How Does GLD Invest in Gold?

GLD, known as SPDR Gold Shares, is the world’s most popular gold ETF.

It revolves around holding physical gold bullion in trust for its shareholders.

This arrangement implies that purchasing a share of GLD equates to buying a minuscule portion of the total gold held by the trust.

Key Takeaways – How Does GLD Invest in Gold?

- GLD holds physical gold bullion in trust.

- Offers direct gold exposure.

- Shares represent fractional ownership of the trust’s gold.

- GLD simplifies gold investment.

- Avoids physical handling and storage complexities.

- We also compare GLD with IAU, GDX, and Gold Futures.

1. Backing by Physical Gold

The foundation of GLD’s operation is the SPDR Gold Trust.

It physically holds gold bars in high-security vaults globally.

The existence and safety of these gold bars are ensured via independent audits and public verification processes.

This structure guarantees that each GLD share is directly supported by a corresponding amount of physical gold.

Owning shares in GLD, therefore, means having a claim to a fractional share of the total gold in the trust’s possession.

2. Buying and Selling Shares

Investing in GLD spares individuals from the complexities of acquiring, storing, and insuring physical gold.

GLD shares are traded on the stock exchange like any other security.

Like all ETFs, it’s about ease and simplicity to getting exposure to what you want at a reasonable cost (i.e., low expenses).

The value of these shares fluctuates based on market supply and demand.

GLD typically mirrors the price movements of gold bullion closely.

3. Expense Ratio

Operating the trust incurs certain costs.

This is addressed through a 0.40% annual expense ratio. (This comes to about $40 per year for every $10,000 invested.)

This fee is used to manage the trust’s expenses and results in a gradual decrease in the amount of gold each GLD share represents.

Despite this minor erosion in value, the convenience and liquidity offered by GLD make it an attractive option for many investors.

Is there a cheaper gold ETF than GLD?

Yes. If you’d like a cheaper gold ETF than GLD, there is IAU (iShares Gold Trust). It comes with an expense ratio of 0.25% – a 15-bp (0.15%) improvement over GLD.

However, IAU is less liquid than GLD.

On top of that, IAU’s options markets aren’t as well developed as GLD’s.

GLD has intra-weekly options, while IAU has only monthly options markets.

GLD’s options typically also have tighter spreads.

So GLD is generally better for traders and those who prefer options trading in gold.

But for those who are looking for a long-term, strategic holding IAU could be the better choice.

Small fee improvements can certainly make a difference over the long run.

4. No Income Generation

GLD doesn’t generate income through dividends or interest.

Its primary function is to reflect the price of gold in the market.

Accordingly, any returns from investing in GLD are solely dependent on the fluctuations in gold prices, either positive or negative.

Gold miners, however, are companies that strive to make a profit from their operations in the gold market.

GDX (VanEck Gold Miners ETF) is one ETF to consider.

Gold ETF vs. Gold Futures

GLD and Gold Futures are two distinct methods of gaining exposure to the gold market.

GLD

As discussed, GLD, as a physically backed gold exchange-traded fund (ETF), allows traders/investors to own a share of physical gold bullion without the complexities of handling and storing the metal.

It incurs a small expense ratio for management and storage, slightly eroding the value over time.

Gold Futures

Gold Futures – e.g., GC or MGC, most commonly – are financial contracts obligating the buyer to purchase gold at a predetermined future date and price.

These futures provide leverage, as traders/investors can control large amounts of gold with a relatively small amount of capital.

They are popular for both speculation and hedging.

But they carry higher risk due to leverage and the potential for significant losses.

Roll Process

Gold futures contracts often involve a “roll” process.

This is where an expiring contract is closed and a new one is opened at a further-out expiration date to maintain a position.

This incurs transaction costs.

Futures may also be less liquid. This is especially true the further out you buy.

Structurally Contango Market

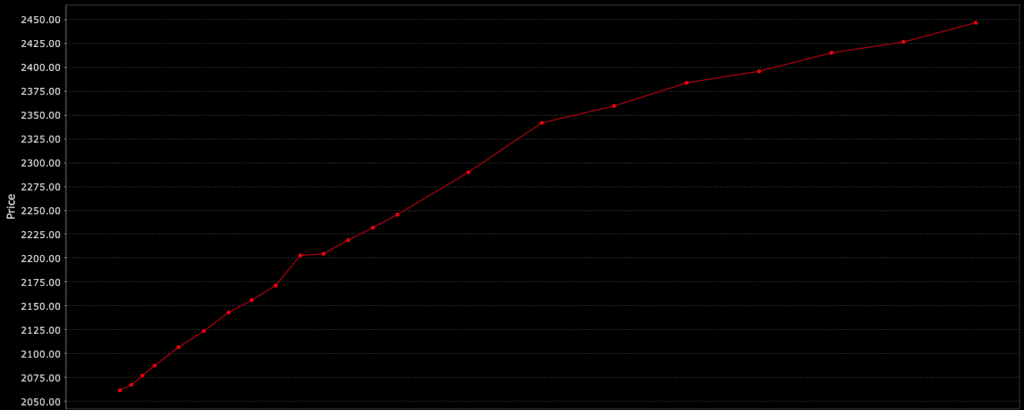

Gold is typically in a structurally contango market, characterized by an upward-sloping futures curve (see image below).

This is due to the costs associated with storage and insurance of physical gold as well as prevailing interest rates.

Related

Summary

GLD offers a more direct and less complex exposure to gold prices. It’s suitable for long-term holding

Gold Futures are more suited for experienced traders focusing on short-term price movements and willing to assume higher risk.

Conclusion

GLD’s approach to gold is through direct holding bullion.

This method provides traders and investors with an efficient, liquid means to access the gold market, eliminating the need to handle physical bullion directly.

GLD offers a blend of physical asset backing and stock market accessibility.