Mitrade Review 2024

Pros

- I think the online education courses, real-time market news and expert analysis resources are extensive and will be useful for both beginners and intermediate traders

- The intuitive trading terminal and mobile app with in-built technical indicators, custom charting and trend analysis are notable advantages for technical traders

- I appreciate the zero minimum deposit requirement, plus free deposits and withdrawals and no hidden charges - ideal for traders on a budget

Cons

- I'm a little hesitant that global traders will be registering with the offshore entities

- It's disappointing that there are no advanced tools including copy trading and a VPS

- There is only one choice of platform which I think will put MiTrade at a disadvantage compared to other brands

Mitrade Review

Mitrade is a forex and CFD broker based in Australia. The firm primarily caters to customers in the southern hemisphere such as in Sarawak, Malaysia, with many northern countries unsupported. This 2024 broker review will go through everything you need to know about Mitrade, including the assets on offer, payment methods supported, leverage rates available and more.

Mitrade Headlines

Mitrade is an international award-winning broker that was founded in 2011. The firm works out of headquarters in Melbourne, Australia. The brand operates under several different names, including Mitrade Global Pty Ltd and Mitrade Group Pte Ltd in Singapore, all under the umbrella of Mitrade Holding Ltd., which is regulated by the Cayman Islands Monetary Authority (CIMA). Mitrade Global Pty Ltd is regulated by the Australian Securities and Investment Commission (ASIC).

Mitrade primarily caters to customers in the southern hemisphere, including residents of countries like Vietnam, Thailand, Taiwan, Hong Kong (HK) and more. Residents in London and the UK, the US, Canada and Japan are unable to trade with the firm. Still, the broker has over 800,000 users worldwide trading forex and other assets online.

