Nexo Review 2026

Available in United States

Available in United States Awards

- Best Cryptocurrency Wallet – FinTech Breakthrough Awards, 2023

- Best Use of Crypto and/or Blockchain in Financial Services – PAY360 Awards, 2022

Pros

- Nexo’s crypto staking and credit features support crypto lending and borrowing, and the yields lenders receive are among the best going

- Traders benefit from bonuses and incentives including free trading funds paid to lenders and cashback in the form of the exchange’s native Nexo token

- Nexo Pro is a user-friendly proprietary platform that suits day trading strategies with great charting features

Cons

- Although Nexo has registered with some reputable watchdogs, it is riskier to trade with than established crypto brokers like AvaTrade and Vantage

- Very few educational resources are available, reducing its appeal to beginners who can find more helpful resources at category leaders like eToro

- High maker/taker fees mean day traders will pay more to trade derivatives than they would at rival exchanges like Binance

Nexo Review

In this Nexo review, we evaluate the range of products, tools and overall trading environment. We also make direct comparisons with suitable alternatives so you can see how it rivals other crypto exchanges and online brokers.

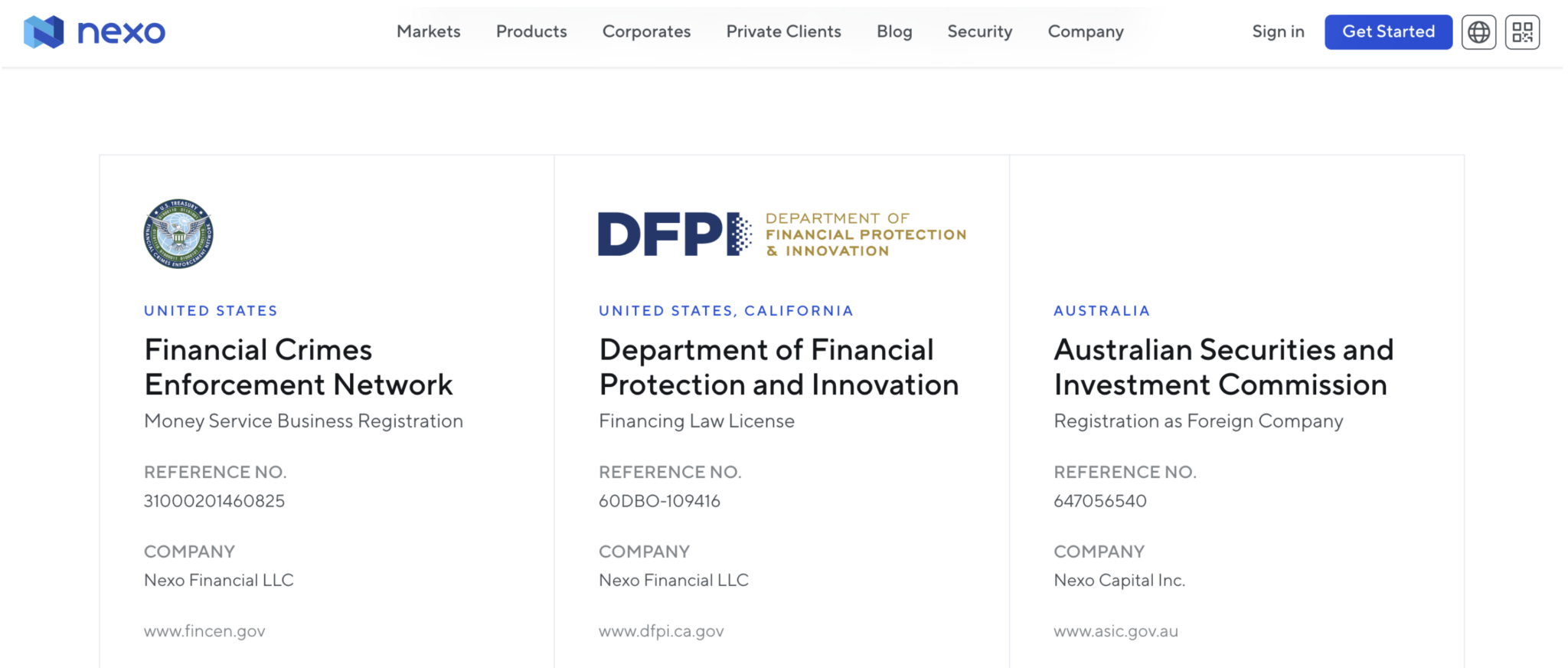

Regulation & Trust

