M1 Finance Review 2026

Awards

- Best Roth IRA Accounts - 2020

Pros

- Multiple portfolios can be facilitated, with up to five accounts under the same login

- The broker delivers a clean and easy-to-use dashboard that illustrates the current composition of your portfolio

- The broker offers commission-free stocks with low fees, plus fractional shares, making it a great choice for beginners

Cons

- Unlike competitors such as Betterment, M1 does not employ any human financial advisors

- You cannot consolidate external accounts for planning purposes

- The way trades are placed puts transaction timing out of your control

M1 Finance Review

M1 Finance is a top-rated robo-advisor aimed at experienced US investors. It offers customizable automated trading and clients can build portfolios across 6,000+ stocks, ETFs and cryptos. Our review lists M1 Finance’s trading products, account types, fees, deposits and more. Find out whether to open an account and start investing today.

M1 Finance Overview

M1 Finance LLC is an online investing platform founded in 2015. Its headquarters are in Chicago and it offers trading, asset management and lending services with the goal of helping clients grow their net worth.

The firm was founded by Brian Barnes and the current owner is M1 Holdings Inc. In 2016, M1 Finance introduced automated monthly deposits and portfolio allocation services, making withdrawals and account changes easier.

The digital brokerage has attracted over 500,000 investors from around the world, including across Europe. Internationally, the company has more than $6 billion in assets under management.

M1 is registered with the Securities and Exchange Commission (SEC) as a broker-dealer and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Services

