebody thinks, “the price target on this is 100” – that’s just a very small piece of the overall distribution.

But nobody ever says – my probability distribution looks like this. It doesn’t sell very well relative to a hot take or specific pronouncement.

Worse, people might just say you’re covering all your bases or you’re just saying it because you don’t know anything (even if you’ve genuinely done a lot of careful research and calculations and understand the cause-effect mechanics in a deep way).

Likewise, when you play poker and your opponent makes a pre-flop bet, you don’t think, “this guy’s got Jack-Nine!”

No, he has a range of hands he could potentially have.

Probabilistic thinking isn’t the easiest, the most intuitive, or the most comfortable when we want to know for sure, but that certainty is almost never there and we have to understand whatever we’re doing as accurately as possible in order to have success with it.

FAQs – Quantum Game Theory

What is quantum game theory?

Quantum game theory is a relatively new and emerging field that extends classical game theory to the quantum domain.

It explores how quantum mechanical effects, such as superposition and entanglement, can impact strategic interactions in various games.

The field aims to understand how the principles of quantum mechanics can be used to devise new strategies and outcomes in games, which are not possible in classical settings.

How does quantum game theory differ from classical game theory?

The main difference between quantum and classical game theory lies in the incorporation of quantum mechanical principles in the former.

Classical game theory, which is based on classical probability theory, assumes that players have fixed strategies and that their choices are definite/deterministric.

In contrast, quantum game theory allows for superposition of strategies, meaning that players can effectively choose multiple strategies at once.

It can help understand the importance of probabilistic thinking and choices.

Additionally, quantum entanglement can lead to correlations between players’ choices, leading to new equilibria and outcomes that do not exist in classical games.

What are the key principles of quantum game theory?

- Superposition: Players can be in a superposition of different strategies, meaning they do not have to commit to a single strategy at the outset.

- Entanglement: Players’ choices and payoffs can be entangled, leading to correlations that can affect the game’s outcome.

- Interference: Quantum interference can lead to unexpected results, as the probability amplitudes for different strategies can interfere constructively or destructively.

- Quantum Information: Players have access to quantum information and can use quantum channels for communication, potentially leading to new types of strategies and games.

How does the concept of superposition apply to game strategies?

In quantum game theory, the concept of superposition allows players to be in multiple strategic states at once.

This is fundamentally different from classical game theory, where players must choose a single, definite strategy.

Superposition can lead to new Nash equilibria and unexpected game outcomes, as the probabilities of different strategies interfere with each other.

Players can use superposition to explore a larger strategic space, potentially finding more optimal strategies than in classical settings.

What is entanglement in quantum game theory?

Entanglement in quantum game theory allows the strategies and outcomes for different players to become correlated in ways that are impossible in classical games.

When players’ strategies are entangled, the choice made by one player can instantaneously affect the other player’s payoffs, even if they are far apart.

This can lead to new types of cooperative and competitive behaviors and can change the nature of Nash equilibria in the game.

Can quantum game theory provide solutions to dilemmas in classical games?

Yes, quantum game theory has the potential to provide new solutions to dilemmas faced in classical games.

For example, in the classical prisoner’s dilemma, players have a dominant strategy to defect, leading to a suboptimal outcome for both.

In the quantum version of this game, entanglement and superposition can allow players to think of their strategies in a way that leads to mutual cooperation, which is a more optimal outcome.

However, the applicability of quantum game theory to real-world situations is still a topic of research and debate.

How might quantum game theory impact economic and financial models?

Quantum game theory could impact economic and financial models by introducing new dynamics and possibilities for strategic interaction.

It could lead to the development of new types of contracts, auctions, and market mechanisms that exploit quantum mechanical effects for improved efficiency and fairness.

For example, if there’s simultaneous and transparent information dissemination, it could minimize information imbalances among market participants.

Additionally, quantum cryptography could be used to enhance the security of financial transactions and communications.