Although we have to give Nexo an average trust score, it doesn’t mean this firm is unreliable. Unfortunately, we can’t go higher because crypto exchanges often operate with limited regulatory safeguards so traders won’t be afforded the same protections as they would with a trusted crypto broker.

The most significant risk is that the exchange might go under due to extreme market volatility, incompetence or scams, and many major exchanges from Mt Gox to FTX have collapsed in recent years, costing clients billions.

That said, we have been reassured to see that Nexo has taken steps to demonstrate its legitimacy by registering with respected bodies, including the Australian Securities and Investments Commission (ASIC) and US Financial Crimes Enforcement Network (FinCEN).

Still, these don’t rival the regulatory credentials of the top crypto brokers, and even crypto exchanges that operate scrupulously still have to contend with shifting regulatory requirements that can inconvenience traders.

For example, changes to rules in the UK in 2023 have forced Nexo to suspend several services in the country including cashback and card transactions, while another big exchange, ByBit, decided to suspend operations entirely.

Accounts & Banking

Live Accounts

Crypto exchanges don’t tend to have tiered account systems in the way that brokerage accounts do, and sure enough Nexo clients all sign up with a single, standard account.

As with many other crypto exchanges, users gain the benefit of reduced fees by increasing their trading volume, rather than through depositing larger amounts.

