HYCM Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Forex Broker 2021-2022 - Spain, Middle East, Asia, Germany

- Best Trading Platform App 2021 - Forex Expo

- Best Mobile Trading App 2020 - World of Finance Forex Award

Pros

- The broker is overseen by trusted regulators, including the FCA

- The low $20 minimum deposit is suitable for beginners, as well as the Fixed spread account with no commissions

- Spreads are competitive in the Raw account, starting from 0.1 pips for EUR/USD

Cons

- There's a high commission of $4 each way on the Raw account

- Market coverage varies quite significantly between account types and platforms

- Not the best overall range of assets, with just 200+ stocks

HYCM Review

HYCM is an international forex and CFD broker with industry-leading MT4 and MT5 platform integration. Our 2026 review covers the essentials of trading with HYCM, including the login process, minimum deposit requirements, spreads, and their deposit bonus offering. Find out whether to register for an account today.

HYCM Headlines

The HYCM brand is part of the Henyep Capital Markets Holdings Group and has UK, Hong Kong, Kuwait, Cayman Islands, Dubai, and Cyprus office locations. The following companies operate under the HYCM name:

- HYCM Ltd, licensed with the Cayman Islands Monetary Authority (CIMA)

- Henyep Capital Markets (UK) Limited, regulated by the Financial Conduct Authority (FCA)

- HYCM (Europe) Ltd, authorized by the Cyprus Securities and Exchange Commission (CySEC)

- Henyep Capital Markets (DIFC) Limited, authorized by the Dubai Financial Services Authority (DFSA)

The company provides its services to traders in over 140 countries, including Malaysia, Singapore, India, Indonesia, Kuwait, and Australia. This broker does not accept clients from the USA or Canada. The official website is available in 14 languages, including Farsi.

Trading Platform Review

Prospective traders need to complete registration on the HYCM website to receive login credentials, then sign-in on the client portal to access the financial markets.

MetaTrader 4

All branches offer MetaTrader 4 (MT4), an industry-leading platform suitable for investors of all experience levels. MT4 is available as a software download and has a breadth of useful features:

- One-click trading directly from the chart

- Interactive charts with 30 technical indicators and nine timeframes

- Three execution modes, two market order types, and four pending orders

- Tracking of all orders and open positions available in the terminal interface

HYCM has also collaborated with Trading Central to provide financial analytics on the MT4 platform. Clients can install the Trading Central indicators to monitor market movements and inform their execution strategy.

Recommended Alternatives To HYCM

MetaTrader 5

Clients can also opt to use MetaTrader 5 (MT5), an update to the MT4 platform with powerful technical analysis and additional functionality:

- Two order account modes

- Three chart types to suit your preference

- Six types of pending orders and 21 timeframes

- Over 80 technical indicators and graphical objects

Users can also refine their execution strategies in MT4 and MT5 using Expert Advisors (EAs). This technology allows 24/5 automated trading without third-party bridges and is easy to install.

Clients should note that scalping is not permitted with this broker.

WebTrader

Both MT4 and MT5 are available on WebTrader. This browser-based solution allows clients to trade on the platform without a software download and is compatible with all operating systems.

Assets & Markets

HYCM offers several asset classes:

- Indices – 28 global indices

- Forex – 40+ currency pairs

- Stocks – 11 major companies

- Commodities – 14 including gold and oil

- ETFs – 20 different ETFs are available, including the most popular: SPDR, S&P 500, iShares Russell 2000 Index, and VelocityShares 3x Inverse Crude Oil ETN

Potential clients should be aware that some currency pairs are only available on the MT5 platform and that the NASDAQ index is not provided. Cryptocurrencies are also not offered with the exception of BTC/USD CFDs.

Spreads & Commissions

Spreads vary with account type and are broadly competitive. For example, EUR/USD is offered at 1.5, 1.2, and 0.1 pips on Fixed, Classic, and Raw accounts, respectively. Raw accounts have a $4 commission per round on forex trades and some commodities. Our broker review was pleased to see that fees align with the industry.

Swap-free / Islamic accounts are not charged interest overnight for the first 14 days a position is open. Thereafter each contract is charged $5 per night. HYCM also charges a $10 monthly inactivity fee on accounts that have been dormant for 90 days.

Leverage

Clients can access different leverage ratios depending on the regulation in their jurisdiction. For example, with Henyep Capital Markets (UK) Ltd and HYCM (Europe) Ltd:

- ETFs – 1:5

- Stocks – 1:5

- BTC CFDs – 1:5

- Forex majors – 1:30

- Commodities (Natgas, soft, and oil) – 1:10

- Indices (cash and futures) – 1:10 – 1:20

- Forex minors and exotics, metals, indices (US cash and futures) – 1:20

For Henyep Capital Markets (DIFC) Limited customers, a 5-20% margin is required depending on the asset. However, with HYCM Ltd (CIMA), this is set at 2%, 1%, or 0.5%.

