Options Strategies for Beginners

When beginning with options trading, it’s important to understand the fundamentals and start with basic strategies that limit risk while providing an opportunity to learn and gain experience.

Key Takeaways – Options Strategies for Beginners

- Options Strategies for Beginners

- Buying Calls and Puts

- Covered Call

- Protective Put

- Sell Cash-Secured Put

- Call and Put Spreads

Here are some strategies suitable for beginners:

Buying Calls and Puts

Buying a Call

Buying a call gives you the right to buy a stock at a specified price (strike price) before a certain date (expiration date).

Buying a Put

Buying a put gives you the right to sell a stock at a specified strike price before the expiration date.

When to Use

- Buy calls when you expect the stock price to rise.

- Buy puts when you expect the stock price to fall.

Risk and Reward

- Risk is limited to the premium paid for the option.

- Reward can be significant if the stock moves in the anticipated direction by more than the premium paid.

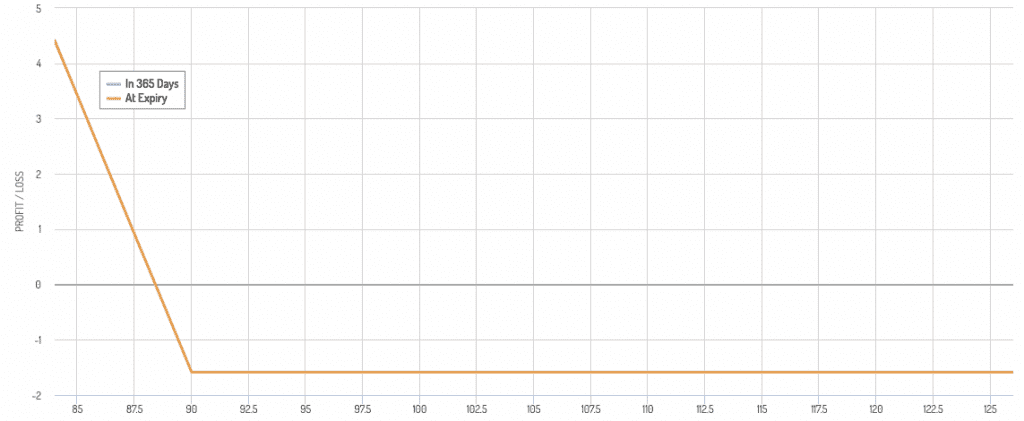

Covered Call

Involves owning the underlying stock and selling a call option on that stock.

This strategy generates income from the option premium and provides some protection against a decline in the stock price.

When to Use

When you have a neutral to slightly bullish outlook on a stock you own.

If you would sell a stock at a certain price, then getting paid some premium to sell at that price could make sense.

Risk and Reward

- Risk is limited to the decline in stock price minus the premium received.

- Reward is capped at the premium received plus the gain up to the strike price of the call.

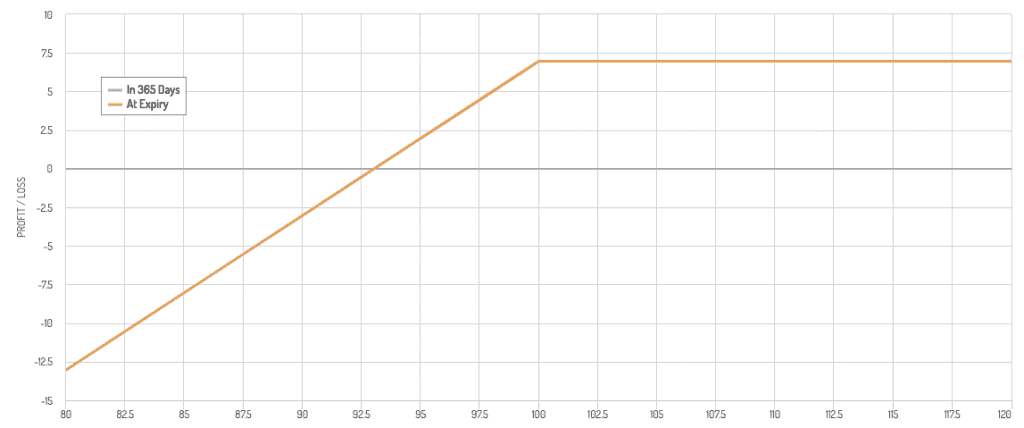

Protective Put

Involves buying a put option for stock you already own.

This strategy acts as an insurance policy, protecting against significant losses in the stock.

When to Use

When you want to protect gains or limit losses in a stock you own.

Risk and Reward

- Risk is reduced to the cost of the put plus any decline in the stock price up to the put’s strike price.

- Reward has no upper limit, as you retain the upside potential of the stock.

