Options Strategies for Small Accounts

Options trading can be a viable trading strategy for small accounts, but it requires planning and careful risk management.

Because small accounts don’t have a lot of wiggle room to trade large premiums or sustain losses, we look at some options strategies for small accounts.

Key Takeaways – Options Strategies for Small Accounts

- Popular Options Strategies for Small Accounts

- Selling Covered Calls

- Selling Cash-Secured Puts

- Buying Long-Dated Options (LEAPS)

- Vertical Spreads

- Iron Condors

- Cheap OTM Options

Here are some strategies that could be appropriate:

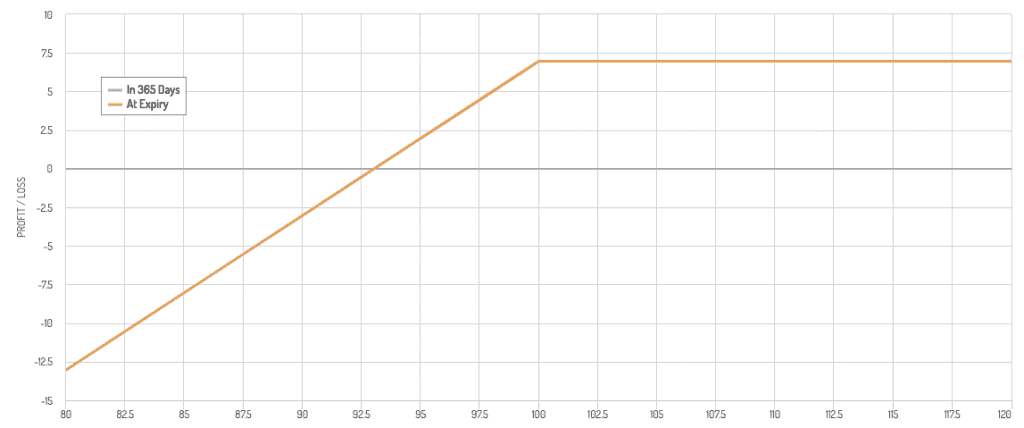

Selling Covered Calls

Sell call options on stocks you already own.

Rationale

Generate additional income from the premium received, which can help grow a small account.

Your broker often won’t require extra margin to sell options against stocks you already own (assuming the sizing isn’t beyond what you own).

For example, if you own 100 shares of a stock, you should be able to sell 1 option contract against it without incurring extra margin requirements.

Risk Management

Losses can occur if the stock price falls significantly below the strike price and loses in excess of the premium.

Your payoff diagram will appear as this type of structure:

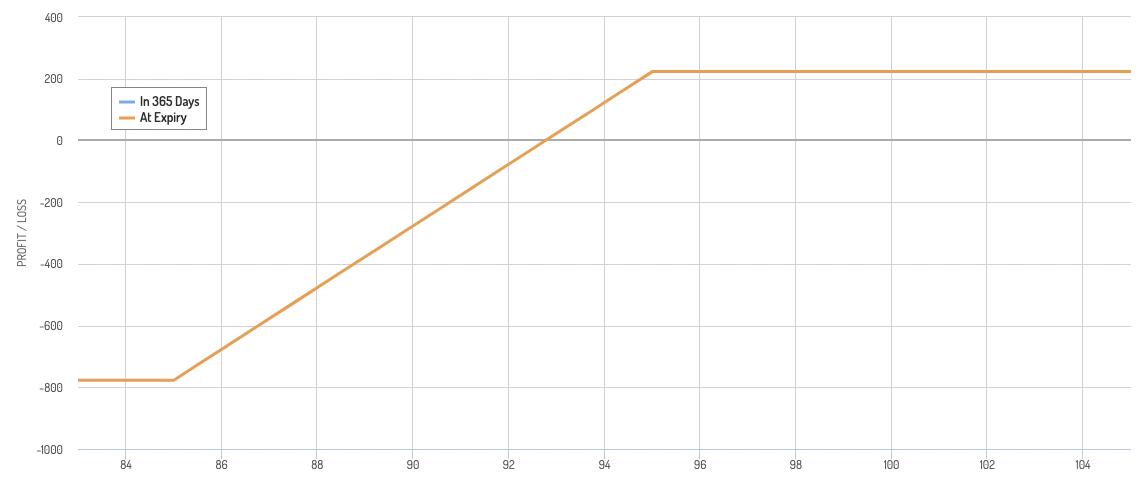

Selling Cash-Secured Puts

Sell put options and keep enough cash in the account to buy the stock if the option is exercised.

Rationale

Earn premium income or potentially purchase the stock at a lower price.

Risk Management

Be prepared to own the stock at the strike price, which should be a price you’re comfortable paying.

Buying Long-Dated Options (LEAPS)

Purchase options with expiration dates far in the future to leverage a longer-term view on a stock.

Rationale

Provides exposure to the underlying asset with less capital than buying the stock outright.

