Prospero Markets Review 2024

Pros

- The MT4 platform and app are available to account holders

- Trading on the volatility index (VIX) is offered

- Prospero Markets is a trustworthy brand regulated by the ASIC

Cons

- The $500 minimum deposit is relatively high

- Crypto is not available

- There is no copy trading platform

Prospero Markets Review

Prospero Markets LLC is a popular broker that offers a variety of financial instruments. The firm provides a secure and user-friendly platform for individual investors and institutions to trade in forex, commodities, stocks, and indices. This review of Prospero Markets will share insights into the background of the company, as well as fees, leverage, sign-up details, plus platform and app ratings.

Company History & Overview

Founded in 2012, Prospero Markets is a financial services firm with headquarters in Melbourne, Australia, and offices in Sydney. The brokerage is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL) licence.

The brand provides traders in Australia with over 300 assets on the MT4 platform and app. Prospero Markets is also a reliable broker for traders worldwide via their two websites (ProsperoMarkets.com and ProsperoGlobal.net), though access is prohibited in Japan, North Korea, and the United States.

Trading Platform

Prospero Markets uses MetaTrader 4. Traders can download MT4 on their desktop devices or use the web trader.

MT4 is the world’s most popular retail investing platform for forex trading. It is renowned for its Expert Advisor (EA) building service, which allows traders to make their own trading robots and indicators. MT4 also offers:

- One-click trading

- Market, stop, and limit orders

- Charts across 9 time frames (M1, M5, M15, M30, H1, H4, D, W1, Mn)

- 24 analytical objects such as Fibonacci and 30+ pre-downloaded indicators including Bollinger bands

Getting Started

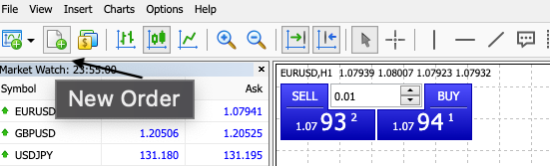

When you download/open the platform, there are three windows:

- The widget on the left is the ‘Market Watch’ window which allows traders to track popular assets

- The widget along the bottom is the ‘Terminal’ which can be used for various functions including keeping track of open trades

- The widget on the right can be used to view charts of your chosen asset

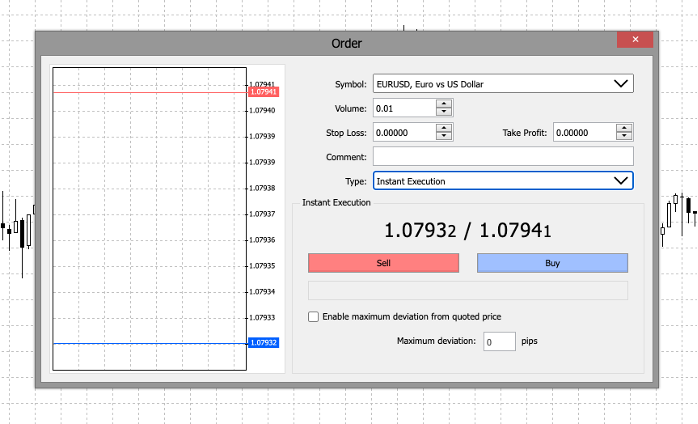

Placing An Order

To place an order with MT4, press the ‘New Order’ option in the toolbar at the top of the screen. A window will then pop up. Input the asset symbol, the trading volume (in lots), any stop loss or take order adjustments, any comments, and decide whether you will buy or sell. You will also need to decide between ‘Pending Order’ or ‘Market Execution’.

Markets & Instruments

Prospero Markets provides access to a good selection of instruments, including forex, precious metals, energies, stock indices, and equity CFDs. There is also access to the VIX (Chicago Board Options Exchange’s CBOE Volatility Index), which provides additional trading opportunities.

On the downside, there are only stock trading opportunities on companies from the US and Australia. Also, cryptocurrency is not offered.

Popular instruments:

- 38 forex pairs including AUD/CAD, EUR/GBP, USD/JPY, and AUD/USD

- 11 stock indices including UK100, USTEC, HK50, and DE30

- 13 commodities and metals including silver, gold, natural gas, copper, crude oil, corn, and wheat

- 58 futures including VIX01-VIX12, WTI01-WTI12 and UKO01-UKO12

- 95 US share CFDs including Apple Inc, Coca-Cola Company, Tesla Inc, and Pfizer

- 114 ASX share CFDs including Computershare Limited, Auckland International Airport Limited, Seek Limited, and Woolworths Group

Prospero Markets Fees

Prospero Markets offers competitive fees, particularly with its VIP trading accounts.