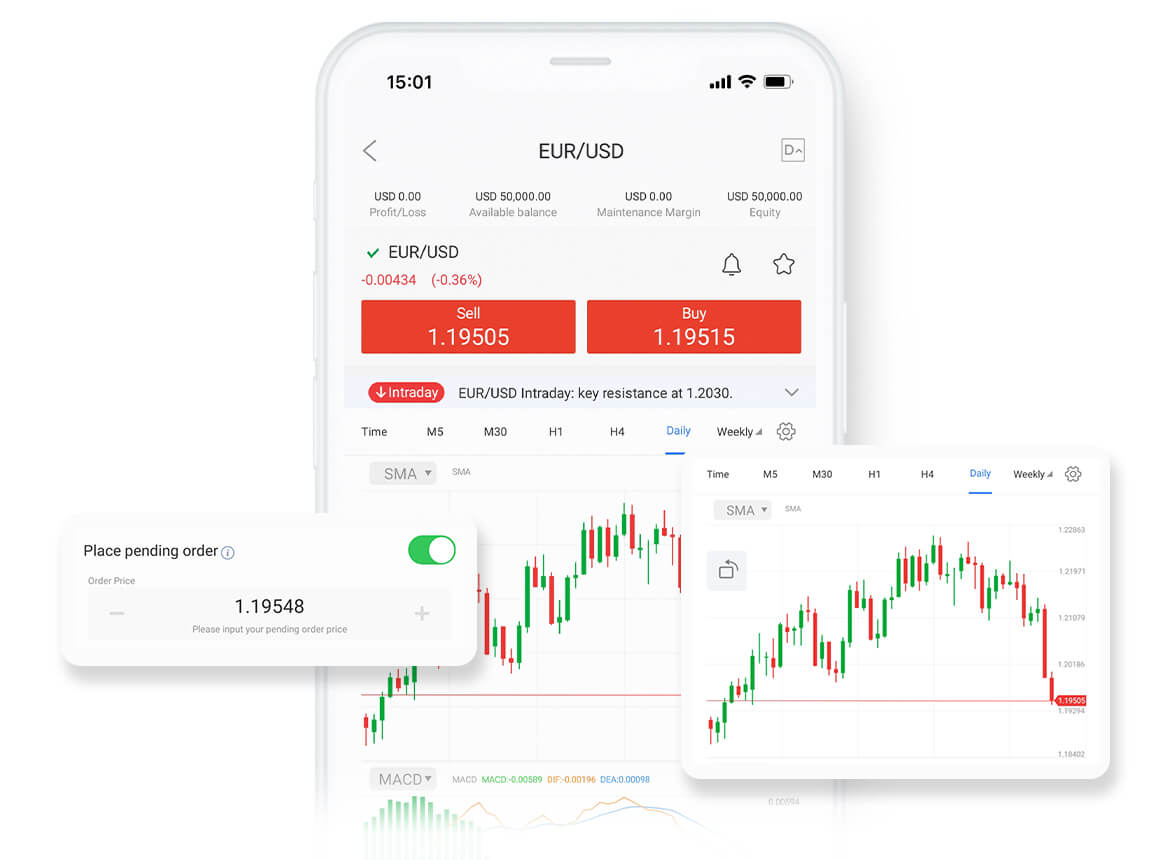

Trading Platform

Rather than offering MetaTrader platforms MT4 and MT5 like many brokers, Mitrade instead provides a bespoke trading platform. The webtrader can be accessed through the website. Through the platform, the registration and sign-up process is simple and, following this, clients can use their login details to start trading. The web trading platform features everything you need for a successful trading experience. There are a variety of order types and execution modes making it easy to open and close trades. The layout is simple and intuitive and there are many technical indicators and charts available to help your research. The platform even allows users to set up notifications and receive price alerts.

Assets

Mitrade offers its customers access to a range of assets and markets including forex and many different classes of CFDs. Some of the assets offered include:

- Forex: The broker features a range of over 60 forex currency pairs with many different major, minor and exotic pairs, including EUR/USD, GBP/USD, AUD/CAD and EUR/ZAR.

- Index CFDs: There are 12 index CFDs available to trade. These include the AUS200, Nasdaq-100 and FTSE-100.

- Commodity CFDs: There are 13 commodity CFDs to trade on Mitrade. These include gold, silver, Brent Oil and coffee.

- Stock CFDs: The firm offers a small range of stock CFDs to its customers with over 100 listed companies. These include big names like Microsoft, Apple and Facebook.

- Cryptocurrency CFDs: CFD trading on cryptocurrencies such as Bitcoin (BTC), Ripple (XRP) and Ethereum (ETH).

Spreads & Commission

Mitrade does not charge commission or fees on any of its trades. Instead, the broker makes all its money from spreads, which start at around 0.8 pips for major forex currency pairs. Comparing the firm against eToro, the spreads offered are generally tighter than its competitor. Some assets incur overnight funding charges, check the website to see funding rates. Some typical spreads are:

- GBP/EUR – 1.2 pips

- GBP/USD – 1.5 pips

- EUR/USD – 1 pip

- Brent Oil – 0.05

- Facebook – 2.5

- FTSE 100 – 3

Leverage

The maximum rate of leverage offered by Mitrade varies according to the type of account you open. Professional clients are offered leverage up to 1:250, while retail clients can only access maximum leverage of 1:30, as per regulatory limitations. This level means that, if you were to put down £100, you could trade positions worth £3,000. Leverage increases winnings but it also increases losses and, as such, caution must be taken.

Mobile Apps

Mitrade offers a mobile app that is available to download on Android and Apple iOS. The app is fully featured and has received many positive reviews on the stores it is listed on. Clients can experience efficient trading performance anytime, anywhere. Opening and closing trades through the app is easy and intuitive and all charts and indicators are available to help with research. Moreover, the app allows you to manage all aspects of your account.

Payment Methods

Mitrade does not charge any fees for deposits or withdrawals. There is also no minimum deposit. Typically, deposits are processed instantly, apart from deposits via bank transfer, which take around a day. Withdrawals are generally processed within 1-2 days. External charges may still be incurred through processes outside of the broker’s control such as currency conversion.