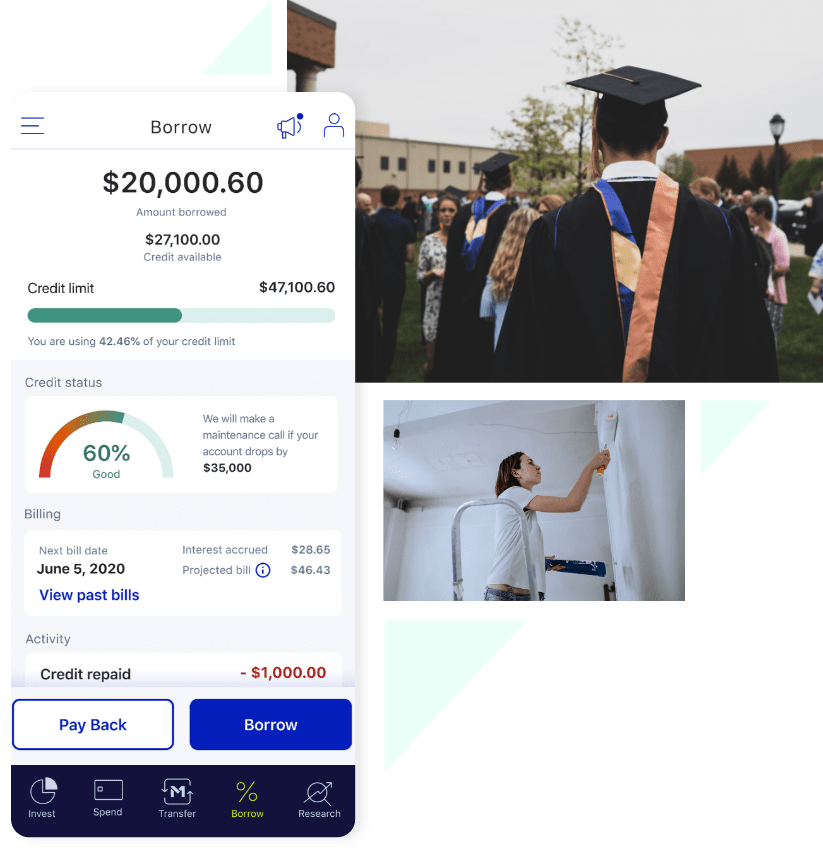

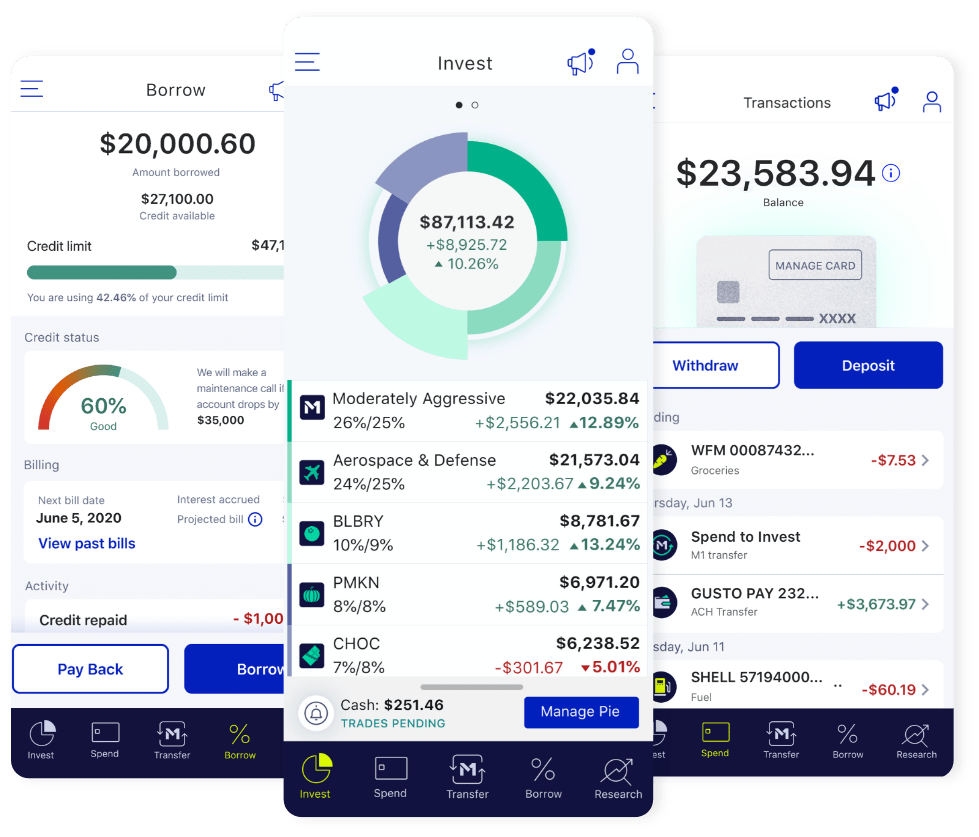

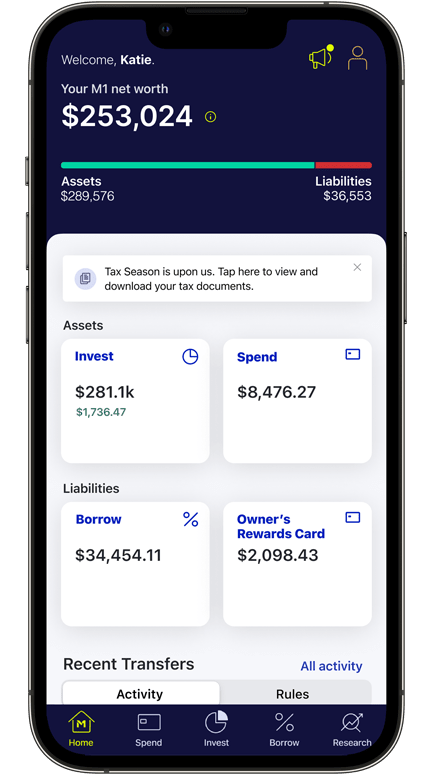

M1 Finance offers three different services – invest, borrow and spend.

M1 Invest

The M1 Invest platform provides a range of easy-to-use tools so that you can curate an investing strategy that works for you. Fractional shares provide flexibility and the broker’s powerful automation tool helps you implement and maintain effective trading strategies.

M1 Borrow

M1 Borrow lets you access a flexible line of credit at one of the lowest rates on the market. You can borrow against your investment without extra paperwork. Through M1 Finance you can loan up to 40% of your portfolio’s value, with rates as low as 3.5%.

M1 Spend

M1 Spend is a digital bank account that comes with a debit card. It lets you seamlessly integrate your spending and savings accounts with your investments. Through M1 Spend you can invest, borrow and spend in one easy-to-use platform.