Standard Account

For standard accounts, floating tight spreads from 0.9 pips apply. There is no commission when trading forex, metals, indices, oil, and futures CFDs. For US share CFDs, traders must pay a commission of A$0.35 per share, and for Australian share CFDs, the commission is 0.07% per side.

VIP Account

With the VIP accounts, spreads start from 0.0 pips and competitive commissions apply on most assets:

- Forex: 3 AUD or 2 USD per standard lot per side

- Metals: 3 AUD or 2 USD per standard lot per side

- Oil: 3 AUD or 2 USD per standard lot per side

- US share CFDs: A$0.35 per share

- AU share CFDs: A$0.35 per share

There are no commissions for index or futures trading on VIP accounts.

Swaps

Swap fees apply with both account types but are not fixed and depend on the asset and the size of the position. For example, swap fees for holding overnight forex positions are based on the tomorrow-to-next-day rate, with a fixed markup in the market for the specific currency pair.

Note, you can view swap fees on the MT4 platform.

Leverage

The highest leverage Prospero Markets offers to Aussie retail traders is 1:30, in line with ASIC regulations.

For global traders, the maximum rate is 1:400 (on most forex pairs and gold spot trading). Leverage on precious metals ranges from 1:50 to 1:100. For oil it’s 1:100, for copper it’s 1:50, and for all other commodities it’s 1:20. Stocks have a maximum leverage of 1:100.

Payment Methods

While using Prospero Markets, our experts found various payment methods available:

- Electronic Fund Transfer: This includes PayPal, Skrill and POLi. Deposits are free of charge but traders will need to provide proof of the transaction (via receipt or screenshot) to accounts@prosperomarkets.com. It can take up to two business days for the payment to be made.

- BPAY: Deposits via BPAY also require proof of payment sent to the same email address. Payments are free and can take up to two business days. The biller and reference numbers required to complete the transaction can be found in the customer portal under My Prospero > Payments.

- Credit or Debit card: This is free of charge and can take up to two hours to complete.

Note, traders signed up with the global entity can only use UnionPay, Tether, and Swift.

How To Make A Deposit

Traders will need to navigate the client portal, then ‘Wallet’, and select the option to add funds. You can then choose one of the deposit methods listed above, as well as the amount.

You will be taken to the appropriate web page, where you can enter the required payment details, such as card information or bank reference numbers. Once this is done, click ‘Next’ to complete the payment.

Withdrawals

Withdrawal requests can be made via the same payment channels. However, requests can take up to five business days which is longer than many alternatives.

Fortunately, withdrawals are free of charge except for PayPal which has a 3% fee.

Mobile App

The broker does not offer a proprietary mobile trading app. However, the MetaTrader application provides all the features and functions of the desktop terminal, with smaller screen compatibility for smartphone and tablet devices. This also includes full account control, access to all order types, historical trade information, three chart types, and interactive symbols.

The MT4 mobile app can be downloaded to Android devices only.

Account Types

There are two live account options at Prospero Markets; Standard and VIP.

Standard Account

- Forex: Minimum spreads are 0.9 pips and the maximum leverage is 1:30

- Metal: Spreads are floating and maximum leverage is 1:20

- Oil: Minimum spread for Brent Crude Oil is 2.3 pips and for WTI Oil it’s 2.4 pips. The maximum leverage is 1:10

- Index and futures: Spreads are floating and the maximum leverage is 1:20

- Share CFDs: Spreads are floating and the maximum leverage is 1:5

Standard accounts also come with a 1-1 account manager, daily and weekly market analysis, and a minimum deposit of 500 AUD. It is worth pointing out that this is a fairly high minimum deposit which may put off some beginners.

VIP Account

- Forex: Minimum spreads are 0.0 pips and the maximum leverage is 1:30

- Metal: Spreads start at 1.4 pips for Gold and 1 pip for Silver. The maximum leverage is 1:20

- Oil: Minimum spread for Brent Crude Oil is 0.8 pips and for WTI Oil it’s 0.9 pips. The maximum leverage is 1:10

- Index and futures: Spreads are floating and the maximum leverage is 1:20

- Share CFDs: Spreads are floating and the maximum leverage is 1:5

VIP accounts come with the same services, however, with VIP profiles the account managers are more involved. Traders also get VIP weekly recaps of the market and dedicated seminars.

The minimum deposit for VIP accounts is 20,000 AUD. This makes it a better fit for advanced investors and active day traders.