Deposits and withdrawals can be made via the following methods:

- Credit Card/Debit Card

- Bank Wire Transfer

- Moneybookers

- Momo

- Skrill

- POLi

- Zalo

Demo Account

Mitrade does offer a demo account to its customers. Each demo account comes stocked with either USD50,000 or AUD50,000 of virtual money. This funding allows clients to familiarise themselves with the platform and get used to the layout. It also lets users learn about CFDs and forex trading and develop an understanding of how the markets work. The demo account is a great place to practise strategies without risking real capital.

Deals & Promotions

Mitrade regularly runs a variety of bonus programmes, including a no deposit bonus and a $50 deposit welcome bonus.

Regulation & Licensing

The holding company, Mitrade Holding Ltd, is regulated by the Cayman Island Monetary Authority (CIMA). Mitrade Global Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) with license no. 398528.

ASIC is a top-tier regulatory body, which means that some clients can put a level of trust in the broker. That said, traders registering with the offshore entities should still be mindful of the low-tier CIMA and FSC regulations.

Education

Mitrade offers a range of educational documents on its website. These are generally aimed at beginners, focusing on basic trading concepts. There is a range of articles covering contract for differences (CFDs), leverage and risk management. In addition to this, the broker provides a comprehensive FAQ section that has information on a wide range of topics.

Account Types

For retail traders, Mitrade offers a single live trading account. The account receives access to a leverage rate of 1:30 and all additional features such as charts, indicators and economic calendars.

The firm also offers an account for professional traders. To qualify, you must have net assets of at least AUD 2.5 million and a gross income of at least AUD 250,000 for the past two years. The professional account receives access to a leverage rate of 1:250.

Trading Hours

All assets on Mitrade are available at the times for their different markets. Forex currency pairs are available 24/5 with breaks on weekends. Stocks, commodities and indices are available at the times of the exchanges they are listed on. Cryptocurrencies can be traded 24/7.

Customer Support

Mitrade can be contacted via a range of contact methods. Unfortunately, no contact number is available on its website but they can still be contacted by the following:

- Enquiry form

- Email: cs@mitrade.com

Safety & Security

Compliance is key to Mitrade and being regulated by a top-tier authority like ASIC ensures the company is held to the highest standard. Deposits and funds are well protected and kept in a separate account from the broker’s funds. The company does not use client money for any operational activities.

Mitrade Verdict

Mitrade is an exciting online forex and CFD broker catering to many clients around the world. It really is trading simplified, as the slogan says. If you are looking to make investments in a range of asset classes, Mitrade is for you. Start trading today and utilise the wealth of resources at your fingertips.

FAQs

Is Mitrade Legit?

Yes, Mitrade is a legitimate firm headquartered in Sydney, Australia. The broker is regulated by several authorities, including the ASIC, as well as two offshore bodies: CIMA and FSC.

Is Mitrade Safe?

Mitrade is a regulated broker with many positive customer reviews. The firm claims that all client money is protected and cannot be used by the broker and follows all regulatory guidance and security standards. That said, regulatory protections for clients may differ depending on which jurisdiction you are in, so we recommend checking this before committing.

Where Is Mitrade Regulated?

Mitrade is regulated by the Australian Securities and Investments Commission (ASIC), a top-tier regulatory body with robust financial safeguards in place for certain clients. The firm is also regulated offshore by the Mauritius FSC and the CIMA in the Cayman Islands.

How Much Capital Do I Need To Trade With Mitrade?

Mitrade has no minimum deposit requirements. This means that you can start trading on Mitrade with any amount of capital.

Does Mitrade Offer A Demo Account?

Yes, Mitrade does offer a demo account. The account comes stocked with 50,000 dollars (AU or US) for users to get used to the platform and CFDs.

Top 3 Alternatives to Mitrade

Compare Mitrade with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Mitrade Comparison Table

| Mitrade | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3.5 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, FSC, CIMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | $50 welcome bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:250 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Mitrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Mitrade | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Mitrade vs Other Brokers

Compare Mitrade with any other broker by selecting the other broker below.

The most popular Mitrade comparisons:

Customer Reviews

There are no customer reviews of Mitrade yet, will you be the first to help fellow traders decide if they should trade with Mitrade or not?