Lightyear Review 2024

Pros

- The investing app has been featured in the Financial Times & CNBC

- Lightyear offers a user-friendly trading app with thousands of global equities

- Low-cost trading with no hidden fees or inactivity penalties

Cons

- Limited range of instruments with no forex trading

- Platform features are basic and won't meet the needs of seasoned traders

- No demo account for prospective users

Lightyear Review

The Lightyear app offers trading on more than 3500 stocks and ETFs with no hidden fees. The mobile-based trading firm aims to provide a straightforward investing environment for retail traders without the complicated fee structure associated with traditional brokers. This Lightyear review unpacks minimum deposits and payment methods, market access, trading tools, pricing, regulatory oversight, and more. Find out if you should download the Lightyear investment app.

Company History & Overview

Lightyear was developed in 2020 by founders and ex-TransferWise employees, Martin Sokk and Mihkel Aamer. The UK-based fintech firm provides investment services to 15+ European countries, including the UK, Germany and Spain.

The mission of the brand is to create a simple yet user-friendly trading app for investors of all experience levels. Traders can invest in stocks and ETFs from just $1. Lightyear also provides multi-currency accounts so users can deposit, hold and invest in their local currency.

Lightyear Europe AS is a regulated investment firm, registered with the Estonian Financial Supervision Authority (Finantsinspektsioon), licence number 4.1-1/31.

UK traders will be registered under the Lightyear Financial Ltd entity. This company is regulated by the Financial Conduct Authority (FCA), license number 955739.

Lightyear App

The Lightyear app can be downloaded to iOS and Android devices. Traders benefit from a slick interface with straightforward navigation. Clients can analyze assets and open trades in a few clicks.

The Lightyear app also offers price projections and real-time news to help with investment decisions.

Other features include:

- Current and historical stock price view

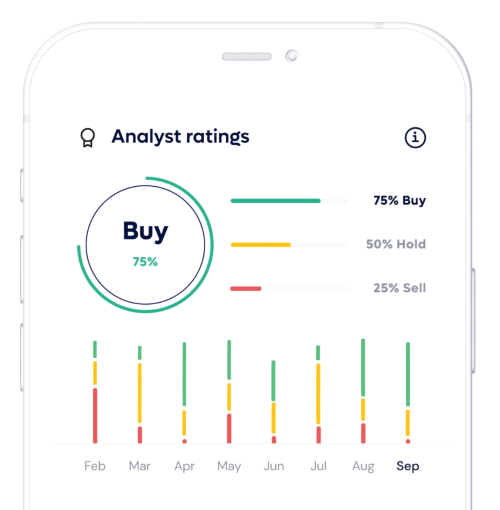

- Product sentiment and analyst ratings

- Personal web link portfolio sharing option

- Repeat order options for daily, weekly, or monthly investment purchases

- Personalized ‘Lightning updates’ with bulletin-style news posts on the latest stock prices

- Product metrics including market cap, earnings per share, P/E ratio, dividend rate and dividend yield

The app is rated an impressive 4.7/5 on the Apple App Store with customer reviews praising the intuitive interface and smooth user experience with all the basic investment tools covered.

But whilst the platform provides some useful features, the app is lacking in terms of technical indicators and drawing tools, especially compared to popular platforms like MetaTrader 4. As a result, Lightyear may not meet the needs of experienced technical traders.

How To Place An Order

- Search for the relevant symbol or company name in the navigation bar

- View the product details alongside analyst forecasts and real-time price charts

- Click ‘Buy’ or ‘Sell’ and input the order details (Market & Limit orders only)

Note, the ‘Your Investments’ icon shows the profit and loss of individual positions in your portfolio plus stock data.

Assets & Markets

Lightyear offers 3500+ US and EU stocks alongside ETFs with access to big names like Tesla, Tesco, Unilever, and Coca-Cola. UK stocks are also due to launch soon and clients can invest in fractional stocks, reducing capital requirements for amateur traders.

On the downside, the range of instruments is fairly narrow. Account holders cannot trade forex, commodities or cryptocurrencies, for example. This is a notable drawback vs alternatives such as Interactive Brokers.

The Lightyear app also supports share transfers from other brokers, such as Fidelity. This process can take anywhere from a few days to several weeks depending on the brokerage your assets are being transferred from.

Fees

When we used Lightyear we were impressed with the straightforward pricing schedule.