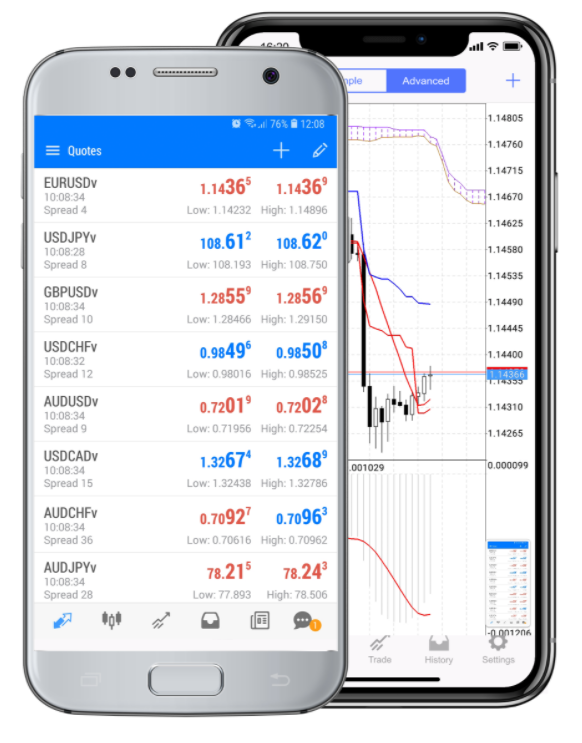

Mobile App

HYCM does not offer an own-brand app but both MT4 and MT5 are available as mobile applications. These fully-featured apps for iPhone and Android are free to download and have useful features:

- Interactive quote charts

- Full set of trading orders

- Tracking of order history

- Chat function and push notifications

HYCM Deposits & Withdrawals

Traders can start investing with a minimum first-time deposit of $100 ($20 on regular deposits), and payments are fee-free. The broker accepts deposits via bank wire (1-7 days processing, minimum $250), plus Visa, Neteller, and Skrill (up to 1 hour processing, minimum $20). This broker does not accept PayPal.

The withdrawal process offers the same payment routes and processing times, except bank wire which is a minimum of $300 with 1-5 days in processing time. Note there is a 1% fee from Skrill or Neteller when withdrawing over $5,000.

Demo Account

HYCM offers a demo account funded with $50,000 in virtual cash, which remains active for 14 days. It uses the MT4 platform and can be opened in USD or EUR currencies. It is also easy to upgrade to a real-money account after the expiry.

Bonuses & Promotions

HYCM Limited clients enjoy a 10% credit bonus on every deposit over $100, up to $5,000. Due to regulatory requirements, the broker cannot offer welcome or no deposit bonus schemes in other jurisdictions.

Regulation & Licensing

The brand has strong regulation from four financial authorities: the Financial Conduct Authority (FCA), the Dubai Financial Services Authority (DFSA), the Cayman Islands Monetary Authority (CIMA), and the Cyprus Securities and Exchange Commission (CySEC). Clients with this broker enjoy negative balance protection, so losses cannot be greater than the original deposit.

Reviews and ratings are generally very positive, and the broker is often equated to large brokers such as IG, FXCM, FXTM, Pepperstone, and eToro in online comparisons.

Additional Features

The broker delivers a market news section on their website, including a daily technical snapshot, plus an economic calendar and forex calculators. HYCM also hosts an expansive training department with forex education, webinars, and workshops.

