Qtrade Review 2026

See the best Qtrade alternatives in your location.

Awards

- 30 industry awards across 15 years

Pros

- Alongside 100+ commission-free ETFs, Qtrade has slashed its options fees, now coming in at $0.75 per options contract (down from $1.00).

- Qtrade has teamed up with PersonaFin to launch “My News” - an AI-powered, personalized newsfeed built around your interests. Get timely insights from premium sources, discover trending topics fast, and explore smarter with AI-driven search.

- After years of testing, Qtrade has cemented its place as one of the best trading platforms in Canada, with easy-to-use software and a growing range of US and Canadian stocks as well as funds, ETFs and other assets.

Cons

- Although Qtrade has added support for Interac e-Transfer, it still offers relatively limited funding options with no credit/debit card deposits.

- Commissions of $8.75 per equity can stack up for active stock traders, reducing its suitability for day traders.

- Qtrade doesn't offer trading opportunities on forex or crypto markets, potentially limiting its appeal if you're looking to build a diverse portfolio.

Qtrade Review

Qtrade is a Canadian broker specializing in stocks, options, ETFs and mutual funds. The award-winning brokerage offers competitive fees, an in-house trading app, plus a choice of account options.

Our 2026 Qtrade review looks at direct investing solutions, trading commissions, welcome bonuses, and more. Find out whether to sign up with Qtrade today.

Company Overview & History

Qtrade Direct Investing, a division of Credential Qtrade Securities Inc. was established in 2000 and is a Canadian brokerage (based in Vancouver). Credential Qtrade Securities Inc. was created from the amalgamation of Credential Securities Inc. and Qtrade Securities Inc.

In April 2018, William Packham became the CEO of Aviso Wealth – which Qtrade Direct Investing falls under.

The company has been a success in Canada where most of its trading operations are focused. The brand has been ranked as the Number 1 online investing platform 25 times in the last 17 years and regularly features in The Globe and Mail’s brokerage rankings.

Qtrade has also partnered with other financial services firms such as Coast Capital Savings, Envision Financial, DUCA Financial Services Credit Union Ltd., Vancity, Meridian, and ATB Financial. These firms make use of services like Qtrade Direct Investing and Qtrade Guided Portfolios, which Qtrade created.

Promotions & Bonuses

The company offers young investor pricing, giving traders aged 18 to 30 who add $50 or more a month to a Qtrade account access to lower commissions and no quarterly admin fees.