Traders pay a low fee for stocks at 0.1% up to $1 for US shares (per order), £1 for UK shares (per order), and €1 for EU shares (per order).

Importantly, Lightyear charges zero fees for various features that often come with a charge at alternative brokers. This includes ETFs, multi-currency accounts, securities transfers, bank transfers in, bank transfers out, and W8-BEN US tax forms.

Users also benefit from interest rate rewards on uninvested cash, which varies by currency. This is earned daily and paid to trading accounts monthly.

- EUR Interest Rate – 2.25% per annum

- GBP Interest Rate – 3.50% per annum

- USD Interest Rate – 4.00% per annum

There is a currency conversion fee of 0.35% and a 0.5% fast deposit transfer fee after the £500 lifetime allowance has been used.

In addition, there is a 0.5% UK stamp duty charge on UK stocks, plus a 0.3% French financial transaction tax on French stocks. Note, local taxes vary by jurisdiction. Contact a local advisor for support.

Lightyear Account

Just one investment account is available to Lightyear traders. This provides access to the broker’s full list of stocks and ETFs with a multi-currency account (USD, EUR, GBP).

But while one account makes it straightforward for new users to get started, it does mean limited perks and rewards for high-volume traders and those that make a large initial deposit.

How To Register For An Account

To open a Lightyear account, traders must be 18 years or over and a resident of the UK or an accepted European country.

New users will be required to provide identity verification and proof of address in line with the regulatory requirements. This includes providing a utility bill or bank statement dated from the last three months and government-issued photo identification such as a passport or driving license.

Importantly, new clients will need to download the Lightyear app from the Apple App Store or Google Play. The registration screen is automatically visible when you open the app and it took our traders less than five minutes to open a profile, though we would recommend having verification documents to hand to save time.

Once you have opened a Lightyear account, you can make a deposit and start trading.

Payment Methods

Deposits

Lightyear accepts several payment methods, including wire transfers and bank cards. Our experts found there is no minimum deposit, which is good news for those on a budget.

Deposits and withdrawals via bank wire transfer are fee-free, though faster deposit transfers via card are liable for a 0.5% fee after the £500 lifetime allowance has been used.

Payments Made In EUR:

- SWIFT – Three to five day processing time, no fee

- SEPA Instant – Up to two hour processing time, no fee

- SEPA – Up to two business day processing time, no fee

- Debit Card/Apple Pay/Google Pay – Instant processing, no fee for first £500 then a 0.5% charge

Payments Made In GBP:

- FPS – Up to two hour processing time, no fee

- SWIFT – Three to five day processing time, no fee

- CHAPS – Up to one business day processing time, no fee

- Debit Card/Apple Pay/Google Pay – Instant processing, no fee for first £500 then a 0.5% charge

Note, BACS payments are not currently supported. While using Lightyear, our traders were also disappointed to see popular e-wallets like PayPal, Skrill and Neteller are not accepted.

Withdrawals

Withdrawals can be made via bank wire transfer only, which is a notable drawback vs competitors. On a more positive note, Lightyear does not charge any fees.

Withdrawal times vary by currency and amount but can take up to three working days. Bank holidays and weekend dates may also cause delays.

To make a withdrawal if you did not deposit via wire transfer, select ‘Create Bank Account’ when requesting a withdrawal. Here you can add your bank account details.

Leverage

Unfortunately, leveraged trading is not permitted at Lightyear. This means clients cannot increase their purchasing power with borrowed funds. Instead, the Lightyear app is designed to be a cash investment profile.

Demo Account

Lightyear does not offer a demo account which may deter prospective investors. However, fractional shares can be traded for just $1 which reduces the entry barrier for beginners. New users can get a feel for the broker’s app and investment products with a small capital outlay.

Bonuses & Promotions

Lightyear offers bonuses and financial incentives to new and existing customers. This includes a Refer a Friend program where a $10 fractional share is offered as a reward for successfully introducing a new trader that deposits $50.

The broker-dealer has also offered sign-up rewards and ‘double deposit’ bonuses in the past. Keep an eye on the app and official website for the latest promotions.

Lightyear Regulation

The Lightyear corporation is regulated through two entities:

- Lightyear Financial Ltd – is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330)

- Lightyear Europe AS – Authorized and regulated as an investment firm by the Estonian Financial Supervision Authority (Finantsinspektsioon), license number 4.1-1/31 955739

Although the Finantsinspektsioon isn’t a top-tier regulator, it does work to combat money laundering and requires various customer safeguarding measures.