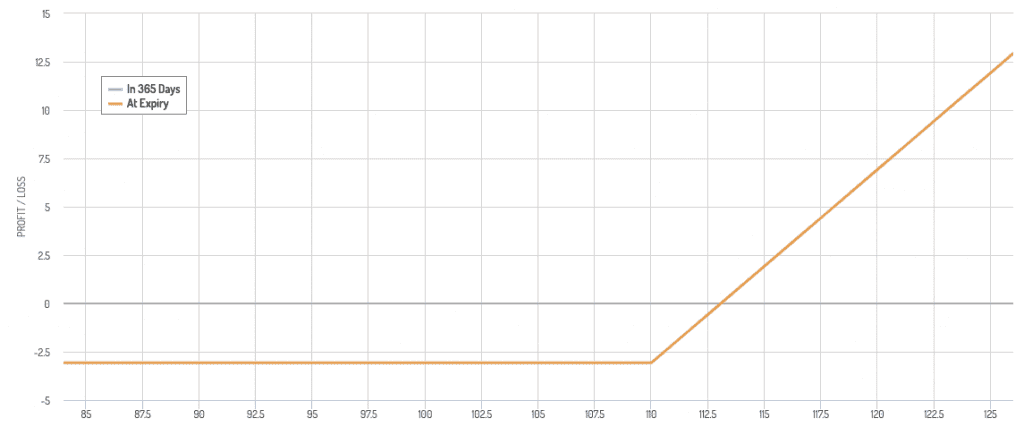

Sell Cash-Secured Put

Involves selling a put option and setting aside enough cash to buy the stock at the put’s strike price.

This strategy generates income from the option premium.

When to Use

When you have a neutral to bullish outlook on a stock and wouldn’t mind owning it at a lower price.

Risk and Reward

- Risk is acquiring the stock at the strike price minus the premium received.

- Reward is limited to the premium received.

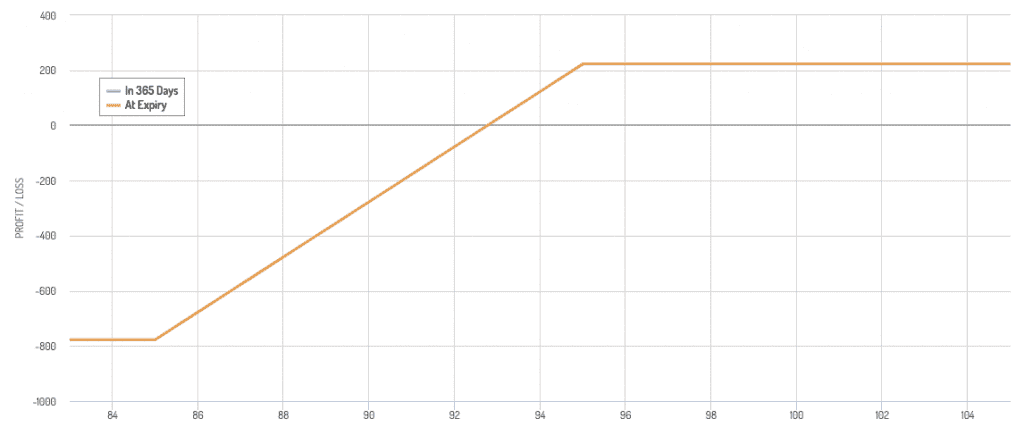

Call and Put Spreads

Involves buying and selling calls or puts with different strike prices or expiration dates.

This strategy can limit both potential profit and loss.

Types

- Vertical Spread – Buy and sell options of the same type (call or put) with different strike prices but the same expiration date.

- Calendar Spread – Buy and sell options of the same type with the same strike price but different expiration dates.

Example Payoff Diagrams

Call Spread

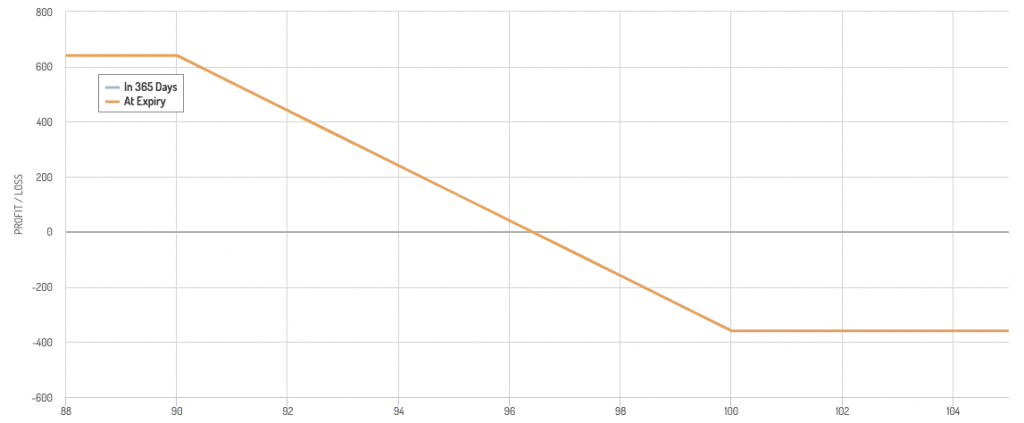

Put Spread

When to Use

When you expect the stock to move in a certain direction but want to limit risk.

Risk and Reward

Risk and reward are both limited and defined by the difference between the strike prices minus the net premium paid or received.

Conclusion

Beginners should start with these basic options strategies to develop an understanding of how options work while managing risk.

As experience grows, more complex strategies can be explored.

With all options strategies, it’s important to understand the potential risks and rewards, as well as the types of markets in which they’re most effective.