Trading Platform

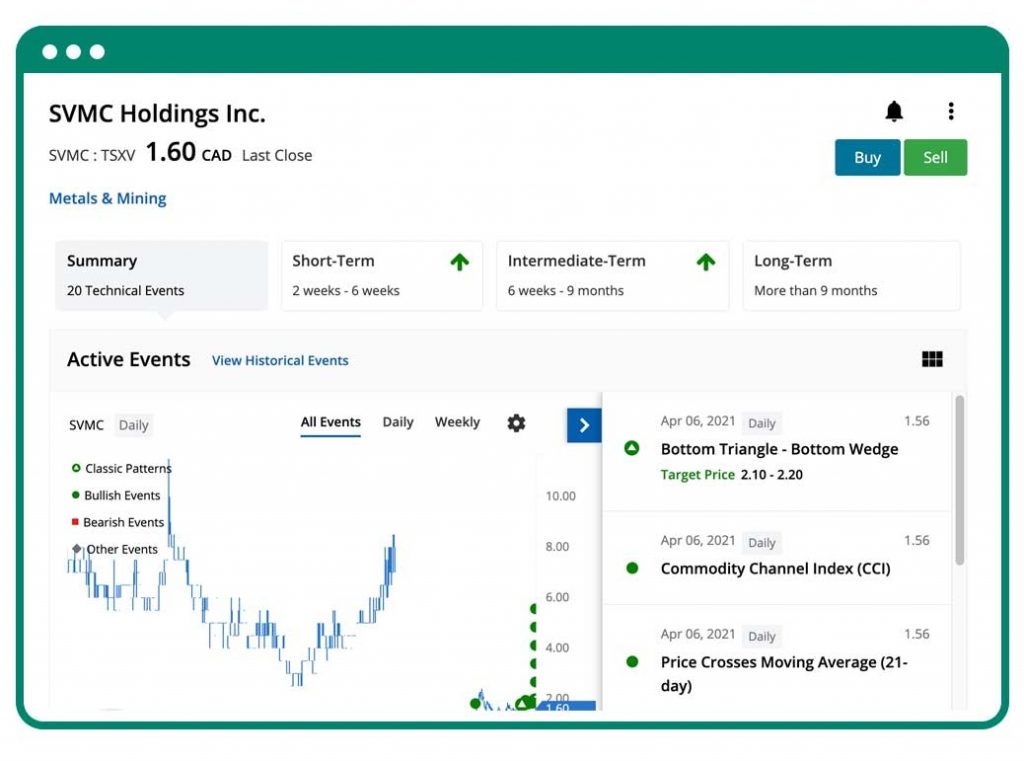

Unlike many brokers that offer external trading platforms such as MetaTrader 4 and cTrader, Qtrade uses an in-house investing platform. The platform is home to a range of useful features:

- Fundamental research capabilities

- Planning tools to create an investment plan

- Technical indicators to interpret market data

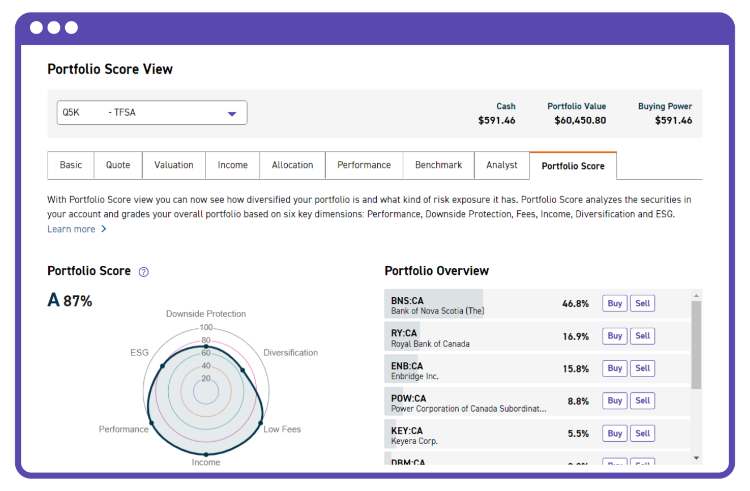

- Portfolio Analytic tools which include portfolio and ETF scores

- Expert reviews of Canadian and US investments

- Morning news call with market and economic updates

- Screening tools to screen stocks and ETFs (e.g. undervalued companies)

- Watchlists to monitor equities (e.g. US stocks you are interested in buying)

- Stop-loss, stop-limit and trailing stop limit order types to control the price at which you buy and sell

- Extended hours in the form of pre-market and after-hours trading are available for US markets

Products & Markets

Clients can invest in:

- Canadian & US Stocks, rights and warrants

- Guaranteed Investment Certificates (GICs)

- ETFs including 100+ commission-free ETFs

- Canadian & US bonds

- Mutual funds

- Options

Qtrade does not provide access to forex markets. Cryptocurrencies such as Bitcoin are also not available. Instead, the broker has tailored its products to traders seeking medium to long-term investment opportunities.

Note that for US stocks and/or residents, Form W-8BEN may need to be completed.

Investing Fees

There is an $8.75 commission for those investing in equities, though clients that make 150+ trades per quarter and/or have at least $500,000 in assets attached to their client ID (referred to as Investor Plus) benefit from a lower commission rate of $6.95.

With the Young Investor Program (investors between the age of 18 and 30) commission charges are $7.75 for equities but require a $50 monthly contribution to your account.

Options pricing has come down, now costing $0.75 per contract (previously $1.00).

Qtrade also has a list of 100+ commission-free (buy and sell) ETFs. The rest of the firm’s ETFs are priced the same as equities. GICs are commission-free.