The FCA, on the other hand, is one of the world’s most reputable financial authorities with stringent business requirements for members.

Client funds are also held separately from business money and inaccessible by creditors in event of company insolvency.

Customers have access to compensation schemes in the case of business failure. This includes €20,000 in asset protection from the Estonian Investor Protection Sectoral Fund for EU clients.

Customers holding US securities via the broker’s partner Alpaca will have asset protection to the value of $500,000 through SIPC insurance.

Additional Features

The Lightyear app has a good range of additional features to support investment decisions and knowledge building. This includes a real-time news feeds related to your trading portfolio plus professional analysts’ price targets and instrument performance ratings.

The broker-dealer’s website lists the latest company information and app updates in a blog-style forum. This includes how to use available stock metrics, how to read financial statements on the app, and portfolio data breakdowns. There is also some useful data published from the brand’s analyst team via the blog page, though this is not posted daily.

Customer Support

We were disappointed by the level of customer support. Lightyear provides an email contact only (support@golightyear.com), with no live chat or telephone assistance.

Alternatively, there is an FAQ section available in the help center section of the broker’s website, organized into five major topics including managing an account, promotions, and trading.

Lightyear is also present on social media networks including Facebook and Twitter. Pages are updated with the latest company and product news.

Security & Safety

The Lightyear investing application has suitable security measures. For example, when we downloaded the app, we could add face recognition and 4-digit PIN protection at the login stage.

The broker will reach out to customers via email if there are any security concerns or account breaches.

Trading Hours

Lightyear follows standard trading hours with stock markets typically open Monday to Friday. With that said, the investment app is available for account management and market analysis over the weekend.

Note, orders placed outside of market opening hours will be executed on the next available working day. There is no out-of-hours trading.

Lightyear Verdict

Lightyear offers straightforward access to stocks and ETFs through a user-friendly mobile app. However, the range of products is limited and there is no advanced trading software for desktop devices. As a result, Lightyear is the best pick for beginner traders looking to trade equities with low fees.

FAQs

Is Lightyear Safe?

Lightyear is a secure investment platform and trading app. The broker is regulated by financial authorities in Europe and the UK. Clients funds are kept separate from business money and retail investors are covered by compensation schemes in the case of business insolvency Traders can also add multi-factor authentication when they sign into the Lightyear app.

With that said, online trading is risky. Only risk what you can afford to lose.

Is Lightyear A Good Investing App?

Lightyear is a modern, sleek and intuitive trading application. It provides all the basic tools to support investment decisions including historical price data, beginner-friendly charts, real-time news bulletins, and insights from analysts.

On the downside, the application is lacking in advanced technical analysis tools and custom charting functions. As a result, it may not meet the needs of veteran traders.

How Can I Make A Deposit On Lightyear?

Customers can fund Lightyear trading accounts via bank wire transfers, debit cards, Apple Pay and Google Pay. There are no fees charged by the broker until the £500 threshold is met for fast deposit transfers.

Does Lightyear Offer A Wide Range Of Trading Products?

The product lineup at Lightyear is limited. Traders can invest in 3500+ US and EU stocks and ETFs. However, there is no CFD trading or access to forex, crypto or commodity markets. This is a major drawback vs traditional brokers.

Is Lightyear A Cheap Broker?

Lightyear offers low-cost trading on stocks and ETFs with no inactivity penalty. This makes it a competitive brand compared to many alternatives. There are also no deposit and withdrawal charges, though fast deposit transfers with a card will incur a 0.5% transaction fee after the £500 allowance has been used.

Top 3 Alternatives to Lightyear

Compare Lightyear with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Lightyear Comparison Table

| Lightyear | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.5 | 4.3 | 4.4 | 4.5 |

| Markets | Stocks, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Stocks, Futures, Futures Options |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $1 | $0 | $0 | $100 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:50 |

| Payment Methods | 4 | 6 | 6 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Lightyear and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Lightyear | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Lightyear vs Other Brokers

Compare Lightyear with any other broker by selecting the other broker below.

The most popular Lightyear comparisons:

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of Lightyear yet, will you be the first to help fellow traders decide if they should trade with Lightyear or not?