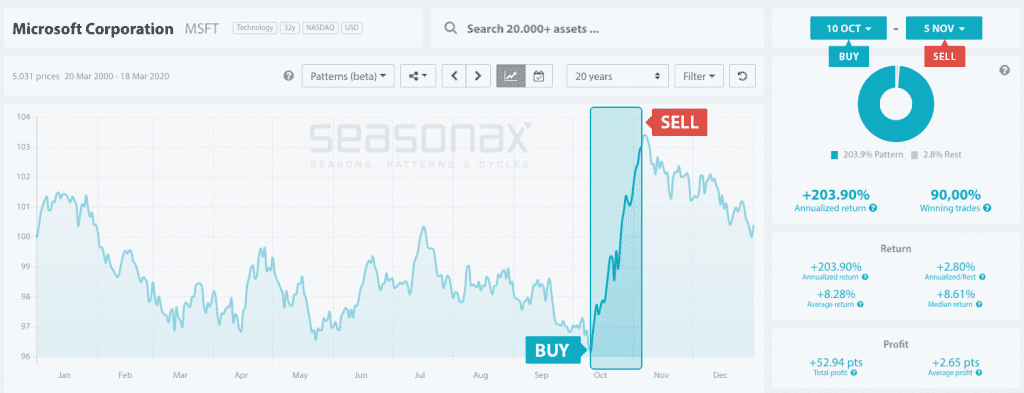

Additionally, the brokerage has teamed up with Seasonax to offer clients an intelligent seasonal pattern analytics service. With an intuitive dashboard, the tool uses powerful algorithms to scan the markets and identify trading opportunities across FX, stocks, indices, and commodities. For users tight on time, the feature can help traders find market opportunities and make more informed trading decisions.

Account Types

Traders can open one of three live accounts with either MT4 or MT5:

- Fixed – fixed spreads from 1.5 pips, $100 minimum deposit

- Classic – variable spreads from 1.2 pips, $100 minimum deposit

- Raw – spreads from 0.2 pips plus $4 commission each way, $200 minimum deposit

EAs and an Islamic option are available with all account types, and the minimum trade volume is 0.01. HYCM does not currently offer an ECN account solution.

Trading Hours

The HYCM website is available to clients 24/7, but trading hours depend on the market. For example, the majority of forex pairs can be traded from 22:01 – 20:00 (GMT), Sunday to Friday.

Customer Support

Clients can access support quickly through the website, live chat, or through:

- Telegram – @henyep

- Contact number – +442088167812

Support staff are quick to respond to queries and knowledgeable about the products and platforms offered. The broker is also active on Facebook and LinkedIn.

Security

HYCM has a thorough privacy policy that safeguards personal information disclosed to the company. The MT4 and MT5 platforms are also secured with encryption protocols and additional safety measures at the login stage.

HYCM Verdict

HYCM is a forex and CFD broker with multi-body regulation that offers MT4 and MT5 integration alongside competitive spreads and a deposit bonus scheme. This broker has account types to suit a range of clients, plus straightforward deposits and withdrawals for easy trading.

FAQ

Is HYCM A Malaysia Scam?

No, HYCM is a legitimate broker that operates in Malaysia and is regulated by many institutions such as the UK Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Dubai Financial Services Authority (DFSA), and the Cayman Islands Monetary Authority (CIMA).

Can You Still Trade On HYCM?

Yes, most customers can use the platform. However, HYCM is not able to accept clients from the following countries: Afghanistan, Albania, The Bahamas, Barbados, Belgium, Botswana, Cambodia, Canada (British Columbia, Quebec, Saskatchewan), France, Ghana, Hong Kong, Iraq, Jamaica, Japan, Lao PDR, Mauritius, Myanmar, Nicaragua, North Korea, Panama, Sudan, Syria, Turkey, Uganda, USA, Vanuatu, Yemen, Zimbabwe.

Is HYCM A Legitimate Broker?

HYCM is a good broker and a genuine firm, not a scam. This broker attracts positive online reviews and clients can access customer support 24/5 for any issues.

Is HYCM Regulated?

The HYCM brand incorporates four companies regulated by different financial authorities. These authorities are the UK Financial Conduct Authority (FCA); the Dubai Financial Services Authority (DFSA); the Cayman Islands Monetary Authority (CIMA); and the Cyprus Securities and Exchange Commission (CySEC).

What Platforms Are Available At HYCM?

HYCM has MetaTrader 4 and MetaTrader 5 integration. These platforms are available to download, as browser-based solutions or as mobile apps.

Does HYCM Offer A Demo Account?

HYCM offers a demo account on the MT4 platform that is funded with $50,000 in virtual cash. Clients can open an account with USD or EUR currencies and can begin to invest at any time.

What Is The Minimum Deposit At HYCM?

The minimum deposit is $100, though traders can access tighter spreads with a deposit of $200. You can open an account from the broker’s homepage.

Best Alternatives to HYCM

Compare HYCM with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

HYCM Comparison Table

| HYCM | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $20 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA, DFSA, CIMA, CySEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | 10% deposit bonus up to $5,000 | – | 100% Anniversary Bonus |

| Platforms | HYCM Trader, MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:301:500 | 1:50 | 1:200 |

| Payment Methods | 7 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by HYCM and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| HYCM | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

HYCM vs Other Brokers

Compare HYCM with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of HYCM yet, will you be the first to help fellow traders decide if they should trade with HYCM or not?