Gemini Review 2025

Awards

- Best Cryptocurrency Exchange 2019 - Markets Choice Awards

- Best Crypto Exchange Overall 2022 - The Ascent

Pros

- The exchange ensures high security standards with 2FA a requirement for all crypto investors

- The TradingView integration delivers top-quality tools, including backtesting and algo trading capabilities

- Crypto perpetual futures are available in many jurisdictions with up to 1:100 leverage

Cons

- The 'convenience fee' for using the mobile app seems arbitrary and makes it inefficient to use this feature

- Some larger coins by market cap are not available to buy through Gemini

- There is no practice profile or demo account for prospective traders

Gemini Review

In this comprehensive Gemini Exchange review, our experts analyse the crypto exchange’s services and features to assess how it stacks up against similar rivals. I also test and rate the brand’s platform, fees and accounts to evaluate Gemini’s overall suitability for day trading.

Regulation & Trust

2 / 5Gemini gets a fairly low regulation and trust rating of 2 out of 5 from our analysts.

On the positive side, the firm holds e-money licenses with several credible US and European authorities, including the UK’s Financial Conduct Authority (FCA) and the Central Bank of Ireland (CBI), which does give them a certain level of accountability.

However, these types of licenses only allow them to provide digital payment services in their respective jurisdictions, and they do not regulate any associated crypto-asset exchange and custody services. This means that traders may not be covered by important safeguards, such as negative balance protection or compensation schemes.

Additionally, the brand does not have the best track record:

- In 2022, a phishing scam led to the leak of 5.7 million users’ personal information.

- In 2023, customers of Gemini’s Earn program were left facing large losses after crypto prices fell dramatically, forcing the exchange and a lender behind it to bankruptcy filings.

Ultimately, crypto exchanges remain far more loosely regulated than other forms of day trading. Numerous crypto giants have recently gone insolvent due to scams or mismanagement – a recent high-profile example being the 2022 collapse of FTX, once the world’s third-largest crypto exchange.

This is why our experts recommend considering one of our top-rated brokers that offer crypto CFDs instead, such as OANDA and Pepperstone. These regulated brokers allow you to speculate on crypto price movements in a more secure environment.

Accounts & Banking

3 / 5Live Accounts

Gemini Exchange keeps things simple by offering a single account type to retail traders, earning it a fair accounts and banking rating of 3. Price differences are based on the volumes traded.

We appreciate that all traders start on an even playing field, with all services and assets available to them. These include the standard crypto trading platform, but also some nice extras including access to the Nifty NFT trading marketplace.

I was also pleased to find crypto staking among these services, which provides day traders with a way to boost their crypto profits with up to 5.69% APR (net) available at the time of research.

The downside is that this yield is relatively low – it’s only roughly in line with what’s available from a far less risky savings account from a bank and is some way behind the top rivals in this department like Nexo, whose peer-to-peer loan service can bring in upwards of 15%.

Deposits & Withdrawals

Gemini supports a decent range of payment options covering both the traditional bank card and wire transfer methods and some fast and convenient e-wallet options.

Clients can make deposits of any size (no minimum) in seven fiat currencies: USD, AUD, CAD, EUR, GBP, SGD, and HKD.

The most affordable methods are transfers via ACH, CBIT and Plaid, none of which incur any fees, though note that Plaid withdrawals are not accepted.

Otherwise, traders may face some hefty charges, including 2.5% plus trading fees for PayPal and 3.49% plus trading fees for card, Apple Pay and Google Pay transactions.

Overall, I find this a little disappointing since these instant methods will be more convenient for day traders than the free options, each of which could take several days to process.

I also feel the range is slightly limited compared to some crypto brokers like Eightcap, which accepts a wider range of e-wallets including Neteller and Skrill.

Bonuses

Gemini Exchange traders who refer friends can earn $15 per year in their chosen cryptocurrency. The exchange has also previously offered sign-up bonuses such as $15 in Bitcoin on signing up, though note that these may not be available in jurisdictions that restrict this type of trading bonus.

