Grand Capital Review 2025

See the Top 3 Alternatives in your location.

Pros

- Wide selection of payment methods and account currencies

- Full range of investments including dedicated GC Option brand for binaries

- Micro account for beginners

Cons

- Basic education and market research

- Limited regulatory oversight

- High spreads on some assets

Grand Capital Review

Grand Capital is a forex and CFD broker with MetaTrader 4 and MetaTrader 5 integration. New traders can claim a welcome bonus upon sign-up and also access the firm’s copy trading platform. This review of Grand Capital examines the benefits and risks of opening an account, from tradable instruments to fees, leverage and regulations.

Assets & Markets

Grand Capital offers a reasonable selection of 400+ assets spanning popular markets, from stocks and forex to commodities and cryptocurrencies.

While not the longest list of trading products, the group also offers binary options and runs a separate website dedicated to this product, GC Option. This straightforward instrument is available on 30+ assets including currency pairs, futures, and metals. The brand offers call and put options in addition to early closure. We also liked the high payouts of over 85% on the firm’s binaries.

Popular instruments at Grand Capital include:

- Forex – 50+ currency pairs including majors like EUR/USD

- Cryptocurrency – 60+ pairs including Bitcoin and Ethereum

- Stocks – US, European and Russian stocks including Amazon and Apple

- Indices – 12 leading stock indices including NASDAQ and FTSE 100

- Spot metals – Five metals including gold and silver

- Energies – Natural gas plus WTI and Brent crude oil

- ETFs – Seven popular assets including QQQ

- Other CFDs – Softs, grains, bonds, and meats

Trading Accounts

We liked the choice of account types that offer different assets and fee structures. This means traders of different experience levels with various strategies can find a suitable setup.

Traders can create MT5, Standard, Swap Free, Micro, Crypto, or ECN Prime accounts:

- All accounts have a minimum 0.01 lot size

- All operate via the MT4 platform, except the MT5 account

- Accounts are in USD, except the Standard account which offers eight other currencies

Your preferred account will ultimately depend on your experience, deposit amount and strategy:

- Standard accounts offer a wide range of assets and are best for forex ($100 minimum deposit)

- MT5 accounts are ideal for algorithmic trading ($100 minimum deposit)

- Micro accounts are good for beginners with 66 popular instruments ($10 minimum deposit)

- ECN Prime accounts are best for seasoned traders and scalpers with low spreads ($500 minimum deposit)

- Swap Free accounts are not charged overnight fees and are suitable for Muslim traders ($100 minimum deposit)

- Crypto accounts come with an analyst and 68 cryptocurrencies ($100 minimum deposit)

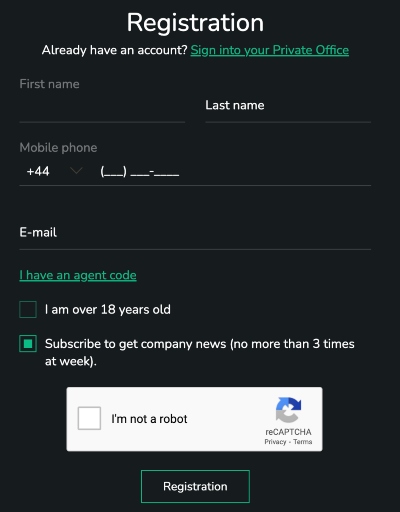

How To Open A Grand Capital Account

I found it quick and easy to open a live account. I was set up and ready to trade in a few minutes.

- Fill out the application form with your name, phone number and email address

- Confirm you are over 18 years old and click ‘Registration’

- Login credentials will be sent to the submitted email address

- Sign in to the Private Office to start trading

Trading Fees

Grand Capital falls short in terms of fees, with wider than average spreads.

For the tightest spreads, I would recommend the MT5, ECN Prime or Crypto accounts, which start at 0.4 pips. Unfortunately spreads on the other profiles start at 1 pip which is fairly high.

Grand Capital also charges a commission on many trades, although we like that trades on the Micro account are commission-free.