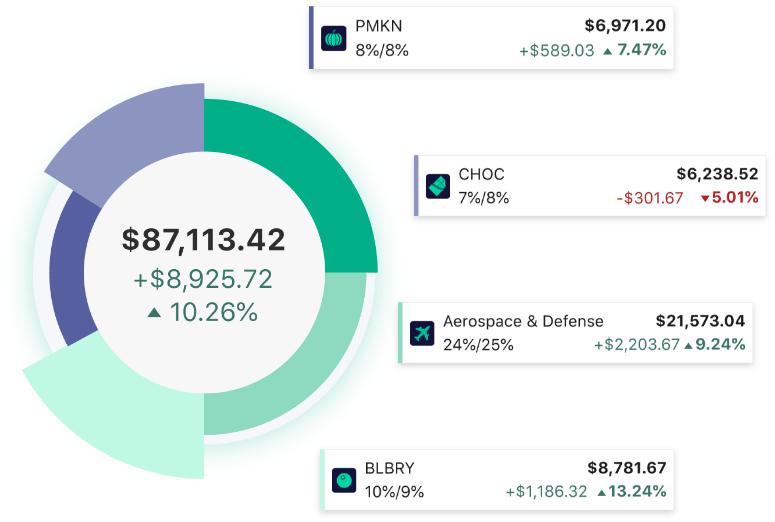

M1 Finance Pies

M1 Finance offers the best pie-based interface on the market. It’s a cleverly designed widget that helps investors to build and manage portfolios with ease. Users can choose from more than 6,000 stocks and funds including ETFs to build custom pies. Investors also have access to over 60 expert pies such as Meet Kevin or Joseph Carlson, who are both top US investors.

You can create multiple pies with different risk parameters, whether safe or ultra-aggressive, to facilitate the best portfolio growth. Different risk allocations help investors to set up separate pies for various life goals.

You can create up to five pies in total, so you could have two stocks and three fund-based pies, for example.

Some of the expert pies offered by M1 Finance in 2026 include:

- Income earnings – This pie is focused on dividends and income returns

- Industries and sectors – This option lets you invest in certain industries and sectors

- Responsible investing – This pie is aimed at investors interested in social impact trading

- Hedge fund followers – This solution follows the strategies of reputable and acclaimed investors

- General investing pie – The user can set this to reflect their risk tolerance and to create a diversified portfolio

- Plan for retirement – This pie is for the user’s target retirement date. You can add a beneficiary to your retirement account under settings

Through the M1 Finance trading platform, you can view current stock prices and valuations before adding to your pies.

M1 does not do tax-loss harvesting. However, all accounts use a tax minimization feature that aims to help clients efficiently manage taxes owed when selling securities.

Assets & Markets

M1 Finance offers over 6,000 exchange-listed securities. The company offers most NYSE, NASDAQ, BATs traded stocks and ETFs. The brokerage also provides a small number of over-the-counter (OTC) stocks. These are investments that trade between two parties without the supervision of major exchanges (i.e. the NYSE and NASDAQ).

M1 Finance also offers fractional shares, so you can diversify your portfolios across assets. Fractional shares mean that investors can trade in particular equities through part of their portfolio and index funds in the other part.

Index funds are investments that track a particular set of assets on a public index. The portfolio of an index fund is built to track a range of different indices such as the S&P 500. You could create a specific pie in M1 Finance for these types of funds. Such funds tend to offer broad exposure to financial markets, lower fees and are passive types of investments.

If you’ve qualified for any dividends you will be able to see these in your account portfolio. You will also see the yield they have generated. While M1 Finance does offer reinvestment of dividends, it is a little bit different. If a dividend payment pushes your cash balance in your portfolio above $10, the cash is returned to your portfolio.

The company also offers a checking account. This option gives users a 1.3% APY on their deposited funds. You can also receive 1% cashback on eligible purchases, the option to process cheques, and early direct deposits on your paycheck – you will receive funds two days early.

M1 Finance does not support mutual funds, options, forex, metals, warrants or futures trading.

M1 Crypto

M1 Crypto is also coming soon. Users will be able to create their own pies, use the broker’s portfolios, or select both.

M1 plans to offer expert crypto pies that span DeFi, Web 3.0 and large-cap cryptocurrencies. Clients will also benefit from automated crypto trading and will have the ability to set a target percentage for each portfolio. In addition, M1 Crypto offers weekend trading and dynamic rebalancing, plus scheduled, manual rebalances. Importantly, M1 Plus members will benefit from access to a wider range of tokens and on-demand trades.

Clients can now sign up for early access on the broker’s site. And while waiting for full access, investors can research digital currencies and start building crypto pies on the broker’s trading interface.

Spreads & Commissions

Most brokerages charge a fee for a DRIP. M1 Finance is completely free. As there are no management fees or trading charges, all you pay is the expense ratio. With that said, accounts with less than $20 and no trading activity for 90 days are charged a fee.

Since the platform is free to use, the company is completely transparent about how it earns revenue, which is usually through earning interest on cash in different forms. For example, interest on lending securities and margin loans (via M1 Borrow).