Demo Account

I was disappointed with the lack of a demo account as I feel traders would benefit from the chance to try out Gemini’s ActiveTrader platform before signing up.

Several notable competitors like Kraken allow you to explore the platform’s interface directly from the website. This feature would have been valuable for newcomers at Gemini looking to test the platform’s tools and indicators.

Assets & Markets

2 / 5I’ve given Gemini a fairly low assets and markets rating of 2.

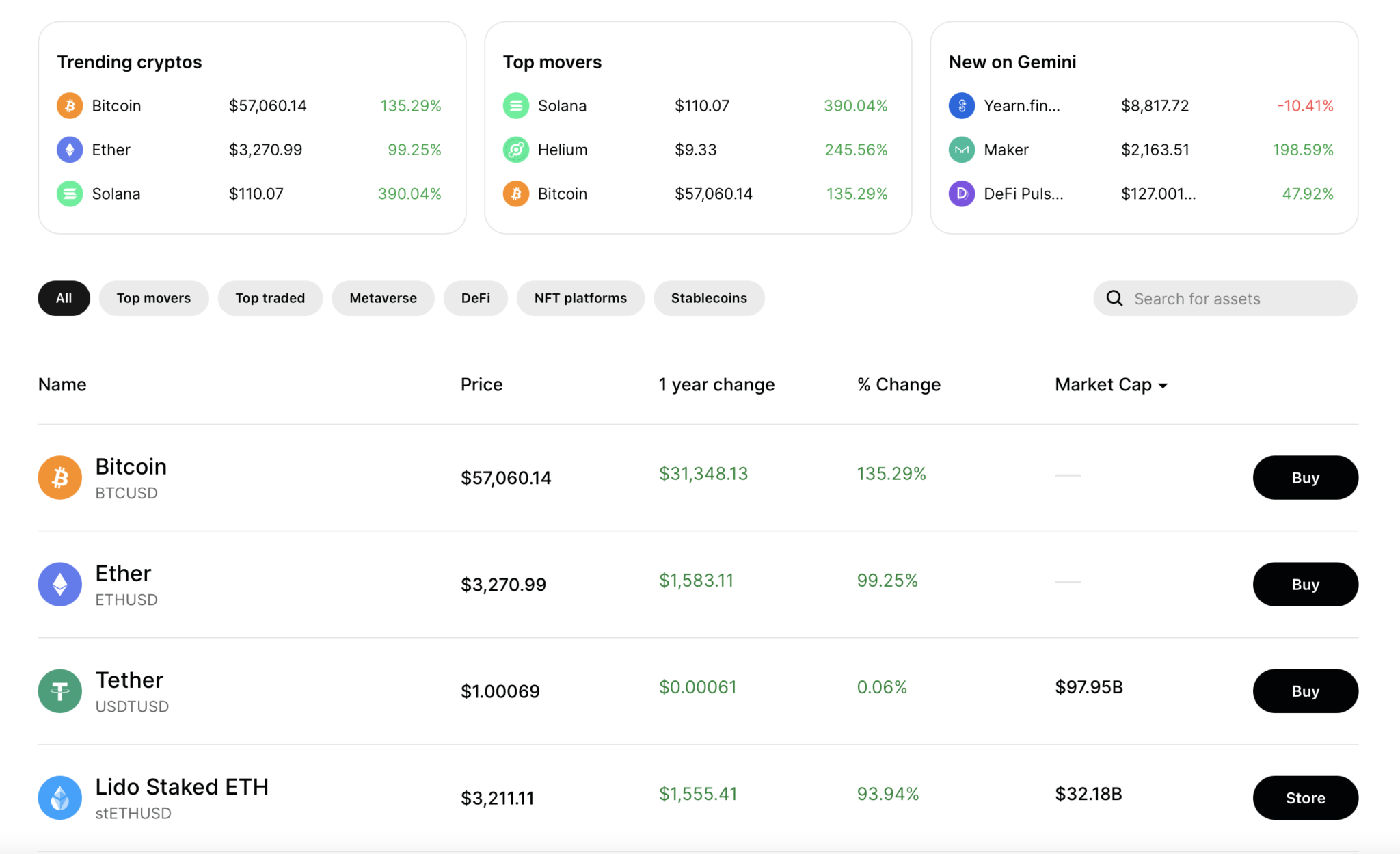

The exchange offers 110+ cryptocurrencies, consisting of the usual giants like Bitcoin, Ethereum and more established altcoins like Avalanche, plus a range of smaller-cap tokens such as Cryptex.