- Standard – CFDs at $14-15

- MT5 – Forex, metals, indices, and energies at $5-10, CFD ETFs and stocks at 0.1%, crypto at 0.5%

- ECN Prime – Forex, metals, and energies at $5, indices at $7, CFD ETFs and stocks at 0.1%

- Swap Free – Forex at $4-10, indices at $30, energies at $45, metals at $50

- Crypto – 0.5% commission

On a lighter note, there are no inactivity fees which is a plus over alternatives. Overall though, our review has to flag that Grand Capital is a relatively expensive broker.

Grand Capital Payment Methods

Deposits

When we used Grand Capital, we were impressed with the selection of accessible payment solutions, which are available to traders from all over the world. The broker accepts funding via bank transfer, electronic payment systems such as Fasapay, and local transfer agents. Support for crypto payments, including Bitcoin, will also be welcomed by some traders.

The minimum deposit to open an account is low at $10 for the Micro account, making it good for beginners. The ECN Prime account has a minimum of $500 and other accounts require $100. Again, these are all accessible and rival competitors.

On the negative side, processing times are up to five days, although the majority of agents are commission-free as Grand Capital compensates for the fee.

Withdrawals

We don’t have any withdrawal issues to report. The minimum withdrawal clients can make is reasonable at $10. Requests are also generally processed within 3 working days, though bank transfer transactions can take up to 5 working days, which is in line with alternatives.

Many of the same transfer options are available, but most of the agents have an associated commission charge.

It is also worth noting that Grand Capital has put in place verification rules in which clients depositing with a bank card must provide colour photos of the card, and their documents such as ID or passport.

Trading Platforms

Our team was pleased with the reliable trading platforms available, including the industry-leading MetaTrader 4 and MetaTrader 5 software.

MetaTrader 4

MetaTrader 4 is a widely popular platform that traders can download on Windows or macOS. It has market-leading technical and analytical capabilities but remains user-friendly for the novice trader. Among my top features are:

- Interactive charts with 23 analytical objects and 30 technical indicators

- Multiple order types including trailing stop, market, and pending orders

- One-click trading to place orders straight off the chart

MetaTrader 5

Clients can also use MetaTrader 5, a powerful updated platform that supports an even wider range of tools and analysis features. I would recommend MT5 for advanced traders as it offers over 80 technical indicators. Other upgrades include:

- Three times as many timeframes as MT4 for flexible quote visualization

- Two position accounting systems: netting and hedging

WebTrader

Grand Capital’s MT4 and MT5 servers can also be accessed on any browser and operating system using the WebTrader online platform. I would start with this if you are a beginner and comfortable with a basic trading environment.

Web trading offers all the functionality of the native programs without the hurdles of software downloads or system compatibility, and data is safeguarded using encryption.

Mobile Apps

While using Grand Capital, we were reassured to find a choice of mobile apps to facilitate investing on the move:

- Grand Capital Invest – This mobile app allows on-the-go access to the your Private Office and accounts. You can stay up to date with news and monitor analytics and are also able to launch MT4 mobile in a single click.

- MT4 & MT5 – Both MT4 and MT5 platforms are free to download from the App Store and Google Play. The apps offer the key features of the desktop experience and allow you to execute orders anywhere.

- Grand Capital Binary – This multifunctional app offers binary options trading with readily available quotes – clients can trade directly on the charts using this multifunctional interface. The application is available for download in PlayMarket and as an APK download.

Leverage

Grand Capital is a good pick if you want high leverage. The downside of high leverage is potentially larger losses but it can significantly amplify purchasing power and potential gains.

Importantly, leverage levels vary depending on your account:

- Up to 1:500 on Standard, Swap Free, and Micro accounts with a 100% margin call and 40% stop-out level

- Up to 1:100 on ECN Prime and MT5 with a 100% margin call and 80% stop-out level

- Up to 1:5 on Crypto with a 100% margin call and 80% stop-out level

Demo Account

Our team was pleased to find a range of demo accounts to reflect the range of live accounts. Clients can open Standard, MT5, and ECN accounts as demo versions. The binary options offering is also available as a demo profile and all simulators have $10,000 in virtual funds.

Another bonus for us was that Grand Capital runs demo trading contests with a 500 USD reward. This is a great way to test your skills against other traders while learning in a risk-free environment.