Risk Management

The total investment is at risk, so only allocate a small portion of the account to any single LEAPS position.

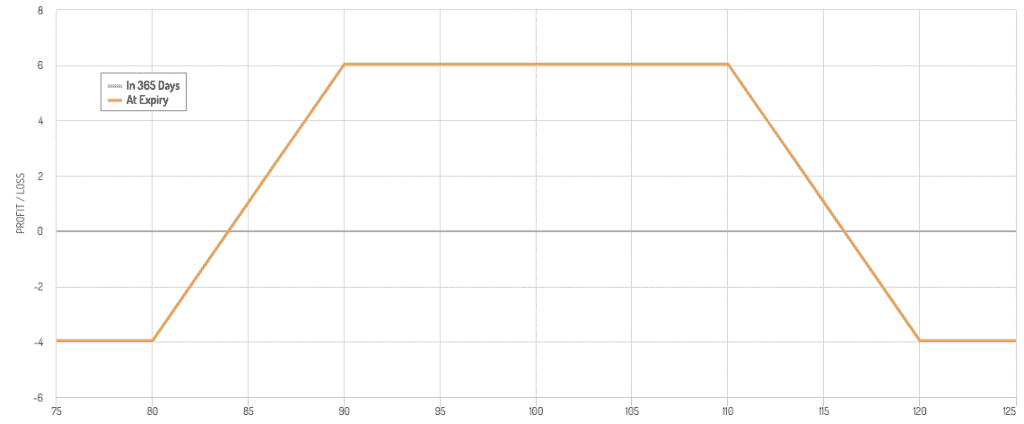

Vertical Spreads

Buy and sell options of the same underlying asset with different strike prices but the same expiration date (either all calls or all puts).

Rationale

Limits the investment required and defines both the maximum gain and loss upfront.

Your trade might look something like this:

Risk Management

Choose spreads that balance potential profit with the risk of loss, and avoid allocating too much of the account to any single trade.

Iron Condors

A combination of selling a put spread and a call spread on the same underlying asset, typically for index or large-cap stocks.

Rationale

Generate income with defined risk and benefit from time decay if the underlying stays within a range.

Because of the limited upside + limited downside structure, the collateral needed on the trade can be reasonable, making the iron condor a good options strategy for small accounts.

Risk Management

Monitor the positions closely and have a plan to adjust or close the trade if the market moves against it.

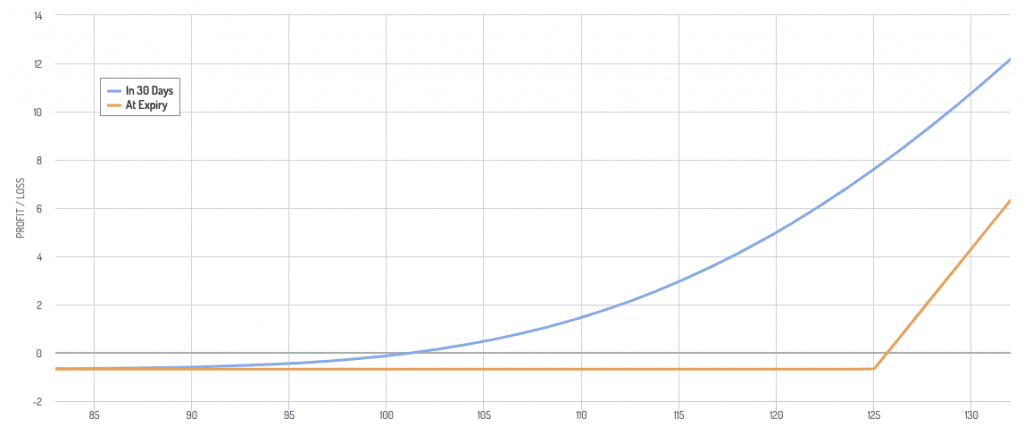

Cheap OTM Options

Options that are out-of-the-money but don’t cost much and have limited downside (the premium).

Rationale

Have a fixed downside but lots of upside and a convex structure.

Don’t need the options to land ITM, just need them to move in that direction.

For example, for an underlying at 100 and buying 125 calls, if the underlying moves that way in a reasonable amount of time (especially on higher volatility) you can have an outsized payoff.

Risk Management

OTM options have high convexity and are often actively traded because of their volatile movement.

Things to Consider

Keep each trade size appropriate to the account size to avoid overexposure.

Risk Management

Always know the maximum potential loss and avoid strategies that can lead to unlimited losses.

Trade Selection

Choose underlyings with good liquidity to help with tighter spreads and better prices for entering and exiting trades (e.g., SPY).

Education and Experience

Start with paper trading to gain experience without risking real money, and continuously learn and work at it.

Conclusion

Implementing these strategies in small accounts requires careful consideration of risk and potential returns to make sure that the account can withstand the volatility and time required to achieve trading objectives.