The range is decent, but I feel it falls short of rival crypto exchanges. As you can see from my analysis below, you can trade around 250 cryptocurrencies with Kraken and over 400 with OKX.

| Gemini | Kraken | OKX | |

|---|---|---|---|

| Number of Assets | 110+ | 250+ | 400+ |

The benefit of having a larger range is that it means you can trade up-and-coming tokens with more potential upside, which for me is one of the main draws of crypto day trading.

If you’re looking to capitalize on the latest trending meme coin, you may not find it on Gemini’s exchange platform. I checked for options like BONK that have made a splash during a recent crypto upswing but was disappointed by their absence. KuCoin may be a better option here.

Derivatives

Gemini’s crypto derivatives platform offers perpetual futures trading to dozens of countries including Singapore, Hong Kong and Brazil. Due to regulatory restrictions, traders from jurisdictions including the European Union, United States and United Kingdom are not offered these derivatives.

The derivative contracts are paired with Gemini’s stablecoin, GUSD, which is pegged to the US dollar.

With up to 1:100 leverage, I feel these crypto futures will work best for experienced traders who understand how to manage risk. Since crypto markets are highly volatile, losses on leveraged positions can quickly mount and become extremely expensive, so take care.

Disappointingly, I found just six crypto pairs available, which is far below the offerings from rivals like Nexo with its 70 futures and Kraken with 95.

In this respect, I feel many traders will be better served by a crypto broker like OANDA, which offers 18 crypto pairs and is well-regarded and highly regulated.

Fees & Costs

2.5 / 5Gemini Exchange gets an average fees and costs rating of 2.5 out of 5. Trading fees are mediocre based on tests, making this a more expensive place to trade than similar crypto exchanges.

Those who trade on Gemini’s ActiveTrader platform will be charged a percentage fee that depends on whether they are a ‘maker’ who brings liquidity to an exchange and those who ‘take’ liquidity through market orders. As usual, taker fees are higher.

The rate you are charged depends on your monthly trading volume, starting from a basic 0.2% for makers and 0.4% for takers for volumes up to $10,000.

These fees reduce to 0.1% for makers and 0.3% for takers for monthly volumes over $10,000 and continue to go down at regular intervals for higher volumes.

This beats some rivals like Coinbase which charges 0.4% (maker) and 0.6% (taker) at a maximum, but as you can see from my evaluation below, some of our top-rated exchanges are significantly cheaper:

| Gemini | OKX | Kraken | |

|---|---|---|---|

| Maker/Taker Fees For Volumes <10,000 USD | 0.2% / 0.4% | 0.08% / 0.1% | 0.16% / 0.26% |

When it came to additional fees, I was disappointed to find seemingly arbitrary ‘convenience’ charges of 0.5% on top of an asset’s prevailing market price for making orders on Gemini’s mobile app.

Given that traders won’t be charged for making the same trades via their browser windows, the mobile app fees struck me as unfair and will simply put people off using this feature.

Besides that, orders placed to purchase crypto via Gemini’s website application are charged fees starting at $0.99 for orders under $10 to a minimum percentage charge of 1.49% for orders over $200.

Platforms & Tools

3 / 5Traders can buy and sell crypto via the Gemini website or mobile applications, but they can also access the lowest pricing via the proprietary ActiveTrader platform, earning the exchange a good platforms and tools rating of 3.

I found the terminal easy to navigate with some decent features including the ability to stack price and depth charts, a range of order types including limit orders, immediate or cancel, maker or cancel and more.

