Is IC Markets Legit Or A Scam?

Based on our assessment, we are confident that IC Markets is a legitimate broker and not a scam.

| Safety Consideration | IC Markets |

|---|---|

| Our Regulation & Trust Rating | 4.6/5 |

| Regulatory Licenses | ASIC (green tier), CySEC (green tier), CMA (orange tier), FSA (red tier) |

| Negative Balance Protection | Yes (retail traders in Australia and the EU) |

| Segregated Client Accounts | Yes |

| Listed on Stock Exchange | No |

| Also Operates as a Bank | No |

We came to the conclusion that IC Markets is a credible, secure broker for five reasons:

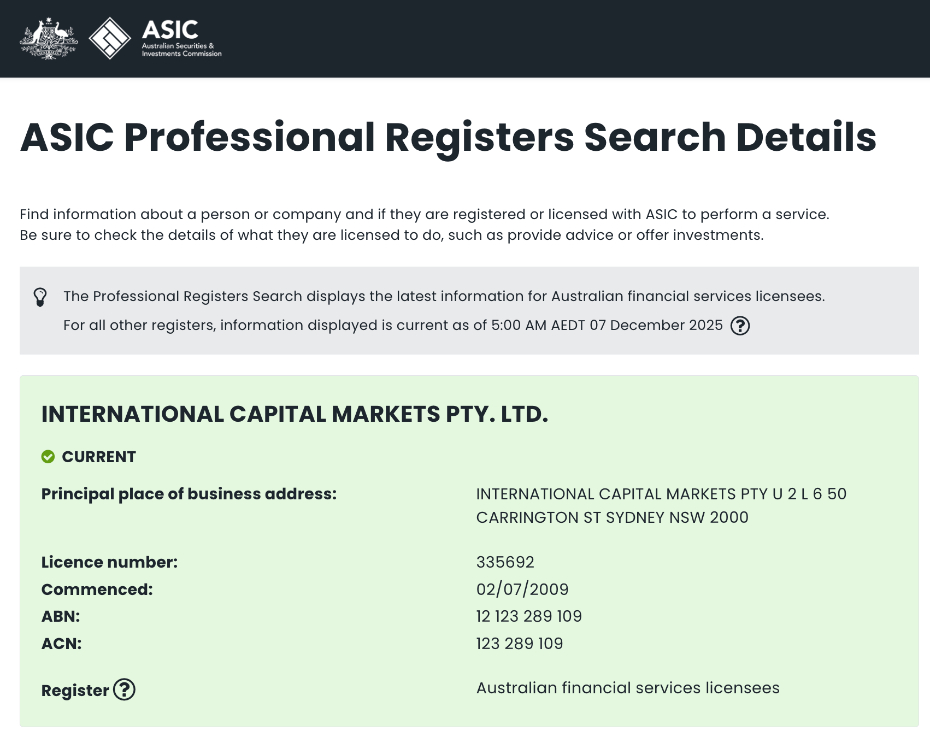

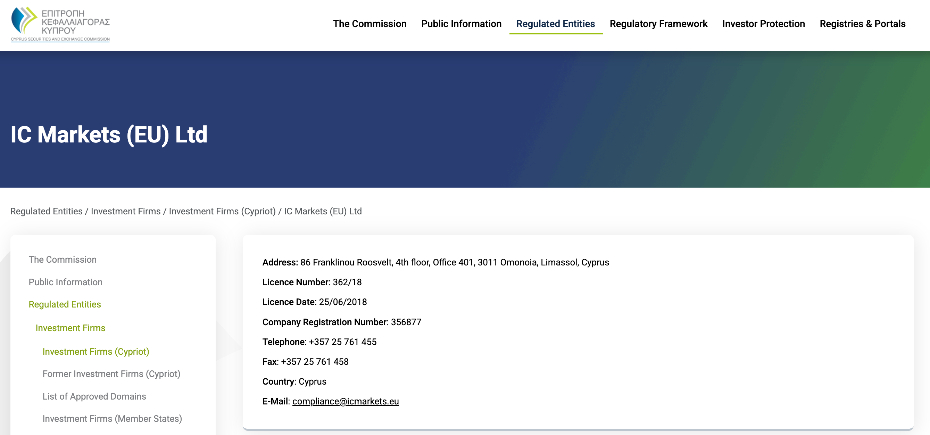

- It holds licenses with two ‘green tier’ bodies in our regulator directory – the Australian Securities & Investments Commission (ASIC), under license number 335692 and the Cyprus Securities & Exchange Commission (CySEC), under license number 362/18. We’ve verified both licenses and also re-checked that they remain authorized multiple times over the years. Below you can see evidence of our last checks – screenshots from the respective regulators’ databases. Only legitimate brokerages secure authorization from trusted regulators like the ASIC and CySEC.

- Alongside our extensive hands-on tests, which demonstrated that its platforms and tools work as advertised, two of our team (Christian Harris and Tobias Robinson) have personally used IC Markets for their own real-money trading, with neither experiencing any issues placing deposits and withdrawals – hallmarks of a legitimate operation. In total, we’ve spent over 100 hours using IC Markets since we first evaluated it in 2018.

- IC Markets has scooped five of DayTrading.com’s annual awards over the years, including Best MT4/MT5 Broker for 2025, Best Forex Broker for 2022, and Best Overall Broker for 2020. When going head-to-head with hundreds of other brokers, many of whom are tightly regulated, only legitimate providers secure our top accolades.

- IC Markets has over 200,000 active global clients, while its app has been downloaded more than 500,000 times and scored over 3/5 on the App Store and Google Play. Generally, only legitimate brokers amass such large client bases with so many positive ratings from other traders.

- IC Markets has stood the test of time, having been operating since 2007 and rolling out various upgrades, including integration with TradingView in 2024. This indicates that it’s a real operation. In contrast, scam brokers tend to crop up, lure in lots of clients over some weeks or months, then disappear with their deposits, prompting a flood of complaints online and user forums – something we’ve not seen with IC Markets.