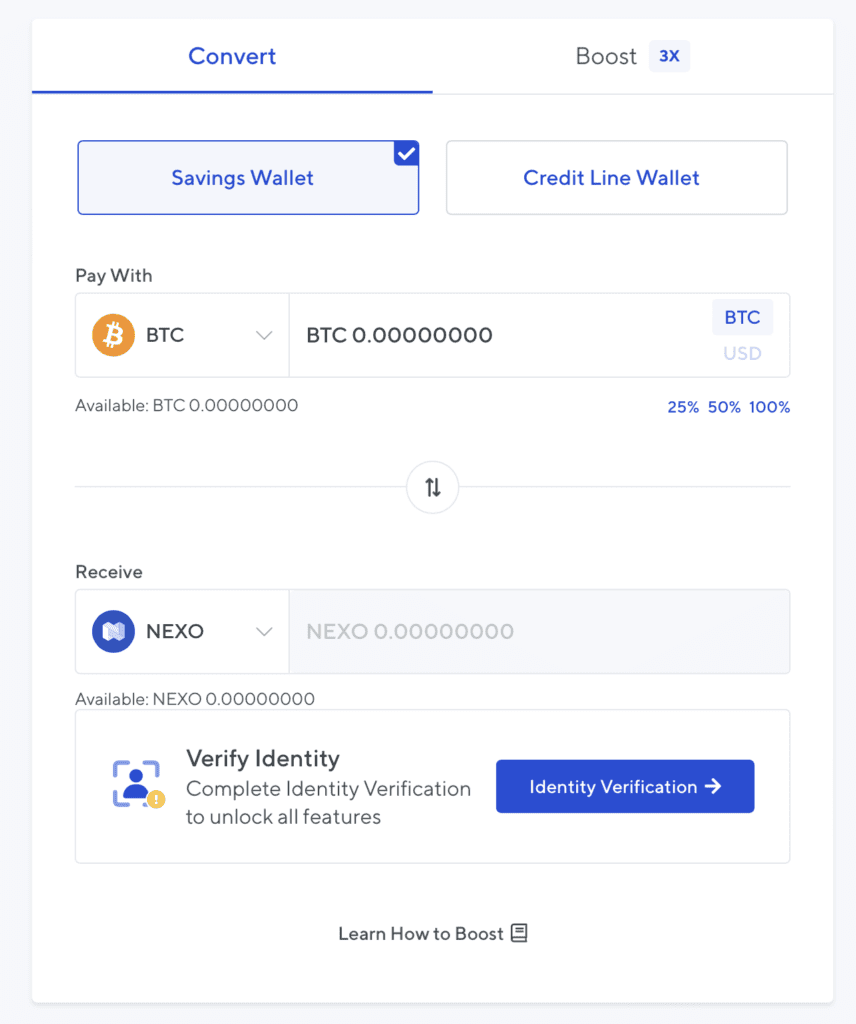

What I really like about Nexo is the range of additional services that account holders can access. These include a non-custodial wallet, a bank card, plus crypto loaning and staking services.

This adds an awful lot of scope and flexibility and makes Nexo a great all-rounder for those who want to go beyond day trading and access comprehensive crypto services.

Deposits & Withdrawals

Nexo doesn’t have as much choice when it comes to funding methods as top crypto brokers like Eightcap. However, I was impressed that it includes the popular digital methods of Apple Pay and Google Pay as well as the standard bank transfers, card transfers and on-chain crypto transfers accepted by most exchanges.

Bank transfer deposits are made free of charge on Nexo’s side, with a $10 minimum and a maximum of $2 million in the relevant currency.

While the card and e-wallet deposits are instant and start with just a $1 minimum, I was frustrated to find fees that can be quite hefty.

Deposits from the European Economic Area pay 1.99%, which is already high, but others will pay much more than that at 3.49%.

Crypto Loans & Nexo Card

One big positive about Nexo that makes up somewhat for the high costs is the opportunity to make money by staking your tokens for some of the best return yields on the market.

While crypto staking can be very risky in itself due to the volatility of many tokens, I was impressed to find a huge 16% on USDC, a stablecoin that is pegged to the value of the dollar.

I also like the opportunity Nexo gives you to take out loans where your crypto assets act as collateral. This makes for a very convenient way to borrow, since loans can be taken out with instant approval and without credit checks.

Importantly, it also allows traders to stake and earn from their crypto assets while securing funds in fiat currencies through loans.

Due to the high fees for fast deposits and withdrawal methods, I think Nexo is better for longer-term investors who will benefit from staking yields rather than day traders who need to frequently move money.

Bonuses

Nexo offers several incentives to traders and I feel these provide a good amount of value and offset some of the expensive fees.

At the time of our last tests, the brand offered up to $100 USDC in trading funds to new joiners who sign up using a bonus code.

Other incentives include a bonus of up to $500 USDC for users who open a new fixed-term contract as a lender. This bonus only kicks in for contracts over $50,000, but lower bonuses of $30 or $150 are available for smaller loans.

There’s also a $25 referral fee and cashback to clients who use their Nexo credit card to make purchases – though note that the cashback comes in Nexo tokens, and not in a fiat currency.

Demo Account

I was disappointed that Nexo doesn’t support a demo account. Although demo accounts are not as common on crypto exchanges as on brokers, some big names like Kraken do support paper trading on crypto futures.

However, for a more comprehensive demo account that lets you check the full range of services on offer and test day trading strategies, we recommend using a crypto broker like Eightcap that provides demo access for anyone who opens a live account.