Grand Capital Bonuses

Grand Capital outperforms many competitors in terms of the selection and frequency of promotions.

The brokerage offers a trading bonus in which traders receive 40% of their initial deposit. Note that to claim the server bonus, you must be actively trading to receive $3 for each lot closed. However, the cash bonus can be withdrawn.

The Payback loyalty program is also a good way to get fee rebates. You can earn cashback after trading for five days straight and the rewards can be withdrawn without restrictions.

Our review was pleased to see these bonus incentives offered, alongside a trading contest. With that said, we do recommend checking terms and conditions for any usage and withdrawal restrictions, especially with no deposit bonus deals.

Regulation

Our major criticism of Grand Capital is that it is not regulated by a major financial institution. This is a drawback vs brands that are authorized by the FCA or CySEC, for example.

However, clients are eligible for compensation up to $20,000 as the broker is a member of the Financial Commission. This broker is also a member of Serenity, which guarantees the security of client funds and provides dispute resolution should there be scams or other concerns.

Overall this broker appears to be trustworthy despite the lack of robust regulatory oversight.

Additional Features

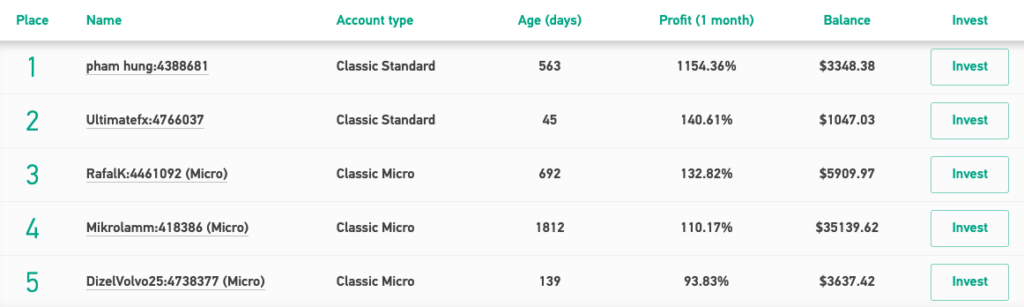

We were impressed with the selection of extra tools and services available. These are a great way to bolster the trading experience and can suit both beginners and seasoned investors.

Grand Capital offers LAMM, a copy trading service that clients can utilize to increase profits. Managers are traders that make their trades available for other clients to copy, and Investors pay Managers a fee to use these trades and potentially improve their takings. The best part is that trades are completed automatically and Investors can set a copying ratio to modulate risk.

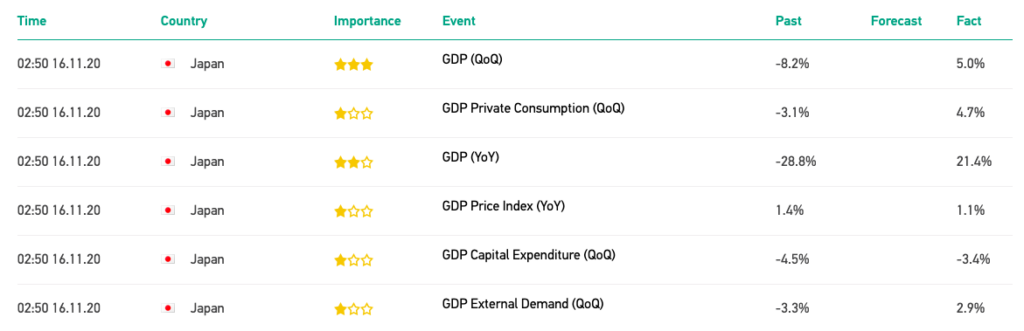

The official website also has a company news section, plus an economic calendar and a forex trading calculator.

The broker also has a channel on Telegram which puts out daily market news and analysis. This is a great way to keep on top of market updates, though the quality of the insights does not match some competitors.

Customer Support

We had no issues with the customer service provided by Grand Capital. Support staff are fairly quick to respond and can assist with account and payment queries.

You can contact customer service using the following channels:

- Email – info@grandcapital.net

- Phone – +1 646 8447187

A chat service is hosted on the broker’s website and clients can also request a callback. Grand Capital also has some regional YouTube channels.