Note, USD is the only base currency available at Prospero Global.

How To Register For A Real Account

To register for a live account at Prospero Markets, traders will need to provide their full name, phone number, and email address. You will then be prompted to provide KYC verification, such as a passport for ID, and a bank statement issued within the last 90 days as proof of address.

After this information is provided, your application status will be emailed to you within 24 hours, so you can make a deposit and start trading online.

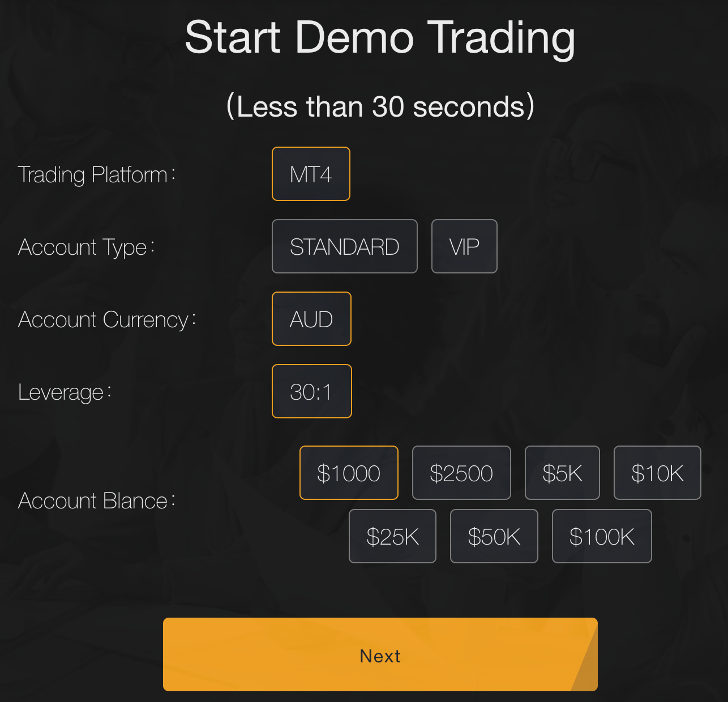

Demo Account

Opening a demo account with Prospero markets is simple. Enter your full name, phone number, and email address. You will then be prompted to choose the details of your paper trading account. Following this, you will be given login details to an MT4 demo account.

Demo accounts are a great way for traders to get comfortable with the broker and platform before committing their own funds. Clients can then upgrade to a live trading account.

Note, the paper trading account will expire after 30 days.

Bonuses & Promos

In line with regulations introduced by the ASIC in March 2021, Prospero Markets does not offer promotions and financial incentives. This is due to bonuses sometimes encouraging traders to take on too much risk.

Alternatively, Prospero Markets offers a range of educational tools to promote safe and successful trading. These are outlined in more detail below.

Prospero Markets Regulation

Prospero Markets is regulated by the Australian Securities & Investments Commission (ASIC), with license number 423034. For international investors, Prospero Global is regulated by St Vincent & Grenadines Financial Services Authority (SVGFSA), with registration number 533LLC2020.

Importantly, the SVGFSA does not actively regulate trading brokers, meaning entry rules and operating conditions are relaxed. The result is fewer legal protections for retail traders. For example, the maximum leverage with the global entity is much higher at 1:400.

Nonetheless, both the Australian entity and the global broker segregate client funds and offer negative balance protection.