Assets & Markets

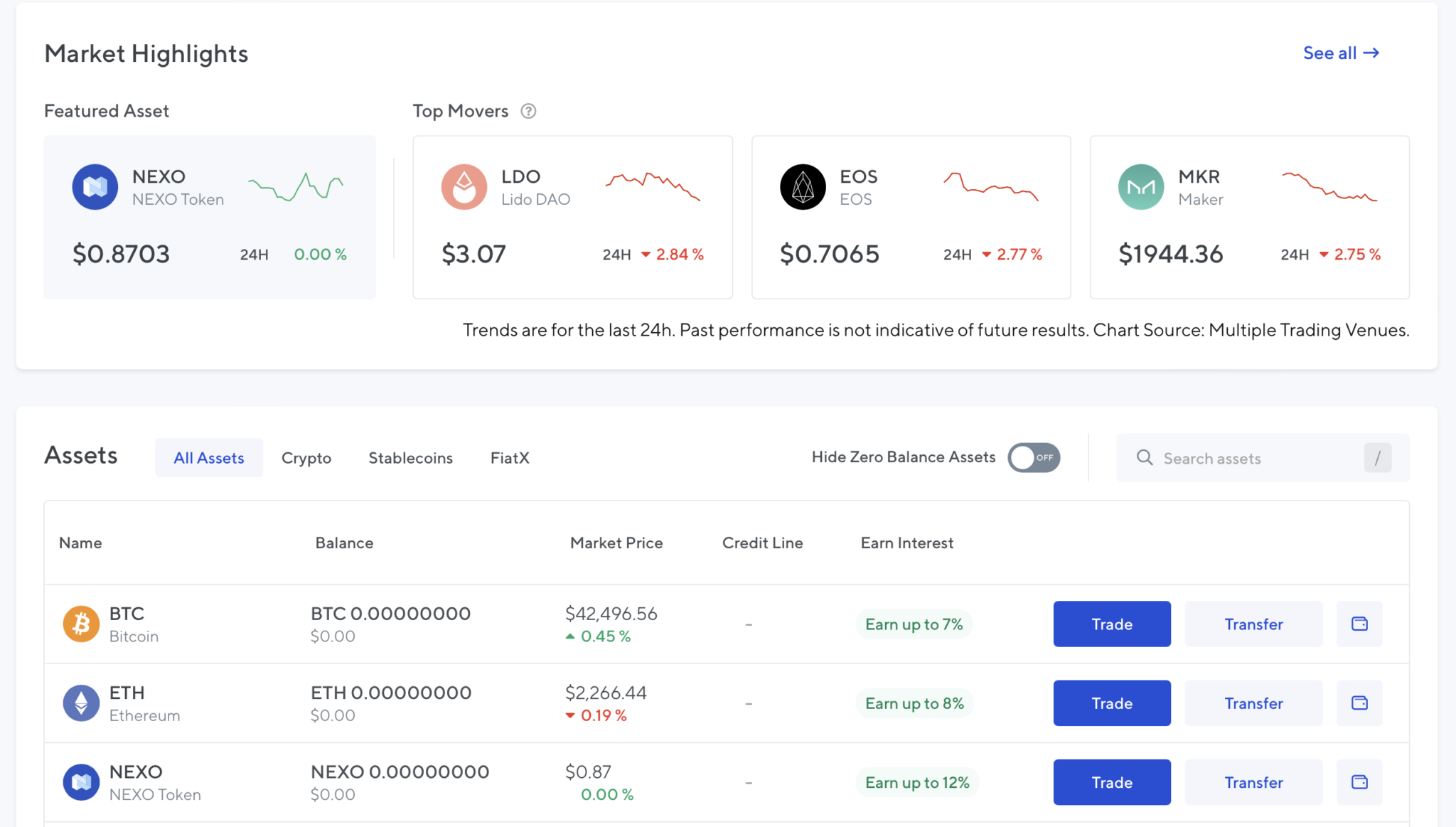

As a crypto exchange, Nexo’s range of tradeable crypto assets far outstrips what’s available from most brokers. There are around 70 digital assets that can be bought, sold and swapped directly or traded in some 500 pairs.

However, when you compare Nexo’s range to other big crypto exchanges or dedicated crypto firms, this isn’t that broad a range. Coinbase offers around 250 crypto assets, while Kraken has 240+ and Binance offers 400+.