Other Charges

Additional fees may apply depending on your account level and trading activity. These include currency exchange fees, for example, market changes in the US Dollar/Canadian Dollar (USD/CAD) exchange rate, plus administration fees (waived, if conditions met) and interest rates on any negative balances.

Customers should also be aware of the administration fee ($25/quarter unless exempt) and the account closure fee ($100 within the first year). Fixed income and exchange-traded debenture phone orders incur an additional commission.

Note that Canadian and US Dividend Re-Investment Plans (DRIPs) are offered free of charge and a list of DRIP-eligible securities is available on the broker’s website. DRIPs allow clients to reinvest their dividends into additional shares (or sometimes fractional shares).

Qtrade Leverage

Qtrade offers a margin account where customers can increase their buying power. The margin rates on eligible stocks trading at $5 or more are 30%, so a margin loan of 70%.

Leverage trading can be used to increase profits but it can also lead to large losses. As a result, make sure you have an appropriate risk management strategy.

Mobile App Review

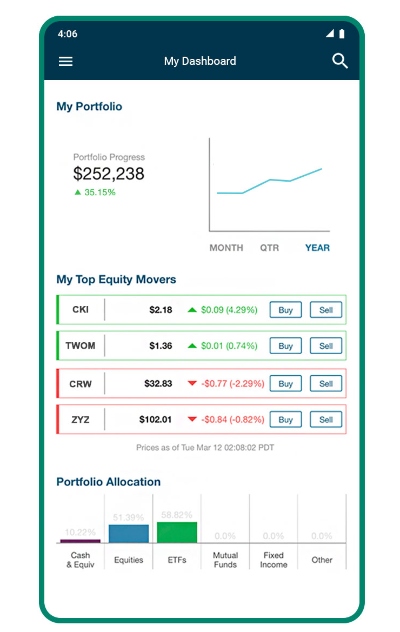

A mobile app is available on iOS and Android devices for customers that like to monitor the market and make trades on the go. In addition, clients can download the Qtrade Direct Investing app to track portfolio progress.

Overall, there is a decent selection of mobile and tablet-compatible investing solutions. Traders may struggle to conduct detailed technical analysis, but clients can scan the markets to identify potential opportunities, execute trades, and manage investment portfolios.

Payment Methods

Deposits

An Electronic Funds Transfer (EFT) – with wire transfers and ACH being types of EFTs – or bill payment from your bank account (using your account number), are the simplest ways to deposit money into a Qtrade account.

Personal cheques can also be sent, while Interac e-Transfer has been added for hassle-free transactions.

Unfortunately, credit/debit cards and e-wallets are not available, which is a drawback versus some competitors, which offer instant payment methods like Visa Debit.

It typically takes 1-2 business days for funds deposited via EFTs and bill payments to be credited to client accounts.

Qtrade does not impose a minimum deposit or maintenance balance. There is also no deposit fee.

Withdrawals

There is no withdrawal fee when using electronic wire transfers to move money from Qtrade to personal bank accounts.

Qtrade Accounts

Traders can sign up for an account in either USD or CAD. To open an account, you need to complete an investor profile and upload the relevant documents, which takes 10-15 minutes. This is part of the broker’s KYC obligations.

Once an account has been created, the sign-in process is simple with just a username/email and password required. It is also easy to reset your trading password if you have forgotten it. Joint accounts are available too.

Qtrade is only available to Canadian residents with a Canadian Social Insurance Number (SIN) needed to open any type of account. This excludes non-residents. If you have a SIN, the following account options are available:

Cash Account

This is the most basic account and allows investors to buy and sell stocks, ETFs, corporate and government bonds, mutual funds and other securities.

Margin Account

The Margin Account allows clients to borrow money from Qtrade to purchase securities. Clients can also add options trading and/or short selling.

Registered Accounts

Registered accounts allow investors to protect their investments from tax or defer it.

When you transfer securities from a third-party account to Qtrade, this can be done in kind where nothing needs to be sold.

Tax-Free Savings Account (TFSA)

Traders do not need to pay Canadian taxes on earnings on this account. Withdrawals are tax-free. Funds can be accessed at any time and up $6,500 CAD can be contributed each year. Investors can transfer existing TFSAs to Qtrade.