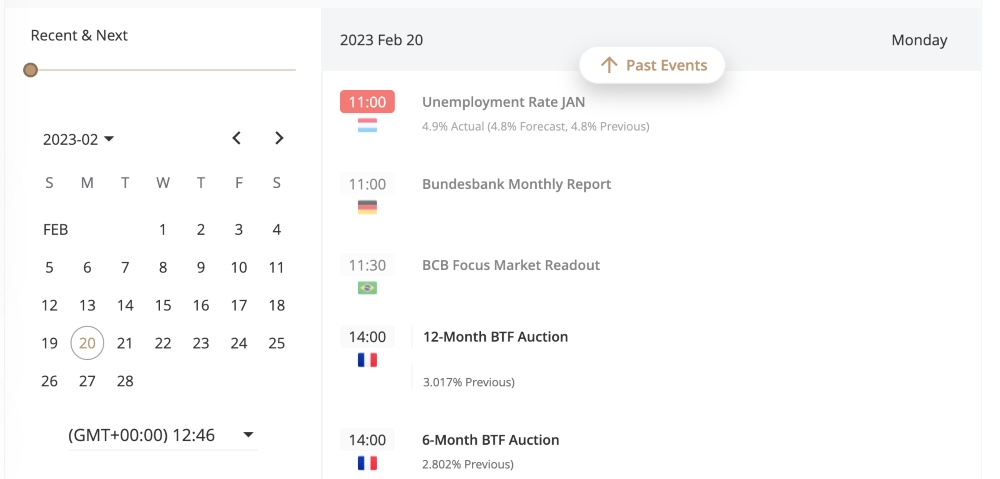

Additional Tools

The Prospero Markets website offers a variety of educational resources. This includes an economic calendar which you can filter based on the most important economic events. There are also live updates on financial news.

You can find seminars catered to different levels of trading experience, from introductory to advanced. Enrolling is free, you just need to input your name and email. Popular examples of classes include Introduction to Forex Trading: Investment Essentials, and Investment Priorities in Practice.

There are also links to financial blogs to broaden traders’ understanding of the financial markets. Good options for beginners are What is Forex? and Explore The Charm Of Trading.

Customer Support

Prospero Markets has a good customer support team with knowledgeable staff. Customer service is available 24 hours a day 5 days a week, via live chat and email. There is also a form that can be filled out on the website and sent directly to the customer service email. Prospero Markets is also on WeChat (prospero_markets_au or prospero_markets).

- Telephone – 1300 768 888

- Email – support@prosperomarkets.com

- Office Address – Suite 502, 1 Castlereagh St, Sydney, NSW 2000

Opening Hours

- Forex – Sunday between 21:00 and 21:15 GMT to Friday between 20:55 and 21:00 GMT

- Commodities, Indices and Futures – It depends on the location of the market. For example, for the F40 (France), trading hours are Monday – Friday 09:00 – 23:00 GMT, and for the HK50 it’s Monday – Friday 03:15 – 06:00, 07:00 – 10:30, and 11:15 – 21:00 GMT

- ASX Shares – Monday – Friday: 01:00 – 07:00

- US Shares – Monday – Friday: 16:30 – 23:00

Security & Safety

Prospero Markets is a safe broker-dealer brand with strict data privacy rules. For any disputes or complaints, customers can use the AFCA external dispute resolution scheme.

The MetaTrader 4 terminal is also secure. All personal information is transmitted between trading accounts and the platform interface with top-tier encryption and RSA digital signatures.

Prospero Markets Verdict

Prospero Markets is a reputable financial broker that offers access to popular markets on the MetaTrader 4 platform. Its global counterpart offers similar products and tools with higher leverage up to 1:400. Users also benefit from tight spreads and competitive commissions, especially with VIP trading accounts. On the downside, the $500 minimum deposit is higher than most competitors. There is also no copy trading.

FAQs

Is Prospero Markets A Safe Broker?

Prospero Markets is a secure online broker. The company holds a license from the Australian Securities & Investments Commission, provides negative balance protection, and segregates client funds at the Commonwealth Bank of Australia. The brand also has many positive reviews from other traders.

Does Prospero Markets Offer High Leverage?

The global entity offers high leverage up to 1:400. However, the Australian entity caps leverage to 1:30 in line with local regulatory restrictions. Note, trading with leverage up to 1:400 will increase your risk exposure so make sure you have a suitable money management system.

Is Prospero Markets Legit?

Yes, Prospero Markets is a legitimate brokerage offering 300+ instruments on the MetaTrader 4 terminal. The company is also registered with the ASIC, a top-tier global regulator with stringent rules for trading firms to comply with.

Does Prospero Markets Offer A Demo Account?

Yes, Prospero Markets offers a free 30-day demo account on the MT4 terminal. The paper trading profile offers risk-free trading with virtual funds and flexible leverage. Traders can sign up via the broker’s website in less than two minutes.

Does Prospero Markets Offer Reliable Customer Support?

Yes, Prospero Markets offers 24/5 customer support for all registered users. This includes a live chat service, telephone, and email. Additionally, there is an online inquiry form and an adequate FAQ section available on the broker’s official website.

Top 3 Alternatives to Prospero Markets

Compare Prospero Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

Prospero Markets Comparison Table

| Prospero Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 3 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Metals, Energies, Stocks, Indices, VIX | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | A$500 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, SVGFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (Australia), 1:400 (Global) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 8 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Prospero Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Prospero Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | Yes |

Prospero Markets vs Other Brokers

Compare Prospero Markets with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Prospero Markets yet, will you be the first to help fellow traders decide if they should trade with Prospero Markets or not?