GO Markets Introduces Local Payment Options In LATAM And TradingView

GO Markets has introduced two major updates: localized payments for clients in Latina America and integration with TradingView.

Both focus on cutting funding and execution friction for active traders looking to speculate on the broker’s growing roster of CFDs.

Key Takeaways

- Local payment options are now available in Brazil, Mexico, Colombia, Peru, and more, including PSE, Pago Efectivo, SPEI, OXXO, and Paynet.

- The new transfer options enable LATAM traders to fund accounts in local currencies while trading in USD, reducing fees and making deposits more convenient.

- GO Markets has integrated directly with TradingView, enabling traders to analyze and manage positions from one screen with reliable execution.

Localized LATAM Payments Simplify Funding

GO Markets has rolled out country-specific payment options for traders across seven key LATAM markets.

Using popular local services like Pago Efectivo, SPEI, and PSE, traders can now fund their accounts directly in their local currency.

As GO Markets’ Angela Caicedo highlighted: “By offering local payment methods, we’re removing barriers, improving speed, and creating a more inclusive trading experience for our clients.”

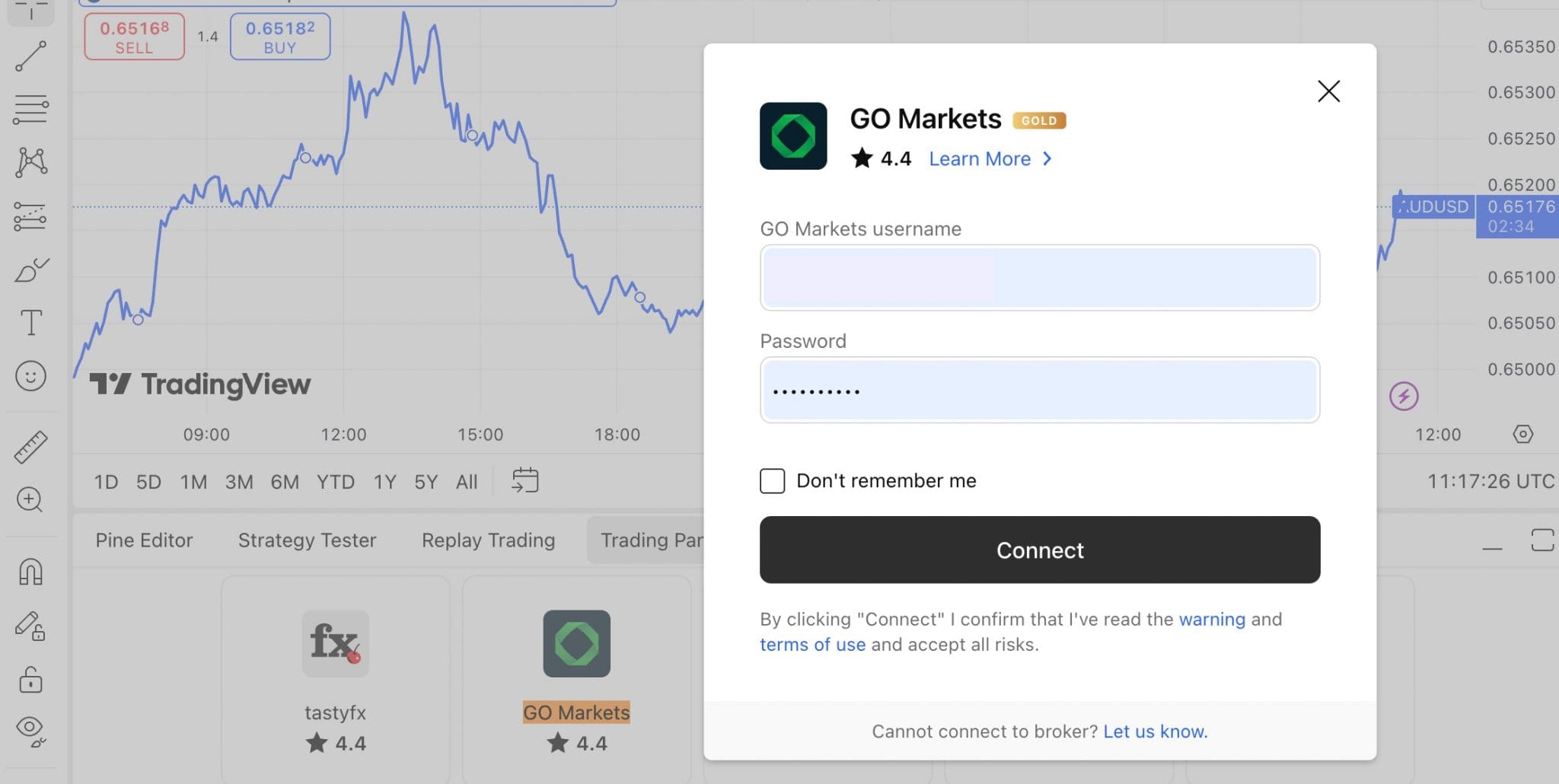

Trade Without Leaving TradingView

For short-term traders focused on execution speed and charting tools, GO Markets’ TradingView integration is a valuable addition.

We recently tested the TradingView’s platform at GO Markets and were impressed with the in-depth multi-asset charting, custom scripts, and community-driven analysis with fast execution.

GO Markets now joins other major brokers in adding TradingView to its suite of platforms, including CMC Markets and IG.

About GO Markets

Established in 2006 in Australia, GO Markets is a multi-regulated forex and CFD broker offering thousands of CFD instruments across forex, stocks, indices, commodities, ETFs, bonds, and crypto.

With competitive spreads, a growing list of localized payment solutions, multi-currency accounts, and an emphasis on education, GO Markets is emerging as a compelling choice for active traders.