Which IC Markets Entity Will You Trade With?

Like lots of large, well-known forex and CFD brokers, IC Markets operates through multiple regulated entities. Your safeguards, such as the strength of regulatory oversight, leverage limits, complaint routes, and negative balance protection, will depend on which entity you open your account with:

| If you live in… | Best IC Markets entity to choose | Why this is the safer pick | What to check before you open |

|---|---|---|---|

| Australia | International Capital Markets Pty Ltd (ASIC) | Top-tier oversight and strong retail safeguards | Make sure your account docs explicitly name International Capital Markets Pty Ltd and reference the ASIC licence |

| EU/EEA | IC Markets (EU) Ltd (CySEC) | Strong EU-style conduct rules and retail protections | Confirm the onboarding entity is IC Markets (EU) Ltd and the CySEC authorisation is shown in your legal docs |

| UK | Check your entity carefully (often IC Markets Global) | UK-specific protections may not apply if you’re onboarded offshore | Your account agreement should clearly state the legal entity (e.g., Raw Trading Ltd) before you deposit |

| Rest of the world | IC Markets Global: Raw Trading Ltd (Seychelles FSA) | Broader access, but protections/recourse can be lighter than ASIC/CySEC | Verify your agreement names Raw Trading Ltd, review entity-specific safeguards, and understand your complaints options |

Safety Considerations To Keep In Mind

Even legitimate, regulated brokers come with practical risks. IC Markets offers high-risk leveraged products, and clients who sign up under offshore entities should expect weaker protections and dispute options than those using its ASIC or CySEC-regulated branches.

It has also come under some regulatory scrutiny. For example, CySEC fined IC Markets (EU) Ltd €200,000 in July 2024 over alleged leverage-limit issues and the FCA warned in October 2024 that IC Markets Global may be providing services in the UK without authorisation.

As with any well-known brand, traders should also stay alert to clone or impersonation scams and verify the exact legal entity and website details before depositing.

These drawbacks don’t override our assessment that IC Markets is a legitimate broker. Top-tier regulation, a long operating history, and high praise from our team members who have used it personally or evaluated it, reassure us that IC Markets is a credible, non-scam operation. Just confirm the exact entity you’ll be onboarded with.