Company Details

The Grand Capital Group comprises two companies, both named Grand Capital Ltd, based in St Vincent and the Grenadines and the Seychelles.

The brokerage serves several regions and has over 40 locations globally, a number of which are in Russia. The broker has also opened a data centre in Hong Kong and has a strong presence in Asia including offices in Myanmar, India, Malaysia, and Indonesia. The group also has opened offices in Nigeria, Namibia, Kenya, and South Africa.

Security & Safety

Grand Capital offers several reliable security measures. Our experts found that the broker ensures that client funds are protected across all transactions and that personal data is not unreasonably disclosed to other parties.

MT4 and MT5 are also well-known for their strong security protocols.

Trading Hours

The Grand Capital site is open to traders 24/7. Clients can execute orders when the market is open for their asset of interest, and this depends on the region and time zone. With that said, cryptos can be traded around the clock including on the weekend.

Grand Capital Verdict

Grand Capital is a global broker that offers a decent range of assets, including binaries at GC Option. The choice of account types is a plus, allowing users to find a profile that suits their investment style and strategy. A low deposit, demo account and copy trading will also be welcomed by beginners.

Our only major issue is the lack of top-tier regulatory oversight, which prevents us from giving the firm a higher trust score.

FAQs

Is Grand Capital A Good Broker?

Grand Capital appears to be a legitimate online broker and not a scam. Generous welcome bonuses and an accessible deposit mean you can start trading in a few minutes. There are also over 400 instruments and access to industry-favorite platforms MetaTrader 4 and MetaTrader 5.

Is Grand Capital Trustworthy?

Grand Capital is not regulated by a well-regarded financial authority, which is a noticeable downside. However, it does offer compensation schemes and dispute resolution services through its membership with the Financial Commission and Serenity mediatory bodies.

Does Grand Capital Offer Mobile Trading?

The broker has MT4 and MT5 integration, which are offered as mobile apps. It also provides its own brand mobile apps Grand Capital Binary and Grand Capital Invest, for trading and account management respectively.

Does Grand Capital Have Promotional Offers?

Yes, Grand Capital routinely advertises deposit and no deposit bonuses. It also runs contests including on demo accounts where no deposit is required. This is good news for beginners in particular, who can improve their skills in a low-risk setting.

Can I Open A Grand Capital Demo Account?

Demo accounts are available with this broker for three live account types, plus binary options trading. Prospective clients can practice on the markets with virtual funds. You can sign up for a simulator account in a few minutes on the broker’s website.

Best Alternatives to Grand Capital

Compare Grand Capital with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Grand Capital Comparison Table

| Grand Capital | Dukascopy | World Forex | |

|---|---|---|---|

| Rating | 3.9 | 3.6 | 4 |

| Markets | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $10 | $100 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FinaCom | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | 40% deposit bonus | 10% Equity Bonus | 100% Deposit Bonus |

| Platforms | MT4, MT5 | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:500 | 1:200 | 1:1000 |

| Payment Methods | 14 | 11 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Grand Capital and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Grand Capital | Dukascopy | World Forex | |

|---|---|---|---|

| Binary Options | Yes | Yes | Yes |

| Expiry Times | 1 minute – 48 hours | 3 minutes – 1 day | 1 minute – 7 days |

| Ladder Options | No | No | No |

| Boundary Options | No | No | No |

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | No |

| Options | No | No | No |

| ETFs | Yes | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | Yes | No |

Grand Capital vs Other Brokers

Compare Grand Capital with any other broker by selecting the other broker below.

Customer Reviews

4 / 5This average customer rating is based on 1 Grand Capital customer reviews submitted by our visitors.

If you have traded with Grand Capital we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Grand Capital

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I started using Grand Capital because they run demo trading contests and at that point in my trading journey I wanted to practice my setups and see how I compare to other traders without putting real cash down. They were great for that. They do one day tournaments and the winner gets $500 (not that I ever won lol). But anyway, was good fun, interesting learning and helpful for getting acquainted with their platform which to be honest is well easy to use because it just simple charts, simple order panel. You can’t really get lost in the Grand Capital’s trading software.