InvestEngine Review 2024

Pros

- We were impressed by the company's provision of analytics reports and strategy advice, as well as top product picks and a detailed blog

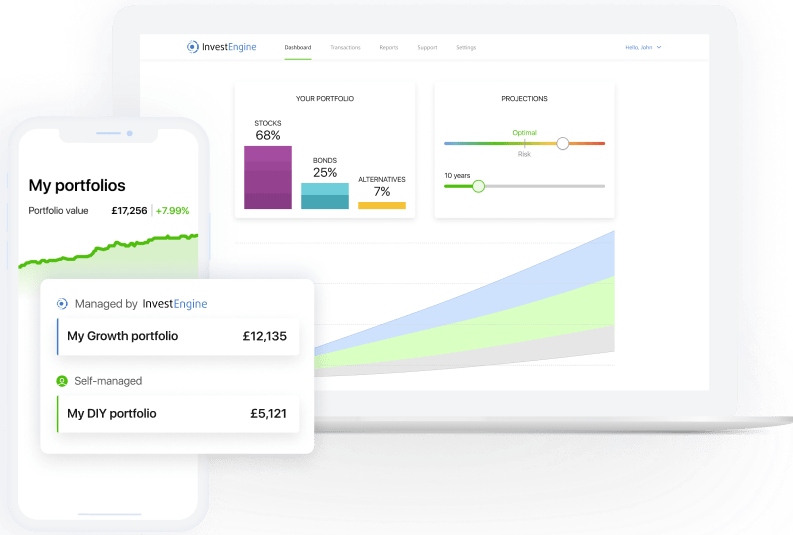

- We think the firm's investment platform is intuitive and impressive, making the whole experience simple and stress-free

- Hands-on investors can benefit from completely free access to InvestEngine's services, only paying for any dealing charges

Cons

- Despite offering several account types, the firm does not support Lifetime ISAs or Self Invested Pension Pots (SIPPs)

- Any clients looking for long-term gains from individual company stock investments must look elsewhere as InvestEngine limits its products to ETFs

- No tiered services for high-net-worth investors

InvestEngine Review

InvestEngine is an innovative online broker that provides its clients with the ability to invest in a wide range of exchange-traded funds (ETFs) through both managed (hands-off) and DIY (hands-on) account options. The broker is gaining popularity and offers low-cost trading opportunities with automatic rebalancing and dividend reinvestment. Read our InvestEngine review to explore the full range of brokerage services and features.

InvestEngine Headlines

InvestEngine is the trading name of InvestEngine Limited, which was co-founded by Simon and Joanna Crookall. Simon was the co-founder of Gumtree and Joanna Crookall is also the CEO of Ramsey Crookall, an independent investment management firm. The firm opened its doors in 2019, intending to outperform competing platforms available to UK investors, such as Vanguard and Nutmeg.

InvestEngine is incorporated in the UK and can be found in Companies House under number 10438231.

Trading Platform

The InvestEngine trading platform is sleek, simplistic and intuitive, with a UI that is very easy to navigate. The software is very accessible to beginners; you can easily view and rebalance your portfolios and withdraw from or top up your account. There are two main services that the broker offers via its trading platform: the do-it-yourself ‘DIY’ portfolio and the ‘Managed’ portfolio.

DIY Portfolio

The DIY portfolio requires you to decide what you want to do with your investments. It allows you to search for individual assets and trade them for 0% commission. You, as the user, decide the percentage investment split between each ETF. The DIY portfolio also has smart top-ups and one-click rebalancing, which can help automatically optimise and support your investment strategy. This service is suited to traders that prefer a hands-on approach to their investments, building portfolios with the support of their knowledge and expertise.

Managed Portfolio

The Managed portfolio allows your portfolio to be managed by the broker’s team, you just need to choose between a growth or income portfolio and answer a few questions relating to your financial situation, time and risk preferences. Growth portfolios rely on equity-based ETFs to achieve long-run capital gains.