The opportunity to trade up-and-coming tokens with more volatility and more potential upside is a major reason that traders sign up with crypto exchanges, so I found the smaller range at Nexo quite limiting.

As a result, you might be better off choosing a crypto broker like XTB, which has a good range of 45+ crypto CFDs plus the security of top-tier regulation.

On Nexo, you’ll find Bitcoin, Ethereum and all the other established tokens, as well as many smaller-cap tokens including the native Nexo token, which does give traders some nice incentives including 0% interest loans and higher yields while staking.

Another thing I like about Nexo’s offering is the 70 perpetual futures, which provide a great way for day traders to profit from shorter-term price movements.

Importantly, these crypto derivatives allow traders to speculate on price movements in both directions in leveraged long and short positions.

Leverage

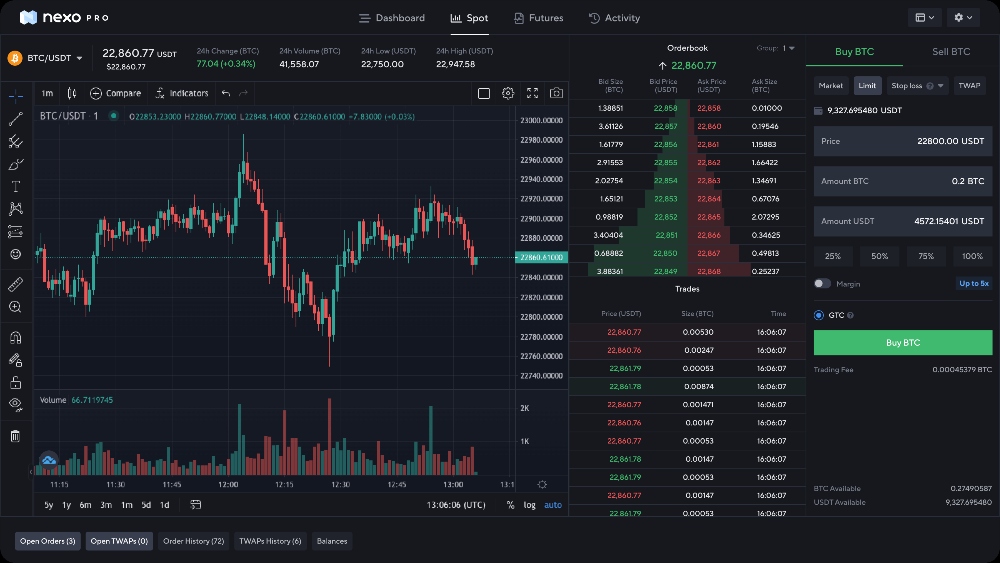

A big benefit for day traders is that these futures can be traded with up to 1:50 leverage on Nexo’s standard app, and up to 1:20 leverage on the Nexo Pro platform.

This is a significant amount of leverage for crypto assets, which crypto brokers tend to limit to much lower levels like 1:2 or 1:5, and it allows Nexo traders to greatly boost their trading positions – both profits and losses.

Another nice feature on Nexo is that traders can borrow funds to increase their crypto purchases by 1.5x to 3x using the ‘Boost’ service.

Importantly, I urge caution and recommend always keeping your risk management tight while trading crypto, since these are highly volatile markets where prices can swing dramatically in a single day’s trading.

Fees & Costs

Nexo clients will face charges at several stages while trading and we found the fees overall to be high compared to similar exchanges and to crypto brokers.

At the first stage is the deposit/withdrawal fee for card and e-wallet transactions, which rings in at a price of 1.99% for EEA and 3.49% for non-EEA traders. I found this to be very excessive, especially considering that the charge applies both when you fund and empty your account.

This means that traders outside the EEA will need to make at least 6.98% in profit from trades just to break even. When you factor in other costs, this amounts to a very high hurdle that day traders will have to cross before you can trade profitably.

Many day traders need to make transactions frequently, and while bank transfers don’t face these charges, the faster payment methods do.