Note that a US dollar-registered TFSA has fees of $15 per quarter (waived for Investor Plus).

Registered Retirement Savings Plan (RRSP)

The retirement savings account allows tax to be deferred. Both individual and spousal RRSPs are available. Customers can transfer existing RSPs to Qtrade.

A USD RSP is available, which may help minimize exchange fees. There are no administration fees with an RRSP if more than $25,000 is held in Qtrade accounts or you trade regularly.

Locked-In Retirement Account (LIRA/LRSP)

The brokerage allows clients to transfer existing LRSPs and LIRAs to their Qtrade account for self-directed investing. Clients maintain the tax-deferred status of pensions from previous employers.

Registered Education Savings Plan (RESP)

Typically used to help pay for a child’s post-secondary education, a RESP and its associated benefits can be transferred to a Qtrade account.

RESPs provide tax-deferred growth for the child’s education. The government will match 20% of contributions per beneficiary to the account up to a maximum of $2,500 contribution per child per year.

There is a lifetime maximum of $50,000 per child of contributions, but there is no limit on the original contributions that the client can withdraw. RESP withdrawals are considered in applications for student loans and grants.

Registered Retirement Income Fund (RRIF)

An RSP can be converted to a RIF to avoid paying tax on the total amount after you turn 71.

Life Income Fund (LIF)

This registered account is another option to ensure assets remain tax-sheltered whilst an income is being drawn.

Demo Account

A trial account is available for 30 days. However, the test account doesn’t allow users to place orders and make trades, so it doesn’t function in the same way as a standard demo account. Still, the practice account will let prospective investors get familiar with the broker’s products and tools.

Head to the Qtrade official website to open a trial account.

Additional Features

A wealth of educational resources is available to clients, including ‘how-to’ videos, guides and articles. The topics of training materials vary from beginner-level content such as how to buy stocks online to explanations of more complex financial products like options.

Another clever feature is the Portfolio Creator. This can help build a personal ETF portfolio based on risk tolerance and preferred mix of stocks and bonds.

Qtrade also offers user-friendly tools that allow for the performance of investments to be assessed against appropriate benchmarks. Traders can analyze their portfolio against a range of different indicators, such as income, fees and diversification.

Regulation

Qtrade is regulated by a top-tier authority: the Canadian Investment Regulatory Organization (CIRO). In addition, the return of client funds is guaranteed (up to a limit) by the Canadian Investor Protection Fund (CIPF) should the company become insolvent. All guaranteed investment certificates (GICs) offered through Qtrade Direct Investing are insured by the Canada Deposit Insurance Corporation up to a maximum of $100,000 (principal and interest combined) per issuer per insured category – with the exception of certain GICs issued by credit unions, which are insured by the Credit Union Deposit Insurance.

For complete details about Canada Deposit Insurance Corporation coverage, visit their website.

For details about Credit Union Deposit Insurance Corporation coverage, visit the Credit Union’s website.

Trading Hours

Investing hours depend on the market being traded. For example, the opening hours of the New York Stock Exchange (NYSE) are 9:30 am to 4:00 pm ET.

Head to the broker’s website for a breakdown of opening hours by market, alongside holiday times and market closures.

Customer Support & Contact Details

What do you do when the Qtrade app is not working or when the system is down? In addition to an extensive FAQ page, Qtrade has a toll-free customer service telephone number available between Monday and Friday from 8:30 am to 8:00 pm ET. There is also an email address: DirectInvesting@qtrade.ca.

Customer service representatives can help with a range of queries, including:

- How to transfer and withdraw money and funds

- How to view your statements

- How to close a live account

- Whether ETF trading is free

- How to sell stocks

- How to trade options

- How to buy an ETF

Qtrade has a social media presence on multiple channels from Facebook and Twitter to LinkedIn, YouTube and Instagram. Other clients may prefer to use the mailing address. Reddit can also be a helpful discussion forum for those wishing to find reviews of Qtrade elsewhere. Plus, Qtrade offers live-chat and secure-site messaging.