Income portfolios provide an estimated variable income that is paid monthly into your bank account. You can choose from a few different portfolios that yield up to 4% a year (estimated and variable). InvestEngine believes that diversification is crucial to making your investment work harder. Consequently, your portfolio will be a robust and globally diversified portfolio consisting of different asset classes. With the Managed portfolio, the broker also automatically rebalances your account for you. This portfolio has a 0.25% commission and is suitable for those traders who would prefer a more hands-off approach.

Markets

InvestEngine allows you to invest exclusively in ETFs, with over 150 offered, covering a range of stock markets, bonds and commodities. The broker has recently released a feature called Look Through, with which you can break down your entire portfolio or an individual ETF by asset type, sector, location and company. With the income portfolio for the Managed portfolio, the ETFs mainly comprise bonds.

Trading Fees

InvestEngine is a low-cost investment broker, sitting entirely free for the DIY portfolio and taking a 0.25% commission for Managed portfolios. There are no deposit or withdrawal fees. Each ETF has its respective charges for both purchase and sale. For DIY portfolios, these vary between 0.05%-0.75%, with spread costs of 0.07%.

Managed income portfolios can expect to pay an annual platform fee of 0.25%, an average ETF charge of 0.27%, and ETF spread costs of 0.09%, totalling 0.61%. Managed growth portfolios can expect a platform fee of 0.25%, ETF charge of 0.17% and ETF spread costs of 0.04%, totalling 0.46%

Mobile Apps

InvestEngine offers a mobile app that can be downloaded onto Apple (iOS) and Android (APK) devices. The mobile application boasts most of the same functionality offered by web-based trading, with a sleek and friendly user experience. The mobile platform also offers a two-step login with biometric authentication.

Payment Methods

Paying into an InvestEngine account is a smooth experience, simply record your basic personal and financial details, then manually connect the bank account from which you wish to transfer your funds. You can also use Open Banking to instantly bank transfer funds across. If you wish to do regular top-ups, you can also set up a direct debit or a standing order. Transactions can be made through wire transfers or ACH transfers, debit and credit card payments are not accepted.

Deposits

- Minimum deposit of £100

- No fees

Withdrawals

- No fees

- No outgoing transfer fees when closing your account

Deals & Promotions

There is currently a £50 sign-up bonus if you deposit a minimum of £100 within 30 days of opening an account. However, if you take out £100 within 12 months, you lose the bonus. This offer expires on 31/12/2021.

Regulation

InvestEngine is Financial Conduct Authority (FCA) regulated [FRN 801128]. The broker is a member of the Financial Services Compensation Scheme (FSCS), meaning that clients have protection up to £85,000 if the firm collapses and cannot pay claims against it. Investors can have peace in mind knowing that the firm is adequately regulated and that their investments are covered.

Additional Features

Analytics & Reports

With InvestEngine, you can access portfolio performance reports and data analytics to assess the status of your investments. You can use the analytics option to see a complete breakdown of your portfolio by sector and location, as well as to check your exposure to each company.

Investment Strategy

The DIY portfolio also has smart top-ups and one-click rebalancing to support you in sticking to your investment strategy

Dividends

Under DIY portfolios, ETFs either automatically reinvest dividends or distribute them by paying into your cash balance when received. Managed portfolios either automatically reinvest them for growth portfolios or pay them for income portfolios.

Blog

The InvestEngine online forum has a weekly blog, in which it posts various articles relating to the broker’s app, general investing and current affairs.

Account Types

InvestEngine offers general investment accounts (both personal and business) and ISAs (individual savings accounts).

ISA

InvestEngine offers clients a stocks and shares ISA, which can produce higher returns than a cash ISA. With this account, you can invest a maximum of £20,000 per tax year. Dividends and capital gains are tax-free. You can only invest in managed portfolios but DIY ISAs are coming soon. You can transfer an existing ISA to the broker and you can withdraw from it at any time, though there may be delays that can impact your allowance. Furthermore, if you add it back again, this counts as a re-investment, thereby eating into the £20,000 limit.

Personal

With the personal account, there is no maximum you can invest per tax year, though there is a minimum of £100. Dividends are taxed once they amount to more than £2,000 and there is a £12,300 tax-free allowance. Personal accounts are available as both DIY and managed portfolios. Whilst personal accounts are not tax-free, you can withdraw fee-free at any time.