Note that miscellaneous fees apply, a list of which can be found on the company’s website.

Leverage

M1 Finance offers some of the cheapest margin rates on the market. Buying on margin means using a loan to buy more securities in your investment portfolio, thereby leveraging your existing deposit. M1 Finance offers 5% margin rates for all users and 3.5% for users who subscribe to M1 Plus.

Note, M1 Finance only accepts market orders for buying and selling — it doesn’t offer limits or stop-loss orders. Meaning all positions are executed at the current price on the spot market.

Mobile App

The M1 Finance Super app is available to download from the app store for both iOS and Android (APK) devices. Through the application, you can review and manage your portfolio. You can also optimize your money across spending, investing, and borrowing with just a few clicks. Client reviews of the app are positive noting the usability and reliability.

M1 Finance Payment Methods

You fund your M1 Finance account by depositing from your bank. You can also fund your account by transferring an account from another institution, or if you have an old 401(k) from a previous employer, you can roll this over to M1.

In-kind transfers (also known as direct account transfers) allow you to transfer stocks and funds directly from one brokerage to another, so switching to M1 Finance is simple.

You can also run a wire transfer into your M1 Finance Invest account by writing to them. Wires can only be sent into M1 Invest accounts; they do not support wires into M1 Spend accounts.

When taking money out of your M1 Finance account, the withdrawal time for M1 spend is 2-3 business days. For taxable/IRA accounts, withdrawals take 3-5 business days. Cheques take 2-9 days to clear. M1 Finance doesn’t charge a withdrawal fee.

Demo Account

You can gain access to the M1 platform by making a free login. From here, you can create a portfolio and test the system before committing to funding an account. This is a good place to start for beginners.

Bonuses & Promotions

M1 Finance doesn’t currently offer a sign-up bonus. In the past, a new account joining bonus of up to $500 was available to traders that switched from another platform. With that said, if you are a new member, you can try Plus free for three months.

M1 Finance also offers a $30 referral credit for both you and a friend. You can find your unique referral link under the “Refer & Earn” section of your profile.

Regulation & Licensing

M1 Finance is a legitimate business registered with the Securities and Exchange Commission (SEC) as a broker-dealer and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). Securities in M1 Invest accounts are insured for up to $500,000 by the SIPC. M1 Spend checking accounts of up to $250,000 are FDIC insured.

Additional Features

Integration With Other Services

You can integrate M1 Finance with other personal money management services. A few examples are Turbotax, H&R Block and Quicken integration for tax forms. You can also integrate your account with cash transfer apps such as Zelle. The process is straightforward and the broker’s support hub features step-by-step guides on how to use wider services within your account.

Automation

M1 Finance has powerful automation built into its services which enable investors to implement and maintain portfolios.

Rather than placing manual trades, users can automate contributions with an investing schedule. The technology built into M1 Finance also keeps portfolios on track with dynamic rebalancing. This means portfolios are monitored constantly and when it’s time to rebalance, the technology will automatically deploy funds across the portfolio to prevent losses.

You can even choose to do a Roth 401k rollover to IRA and then automate your trades so you never miss a chance to invest in the future.

Account Types

M1 Finance offers four main account types, all with zero fees:

- Joint – A joint checking account that can be shared with a relative, spouse or domestic partner

- IRA – Invest in your future with Traditional, Backdoor Roths and SEP IRAs

- Individual – Perfect for managing sole investments and trading activity

- Trust – Manage trust investments with an M1 Trust Account

Currently, M1 Finance does not offer an HSA (Health Savings Account).

M1 Finance has no hidden fees. You also won’t pay any trading costs with M1 Finance, but you will need at least $100 as an instant deposit for investment accounts and $500 for IRAs. As a result, it’s important to review which account is best for you.

M1 Finance also offers an M1 Plus account for $125 a year. It comes with a range of perks:

- IPO trading – Ability to invest in companies the same day as they launch an IPO

- Custodial accounts – Start building long-term wealth for the children and family in your life

- 3.5% loans – Get a 1.5% reduction on the base rate of M1 Borrow, M1’s low-cost portfolio line of credit

- Credit benefits – This includes up to 10% cashback, the ability to reinvest rewards, and Visa Signature benefits

- 1% cashback on M1 Finance spend checking accounts – Earn 1% cashback on qualifying debit card purchases

- Smart transfers – Set up a system of automated rules and optimize your money across spending, investing, and borrowing

- Afternoon trading window – Invest in the morning or the afternoon, or both when you have more than $25,000 in your investment portfolio

- 1.3% APY checking on M1 spend accounts – M1 Finance can provide a high yield on savings. Earn 43x the national average APY for a checking account. That means you could earn more in two weeks than you would in an entire year with a big bank.

