Interactive Brokers Launches Forecast Contracts In Europe With Simple ‘Yes/No’ Trades

Interactive Brokers (IBKR) has made its ForecastTrader platform, which lets you place yes or no trades on elections, economic indicators, government announcements, and other events, available to traders in Europe.

We recently tested Interactive Brokers as part of our evaluation of the best brokers for prediction markets, and it came out on top thanks to its growing range of contracts (although political and pop culture events aren’t available in Europe currently), intuitive platform, and stellar reputation.

Key Takeaways

- European clients of Interactive Brokers can now use the ForecastTrader platform to place trades on fixed outcomes.

- Simply answer a question with a yes or no for a fixed payout, for example, “Will the EU Deposit Facilities Rate be set above 2.15% at the meeting of the Governing Council of the European Central Bank ending October, 30, 2025?”

- This follows the product’s launch in other major regions, including the US and Canada.

How IBKR’s ForecastTrader Works

The platform enables you to make predictions on a range of events, from politics and economics to finance and climate indicators.

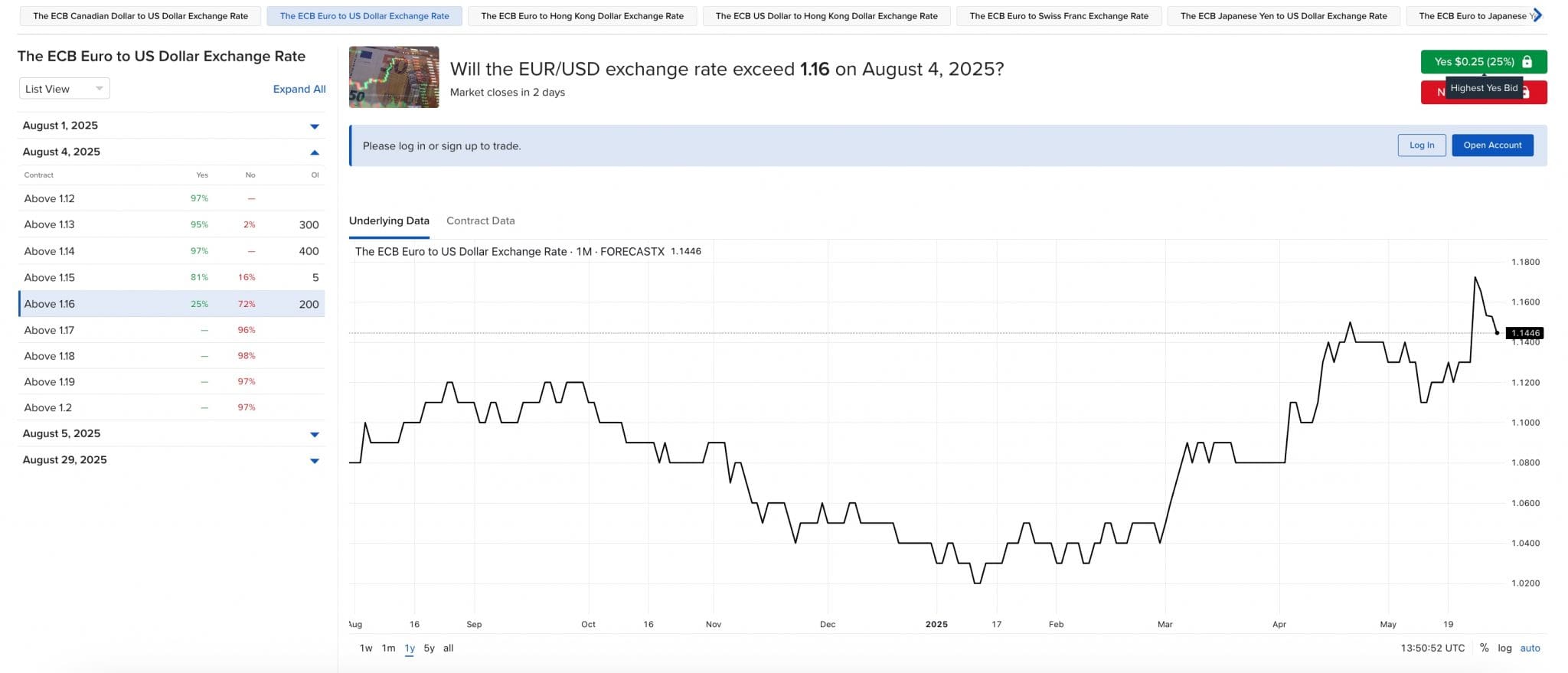

You can see below that I had to decide whether I thought the EUR/USD exchange rate would push past 1.16 on the 4th of August.

If I were right, that is the contract I hold expires “in the money” based on the final settlement value, I’d receive a fixed payout of USD 1.00.

The maximum profit per contract is USD 1.00 minus the purchase price, along with any fees. Contracts are priced between USD 0.02 and USD 0.99, with increments of USD 0.01.

If I were wrong, that is the contract I hold expires “out of the money”, my loss would be capped at my initial investment.

The appeal is the way this product is devised – it’s a simple yes/no question where your losses are capped to your stake and you know how much you stand to gain.

Event-based contracts can be traded almost 24 hours a day, 6 days a week.

About Interactive Brokers

Interactive Brokers is among the most trusted names in the industry. Listed on the NASDAQ, it’s authorized by a string of regulators in the US, UK and Europe, and earned the trust of over 3.8 million traders.

IBKR is among the first major brokers to enter the prediction markets space, breathing fresh air into a financial product that’s in the past attracted some nefarious actors and regulatory scrutiny.

New clients in Europe can get started with Interactive Brokers’ ForecastTrader with no minimum deposit.