Business

You can invest your company’s surplus cash in ETFs with InvestEngine for the possibility of higher returns. With the business account, there is no maximum that you can invest per tax year. Tax on dividends and capital gains both depend on your business circumstances. Both DIY and Managed portfolios are supported for business accounts.

Setting Up An Account

Opening an InvestEngine account takes a matter of minutes. To get started, visit the website or open the app, and select the ‘Get Started’ icon. Next, you will need to sign up and fill in various forms with personal and financial information. You can then choose your chosen funding method and start looking at the various portfolio options available.

Trading Hours

InvestEngine’s platform is accessible 24/7, though trading times are limited by the market that each ETF is traded on.

Customer Support

InvestEngine customer support provides relevant and quick responses to any queries. The team can be contacted via telephone, live chat and email between 09:00 and 17:00 GMT, Monday through Friday. Alternatively, there is a fairly comprehensive FAQ section on the broker’s website.

- Phone: 0800 808 5771

- Email: support@investengine.com

- Live Chat: Lower right corner of the website

Safety & Security

InvestEngine uses several tools to secure crypto holdings against theft, including SSL 256-bit encryption and two-factor authentication (2FA), whilst ensuring personal and financial information is kept secure.

User funds are secured in pooled client bank accounts at NatWest and user investments are secured in a pooled client account as CREST. This ensures that all your funds and investments are separated from InvestEngine’s own liabilities and investments. This means that, if the broker filed for bankruptcy, your funds would be protected and the firm cannot access your funds to pay for its own obligations.

The broker is regulated by the FCA and protected by the FSCS, which means that you can receive up to £85,000 in compensation if the company collapses.

Given the youth of the platform, there are not many customer reviews on the app stores. However, those that have been left contain generally positive sentiments, with a 4.7 rating on TrustPilot, a 5.0 rating on the App Store and a 4.6 on the Play Store.

InvestEngine Verdict

InvestEngine provides an accessible and functional trading experience with a sleek user interface and a range of competitive features. Accounts can either be controlled manually for free or entrusted to the broker’s robo advisor service for a 0.25% commission. The firm offers a wide range of ETFs, though investment in individual securities and company stocks is not supported. Overall, the broker offers regulated investment products and a range of useful reporting and analytical tools, though no SIPPs or LISAs are offered.

FAQs

How Much Capital Do I Need To Trade With InvestEngine?

Prospective clients can get started with InvestEngine for as little as £100, the broker’s minimum deposit limit. However, there is no account minimum, so you can withdraw money and maintain less capital in your account.

Does InvestEngine Offer A Demo Account?

There is no demo account offered by InvestEngine, which is not uncommon in brokerage firms targeting long-term investors more than day traders.

Is InvestEngine Regulated?

InvestEngine Ltd. is regulated by the UK’s Financial Conduct Authority (FCA), a tier 1 regulatory agency. With this comes membership to the Financial Services Compensation Scheme (FSCS), protecting client funds up to £85,000.

Where Can InvestEngine Be Used?

InvestEngine is a UK-only brokerage firm, so clients from other countries are not able to open accounts.

How Can I Contact InvestEngine?

InvestEngine can be contacted via telephone, email or a live chat window, which is found in the lower right corner of the site. The firm’s telephone number is 0800 808 5771 and the email address is support@investengine.com.

Top 3 Alternatives to InvestEngine

Compare InvestEngine with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

InvestEngine Comparison Table

| InvestEngine | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 4.4 | 4.5 |

| Markets | ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Stocks, Futures, Futures Options |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | £100 | $0 | $0 | $100 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:50 |

| Payment Methods | 2 | 6 | 6 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by InvestEngine and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| InvestEngine | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

InvestEngine vs Other Brokers

Compare InvestEngine with any other broker by selecting the other broker below.

The most popular InvestEngine comparisons:

Customer Reviews

There are no customer reviews of InvestEngine yet, will you be the first to help fellow traders decide if they should trade with InvestEngine or not?