Trading Hours

M1’s trading window begins at 9:30 am Eastern time zone on days that the NYSE market is open, and runs until all orders have been completed. Users have access to after-hours trading although any changes made to your portfolio before 8 am Eastern time on trading days will be executed once the market opens. Orders are generally processed the same day during M1 Finance’s trading window.

Customer Support

M1 Finance customer service representatives are English-speaking and available on days when the US stock market is trading. You can get instant help through live chat, or contact via direct telephone or email. M1 Finance aims to respond to emails within one business day. They can also help if you have login issues such as “phone number invalid.”

Head to the contact us page on the website for the phone number, email address and office address. The live chat logo is available in the bottom right-hand corner of the broker’s website.

You can also access customer service support with M1 Finance through Zendesk.

Since M1 is not an investment advisory service, there are no financial advisors to consult, so support is designed to help or guide with the technical aspects of your M1 account only. For example, if your account is not working correctly, funds haven’t been deposited, or if you are unable to log in.

M1 Finance also runs a YouTube channel with top tips, guides and news on how to use your account.

Security

The M1 Finance desktop website and mobile app are safe. Investors can enable two-factor authentication, which is a more secure way to protect your assets. It consists of providing a password and a second identifying piece of information which is often a question and answer, or a code sent to a mobile device.

M1 Finance Verdict

M1 Finance is an excellent online broker that offers market-leading services. The pie-based interface and level of automation included within M1 Finance can help you to save time, customize and manage your portfolios with ease, and aid you on your way to becoming a successful investor.

Note, M1 Finance is only available to users in the US. Traders outside of the US, including UK-based investors, will need to find a suitable equivalent (listed below). Check our questions and answers below for more information.

FAQ

How Do I Close An M1 Finance Account?

To delete an account is simple. If you have any cash or assets held you will want to put your M1 finance account through a liquidation process first. There are no withdrawal or liquidation fees at M1 Finance. If you have recurring deposits set up, you will need to cancel future scheduled deposits. You can then close your account in the support section. Account closures take 3-4 business days.

How Is It Possible To Create A New Pie in M1 Finance?

You can add a second pie “My Pie” to your portfolio, as a slice. Head to the M1 Finance Support Centre for a step-by-step guide on adding a second pie, whether custom or expert, into your account.

Is M1 Finance Available In The UK?

M1 Finance hasn’t confirmed when it’s coming to the UK. To open an M1 Finance account, you must be over 18 years old, a US citizen or permanent resident (a Green Cardholder) and have a current US mailing address.

What Alternatives Are Available to UK Investors?

UK-based investors will need to look at M1 Finance versus alternative investment platforms since it’s not currently available to non US citizens. Good alternatives include eToro, Fidelity, or Vanguard. You can invest in any of these from the UK and set up your chosen funds or ISAs.

Did M1 Finance Block GameStop (GME)?

You currently aren’t able to trade GME on the M1 platform because of the restrictions imposed by the firm’s custodial bank, Apex.

Can You Use M1 Finance For Day Trading?

M1 Finance is not designed for day trading. Instead, it is designed for long-term buy-and-hold investing. You can browse the broker’s range of services in our review.

Best Alternatives to M1 Finance

Compare M1 Finance with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

M1 Finance Comparison Table

| M1 Finance | Interactive Brokers | Firstrade | |

|---|---|---|---|

| Rating | 3.9 | 4.3 | 4 |

| Markets | Stocks, ETFs, OTC stocks | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | Yes | Yes | No |

| Minimum Deposit | $100 | $0 | $0 |

| Minimum Trade | $1 | $100 | $1 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | M1 Finance Plus free for 3 months on new accounts | – | Deposit Bonus Up To $4000 |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | TradingCentral |

| Leverage | – | 1:50 | – |

| Payment Methods | 3 | 6 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by M1 Finance and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| M1 Finance | Interactive Brokers | Firstrade | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

M1 Finance vs Other Brokers

Compare M1 Finance with any other broker by selecting the other broker below.

The most popular M1 Finance comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of M1 Finance yet, will you be the first to help fellow traders decide if they should trade with M1 Finance or not?