And, while Nexo does mitigate this to an extent by allowing traders on the loyalty program (unlocked by holding Nexo tokens) a free withdrawal per month, this may not go far for high-volume traders.

This is a major reason we can’t score Nexo more highly as a destination for day traders, though it might work for those who keep their main trading funds in cryptocurrencies and will therefore only need to pay gas fees for transactions.

Unfortunately, we also found Nexo’s trading fees to be higher than similar competitors like Binance and Kraken.

Traders will pay a maker/taker fee for spot trades. As with many other crypto exchanges, the fees are on a sliding scale that decreases as the trading volume goes up.

At the lowest tier of up to $10,000 in trading volume, Nexo charges 0.2% each to makers and takers. This decreases in stages to 0.12% for takers and 0.1% for makers with a trading volume of $1 million, and then on to a minimum fee of 0.07% and 0.04% respectively to takers and makers who trade $500 million+.

This is much higher than Kraken, which starts at 0.05% and 0.02% for takers and makers with volumes below $100,000 and progresses to the highest tier with 0.01% for takers and no fees for makers.

Additional fees include the spread, which greatly varies between tokens and according to market conditions due to the volatility of crypto, and gas fees for crypto transactions.

You’ll also pay an interest rate for margin trading, and you should be aware that interest is charged per 15 minutes the position is open, and not only for overnight positions.

Platforms & Tools

Overall, I like Nexo’s platform options. Besides the basic browser-based platform, which is best for the brand’s investment services, there’s also the Nexo Pro platform, which works well for day trading.

Starting with the basic portal, you’ll find all the vital info on its assets in straightforward table format with a summary of the latest market movements at the top of the page.

I find it easy to click on tokens of interest and bring up a chart and more detailed information. I can also very easily buy or convert tokens by clicking the ‘trade’ button and selecting ‘buy’ or ‘sell’.

I see the Nexo Pro platform as a far better option for day trading as it provides a terminal with real-time charts and crucial tools including different order types.

These include advanced order types including market, limit, stop loss, and take profit orders, and support for automated strategies.

The chart suits fast-paced day trading strategies with timeframes ranging from 1 minute to 1 month. The 100+ in-built indicators are another great feature that puts this platform ahead of some older standard platforms like MetaTrader 4, which has just 30.

I especially liked its integrated tools, which include widgets to track social media sentiment and access sector performance, on-chain data and other advanced information.

Since there’s a Nexo Pro mobile app, you will also be able to access charts and set market or limit orders on the full range of assets, though the functionality is slightly curtailed compared to the desktop version.

I did find some areas that were frustrating compared to trading with my favorite modern platforms like TradingView – most importantly, the lack of support for custom indicators.

Nevertheless, Nexo Pro is a very good fit for day traders, and I think it stands up very favorably against the terminals used by its biggest rival exchanges like Binance and Kraken.

Nexo’s standard spot trading functions are fairly basic, but with a wide range of in-built indicators, advanced data and integrated research tools, the Nexo Pro terminal will certainly suit day traders.

Research

Nexo’s research tools are concentrated on the Nexo Pro platform, and though I do find value in them I feel that, overall, there is much room for improvement.

For a start, I would like to see news and analysis added directly to Nexo’s basic platform, which does not include any research tools at all.

When it comes to the Nexo Pro research tools, the aforementioned tool that analyzes social media sentiment is a great addition. It is also fantastic to see trending news from top outlets for the full range of assets.

However, top rivals offer similar tools, with Coinbase’s research hub being particularly impressive.

And I feel that this is another area where, generally, crypto brokers have the edge over exchanges. For example, eToro offers insights and analysis for each of its crypto assets with links to top news stories, but it also provides daily market updates and weekly analysis roundups via email.

Education

I was disappointed with Nexo’s very slim offering of educational resources. These were limited to the very basics, with a ‘Knowledge Base’ only providing three videos on how to fund your account and use some of Nexo’s features.