The chart can be set to one of seven timeframes from 1 minute to 1 day and it comes with a very large range of indicators that can be easily configured and applied with a couple of mouse clicks.

When I tested the platform I found high volumes of trading on BTCUSD and similar major crypto pairs as you’d expect, but much smaller volumes even on well-established cryptos like AVAX.

This led me to some choppy trading and frequent gaps on order books. While this is part and parcel of trading with smaller tokens it isn’t ideal for day trading and you should bear in mind that Gemini is only the 16th largest exchange.

I also missed some of the integrated research and sentiment analysis tools that you get with eToro and other top-rated brokers’ proprietary platforms.

So, I was pleased to find that Gemini Exchange has integrated the popular TradingView platform which, as well as boasting far more powerful charting capabilities, also comes with an excellent range of research and analysis tools.

These, and the backtesting and algorithmic trading capabilities presented by its native Pine script, make TradingView one of our experts’ favorite platforms.

Research

2.5 / 5Because Gemini lacks depth in its native suite of research tools, I can only give it an average research rating of 2.5.

This is a shame as the TradingView integration does give traders a great deal of scope for research via that platform. But for the Gemini Exchange to improve, it needs to offer more beyond the weekly updates and sparse analysis articles on its blog.

Even though crypto exchanges tend to do poorly in this respect and I prefer Gemini’s offering to Kraken and others, it wasn’t on a level with Coinbase, which updates more frequently with in-depth insights.

I’d like to see daily updates, more frequent expert analysis articles and regular support for technical analysis on a number of popular tokens before bumping up Gemini’s score.

Education

3 / 5I found Gemini’s educational offering to be fairly broad for a crypto exchange, which gets it a good education rating of 3. All the basics are covered in the exchange’s FAQ and Education sections, which should be enough to help even a total beginner get started trading.

Beyond that, there’s also a ‘Cryptopedia’ section that has more theoretical articles on concepts related to crypto and NFT trading.

What I missed were in-depth guides that specifically focus on trading strategies and appeal to a range of beginners and more advanced traders. These can be found at some top crypto brokers, including category leader eToro, with its comprehensive Academy.

I feel that highly focused educational material on analysis and similar trading-related topics are more relevant to day traders than the more conceptual content that the Gemini Exchange tends to provide.

Customer Support

2 / 5Gemini gets a poor customer support rating of 2, thanks to the lack of an instant live chat option. Since crypto markets are open 24/7 and are highly volatile, it can be crucial to be able to access support quickly.

Instead, there’s a chat window with a bot that directs you to FAQ topics depending on your input. Unfortunately, when I tested this function there was no way to reach a live agent through the bot, which directed me to an email contact form.

I also found this form of contact slow, as my simple enquiry went unanswered until the following morning.

The upside is that Gemini Exchange packs plenty of useful information onto its support pages, which are easily navigated via subheadings or via the search tool. However, this is no substitute for the 24/7 live assistance offered by rivals like Nexo.

Should You Trade With Gemini Exchange?

Gemini delivers a promising day trading environment to clients looking for a stable and feature-rich trading platform and access to other crypto opportunities such as NFTs.

However, regulatory oversight is weak, fees are not the most competitive and day traders may find trading smaller altcoins tricky on this relatively small exchange. Traders might instead prefer the simplicity and security of a regulated broker that offers crypto CFDs.

FAQ

Is Gemini Legit Or A Scam?

Gemini is a legitimate crypto exchange that’s been around since 2014 and has secured reputable licenses for its e-money services, making it less likely to be a scam.

However, scams still operate abundantly in the crypto exchange market, so we urge all traders to take care when depositing their funds with unregulated firms.

Can I Trust Gemini?

Crypto exchanges are higher risk than traditional financial markets due to the lack of regulation.

Although Gemini has made some important steps toward gaining customers’ trust, the company does not have the best track record, including a near-bankruptcy incident which left customers facing large losses.

We recommend doing your own careful research and only investing amounts you can afford to lose.

Is Gemini A Regulated Broker?