Safety & Security

The Qtrade website only supports browsers that use 256-bit encryption – one of the strongest forms of online security. The company also uses firewalls to protect customer account information. In addition, two-factor authentication (2fa) is mandatory for live accounts.

Qtrade Verdict

Although Qtrade cannot be considered a global broker, it is one of the best online brokerages in Canada. Qtrade is an award winning platform and features best in class portfolio analytics tools and a Service Centre that is consistently top rated. The range of free ETFs makes the brand attractive to retail investors. The wide selection of account types also means there is something for everyone.

So, if you are a resident in Canada, create or login to your Qtrade account to start investing.

FAQs

Is Qtrade Safe?

Qtrade uses encryption technology and firewalls to reduce the risk of a successful malicious cyber attack. The Canadian Investor Protection Fund (CIPF) and the Canada Deposit Insurance Corporation (CDIC) also help protect client funds.

Is Qtrade CDIC Insured?

All guaranteed investment certificates (GICs) offered through Qtrade Direct Investing are insured by the Canada Deposit Insurance Corporation up to a maximum of $100,000 (principal and interest combined) per issuer per insured category – with the exception of certain GICs issued by credit unions, which are insured by the Credit Union Deposit Insurance. Other funds are protected by the Canadian Investor Protection Fund (CIPF) up to specified limits.

Where Is Qtrade Based?

Qtrade is a Canadian broker located in Vancouver.

Does Qtrade Have Crypto?

No. Investors wanting to trade cryptos such as Bitcoin, Dogecoin and Ethereum will need to find a different brokerage.

Does Qtrade Have A Mobile App?

Qtrade has its own mobile app available on iOS and Android that allows investors to make trades and monitor the markets on the go.

Is Qtrade The Same As Questrade?

Although Questrade is an entirely separate broker to Qtrade, they do share similarities – for example, they offer similar account types and tradable securities. When it comes to Qtrade vs Questrade, one of the main differences is that Questrade also offers a wide range of forex pairs.

Does Qtrade Have A Robo-Advisor?

Clients have access to Qtrade Guided Portfolios, which is an automated portfolio service with regular re-balancing.

Who Owns Qtrade?

Qtrade is owned by Aviso Wealth, one of Canada’s largest wealth management firms.

Does Qtrade Have After Hours Trading?

Yes. After hours trading is available on US equities and markets.

Online brokerage services are offered through Qtrade Direct Investing, a division of Credential Qtrade Securities Inc. Qtrade, Qtrade Direct Investing, and Write Your Own Future are trade names and/or trademarks of Aviso Wealth.

Best Alternatives to Qtrade

Compare Qtrade with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

Qtrade Comparison Table

| Qtrade | Interactive Brokers | Firstrade | |

|---|---|---|---|

| Rating | 3.6 | 4.3 | 4 |

| Markets | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $0 |

| Minimum Trade | Variable | $100 | $1 |

| Regulators | CIRO | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | – | – | Deposit Bonus Up To $4000 |

| Platforms | TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | Firstrade Invest 3.0, TradingCentral |

| Leverage | – | 1:50 | – |

| Payment Methods | 4 | 6 | 4 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Qtrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Qtrade | Interactive Brokers | Firstrade | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | Yes | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Qtrade vs Other Brokers

Compare Qtrade with any other broker by selecting the other broker below.

Customer Reviews

4.5 / 5This average customer rating is based on 2 Qtrade customer reviews submitted by our visitors.

If you have traded with Qtrade we would really like to know about your experience - please submit your own review. Thank you.

I always use Qtrade’s portfolio tracker before buying any securities now. Its scoring system helped me realise I was too exposed to Canadian equities and needed more diversification, so now I’ve leaned more into US and emerging markets. They’re a good bunch at Qtrade – available and helpful whenever I pick up the phone or speak to them on email.

If you’re into ETF trading like I am, Qtrade’s a solid pick. What really works for me is the Portfolio Analytics feature which breaks down ETF ratings and loads of useful info to help spot solid funds and new opportunities. The app does the job for keeping an eye on your portfolio, and knowing it’s regulated by CIRO and has been around forever (almost as long as I have!) definitely adds some peace of mind.