With Kraken providing an intuitive and easy-to-use Learn Center, and crypto brokers like Eightcap offering comprehensive educational sites of their own, I found the lack of educational resources on Nexo a notable letdown, especially for beginners.

Customer Support

Overall, I’ve had positive experiences with the Nexo customer service agents, who are available 24/7 via live chat.

Starting with the downsides, the exchange doesn’t offer a contact number, so all queries are handled via live chat or email. I had a disappointing experience after emailing a question, which went unanswered for more than 24 hours and was still not answered at the time of writing.

Fortunately, the live chat team made up for this by giving me quick and helpful answers to all of my queries within minutes of launching the chat.

Should You Trade With Nexo?

There’s no question that Nexo is a good destination for dedicated crypto investors. Thanks to features including high-interest crypto loans and its overall professionalism, this competes well against similar crypto exchanges.

For trading, the Nexo Pro platform is a big positive, though this is somewhat tarnished by the lack of research and educational content, high trading fees and deposit/withdrawal charges.

FAQ

Is Nexo Legit Or A Scam?

We scored Nexo averagely for Regulation & Trust. This is largely because, while a legitimate company, it’s a crypto exchange which typically operate with limited regulatory oversight.

Also, there have been a number of high-profile firms that have gone under over the years leaving many customers out of pocket, think FTX, Genesis, BlockFi etc.

In summary, it’s a legit firm but crypto exchanges by their very nature are high-risk.

Can I Trust Nexo?

Nexo is certainly reputable among crypto traders, though you should be aware of the risks of trading in a highly volatile sector where exchanges do collapse.

Is Nexo A Regulated Broker?

As with other crypto exchanges, Nexo is not regulated in the way that brokers are, so you should not expect the same protections. That said, it is registered with the ASIC and FinCEN.

Is Nexo Good For Beginners?

Nexo’s lack of educational resources puts beginners at a disadvantage, but in any case, we generally advise new traders to start with a broker rather than a crypto exchange to limit their risk while they learn the basics.

Does Nexo Offer Low Fees?

Nexo’s maker/taker fees are higher than similar competitors, and traders who deposit with cards or e-wallets will need to contend with very high charges from 1.99% each way.

Is Nexo A Good Broker For Day Trading?

Nexo has some good points for day trading, including a powerful and user-friendly platform, but the fees are higher than some competitors. The range of tokens also beats most online brokers, though it does trail other crypto exchanges if you want to speculate on a large choice of emerging digital assets.

Does Nexo Have A Mobile App?

The Nexo Pro mobile app, available on iOS and Android devices, allows for trading on the exchange’s range of assets while on the move. It’s intuitive and streamlined, though it doesn’t have the same depth as the desktop version.

Best Alternatives to Nexo

Compare Nexo with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Crypto.com – Crypto.com is one of the biggest names in cryptocurrency trading, developed with the aim to expedite the world’s transition to DeFi technologies. The crypto exchange offers token lending, pre-paid cards, NFTs and more. The firm was established in Germany in 2016 and its quality is proven by its 150 million users.

Nexo Comparison Table

| Nexo | Interactive Brokers | Crypto.com | |

|---|---|---|---|

| Rating | 3.9 | 4.3 | 3.5 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $10 | $0 | Varies by payment method |

| Minimum Trade | $30 | $100 | $1 |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU |

| Bonus | Loyalty scheme with various bonuses, plus referral program and bonus paid to lenders on credit line | – | – |

| Platforms | Nexo Pro | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | Own |

| Leverage | – | 1:50 | – |

| Payment Methods | 6 | 6 | 6 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Crypto.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Nexo and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Nexo | Interactive Brokers | Crypto.com | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Nexo vs Other Brokers

Compare Nexo with any other broker by selecting the other broker below.

The most popular Nexo comparisons:

Customer Reviews

There are no customer reviews of Nexo yet, will you be the first to help fellow traders decide if they should trade with Nexo or not?