Gemini is a crypto exchange and not a traditional broker, and consequently, it isn’t regulated in the same way.

It has obtained several licences from the UK, US and EU, though these only permit the broker to provide e-money and virtual asset services in certain jurisdictions. As a result, traders won’t have the same protections as they would get from a CFD broker that’s fully regulated by a tier-one watchdog.

Is Gemini Good For Beginners?

In general, we feel beginners should be cautious about trading cryptocurrencies, which are subject to more extreme price fluctuations than most other assets and thus to higher risks.

As far as crypto exchanges go, Gemini is only a mediocre destination for new traders – its platform is fairly intuitive and it has some educational content, but it lacks a demo account and a full educational academy.

Does Gemini Offer Low Fees?

Gemini’s fees are mediocre – it’s much more expensive than alternatives like OKX, but cheaper than some highly rated competitors like Coinbase. We were also put off by the ‘convenience fee’ for trading on the Gemini mobile app.

Is Gemini A Good Broker For Day Trading?

Gemini has some good features for day traders including a decent platform, crypto perpetual futures with 1:100 leverage and access to TradingView.

For me, the main sticking point is that this isn’t the biggest exchange, which means trading volumes will generally be lower than on larger rivals.

Does Gemini Have A Mobile App?

Gemini does have a mobile app, but traders should note that they’ll need to pay the added expense of a ‘convenience fee’ to use it, so it would be cheaper to trade via a browser window on your phone.

Top 3 Alternatives to Gemini

Compare Gemini with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Kraken – Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

- CEX.IO – CEX.IO is one-stop-shop for crypto investors where you can buy and sell popular digital tokens, speculate on prices with margin trading and earn rewards through staking. Since it launched in 2013, more than five million traders have deposited over $7.5 billion. CEX.IO is registered with the FinCEN in the US and the GFSC in the EU.

Gemini Comparison Table

| Gemini | Interactive Brokers | Kraken | CEX.IO | |

|---|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.9 | 3.7 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos | Cryptos |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $10 | $20 |

| Minimum Trade | 0.00001 BTC | $100 | Variable | $1 |

| Regulators | NYDFS, MAS, FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FinCEN, FINTRAC, AUSTRAC, FSA | GFSC |

| Bonus | – | – | Lower fees when trading volume exceeds $50,000 in 30 days | – |

| Education | Yes | Yes | Yes | Yes |

| Platforms | ActiveTrader, AlgoTrader, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | AlgoTrader, Quantower | TradingView |

| Leverage | – | 1:50 | – | – |

| Payment Methods | 10 | 6 | 6 | 12 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Kraken Review |

CEX.IO Review |

Compare Trading Instruments

Compare the markets and instruments offered by Gemini and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Gemini | Interactive Brokers | Kraken | CEX.IO | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | No | No |

| Stocks | No | Yes | No | No |

| Commodities | No | Yes | No | No |

| Oil | No | No | No | No |

| Gold | No | Yes | No | No |

| Copper | No | No | No | No |

| Silver | No | No | No | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Gemini vs Other Brokers

Compare Gemini with any other broker by selecting the other broker below.

The most popular Gemini comparisons:

Customer Reviews

1 / 5This average customer rating is based on 2 Gemini customer reviews submitted by our visitors.

If you have traded with Gemini we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Gemini

Article Sources

- Hellenic Capital Market Commission Registration

- Central Bank of Ireland Registration

- 'Gemini Earn' lending program failure

- Gemini phishing scam

- FTX Exchange collapse

- FCA Registration

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

A very dishonest company who only wants is to keep you putting more money into it to get your profits, they now want me to pay $3500 for a dmn card in order to get access to my funds( I will just have to take the loss and be more careful next time) I will not send any more money!

I have had poor experience gemini crypto exchange. I would not recommend the crypto exchange under any circumstances due to their poor customer service.. I had a security hold on my account and can’t get any funds out due to no apparent reason they’re holding funds for no reason. I think what you will find with Gemini it’s easy to get money into Gemini. It’s difficult to get it out.